Introduction

It’s time to talk about one of the most iconic companies in the world, The Coca-Cola Company (NYSE:KO). Founded in 1892, the company has grown into a giant with a market cap of $250 billion.

Headquartered in Atlanta, Georgia, the company has been a cornerstone of millions of dividend portfolios, thanks to its reliable stream of steadily rising dividends.

One of them is Mr. Buffett, who owns more than 9% of this company.

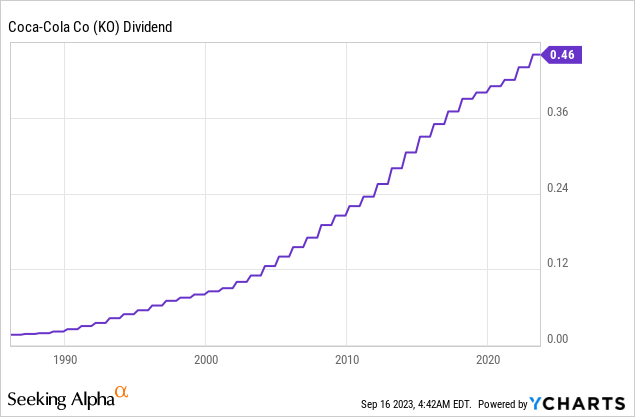

Coca-Cola has hiked its dividend for 60 consecutive years, and after dropping 9% year-to-date, it now yields 3.2%.

In this article, I will provide you with one key reason to consider buying the KO ticker and one reason to avoid investing in it. Depending on your preferences for a solid dividend stock, Coca-Cola’s stock may offer significant benefits to your dividend portfolio.

So, before I spoil anything, let’s dive in!

A Reason To Buy: (Income) Stability & Growth Opportunities

If I had to describe Coca-Cola using just one word, it would be stability. When looking for sleep-well-at-night investments, Coca-Cola is almost a must-own.

The company has an anti-cyclical business model, it isn’t prone to technological disruption (it’s not a tech or service company), and it has reached a status that protects it against generic alternatives – at least to a certain extent.

As a result, the company has hiked its dividend for 60 consecutive years.

Over the past five years, the average annual dividend growth rate was 3.4%.

The company increased its dividend by 4.5% to $0.46 per share per quarter on February 16, resulting in a current yield of 3.2%.

This dividend is protected by a 70% net income payout ratio and a 73% cash payout ratio, using next year’s expected free cash flow of $10.9 billion (4.4% free cash flow yield).

The company also maintains a strong balance sheet with a net debt leverage of 1.6x EBITDA, below the targeted range of 2 to 2.5x. As a result, the company has an A-rated balance sheet.

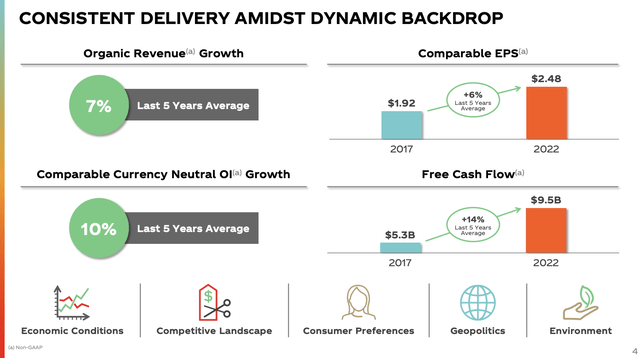

In its second-quarter earnings call, the company made clear that capital allocation priorities are consistent, emphasizing long-term growth. Over the past five years, the company has grown organic revenue by 7%.

The Coca-Cola Company

The strategic approach involves a focus on top-line-led growth while actively addressing cost headwinds to maintain steady gross margins.

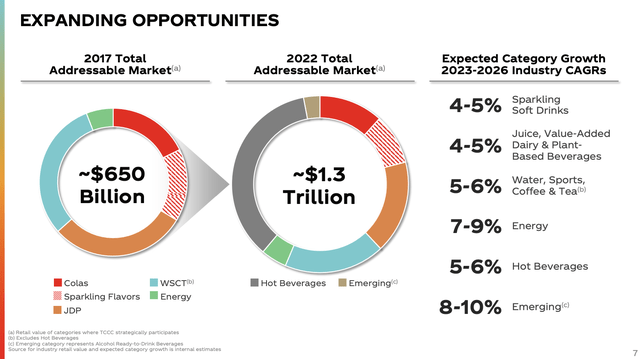

Between 2023 and 2026, the company expects GDP-beating growth rates in all of its main selling categories, led by between 8% to 10% annual compounding growth in emerging markets.

The Coca-Cola Company

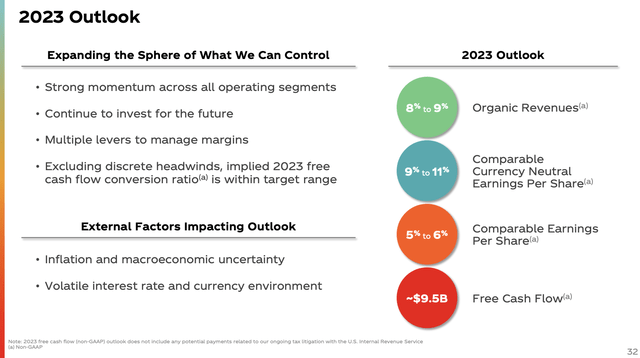

On a shorter-term timeline, the company also has a positive outlook, aiming for 8% to 9% organic revenue growth in 2023, driven primarily by price mix, and anticipates positive volume growth, which would be a great achievement in an industry pressured by tremendous consumer weakness.

The Coca-Cola Company

However, they expect pricing in developed markets to moderate throughout the year.

As seen in the overview above, the estimated growth of comparable currency-neutral earnings per share for 2023 is between 9% to 11%. This estimate takes into account the negative impact of currency fluctuations, which is expected to be around 3 to 4 percentage points on net revenues and around 4 to 5 percentage points on earnings per share.

While inflationary pressures are showing signs of moderation in some areas, specific commodities like sugar and juice continue to face elevated prices.

Looking at the chart below, we see that ICE Sugar futures just made a new multi-year high.

TradingView (ICE Sugar)

The company foresees a mid-single-digit impact on the comparable cost of goods sold in 2023 due to commodity price inflation.

KO is also gaining market share in key segments:

We are raising the bar and increasing quality leadership across our portfolio. Starting with Coca-Cola. We are growing our base of Gen-Z drinkers, gaining share and leveraging our scale to drive efficiencies across our system.

During the quarter, we gained volume and value share by linking Coca-Cola to consumption occasions and engaging consumers through local experiences. A great example is A Recipe for Magic, which was activated more than 50 markets and celebrates consuming Coca-Cola with meals.

The campaign was supported by experiences using local chefs, leveraging approximately 750 influencers globally and was brought to life through social media and recipe focused billboards. – KO 2Q23 Earnings Call

In the second quarter, the company achieved an impressive 11% organic revenue growth. Volume started slowing but improved sequentially, with June being the strongest month.

Furthermore, the company’s first-half performance was consistent with the trend since 2019, which demonstrates industry strength and a gain in market share, according to its management.

The comparable gross margin increased by approximately 40 basis points, fueled by expansion and bottler refranchising, albeit slightly offset by currency impact.

So far, I like the company’s progress. It’s doing a great job generating growth in a very mature market by focusing on emerging markets and business segments.

A Reason To Avoid: Underperformance

As much as I love Coca-Cola, there’s a reason why I own its peer PepsiCo (PEP) and not Coca-Cola.

Coca-Cola has been an underperformer.

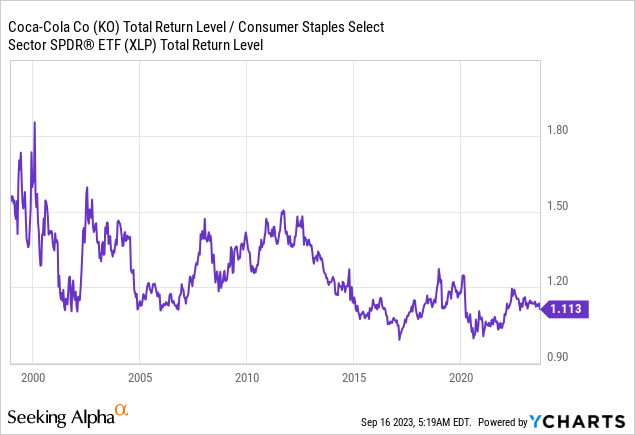

Although KO has ceased to underperform its peers in the Consumer Staples Select Sector SPDR ETF (XLP) over the past ten years, investors have been better off buying this well-diversified ETF since its inception in the late 1990s.

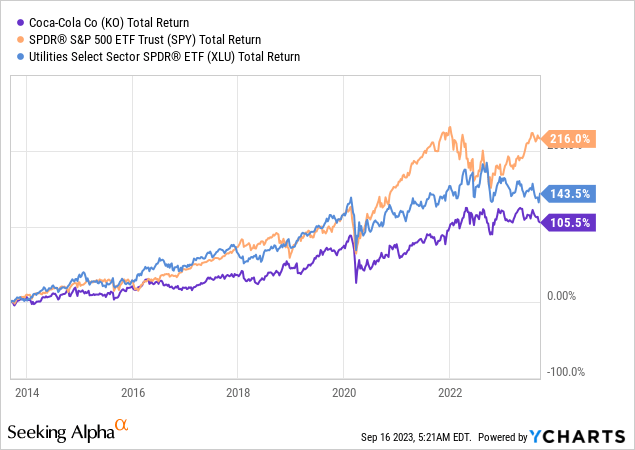

Over the past ten years, KO shares have returned 106%, including dividends. The S&P 500 returned 216%. Even the ultra-boring 3.3%-yielding utilities ETF (XLU) returned 144%.

On top of that, a 3.2% yield is not juicy enough to be satisfied with low-to-mid-single-digit annual dividend growth. Even though this dividend is very consistent, after recent market woes, it is not very hard to buy stocks with similar yields and better dividend growth. Although, I have to say that most of these stocks are in less-defensive sectors.

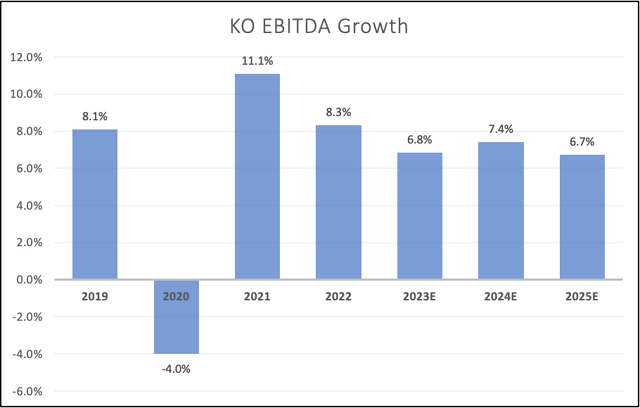

I also need to add that analysts seem to agree with the company. The company is expected to maintain mid-to-high-single-digit annual EBITDA growth going forward.

Leo Nelissen (Based on analyst estimates)

If the company is indeed able to execute, I believe it will continue to hold up quite well versus its peers.

So, although I’m using its low yield and mature business (long-term underperformance) as a reason to avoid the stock, I have to say that things are looking better than a few years ago.

Coca-Cola’s management is clearly doing a great job adjusting this giant to new market developments.

Valuation

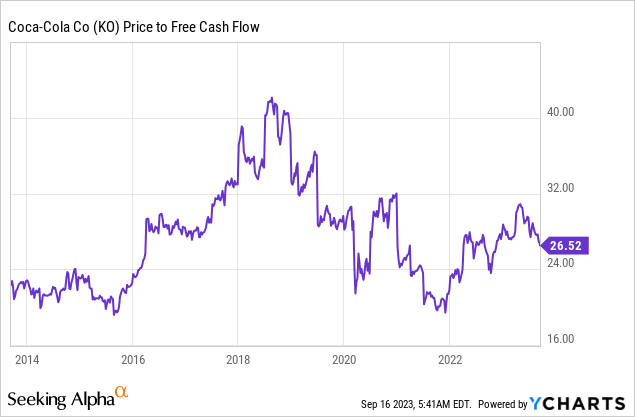

KO shares are trading at 26.5x LTM free cash flow. That number is expected to fall to 21x by 2025, thanks to an expected free cash flow surge to almost $12 billion by 2025.

This would make the valuation attractive, especially if the company is able to maintain strong (EBITDA) growth.

The current consensus price target is $70, which is 21% above the current price.

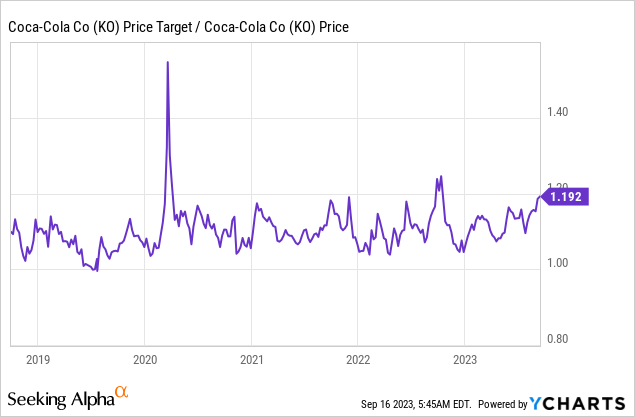

According to the chart below, the difference between the average consensus price target and the current stock price is in the upper range of the long-term range.

One of the reasons why KO is currently struggling on the stock market is the belief that inflation may be sticky after all. This could put more pressure on consumer stocks than initially expected.

Although I am in the camp that believes that inflation will remain elevated on a long-term basis, I do believe that KO shares have entered the buy zone.

I will give the stock a Buy rating.

Takeaway

When it comes to the iconic Coca-Cola Company, there’s a lot to consider.

On one hand, if you’re seeking stability and long-term growth opportunities, KO is a solid choice. With 60 consecutive years of dividend hikes and a resilient business model, it’s a sleep-well-at-night investment. The company’s focus on top-line-led growth, especially in emerging markets, indicates a promising future.

However, there’s an underperformance issue to keep in mind. KO hasn’t kept pace with some other similar investment options over the past decade, and its 3.2% yield might not be juicy enough for everyone, especially considering subdued dividend growth. But it’s worth noting that the company is making improvements to adapt to changing market dynamics.

In terms of valuation, KO seems attractive, especially if EBITDA growth remains strong. With a consensus price target suggesting a 21% upside, it could be a good time to consider adding KO to your portfolio.

Read the full article here