Bridgestone (OTCPK:BRDCY) may be interesting on two fronts. The first thing is that tyre turnover should improve as more cars become battery powered. The second thing is that the pent-up demand situation for automotive remains the case, despite mounting economic pressures. We are still in the rebound phase for volumes into the newbuild car market. Destocking overhang should also wane in the coming quarters. Bridgestone results are already impressive. Their sales change plan has worked improving the mix, and pricing initiatives have all resulted in a strong performance.

H1 Breakdown

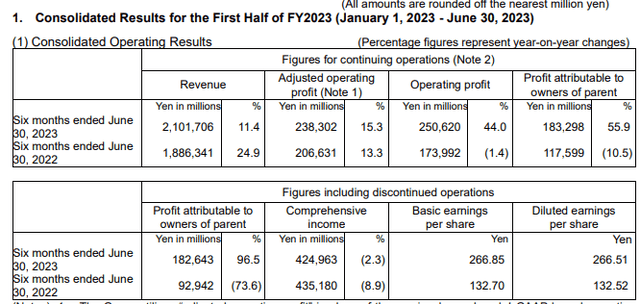

Let’s have a look at the results first. Sales are up nicely, and profits are up even more. Volumes were alright in some segments, and less good in others, but increased pricing ahead of material prices has grows gross profit, albeit slightly slower than revenues.

Highlights (H1 2023 Report)

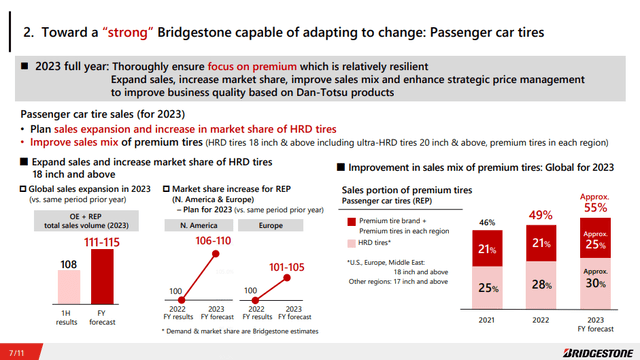

One of the reasons for the especially good profit performance are mix effects. There was more push into markets like mining and other specialty tyres, as well as other tyre grades that benefit from better pricing and unit economics. Even in just passenger car tyres, they shifted their mix towards more premium grades. Pricing action also took place which has yet to see its full effects due to destocking overhang.

Mix Effects (H1 2023 Pres)

OEM volumes thankfully grew as newbuild markets improve on the release of semiconductor shortage pressures.

There was pressure on volumes for bus and truck tyres, again due to destocking overhang, but specialty tyres remained resilient, helping with positive segment mix effects as well that all contributed to relatively good unit economics. Although, there was some slight 0.2% pressure on gross profit on account of material inflation.

Bottom Line

Pricing initiatives will continue to translate as inventory at dealerships gets digested. That will also lead to better volumes, especially in truck and bus. Specialty markets tend to be resilient and less cyclical, we saw that during the initial COVID-19 outbreak as well. No one stopped ordering these tyres.

We think there are other latent sources of earnings growth.

- Our coverage tells us that newbuild volumes are still down around 10-15% in various markets below pre-COVID levels. This is still due to supply chain issues. Those volumes are growing, and there has been pent-up demand supporting that volume growth despite the pressures on the economy. This should give at least a margin of safety for resilient OEM volumes, or quite likely continued growth in those earnings.

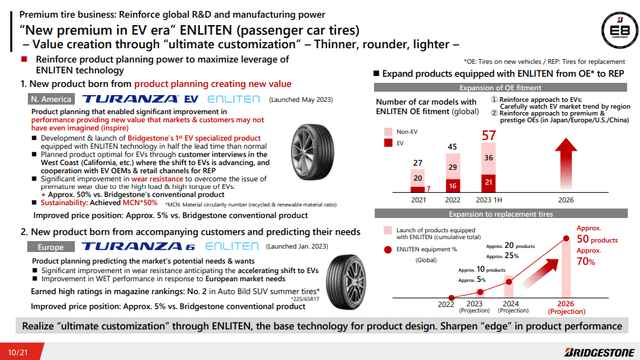

- BEVs are heavier than ICEs due to the weight of the batteries. This is going to wear tyres down faster. We believe that once the dust settles over the next few years on supply chains and other issues, the growing mix of BEVs in the fleet of cars will start translating into real effects on tyre turnover. Tyres are a stealth play on EV. This point is actually already being acknowledged by incumbents. Bridgestone is already trying to compete on performance by selling higher value tyres that are more wear resistant specifically for the EV market. This will start contributing to profits in 2024.

EV Tyres (Management Plan 2023)

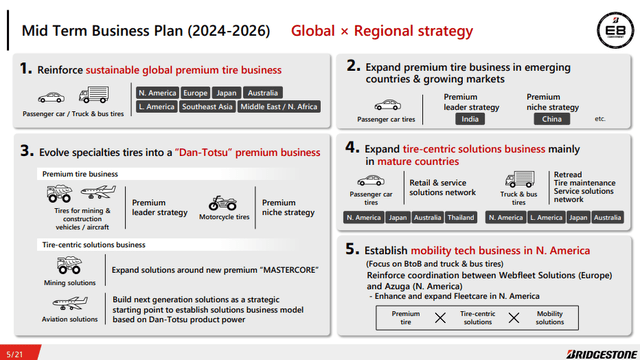

Bridgestone is also quite awake to the opportunity presented by growth in ASEAN countries, including India and Vietnam.

Emerging Market Plan (Management plan bridgestone)

We are pretty bullish on tyre companies in general. All of them are pretty similarly managed. While we like Bridgestone, we would probably opt for European peers just to avoid some of the corporate governance issues and shareholder payout reticence that comes in Japanese markets, particularly in companies where there is still substantial controlling interests from a family. Bridgestone is not a major offender, but it is a slight consideration and the European picks come at the same price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Read the full article here