Before yesterday’s ECB meeting, there was a bit of uncertainty about whether the ECB would hike or not, with markets pricing in a 65% implied probability of a 25-bps hike.

In the end, it went ahead with the rate hike, lifting the main refinancing rate to 4.50% from 4.25% previously. But the euro nonetheless fell sharply. This is because the ECB strongly indicated that we have reached a terminal interest rate, meaning no more hikes are likely moving forward.

EUR/USD Outlook Bearish as Rates at ‘Sufficiently Restrictive Levels’: ECB

As per the policy statement, the “ECB considers that key rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target. Future decisions will ensure that the key rates will be set at sufficiently restrictive levels for as long as necessary.”

The ECB is worried about the path of growth more than the inflation outlook. While rising oil prices may keep global inflation elevated, the ECB’s aggressive tightening is impacting demand, as we have witnessed in recent data releases in Germany and the Eurozone.

A weakening economy should ensure to bring inflation back down to the target in the medium term, especially when interest rates are now “at sufficiently restrictive levels.”

Accordingly, the ECB has cut its growth forecast for 2023 and 2024, while increasing its inflation projections slightly.

The ECB:

- Cuts 2023 GDP growth from 0.9% to 0.7%

- Cuts 2024 GDP growth from 1.5% to 1.0%

- Raises 2023 Inflation to 5.6% from 5.4%

- Raises 2024 Inflation to 3.2% from 3.0%

Moving forward, investors will be keeping a close eye on incoming data to gauge how long rates will be held at these levels. But until such a time that the trend of US data starts to deteriorate sufficiently enough to cause the dollar to reverse its bullish trend, the EUR/USD should remain in an overall bearish trend.

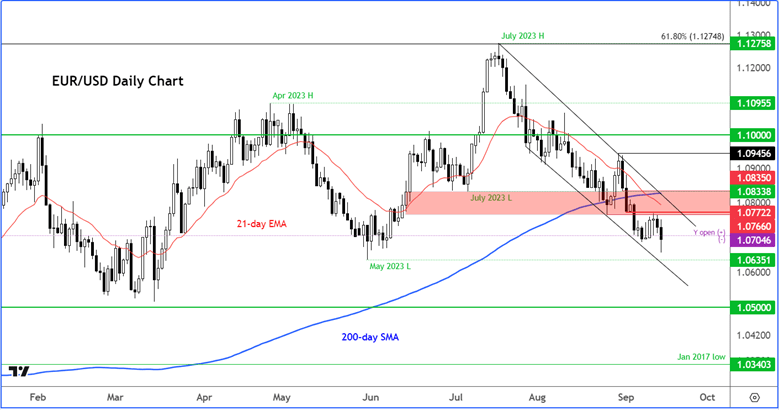

EUR/USD Could Breakaway low

Thus, a break below the May low of 1.0635 still looks likely for the EUR/USD. Even if rates bounce back somewhat, I will maintain a bearish view of this pair until the charts tell us otherwise.

Key resistance is seen around the 1.0765-75 area, which was previously supported. This area has held for now. The EUR/USD will need to reclaim this tower to tip the balance back in bull’s favor slightly.

But that won’t be enough without a higher high above 1.0945 for confirmation. On the downside, the next major target below the May 2023 low of 1.0635 is probably at 1.0500. But we will cross that bridge if and when we get there.

Source: TradingView.com

US Dollar Extends Rise Ahead of FOMC

The focus will remain on the US dollar, with more data releases and the Fed’s decision to come next week.

A day after US CPI inflation came in slightly hotter than expected in August, PPI was also a touch stronger on the headline front at 1.6% y/y vs. 1.2% expected, although core PPI was in line at 2.2% y/y.

The fact that retail sales (+0.6%) and unemployment claims (220K vs. 226K expected) also both came in better than hoped today means there is more reason why the Fed will maintain a contractionary policy in place for even longer.

On Friday, we will have more US data to look forward to in the form of the Empire State Manufacturing Index, industrial production, and UoM Consumer sentiment survey, followed on Tuesday by building permits and housing starts.

Unless we see significantly weak numbers, the broad dollar strength should remain in place as we head into the Fed’s meeting on Wednesday.

This week’s most positive data and hotter inflation print has given rise to speculation that the Fed’s tightening cycle is not over just yet. While no policy changes are expected at this FOMC meeting, traders will be looking for it in regard to the next meeting.

If there’s a strong inclination in the policy statement, dot plots, and/or Powell’s press conference towards a final hike before the year is out, then this should support the dollar.

Next Week’s Macro Highlights Include FOMC, BOE and Global PMIs

The economic calendar is full of key market-moving data next week, so expect lots of volatility in the EUR/USD and other forex pairs. Here are the main ones to keep an eye on:

- Canadian CPI (Tuesday)

- US Building Permits and housing starts (Tuesday)

- New Zealand GDP (Thursday)

- UK CPI (Wednesday)

- FOMC policy decision (Wednesday)

- SNB rate decision (Thursday)

- BOE rate decision (Thursday)

- US jobless claims, Philly Fed and existing home sales (Thursday)

- BOJ policy decision (Friday)

- Global PMIs (Friday)

Originally published on MoneyShow.com

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here