The market has been selling off Iovance stock aggressively over the past few days, despite the fact the company could achieve a historic first approval for a solid-tumor targeting cell therapy. In this post I cover the company’s journey to this point, and why betting on an approval is a high risk, high reward opportunity.

Investment Thesis – Iovance’s Slow Progress Contributing To Cell Therapy Malaise

So far, 2023 has been the year that the market fell out of love with cell therapies. Almost every listed cell therapy developing company I can think of has seen its share price lose >50% of their value across the past 12 months, including (but not limited to) Immunocore (IMCR), MiNK Therapeutics (INKT), Century Therapeutics (IPSC), Lineage Cell Therapeutics (LCTX), Nkarta (NKTX), Omeros Group (OMER), Orgenesis (ORGS), Poseida Therapeutics (PSTX), Alaunos Therapeutics (TCRT), Instil Bio (TIL), and Iovance (NASDAQ:IOVA) – the subject of this post.

Although several CAR-T cell therapies have been approved – Gilead Sciences (GILD) Yescarta and Tecartus, Novartis’ (NVS) Kymriah, Bristol-Myers Squibb’s (BMY) Abecma and Breyanzi, and Legend Biotech (LEGN) / Johnson & Johnson’s (JNJ) Carvykti, going on to earn meaningful revenues for their developers, outside of the CAR-T field, it seems the market harbors significant doubts over durability, efficacy, safety, and the companies ability to bring cell therapies that use different mechanisms of action (“MoA”). That is targeting natural killer cells or tumor infiltrating lymphocytes (“TILs”), or target solid tumors as opposed to hematological (blood related) cancers, or use an allogeneic (donor derived) as opposed to autologous (patient derived) cells – to market.

Back in May I covered Iovance in a deep dive note for Seeking Alpha and its attempts to gain approval for a first ever cell therapy targeting solid tumors. The asset in question is lifileucel, which, according to a recent Iovance presentation:

… deploys billions of individualized patient-specific polyclonal TIL cells to recognize and target a multitude of non-overlapping neoantigens in patients with solid tumors

In early 2021, Iovance shares spiked as high as $50 per share, and although that was short lived, when, in April 2021, the company released positive data from Cohort 2 of its C-144-01 study of lifileucel in advanced melanoma showing the median duration of response had not been reached at 28.1 months, and the overall response rate (“ORR”) remained at 36.4 percent, shares were worth $31 per share.

The next step forward was to submit a biologics license application (“BLA”) to the FDA, pushing for an accelerated approval of the drug, but alas, in May that year the company revealed that after feedback from the FDA, Iovance was pushing back its BLA submission to “the first half of 2022,” as the company needed to:

… continue its ongoing work developing and validating its potency assays and plans to submit additional assay data and to meet with the FDA in the second half of 2021.

This bad news was quickly followed by worse – company CEO Maria Fardis opted to resign, apparently on account of the delays, and following this news, the market dumped Iovance stock once again, and the share price fell to $18.

Lifileucel’s data continued to impress, showing an 86% ORR and 43% Complete Response (“CR”) rate in combo with Merck’s Keytruda in patients with advanced melanoma, and maintaining its ORR of 36% after 33-month follow up as a monotherapy in the same indication.

In April 2022, Iovance announced it had received positive feedback from the FDA “on both its potency assay matrix and its proprietary cell co-culture assay included in the potency assay matrix,” apparently giving the company the green light to finally submit its BLA.

Analysts began raising price targets, but in May there was another setback – lifileucel was now only showing an ORR of 29% in the C-144-01 study, with the 87-patient, registrational Cohort 4 now showing a median duration of response of 10.4 months. Although Iovance pledged to submit its BLA in August, the market dumped the stock once again, and the share price slipped to just $7 per share.

In November 2022, Iovance shared another update, stating that the BLA was now due to be submitted “in the first quarter of 2023,” as a result of its receiving “recent FDA feedback regarding supplemental assay validation information and comparability data for lifileucel.”

The BLA was eventually completed in March this year, and was accepted by the FDA in May, and there was some good news in that the FDA granted lifileucel Priority Review – meaning the company need only wait six months for its approval decision, which was set for Nov. 25, and the FDA indicated it would not need to convene an advisory committee to discuss the data submitted and vote on whether an approval was justified.

The Closer We Get To Approval Date, The More The Market Sells Off Iovance – But Why?

In fairness to Iovance, the company is attempting to do something no company before it has achieved – secure an approval for a cell therapy targeting a solid tumor cancer – so perhaps some of the delays can be forgiven, although it’s tempting to wonder what prompted the ex-CEO’s sudden departure – had Fardis seen something in the data and realised the approval shot was doomed?

Either way, the market has not been in a forgiving mood – Iovance stock touched $9 per share in July, but by mid August it had fallen to $6 per share, and this week, it has fallen from $6, to $4.9 per share – down 56% across the past 12 months, and 25% year-to-date.

It seems the market is struggling to believe that lifileucel is approval worthy, but is that fair? In my last note I discussed some of the positive data the company has put before the FDA, as I wrote in my last note, “appears to be quite compelling.”

Across cohorts 2 and 4 of the pivotal study, the ORR was 31.4% (according to a September corporate presentation), with nine complete responses (absence of detectable cancer) recorded, 39 partial responses (“PR”), and 71 stable disease – 46.4% of the patient population. The pooled analysis of these two cohorts showed a reduction of tumor burden in 79.3% of patients – 111 out of 140 patients. 42% of responses continued for >24 months.

An article in the Journal of Clinical Oncology – admittedly sponsored by Iovance, offered the following conclusion about lifileucel’s pivotal data:

In summary, lifileucel, a first-in-class centrally manufactured autologous TIL cell therapy, was efficacious and demonstrated durable responses in heavily pretreated patients and represents a potential new standard of care for patients with advanced melanoma following failure of ICI and targeted therapy.

This does seem to be a fair conclusion, and with the amount of data shared between Iovance and the FDA over the past couple of years, and the FDA’s decision not to convene an Advisory Committee, could this mean the FDA will return a positive verdict on approval in late November?

Typically, the criticism of cell therapies – especially those that do not target CAR-T – is that the therapies have durability issues, working well in patients initially before their conditions begin to worsen again. But there’s not much more Iovance could have done to show its therapy improves patients’ conditions over a long period of time.

Iovance Is More Than A Single Asset Company

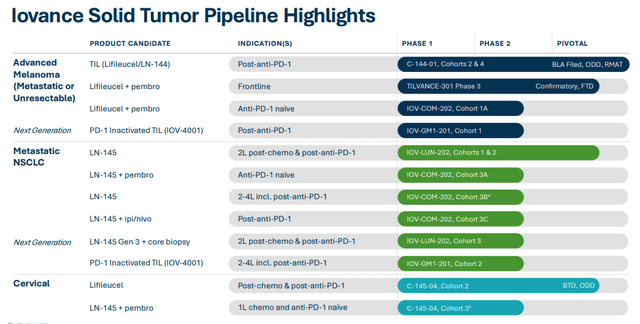

Another positive to consider is that, unlike so many biotechs relying on the progress of a single asset to drive the share price, Iovance has developed a reasonably broad pipeline, as we can see below.

Iovance pipeline (corporate presentation)

I already have mentioned the positive results lifileucel has obtained by in frontline melanoma alongside pharma giant Merck’s (MRK) all-conquering immunotherapy keytruda – surely an intriguing opportunity – and in addition, the company reported in July that its lung cancer therapy, LN-145, “may be acceptable for accelerated approval” after discussion with the FDA.” Iovance says it “plans to enroll a total of approximately 120 patients into the registrational IOV-LUN-202 trial,” and that enrollment is expected to be complete in the second half of 2024.

Melanoma and lung cancer are no small markets – according to Iovance’s research, 98,000 new cases of melanoma are reported each year in the US, and 238,000 cases of lung cancer. Cervical cancer, another target for lifileucel and LN-145, records ~14,000 new cases each year. In my last post, I shared some thoughts on potential peak sales for lifileucel as follows:

The global malignant melanoma market will apparently be worth ~$8bn per annum by 2029, and Iovance believes the US incidence of unresectable or metastatic melanoma is ~15k patients. It is hard to estimate what the market opportunity for lifileucel is, but one very ballpark equation, based on the lower end of recommended list prices for approved CAR-T drugs of ~$300k, multiplied by the 15k unresectable or metastatic patients, would put it at ~$4.5bn, and a 20% share of such a market would imply there is a potential blockbuster (>$1bn per annum) revenue opportunity in play.

Iovance also has developed an efficient 22-day GMP manufacturing process at its 136,00-square-foot cell therapy centre in Navy Yard, Philadelphia. Although the center is only capable of treating hundreds of patients per annum at the present time, the aim is to eventually get to >10k patients treated per annum.

In short, despite the company’s woes, Iovance is heavily invested in cell therapy, has two therapies with genuine commercialisation potential, targets very large markets, partners successfully with the most successful cancer drug on the market in Merck’s Keytruda, and has its own in-house manufacturing facility. Progress may have been stuttering, but it’s also tangible – although all of this progress has come at a cost.

Iovance’s Heavy Spending Has Almost Exhausted The Funding Runway

Iovance’s financial management has not been exactly frugal over the years. The company made a net loss of $(396m) in 2022, $(342m) in 2021, and $(260m) in 2020. It may be unsustainable for the company to continue this way given that as of Q223, the company reported cash and equivalents of just $251m, whilst making a net loss of $(106m) for the quarter, and $(213m) for the half year.

That level of loss implies that Iovance will need to begin fundraising before the end of 2023, and of course, the perfect time to do that would be immediately following the FDA approval of lifileucel, which would validate the company’s approach and likely allow it to raise a few hundred million to support a commercial launch and extend the funding runway.

As discussed above, that possibility remains in play, and if Iovance followed up with a second approval, and became the first company to market and sell not one, but two solid tumor targeting cell therapies, you can make a strong argument that the business is undervalued at a market cap valuation of $1.1bn.

If we can make an argument that lifileucel has peak sales potential of – let’s be conservative and suggest $500m per annum – and assume that a price to sales ratio of 3-5x forward sales is an appropriate method of valuation, then we can make the argument that Iovance shares are at least 25% undervalued, and in a best-case scenario, a doubling of the current market cap valuation is a possibility.

Of course, the corollary to that argument is that Iovance has over-extended itself financially, and that an FDA rejection of lifileucel would be nothing short of disastrous for the company and its stock price – cell therapy centre or no cell therapy centre.

Concluding Thoughts – Boom or Bust – Backing Iovance Is Not For The Faint Hearted

While it’s clear the market is not expecting a positive development come the Prescription Drug User Fee Act (“PDUFA”) date of Nov. 25, the counter-argument suggests that after years of discussions with the FDA, Iovance may be on the verge of something momentous, that will open a path to commercial revenue, fresh fundraising, and more pipeline opportunities to come, with a significant shift in share price momentum to boot.

Bears will bring forward the argument that Iovance’s path to a potential approval date is laden with red flags, from the resignation of the company’s CEO, to the continual delays, to the over-spending, to the doubts over not CAR-T cell therapies that persist no matter the apparently positive data produced.

Ultimately, I would lay out the investment thesis as follows – if I had to back one cell therapy today, I would probably choose Iovance – by some distance the industry’s pioneer at this time outside of CAR-T. If, however, my appetite for risk is anything but voracious, I would probably pass on the opportunity to buy stock ahead of the PDUFA date.

Read the full article here