Introduction

In my previous article, I talked about Solaris Oilfield Infrastructure (NYSE:SOI) as a stock to keep an eye on, particularly if we start seeing signs of a recovery in the oilfield services industry. Well, guess what? It seems like that time might just be upon us. For investors in search of promising opportunities, now might be the perfect moment to dig deeper into Solaris Oilfield Infrastructure and consider its prospects as an investment. The company’s latest quarterly results were promising and the surge in oil prices has improved its outlook.

Weakness Catching Up

Solaris has carved a niche for itself in the arena of oilfield services, catering not only to oil and gas producers but also to fellow service providers. The company’s forte lies in its well-site sand handling equipment and the associated services. These specialized offerings enable oil and gas producers to efficiently handle the delivery, storage, and processing of proppant, water, and chemicals right at the well-site. Solaris extends its services across the major onshore oil and gas production regions in the US.

While the company has witnessed strong growth in both revenues and earnings in the past, I noted in my previous article how the drilling activity has taken a downturn this year. A number of oil and gas producers have retracted hundreds rigs from shale oil and gas producing plays, and this reduced demand was bound to leave its mark on Solaris. The effects became evident in the company’s second quarter performance.

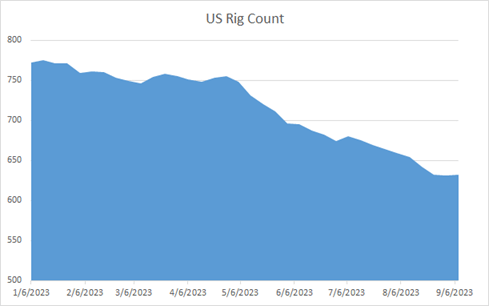

According to data from Baker Hughes (BKR), the US rig count experienced a sharp decline, plummeting from 772 rigs at the year’s outset to 632 by the week’s end, largely influenced by the volatile and weak oil prices. This downturn was ubiquitous. For instance, the Permian Basin, recognized as the US’s primary shale oil play, saw its rig count slide from 353 at the year’s beginning to 320 by the past week’s close. The situation in other regions, like the oil-rich Eagle Ford and the gas-dominant Marcellus, was even grimmer. These areas registered a significantly steeper decrease in their rig counts as compared to the Permian Basin. These numbers provide a telling insight into the industry’s current state and the challenges Solaris faces.

Author

Solaris’s first quarter performance unveiled a robust year-over-year revenue increase, although it showed a slight sequential decline. However, the second quarter was a bit of a reality check. Persistent market sluggishness, leading to a dip in oil and gas well completion activity across multiple basins, exerted pressure on the company’s revenues. Specifically, Solaris reported a 7% sequential drop and an 11% year-over-year decrease, culminating in revenues of $77.2 million. This downturn was driven by weakness in frac activities and a slump in demand for its auxiliary trucking services.

Two Positives

Despite the challenging business landscape, I’m increasingly bullish about Solaris’s trajectory for a couple of noteworthy reasons. Firstly, even amid softer market conditions, Solaris showcased the resilience and efficacy of its products. Its ability to register earnings growth in such a climate is commendable. Case in point, the company’s adjusted EBITDA surged by 27% year-over-year and 6.8% sequentially, reaching a solid $26.8 million. This increase is attributed largely to the stellar performance of its top fill and AutoBlend systems, which effectively counteracted the repercussions of dwindling well completion activities.

Solaris has been diligently channeling its efforts and resources into rolling out new products and technologies for the past 18 months. Notably, the introduction of systems like AutoBlend is now bearing fruit, positively influencing the company’s earnings. A growing number of its clients are incorporating multiple Solaris systems into their operations, compared to the previous year. A mere year ago, owing to a constrained product range, Solaris had only a smattering of units in operation. Fast forward to the present, and that number has leaped to 50. This strategic growth has empowered Solaris to significantly amplify its product offerings per frac crew, furnish superior services to its clients, and ultimately, garner greater returns on investment.

Looking forward, as Solaris gears up to roll out additional products and technologies in the ongoing quarter, I believe these introductions will further bolster its earnings. Even if the broader market remains lackluster, the infusion of these new products in the field is poised to provide crucial reinforcement to the company’s financial standing.

Secondly, and perhaps more importantly, a pivotal shift in the oil price landscape over the past two months augments the optimistic outlook for Solaris. When I wrote my previous article in early June, WTI crude was hovering around the $70 per barrel mark. As of now, this figure has ascended to nearly $90. In my view, these elevated prices may persist in the foreseeable future.

This surge in oil prices is fundamentally anchored in robust demand juxtaposed against shrinking supplies. A testament to this is the recent move by Saudi Arabia and Russia, who chose to prolong their voluntary oil production cuts until the close of this year. While Saudi Arabia intends to pare down its output by a staggering million barrels daily, Russia has committed to a reduction in oil exports by 300,000 barrels daily. It’s noteworthy to mention that these are voluntary cuts, supplemental to the diminished production quotas that OPEC+ settled on in April. Drawing from OPEC’s projections, the ensuing aftermath is likely a supply shortfall of about 3.3 million barrels daily in the fourth quarter – potentially one of the most pronounced in over a decade.

Underpinning this supply crunch is the robust demand, especially from key players like China. The country’s oil consumption has shown unexpected tenacity. Despite China not showcasing the anticipated strong economic resurgence following the lifting of its COVID-19-induced curbs, there remains a healthy appetite for fuels, such as gasoline and jet fuel. For context, China’s crude oil imports in August swelled by 21% from July and stood at an impressive 25% year-on-year increase, amounting to 52.8 million tonnes. The global stage might soon witness a seasonal spike in oil demand as winter approaches. This surge in demand, in tandem with dwindling supplies, could be a catalyst for even higher oil prices.

Should this bullish oil price trend retain its momentum, it could prompt a notable shift in the strategic playbook of US oil producers. Up until now, they’ve judiciously managed their spending, emphasizing shareholder returns. However, with the benchmark US oil nearing $90 and potentially remaining high in the future, revisiting production growth might become a priority. This could herald increased capital spending and an increase in drilling activities. We might see a rise in well completion work on the horizon, which, I believe, could drive demand for Solaris’s offerings. As the frequency of rig deployments ratchets up and oil producers intensify their drilling and completion projects to leverage these high oil prices, Solaris stands poised to experience a surge in demand, potentially at better prices. This dynamic could steer Solaris’s revenue, earnings, and profit margins higher.

Although I think the sector is yet to display definitive signs of recovery, there’s an underlying sentiment of optimism that was missing before. Several companies in the oilfield services and equipment space anticipate a potential rise in frac activity commencing in the fourth quarter. To illustrate, Patterson-UTI Energy’s (PTEN) top brass, in their late-July discourse, projected a likely uplift in both the rig count and frac activities as the year draws to a close, extending into 2024. In this backdrop, I think the recent rig count figures can be perceived positively. A detailed look reveals a decline of 10 units in the rig count, bringing it down to 632 rigs by August-end. This was followed by a marginal dip to 631 rigs the succeeding week and an increment by one to 632 the subsequent week. In my view, this could be an early indication of market stabilization.

Conclusion

With a strong product portfolio that supports its bottom-line and early signs of a recovery in the market driven by higher oil prices, Solaris could be on the verge of a turnaround.

In the context of valuation, Solaris currently trades at 10.5x its forward earnings estimates. This metric aligns closely with the sector’s median of 10.7x, based on Seeking Alpha data. The company has received a valuation grade of C+ from Seeking Alpha. Yet, I believe this valuation appears reasonable for a company that has demonstrated resilience amidst market challenges, hints at an imminent turnaround, and boasts a sturdy financial position. Its balance sheet reflects a robust financial health, with $9.4 million in cash reserves, a $43 million drawn from a credit arrangement, and an absence of long-term debt. The credit agreement matures in April 2025 and the company’s cash reserves have been growing, thanks to its ability to generate free cash flows. For these reasons, I think investors should consider buying Solaris stock.

That being said, it is important to consider risks as well. A pivotal factor underscoring Solaris’s potential resurgence is the movement in oil prices. If they were to decline, the anticipated upswing in rig count and frac activity might not materialize, perpetuating the subdued market conditions. Such a scenario could exert downward pressure on Solaris’s earnings. Thus, should oil prices waver in the future, it could cast a shadow on the company’s prospects, potentially affecting its share prices. This inherent volatility tied to oil prices stands out as a principal risk that investors must weigh prior to any commitment to Solaris’s stock.

Read the full article here