The Fed may pass on raising rates this week, but that doesn’t mean they are done. Given the stronger-than-expected economic growth witnessed over the last few months, it seems more likely than not that the Fed will signal through its Summary of Economic Projections that another hike may be needed while removing rate cuts for 2024.

This is critical for the Fed, especially when asset price inflation has skyrocketed, and core inflation metrics stay elevated. On top of that, commodities like oil and gasoline are again on the rise, and that effect can ripple through the economy.

This has already resulted in rates on the back of the yield curve and market-based inflation expectations. Additionally, it puts the Fed in a tough spot because if the market views the Fed as not being aggressive enough against sticky inflation, yields on the back of the curve could rise even further while inflation expectations rise.

This is why the Fed will need to communicate to the market that they remain data-dependent, that a rate hike in November is on the table, and that the unexpected outperformance of the US economy means rates in 2024 may not come down as much as expected.

Communication Through Projections

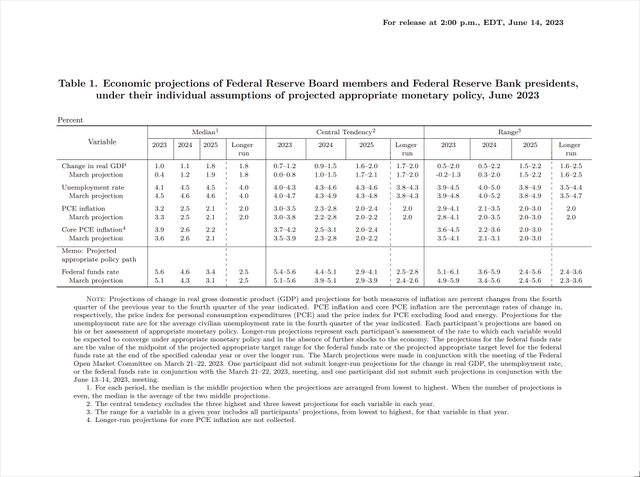

The June SEP revealed a peak Fed Funds terminal rate of 5.6% in 2023, which is then expected to come down to 4.6% in 2024, 3.4% in 2025, a long-run rate of 2.5%. Given the current data set, it seems most likely that the 2023 projection of 5.6% will remain while the 2024 and 2025 rates move higher and rate cuts are removed from the equation.

Federal Reserve

While the long-run rate stayed at 2.5% after the June meeting, its central tendency shifted from 2.4%-2.6% to 2.5%-2.8%. This suggests the Fed may see the neutral rate, which neither stimulates nor restricts economic activity, as potentially higher than before. A 2% inflation target implies a real interest rate of 0.5%. A higher long-run rate could mean the Fed estimates a higher neutral real rate for the economy.

Bond Market See Higher Rates

The market may already be one step ahead of the Fed because currently, the market sees real rates at roughly 2% across the entire yield curve out to 30 years. Compare that to where the market saw rates back in September 2018, when the market saw a neutral rate closer to around 0.75%. In September 2018, the Fed’s long-run rate was 3%, with a 2% inflation rate projecting a 1% real yield.

Bloomberg

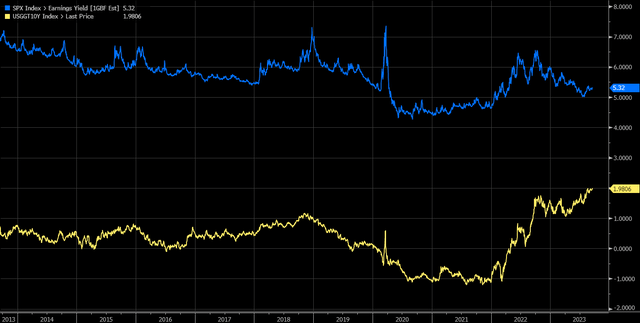

The bond market seems to be saying today that the Fed’s idea of the long-run is too low, and that would suggest that one should pay particular attention to any changes in the long-run interest rate. Because it seems on the surface, just by looking at the direction of the earnings yield of the S&P 500, the equity market thinks a slew of rate cuts are coming. This is noted by the earnings yield moving lower while real yields are moving higher. This would suggest that the equity market still doesn’t believe the Fed when it says that rates will have to stay restrictive for some time.

Bloomberg

What is interesting at this point is that the bond market is in almost complete agreement with the Fed regarding the path of rates, with a peak policy rate of 5.45%, while seeing rates falling to around 4.6% by the end of 2024, which is what the SEP was forecasting back in June.

Bloomberg

But the question becomes more about that long-run rate because a 2% inflation rate and a 2% real yield would suggest that the nominal rates stay above 4.0% over a very long period. The Fed Funds futures see rates falling to around 4.1% by 2026 and never going below. This would suggest that the Fed cutting rates to 4.6% in 2024 is probably not likely, and that will result in that 2024 estimate rising, and it probably indicates that 2025 estimates of 3.4% is way too low and will need to rise above 4% as well.

Difference of Opinion

However, the equity market seems to be pricing a much lower long-run rate than the bond market. The current earnings yield of the S&P 500 over the next 12 months is 5.3%, while the 10-year real yield is 1.98%, a spread of 3.3%. Historically, that spread averages around 5.4% over the past ten years, a difference of about 2.1%. This means the S&P 500 should be trading with an earnings yield of about 7.4% and with a 5.4% premium over the 10-year real yield, we would get a 2% real yield plus a 2% inflation target rate, giving us a long-run rate of about 4%, almost the same as bonds. However, at an earning yield of 5.3% and an average premium of 5.4%, we get a real yield of -0.1%, plus a 2% inflation target rate would give us a long-run rate of 1.9%.

Bloomberg

These spreads can change and valuation shift. However, if we just put the numbers aside. The message is that the bond market thinks rates will have to be restrictive for a long time, while the equity market thinks that rates won’t be restrictive for a long time and that the Fed will be aggressively cutting rates.

Of course, many things can change over the next two years, and trying to predict the next six months is hard enough, let alone the next 2 or 3 years. But that is not the point; the equity market is betting on many rate cuts, which is not what the bond market says. That message of higher for longer is likely to be shown in this week’s FOMC SEP, which should show rate cuts being removed while the equity market still thinks big rate cuts are coming.

Read the full article here