B3 – Brasil, Bolsa, Balcão (OTCPK:BOLSY), Brazil’s stock exchange, has reported its second-quarter 2023 results, which were not particularly surprising but have reinforced a more positive outlook for the end of this year and the next.

During the quarter, B3 experienced increased trading volumes due to Brazil’s interest rate decline. This trend is expected to continue, leading to a significant margin expansion, which will inevitably positively impact the company’s profitability.

In my previous article on the company, I expressed my optimistic stance on the B3 investment thesis, primarily because the expected slowdown in Brazilian interest rates over the coming years is imminent. While this presents a risk factor, it is on a regressive path in the medium to long term, especially as inflation in Brazil currently stands at 4.6%.

Therefore, based on my analysis, the company’s latest results affirm that the bullish thesis is on the right track. B3 continues to be a company that is growing without the need for additional capital and is riding a positive secular trend. Moreover, over time, the company has successfully grown while rewarding its shareholders, an accomplishment achieved by a few companies.

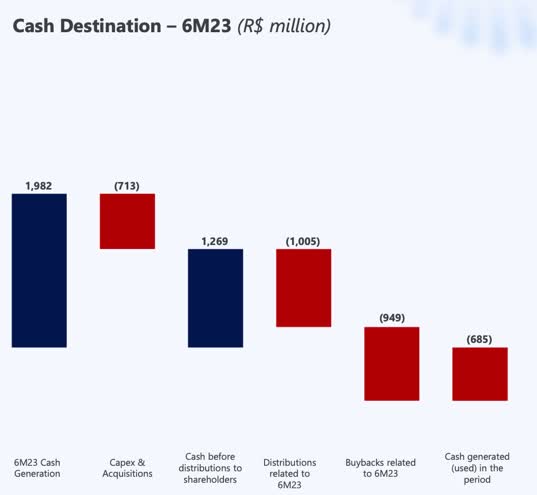

The trajectory for the first half of 2023 suggests that the company generated nearly R$2 billion in cash. It allocated R$713 million for acquisitions and expansion, paid out R$1 billion in dividends, and spent R$950 million on share buybacks.

Additionally, with B3’s shares experiencing a significant decline, particularly in August this year, when the Brazilian stock market (Ibovespa) corrected sharply due to macroeconomic factors, I view the more attractive valuation as an excellent entry point. This is especially noteworthy because B3 is expected to double its dividend yield by 2024.

Second-quarter results

B3 reported a net income of R$1.05 billion for the second quarter of 2023, representing a slight decrease of 3.4% compared to the previous quarter and a 3.6% decline year-on-year (YoY). This decrease in profit was primarily driven by a weaker financial result and a higher tax rate of 28.7%, which was 1.4 percentage points higher than in the previous period.

B3’s IR

It’s worth noting that B3 concluded the acquisition of Neurotech in mid-May, and as a result, the financial statements began to consolidate their information. This acquisition impacted revenue by R$12.5 million and expenses by R$12.8 million, with no impact on profit.

During the second quarter of 2023, the stock market witnessed increased activity due to Brazil’s macroeconomic scenario improvements, including the anticipation of future interest rate cuts.

The net revenue for the quarter amounted to R$2.5 billion, showing limited growth, increasing by 0.9% quarter-on-quarter (QoQ) and decreasing by 0.5% year-on-year (YoY), which was slightly below expectations. All revenue lines experienced slight growth compared to the previous quarter, except for the Listed segment, which was negatively impacted by Interest, Currencies, and Commodities.

Expenses totaled R$859 million, reflecting a moderate increase of 0.8% QoQ and 2% YoY, which remained under control and below the IPCA inflation rate. The recurring EBITDA for the quarter reached R$1.63 billion, remaining nearly stable, increasing by 0.3% QoQ and decreasing by 2.3% YoY. However, the EBITDA margin contracted by 0.2 percentage points QoQ and -1.2 percentage points YoY, reaching 73.2%.

The financial result for the quarter was R$102.8 million, representing a decrease of 27.7% YoY but an improvement compared to the -R$15.3 million reported in the second quarter of 2022. It’s important to note that in the first quarter of 2023, R$142 million was positively influenced by a US$53 million buyback related to the 2031 Bond, generating a profit of approximately R$40 million. Excluding this factor, the result would have remained stable QoQ at R$100 million.

Now, let’s break down the results by segment:

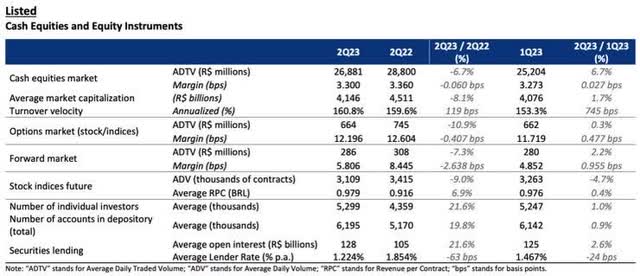

Listed Segment: Revenues for this segment experienced a 1% decrease QoQ and a 5.9% decline YoY, amounting to R$1.5 billion. Interest, Currencies, and Commodities influenced this decline despite a higher total ADV (number of contracts traded daily) of 6.3% YoY and 49.5% YoY.

B3’s IR

The decrease in revenue per contract (RPC) of 7.3% YoY and 28% YoY resulted from more short-term contracts with lower RPC. However, the segment saw a more favorable outcome from equities and variable income instruments, driven by a better scenario with rising ADTV and turnover increasing by 7.45 percentage points QoQ and 1.19 percentage points YoY to 160.8%.

Despite the slight drop in results, there is a high probability that a lower interest rate environment will lead to a more robust capital market. For instance, the equities and variable-income instruments segment showed an improvement in revenue of 0.5% YoY, compared to a drop of 13.3% YoY in the first quarter of 2023.

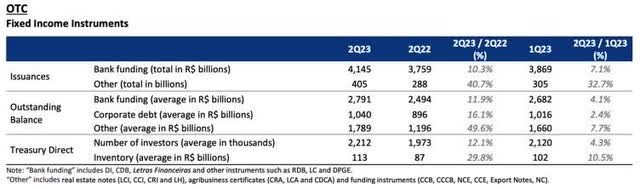

OTC Segment: The result for this segment improved by 4.5% QoQ and 14.5% YoY, reaching R$365 million. The over-the-counter segment continued to perform well due to a favorable scenario for fixed-income instruments. This improvement was attributed to increased issuance and average stock.

B3’s IR

Infrastructure for Financing Segment: This segment showed a marginal improvement of 1.9% QoQ and YoY, amounting to R$113 million. The improvement reflected an increase in the number of vehicles sold and financed despite a slight decrease in the penetration of financed vehicles by 0.9 percentage points QoQ and YoY.

Technology, Data, and Services Segment: Revenues in this segment amounted to R$475 million, showing a growth of 3% YoY and 8.4% quarter-QoQ. This growth was driven by an increase in the average number of customers in over-the-counter usage, with a 1.7% YoY increase and a 9.9% QoQ increase, as well as in market data with a 1.3% YoY increase and a 7.8% QoQ increase. These increases offset the 1.4% YoY drop in co-location.

New initiatives on blockchain technology

In June, B3 announced the launch of a platform designed for issuing, registering, and trading tokenized assets, leveraging blockchain technology. In July, B3 forged a strategic partnership with Nasdaq (NDAQ) to collaborate on developing the company’s clearing house.

Furthermore, during the same month, B3 introduced its cloud platform for fixed-income trading. Additionally, B3 Digitas, a subsidiary focusing on digital assets, unveiled a partnership with a Brazilian digital bank to offer cryptocurrencies.

Dividend evolution ahead

B3 has approved the payment of R$317.5 million in interest on equity (JCP) to shareholders. JCP is a specific practice in the Brazilian tax system where companies pay interest to their shareholders based on the equity invested in the company. It carries distinct tax implications in Brazil, as it is accounted for as an “expense” for companies, reducing taxable net income. In addition, B3 paid dividends of R$280.2 million. This results in a total of R$597.7 million in dividend payments, equivalent to a gross amount of R$0.05 per share.

The dividends related to the results of the second quarter of the 2023 fiscal year’s quarter will amount to R$280.2 million, equivalent to R$0.04 per share. The payment will be made on October 6, based on the share position as of September 21.

Currently, B3 offers a yield of 2.8%. However, it is estimated that by the end of this year, with the reacceleration of the stock exchange’s activity driven by the downward cycle in Brazilian interest rates, there should be a considerable increase in cash flow. The estimated yield for 2023 is 4.7%, expected to rise to 7.1% in 2024, which is considered very attractive.

Seeking Alpha

It’s important to highlight that B3 is a company that continues to grow without the need for additional capital and benefits from a positive secular trend. Moreover, over time, the company has succeeded in increasing while rewarding its shareholders, which only a few companies have achieved.

In the first six months of this year, the company generated close to R$2 billion in cash. These funds were allocated R$713 million for acquisitions and expansion, R$1 billion for dividends, and R$950 million for share buybacks, as depicted in the graph below.

B3’s IR

In 2023 alone, the company has already repurchased 100 million shares, investing more than R$1.1 billion in buybacks and dividends paid during the same period. In essence, although buybacks may not immediately impact investors’ accounts, unlike dividends, they enhance shareholder value.

In simpler terms, the company is consistently reducing the number of shares in circulation, thereby increasing the ownership stake of current shareholders. The natural outcome of this is the likelihood of higher dividends in the future because investors’ ownership stakes will be proportionally more significant than they are today.

In a final word, B3 remains undervalued and a solid income stock choice

B3 has consistently delivered strong results. On the one hand, Brazilian high-interest rates have impacted revenue in the Listed segment. On the other hand, expenses have been effectively managed, reflecting B3’s commitment to financial discipline.

In this context, as we anticipate an improvement in the market with increasing trading volumes due to the decline in interest rates, we can expect a significant margin expansion, which will inevitably positively impact the company’s profitability.

In August 2023, the average daily trading volume of derivatives on B3 reached R$6.14 billion, representing a substantial increase of approximately 39.6% compared to the same period last year and a 5% increase compared to July of this year. It’s important to note that this sector includes foreign exchange, interest, and commodities.

In August of the previous year, B3 had approximately 4.5 million investors. By July 2023, this number had risen to 5.35 million, with a slight decrease to 4.806 million in August of the current year. Consequently, the updated figure represents an annual increase of 6.7% but a monthly decline of 10.2%.

It’s crucial to emphasize that B3 is a highly resilient company. The company maintains robust profitability even during the most challenging moments in the stock market. It generates cash, enabling it to make strategic acquisitions, as it has previously done.

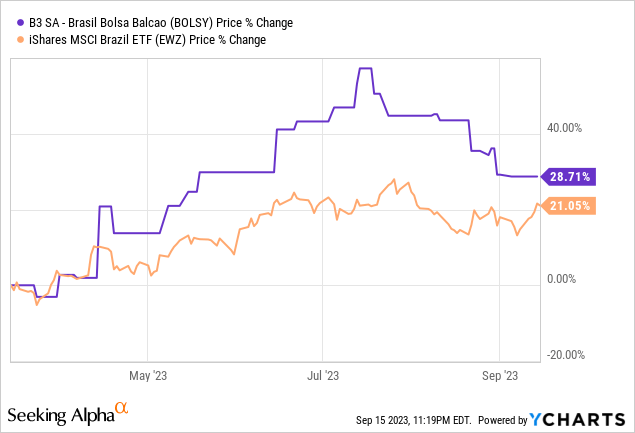

With the expectation of a declining interest rate cycle in Brazil (anticipated to reach 11.75% by year-end) and the prospect of operational improvements at B3 by 2024, I believe that B3 is currently trading at an attractive valuation. This is particularly true following a roughly 20% decline in its stock price since July, in line with a significant correction in the Brazilian stock market (tracked by the iShares MSCI Brazil ETF (EWZ)), primarily driven by macroeconomic developments related to China’s economic situation.

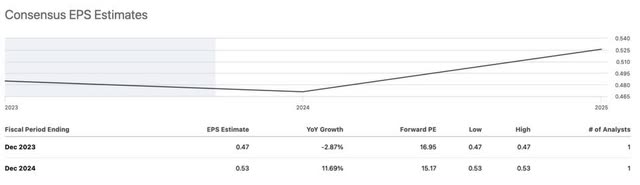

It’s worth noting that while B3 may not experience the same level of growth as some other investments, its liquidity and valuation still make it an appealing choice for investors. B3 shares are trading at a P/E ratio of 18.4x for 2023 (with tax benefit) and 15.4x for 2024, below its historical average P/E ratios by 18%. This suggests the potential for significant returns, especially in the current interest rate environment.

Seeking Alpha

However, it’s essential to consider the competitive landscape. With the advancement of technologies like blockchain, new trading methods may emerge, and global competition may intensify. The possibility of buying and selling assets directly through technologies such as blockchain could bring substantial changes to stock exchanges worldwide.

Despite these challenges, B3 maintains competitive advantages. It provides custody and clearing services, reducing counterparty risk for traders. These substantial barriers to entry have contributed to its enduring dominance in the market.

Therefore, I maintain my bullish outlook on B3. Investors who add B3 shares to their portfolios, particularly those focused on dividends, will likely enjoy an attractive yield, possibly as early as next year.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here