In this article, we dial in on the iShares MBS ETF (MBB) to garner an understanding of what’s in store for mortgage-backed securities. The exchange-traded fund, or ETF, presents an exciting proposition amid a pending pivot in the interest rate cycle, which could alter the outlook for bond coupons and asset class risk premiums.

Without further delay, let’s jump onto the golden thread and discuss the iShares MBS ETF’s prospects.

Interest Rates: Effect on Total Return

Fund Dynamics

To start this section, I wanted to illustrate the tradeoff between interest rates and the fund’s return structure.

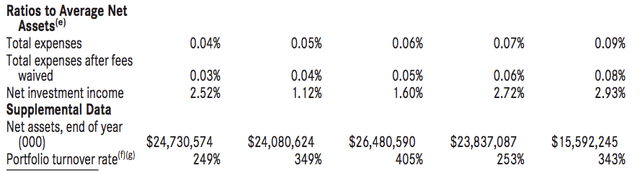

Although slightly dated, the diagram below shows the negative tradeoff between the fund’s income and valuation. Even though the iShares MBS ETF locks in fixed-rate securities, its fast turnover means its investment opportunity set fluctuates with the interest rate cycle. Moreover, interest and mortgage rates influence risk premiums on the ETF’s constituents, concurrently adjusting their fair values.

Exposition of Rates Vs. Value Tradeoff (iShares)

Although an active fund, the iShares MBS ETF primarily invests in intermediate fixed-rate securities. In fact, I paged through its holdings, and nearly all its exposure seems fixed. With a 62.63% exposure to 7 to 10-year securities and a 98.73% exposure to A-rated government-backed bonds, it is safe to say that the government benchmark yield curve will play a prominent role in determining the trajectory of this ETF.

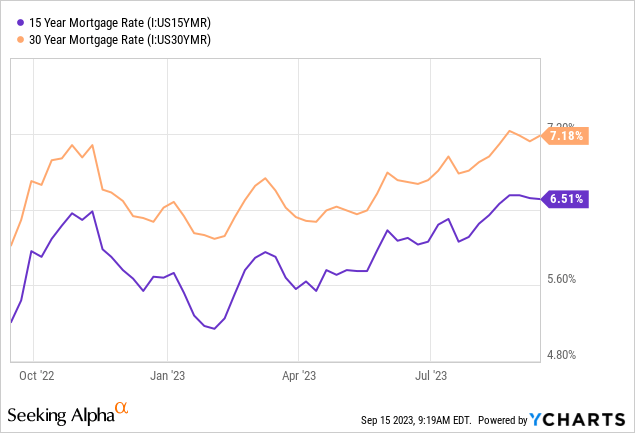

As visible in the diagram below, the risk premium on longer-dated mortgages is significant despite the inverted U.S. yield curve. In our view, the iShares MBS ETF’s intermediate-term and high-grade debt means it is on the lower end of the risk spectrum for MBS securities. Therefore, do not be surprised if this asset behaves like high-grade corporate debt instead of real estate debt at times.

Even though the iShares MBS ETF seems like a lower-risk MBS vehicle, its effective duration of 6.04 implies that it does possess cyclical risk, especially “shaping risk,” as its effective duration is much shorter than its weighted average maturity of 8.27 years. Additionally, I looked at the portfolio’s turnover via one of iShares’ downloadable documents, and it occurred to me that frequent dispositions and acquisitions occur, which brings in the influence of interest rates on coupons.

Our Take on Risk Premiums

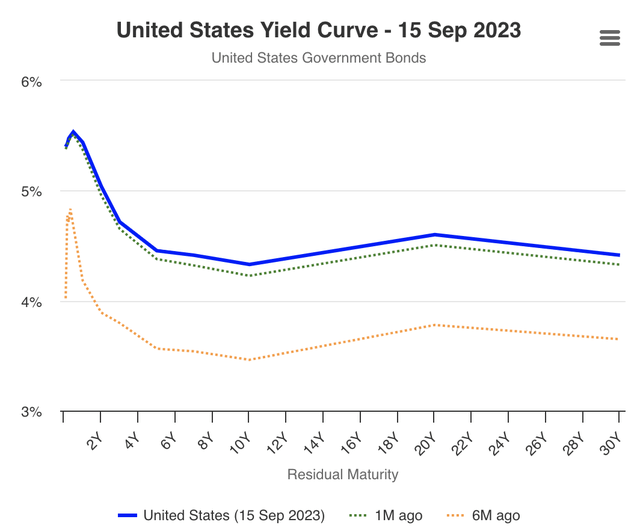

The U.S. yield curve remains inverted, which is likely already priced by the iShares MBS ETF. In our view, the curve’s level is intact; however, we might see a lower short end occur in early 2024 as an interest rate pivot slowly gets priced by the bond market.

However, we think the intermediate term will stay where it is, presenting little price-based headwinds/tailwinds to the iShares MBS ETF. I mean, we could be wrong, but at some stage, the curve will need to steepen, and we think it is more likely that a linear steepening will occur, which will see the short-end drop while the longer-end rises. I believe many are currently pricing the “higher for longer” interest rate outlook, which has kept the shorter end very high.

worldgovernmentbonds.com

The iShares MBS ETF is invested in loads of fixed-rate securities, which locked in high rates during the past year. We believe this will lead to sustainable income. However, the fund’s opportunity set might change as the curve shifts. In our view, as an actively managed fund, the iShares MBS ETF should start betting on longer-dated assets (for income purposes) when the curve starts steepening. As an astute fund, the iShares MBS ETF will likely do this and sustain its income-based prospects.

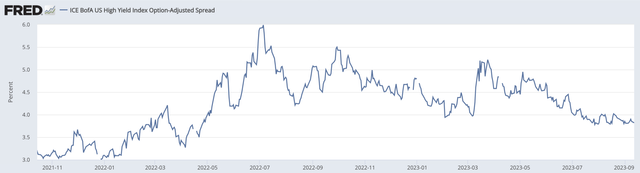

Furthermore, option-adjusted spreads within the U.S. have tapered significantly in the past few months amid a lower VIX index (VIX) and a calm down of the banking crisis talks that were so prevalent earlier this year.

Unfortunately, we think option-adjusted spreads have flatlined for now and that most of the benefits have already been priced in by the iShares MBS ETF’s investors. Thus, we do not believe this risk premium will provide additional price support in the short term.

St. Louis Fed

A drawback of option-adjusted spreads as a means of assessing credit risk is that it doesn’t consider prepayments and extension risk. So, let’s delve into the aspects by ourselves.

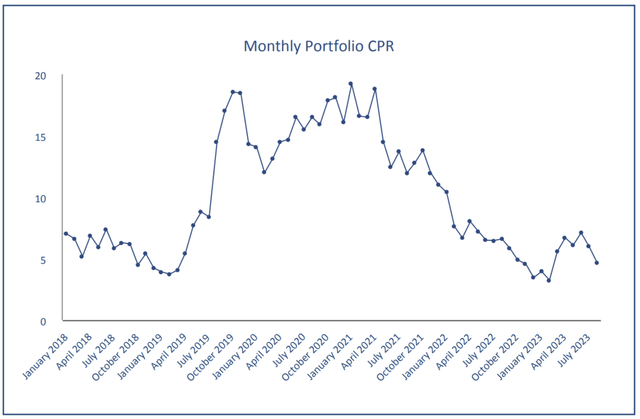

It’s difficult to find up-to-speed prepayment/extension data on a sector basis. Thus, I used Armour Residential’s (ARR) figures as part of a comparables analysis. According to the results, prepayments have tapered significantly since the interest rate hiking cycle started, which is normal – as a matter of fact, it is cited in the iShares MBS ETF’s literature.

Prepayments (Armour Residential)

Although prepayments have receded, extension risk is starting to come into play as the economy has seemingly reached its cyclical peak. However, the iShares MBS ETF’s investment-grade status, paired with its government-backed cushion, provides reason to believe that extension and default risk will likely be low for the vehicle; as such, we think cash flows will remain sound, concurrently keeping the ETF’s counterparty risk premium at bay and justifying a higher valuation than its cohorts.

MBB ETF’s Dividend & Tax Status

According to the iShares MBS ETF’s literature, dividends are taxed as ordinary income, and long-term capital gains tax is around 15% to 20%. As such, we believe this asset is best held in tax-deferred or tax-exempt accounts instead of short-term liability-matching accounts.

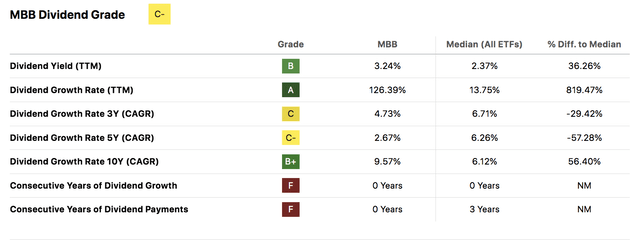

As for iShares MBS ETF’s dividends, a trailing yield of 3.24% isn’t bad, in our opinion, especially as this is a recently-listed fund. Keep in mind that the dividends will likely oscillate along with the interest rate cycle; however, so will price gains/losses.

All in all, we believe the ETF’s total return structure is well-balanced. However, it doesn’t really stand out as a best-in-class asset.

Seeking Alpha

Final Word

Our analysis shows that the iShares MBS ETF presents low-risk exposure to mortgage-backed securities as a sub-asset class. Although it has a respectable total return profile with diversification benefits, we fail to justify it as a best-in-class asset.

Consensus: Neutral/Hold.

Read the full article here