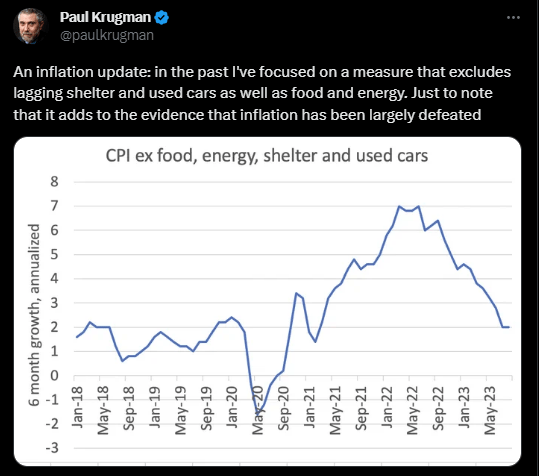

Paul Krugman wrote an interesting comment on Twitter (X) this week stating that inflation has been defeated. The chart he posted showed inflation minus food, energy, shelter and used cars.

He was mercilessly mocked on the platform for posting data that removed most of the items we all need to live. The backlash was right, but Krugman is also making a relevant point – he just isn’t presenting it very well.

Economists prefer to look at the rate of change of inflation knowing that inflation almost always goes up in the long run. The rate of change is important because a low rate of change is generally consistent with rising living standards, whereas a high rate of change is consistent with declining living standards.

Economists sometimes extract certain items like oil and food because they are “noisy”. That is, they can add a lot of short-term variance in the trend that might mislead us about the long-term trend. Removing certain items can give us a better idea of what the true long-term trend looks like.

At the same time, it’s a bit silly how we extract certain items. During the Covid period, we’ve seen economists consistently extract more and more items to reinforce the idea that inflation has been “transitory”. It comes across as a disingenuous approach to make the data fit a narrative that has been wrong for many years.

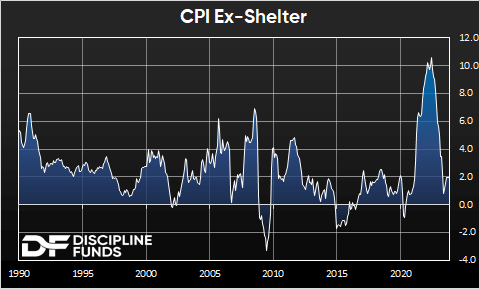

All that said, I do think Krugman is more right than wrong here. But the more practical way to present this data is to just show CPI minus shelter. That chart shows the same general conclusion (that inflation is lower than many people think), but it doesn’t rely on extracting so many controversial items.

More importantly, extracting shelter is perfectly reasonable at this point in time because the current shelter inflation is significantly overstated relative to real-time shelter prices.

We know that’s true because we can see what real-time rents are and we also know that the BLS measurement of shelter CPI lags by 9-12 months.

This chart reinforces Krugman’s point about inflation being defeated because, if the BLS used a more real-time measurement of inflation in shelter, the CPI would be significantly lower than it currently shows.

This is also one reason why we think disinflation is likely to remain entrenched in the coming year, as this lagging shelter component continues to act as a headwind against other rising prices.

So yes, Paul Krugman is more right than wrong here. Inflation has been largely defeated, but the Fed doesn’t see it that way because they’re too focused on the lagging indicators in this data.

Which, interestingly, is also why they were late raising rates in 2021 and are now exacerbating the risk of being too tight for too long…

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here