Goldilocks is transitional; it’s what’s next that will represent the next major macro theme

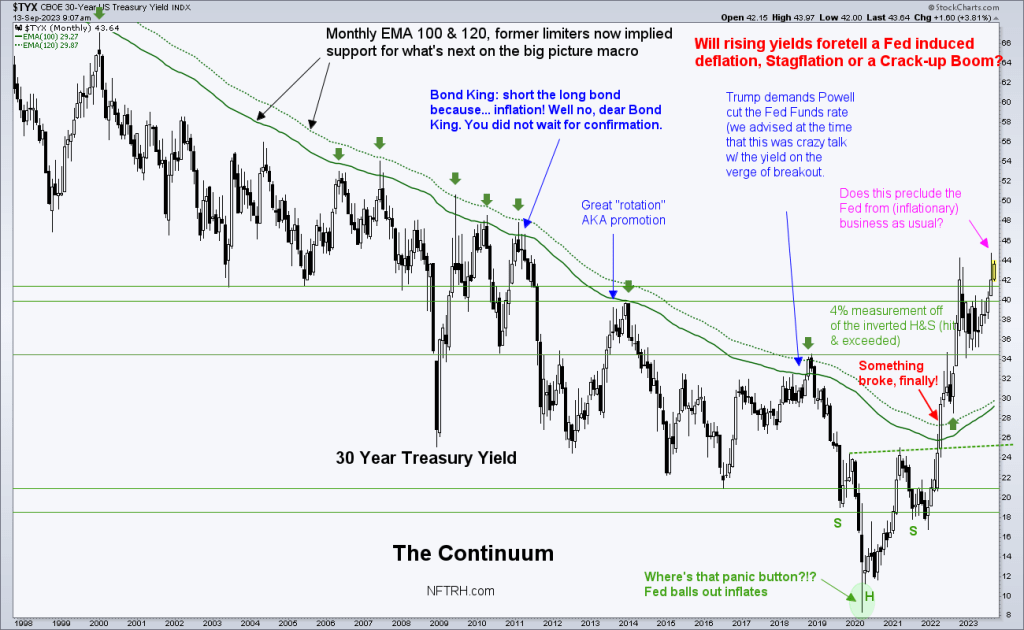

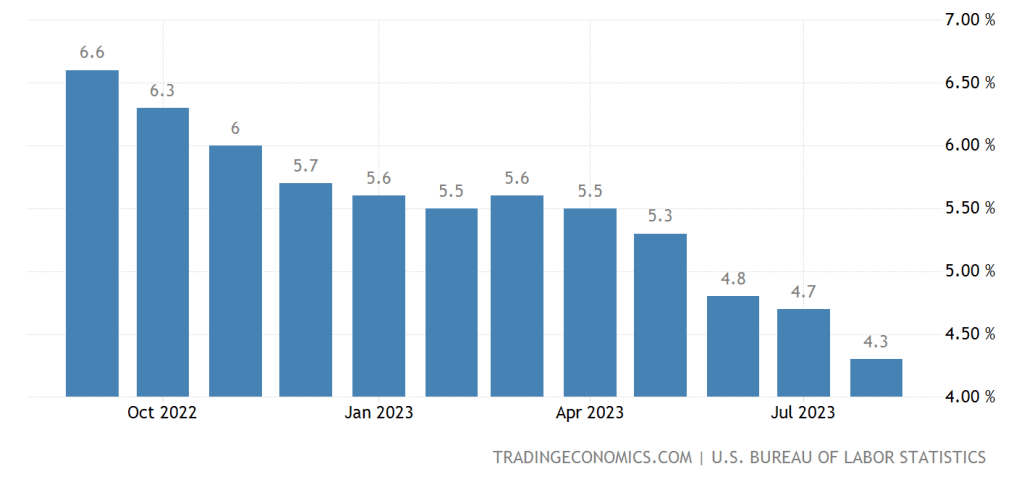

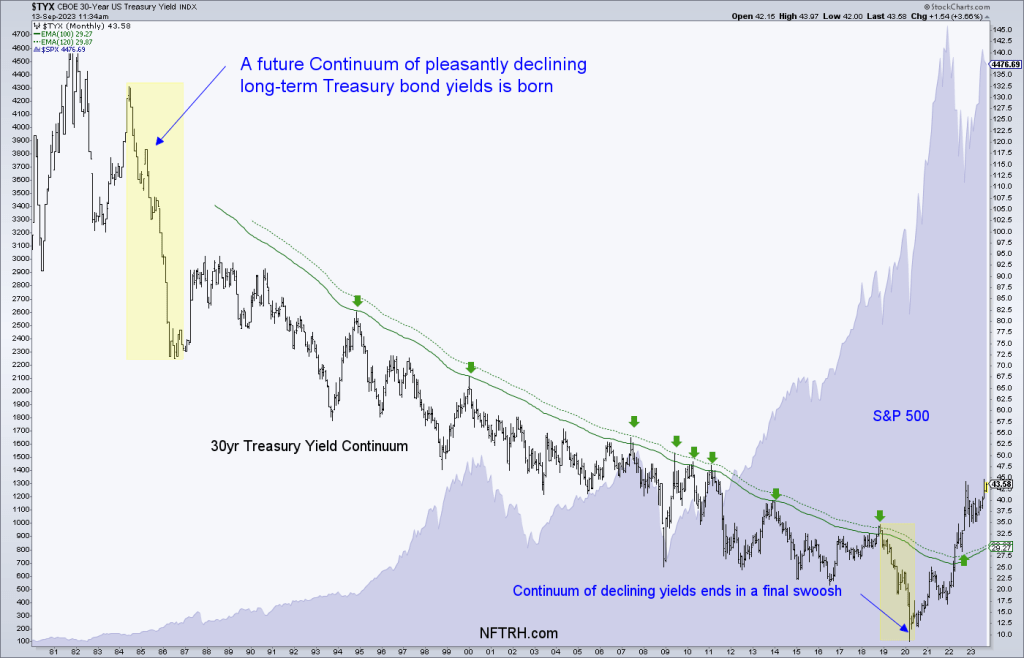

Ever since the 30-year Treasury bond yield (one ‘top-down’ macro tool NFTRH uses to gauge the environment so that we may invest in, speculate upon or avoid certain situations, accordingly) broke its Continuum of pleasantly declining long-term Treasury bond yields, macro nerds have been called to task in order to correctly interpret the forward backdrop that this break implies. The note at the upper right of the chart asks the key question.

Stockcharts.com

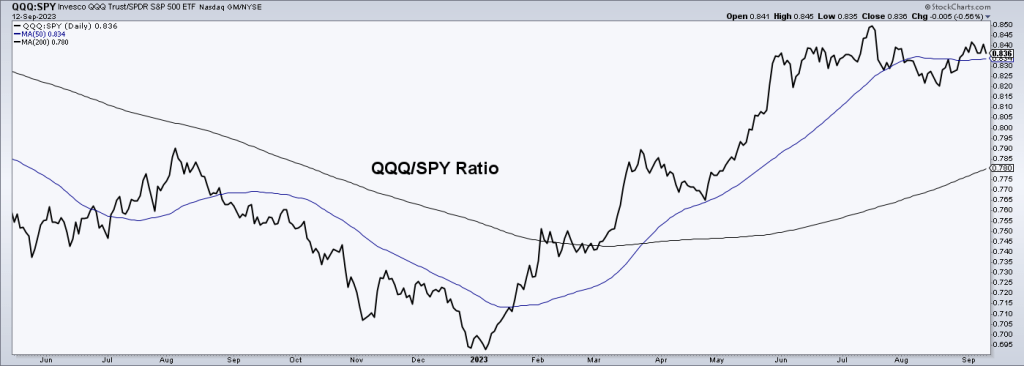

In Q4, 2022 we began forecasting a Goldilocks (inflation not too hot or cold) style recovery in financial markets to be led by the Tech sector due to the over-bearish sentiment at the time, the mid-term election cycle, a projected of easing inflation signals and certain signals that traditionally coincide with or precede oncoming bear markets, that were not in place in 2022 (e.g. the yield curve still flattening, 2yr yield not divergent from the 3 mo. T-bill yield).

Well, a Tech-led Goldilocks came and to this day endures by measures like the ratio of Tech stocks to broad stocks (QQQ/SPY). Also, growth stocks (IGX) are still leading value stocks (IVX).

Stockcharts.com

But what is now important is not what has been since Q4, 2022. By now, everybody long-since has the memo. What is important is where we are going, because forward gains and proper risk management demand a forward view based in reality, not dogma, bias or media-served robo analysis (and eyeball harvesting). Here are the three options for what is ahead, assuming I am correct that Goldilocks will not endure (not so humbly, I am).

Deflation

The simple fact that the battle against the inflation that the Fed itself printed in 2020 rages on, may bring about the eventual demise of inflation as the Goldilocks disinflation of the post-2022 phase progresses straight to a market liquidation under the pressure of tight monetary policy. This is our Fed Chief fighting inflation with extra verve, like Don Quixote tilting to a windmill because he knows the Fed was primary in creating the inflation problem and what its economically corrosive, even destructive potentials are.

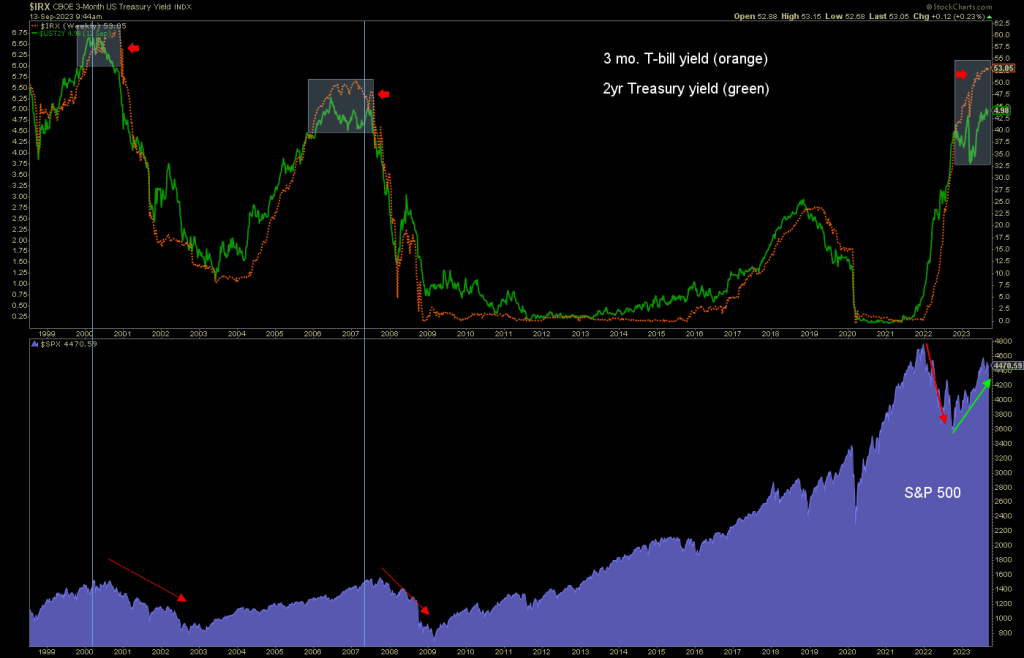

Let’s take a look at one major signal that has stretched the elastic band of risk excessively. The last two times the Fed’s monetary policy (3 mo. T-bill, Fed proxy) notably exceeded the bond market’s signal (2yr yield) deflation scares followed. If we are to extrapolate what has been to what is today, the pressure of the Fed’s tight policy, not to mention the spike in long-term yields per the Continuum chart above would result in a hard failure of the 2020 inflation > 2023 Goldilocks into a deflationary liquidation.

I continue to give the deflationary scenario solid odds of playing out as the next phase, with a slight edge over the next option. This could be very temporary before the next inflationary episode, or it could go beyond previous deflation ‘scares’.

Stockcharts.com

Stagflation

Enter, the Stag. This is where the economically corrosive effects of inflation persist, the bond market continues to battle it through rising interest rates (ref. the Continuum above), but the resolution is not a deflationary cleansing, but instead, an ongoing phase of a weak economy, impaired by persistent inflationary effects. Again with respect to the Continuum, might the bond market, after all those decades of inflationary policy slop licensed by those same decades of disinflationary signaling, simply be telling us that such policy has hit a saturation point? So much slop shoveled onto the pile, and now it’s starting to just roll over and topple.

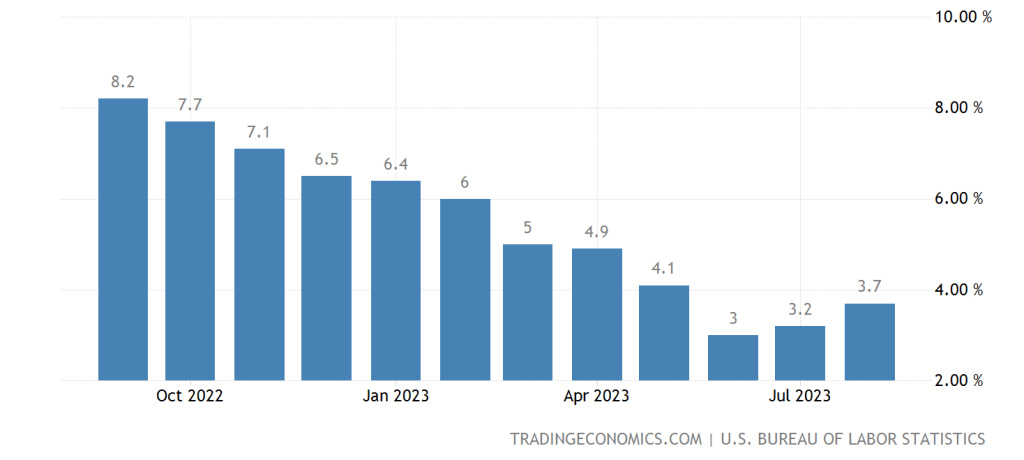

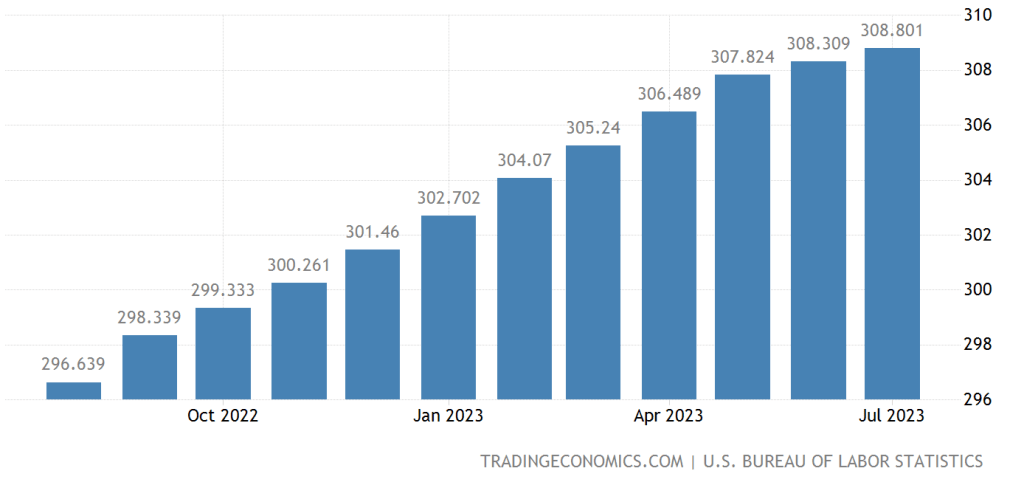

Wednesday’s inflation data showed a second month in a row of an annually increased consumer inflation rate. OPEC+ and its oil price rigging has much to do with this.

Tradingeconomics.com

The core inflation rate, which strips out energy (OIL) and food prices, continues to decline.

Tradingeconomics.com

Even though the prices of agricultural commodities have generally been in decline, the prices being gouged upon consumers within the supply chain are not helping tamp down headline inflation. This appears to be the Fed’s greatest backward looking enemy, perhaps because an election is upcoming for an administration that has staked its reputation on fighting inflation (while shoving inflationary fiscal policy into the economy out the other side of its orifice). This appears to be the makings of the Stag case.

Tradingeconomics.com

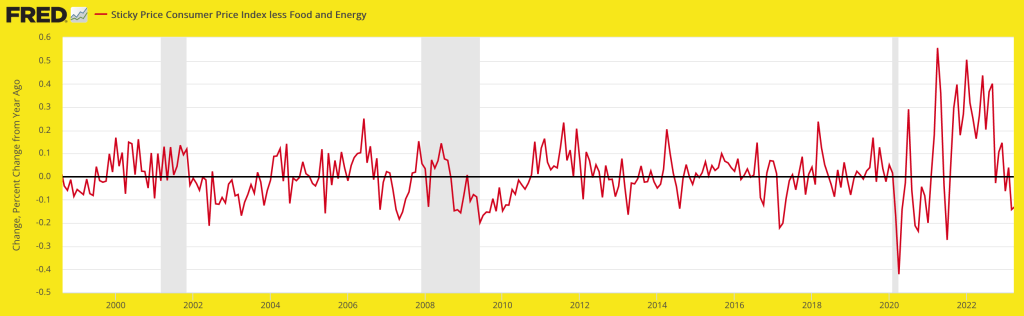

Yet the rate of “sticky” price inflation is actually decelerating. While still aloft nominally, a decline in these prices would start here.

St. Louis Fed

I give the Stagflationary view near equal odds to the deflationary view.

Crack-up Boom

A Ludwig von Mises style Crack-up Boom would be viable if the markets disregard the Fed’s current state of hawkishness and pretense of sound monetary policy and an oncoming Stagflation eventually morphs into an all out inflationary panic.

In this case the interpretation would be that the credit expansion, systematic through the decades of the Treasury yield Continuum, finally resolves not in a deflationary liquidation but instead, an excessively intense, even hyper-intense inflationary panic. This is where you hear stories about Wiemar, Germany and wheelbarrows full of paper money for a loaf of bread.

This option, which I do not (yet) favor, would end the system. It would have people wishing for the good old days of the policy induced boom/bust (inflation/deflation) cycle.

That cycle was most prominent from 2000 to this day, as the age of an alternately boomed and busted stock market bubble really kicked in. But now the blessed secular downtrend in long-term yields that kicked off in the 1980s is done. Change, probably measured over the next several years, is at hand.

Stockcharts.com

Bottom Line

A profound change has come upon the macro. A nearly four decade long trend is done, kaput. A system saturated with inflationary policy that was given license by the disinflationary signaling of the bond market is no more.

Now the signaling is inflationary, and it is going to resolve into a deflationary liquidation of the excess or an ongoing inflationary and economically corrosive Stag, which one day could resolve in a deflationary climax (unlike the deflation scares of 2001, 2008 and 2020 that were ably attended to by central banks with one primary tool, inflationary rescue policy) or a hyperinflationary one. Either of which will likely end or radically change the system.

As to those inflationary tools, one image eternally sticks in my mind. The Hero, Ben Bernanke, as celebrated on the cover of the Atlantic after the “Great Recession” was subdued through monetary policy. It was emblematic of inflationary policy to the rescue at every turn toward deflation. I and a good number of you could see it for the (inflationary) blight it was then, and one day so too will the public caught in the savage changes to come.

Meanwhile, we as individual investors, speculators, financial and social refuge seekers, etc. had better be right in our interpretations over the coming years because never in my experience (which has obviously been within the scope of the Continuum’s decades) have the options been so different and also so viable.

Read the full article here