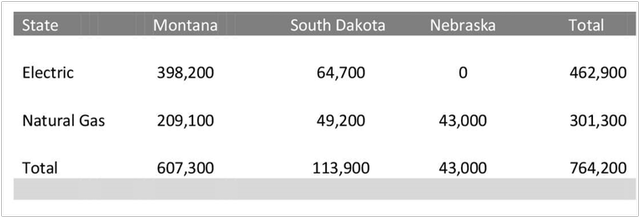

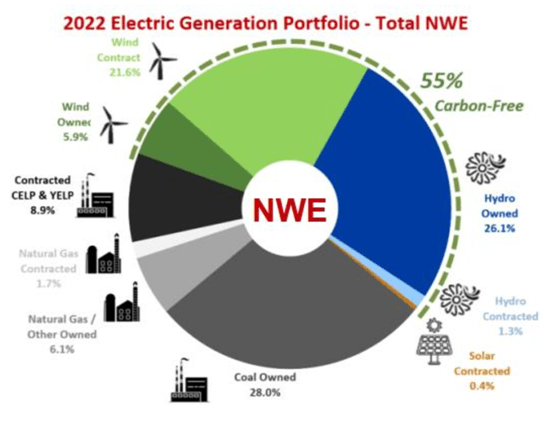

NorthWestern Corporation (NASDAQ:NWE) is a holding company for the utility NorthWestern Energy, headquartered in Sioux Falls, South Dakota. It has been in existence in various forms since 1923. The current version was formed in 2002 when NorthWestern Corporation purchased the Montana Power Company’s transmission and distribution system. This increased the size of the business by one-third. Today Northwestern provides natural gas and electric power to two primary markets: the western portion of Montana and the eastern third of South Dakota. It also provides gas service in southern Nebraska, and electricity to the niche market of Yellowstone National Park. The company’s energy generation is reportedly 55.0% non-carbon, well above the national utility average of 40.0%, and it is produced through a combination of hydroelectric, wind, and solar. NWE has 764,200 customers in total, as illustrated below. It is a mid-cap company with a current market value of $3.04 billion. Standard & Poor’s has assigned it a BBB credit rating or lower-medium investment grade.

Customers by State and Product (2022 Annual Report)

I analyzed this company because it was on my watch list as a potential buy. I believe the shares are just slightly undervalued at the current price of $51.96. They are down 34.2% from their short-lived February 2020 peak of $78.92, when volatility entered the utility market. If you are an income investor with a long-term horizon, you might find the dividend appealing, but I have some concerns beyond that positive trait, as addressed later.

The Electric Business

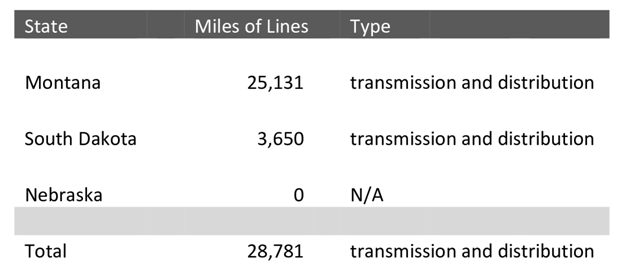

Electric Customers by State (2022 Annual Report)

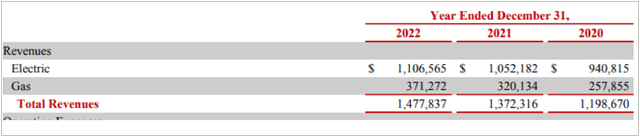

NorthWestern has two divisions consisting of gas delivery and electric transmission. Electric generation and transmission is by far the largest revenue creator, responsible for 75.0% or more of the company’s income, per the 2022 Annual Report.

Electric versus Gas Revenues (Annual Report)

Electric demand in this market is relatively steady year round and this is where most of the growth for the company occurs. Between 2008 and 2022, the electric customer base grew at a compound annual growth rate (CAGR) of 1.17%, slightly above the national utility average of 0.82%.

For NorthWestern, Montana has been the primary source of growth. It has a strategy that it calls the ‘80/20’ rule: in the future, the company will be “80% Electric and 80% Montana.” However, NWE says it is concerned about securing adequate energy capacity for the state going forward. This was a particular problem during the December 2022 cold weather event that brought record lows to the area, with wind chills of 30 below zero. NorthWestern relied on the energy market to cover shortages but doing so exposed it to volatile market prices. This had a negative effect on the company’s 2022 income, and earnings per share dropped to $3.28 from $3.61, a decrease of 9.1%.

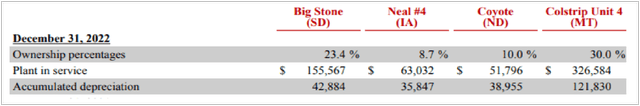

NorthWestern is trying to be less reliant on market rate energy. It still uses traditional coal in several facilities but must retire these in the future, resulting in more capacity shortages when energy demand is high. The company also has three wind farms in Montana and South Dakota, 11 fully owned hydro facilities in Montana, and five thermal generating plants. It has a partial interest in four coal-fired power plants. One of these is the Colstrip Power plant in Montana, which it co-owns with five other utilities, a common arrangement.

Ownership in Coal Plants (2022 Annual Report)

To increase capacity, NorthWestern is currently building the 175-megawatt Yellowstone County Generating Station, expected to begin serving customers in 2024. It will be powered by a natural gas internal combustion engine. The company also recently added the 58-megawatt Bob Glanzer Generating Station near Huron, South Dakota, which it built at a cost of $83.1 million. The current electric generation configuration is as follows:

Electric Generation by Type (2023 Investor Presentation)

The Natural Gas Business

Natural Gas Customers by State (2022 Annual Report)

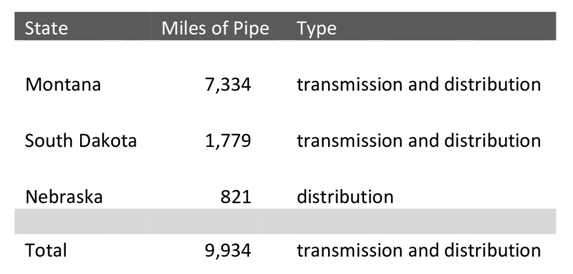

The gas utility operations include the production, purchase, storage, and distribution of natural gas. The extreme winters in Nebraska, South Dakota, and Montana necessitate gas heating, which is more affordable than electric heat. As NorthWestern states: “demand for this product depends heavily upon weather patterns throughout our service territory, and a significant amount of natural gas revenues are recognized in the first and fourth quarters related to the heating season.” NorthWestern has none of the older cast iron or non-protected steel piping, which is better for maintenance costs.

Gas revenues are typically between 21.0 and 25.0% of the total revenues. They escalated in 2022 due to the December cold weather event. Between 2008 and 2022, the CAGR for gas customers was 0.97%, above the national gas utility average of 0.73%.

And Now a Complete Restructuring…

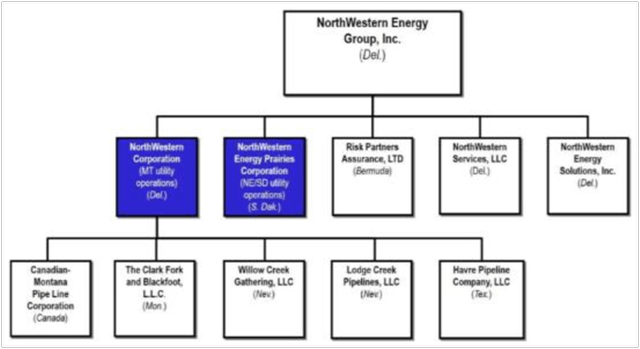

Going forward, the Montana utility operations will be separated into a new division. An exact date has not been given. According to the agreement, however, NorthWestern’s utility operations in Montana will become separate, wholly owned subsidiaries of a new holding company, NorthWestern Energy Group, Incorporated. The Montana portion of the company, which is most of its operations, will be managed by NorthWestern Corporation. The electricity and natural gas operations in South Dakota and Nebraska will be run by another newly formed subsidiary, NorthWestern Energy Prairies Corporation. The proposed corporate structure is below.

NorthWestern Reorganization Plan (Investor Presentation)

According to NorthWestern, this plan will “serve the public interest (of) Montana public utility customers by isolating and insulating the Montana public utility in its own corporate entity, separate and distinct from NorthWestern’s other utility operations.” It will also allow NorthWestern to make a clearer case for an important rate increase with the Montana Public Service Commission.

Montana intends to place limits on the new NorthWestern Corporation operations. These have not been finalized, but there will be restrictions on the transfer of assets over $5.0 million, dividend payouts, and the appointment of an independent director capable of vetoing any bankruptcy decisions. These restrictions are because the Montana Power Company had filed for bankruptcy in 2002, after starting a fiber-optics business. Montana Power was a 90-year-old company and many of the company’s assets were acquired by NWE. Per the restructuring agreement, the Montana utility portion of the business will not be able to issue dividends to shareholders if its equity falls below 40% of its total capital structure. This would make sure the company is servicing debt first.

I would like to point out here that the Second Quarter 2023 net income for the period was $19.1 million, or $0.32 per diluted share, as compared with net income of $29.8 million, or $0.54 per diluted share, for the same period in 2022. The dividend paid in the second quarter 2023 was $0.64 per share, greater than the net income. The income decrease was primarily due to “unfavorable weather” creating lower electric and natural gas demand. Unfavorable weather here means the temperatures were about 20 degrees above normal, and records were made.

It is also important to note that NorthWestern Energy filed for bankruptcy in September 2003. This bankruptcy was associated with the performance of the Montana division. NWE at the time had too much debt and “had failed to get enough shareholder votes to issue new shares of stock,” so it filed for voluntary reorganization.

NWE’s Debt and Common Stock Sales

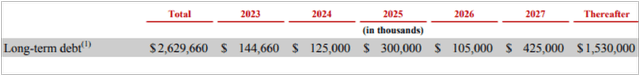

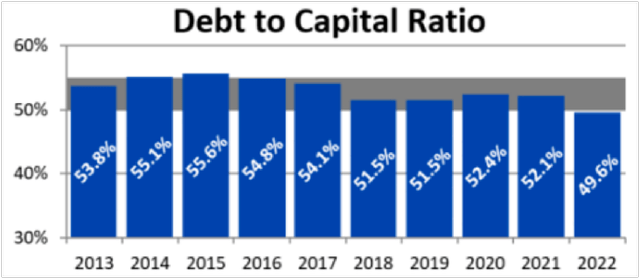

Currently Northwestern appears to have a reasonable amount of debt for a utility. However, it has relied on frequent share issuances to raise funds. NWE’s total debt to capitalization ratio was 49.6% at the end of 2022, and 52.1% in 2021. The company plans to have a long-term 50-55 percent debt to total capital ratio. NorthWestern has $144.7 million of debt maturing this year, to be refinanced at higher rates. The annual expiration schedule for the company’s long-term debt is below. These yearly rollovers are generally low, about 5.0%, except for 2025, which is a not-insubstantial 11.4%.

Long-Term Debt Rollovers by Year (2022 Annual Report)

All of NWE’s debt has fixed interest rates, with the exception of its revolving credit facilities. There is a $425 million Credit Facility and $100 million Additional Credit Facility that pays interest at SOFR plus 10 basis points.

Debt to Capital Ratio Over Time (2023 Investor Presentation)

NorthWestern frequently relies on the sale of common stock to raise capital. Of course, this pattern dilutes the holdings of existing shareowners. A schedule of recent issuances is below and these alone represent almost 10.0% of the current market capitalization. There is no buyback plan in place and there is no preferred stock.

- 2022 – $277.0 million in proceeds from the sale of common stock,

- 2021 – $196.2 million in common stock issuances,

- 2018 – $44.8 million was raised from common stock, and

- 2017 – $53.7 million was raised from common stock sales.

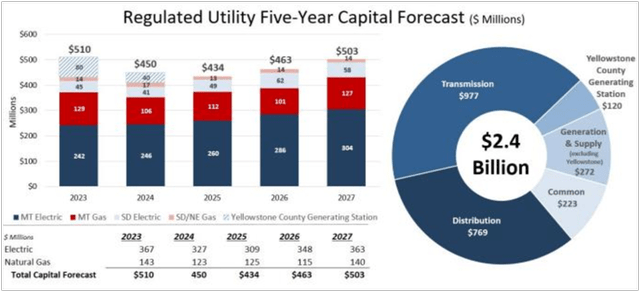

Necessary Capital Expenditures

Utilities are capital-intensive businesses requiring large, long-term investments to develop and maintain infrastructure. In 2022, the company spent $580 million in investments, and in 2021, $463 million. Ongoing issues are generation and transmission capacity constraints, grid modernization, and renewable energy integration. NorthWestern expects to finance these items through “a combination of cash flow from operations, first mortgage bonds, and equity issuances.” Recent big ticket items include the Glanzer Generating Station in South Dakota, completed for $83.1 million, and Yellowstone County Generating Station in Montana, with $173.5 million invested to date. Currently, NorthWestern is installing automated metering infrastructure in Montana at a total cost of $112.0 million. The company’s five-year capital plan is below:

Upcoming Capital Expenditures (2023 Investor Presentation)

Critical Rate Increase Request

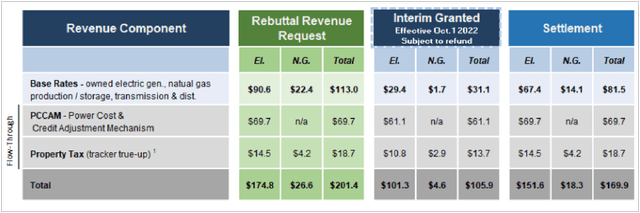

NWE says its residential electric and gas rates are well below the national average. The company is counting on a substantial rate increase from the State of Montana, for which it applied in October 2022. This could increase base rates by as much as 25.0%. This is the reason NorthWestern separated Montana’s energy operations into a different division.

In Montana, energy is regulated by the Montana Public Service Commission (PSC). This “historic rate increase” would cost the average residential customer $364 a year. In October 2022, the PSC approved a temporary rate increase, and in April, NWE and the main parties reached a settlement agreement for electric and natural gas rates providing 9.65% and 9.55% returns on equity, respectively. The company had requested 10.6% for both. Final rates, once approved, will be retroactive back to the request date of October 1, 2022.

This rate increase will raise net income by an estimated $41.2 million for 2023 if approved, or $0.68 per share. It would also boost EPS for the first half of 2023 by 25%, from $1.37 to $1.72, per the 2023 Investor Presentation. Net income would have increased from 2021 to 2022 if it had been in place earlier. NorthWestern also filed this year for an electric base rate increase of 30% in South Dakota. This is the first rate review there since 2015.

Proposed Rate Increase Montana (2023 Investor Presentation)

Dividend History

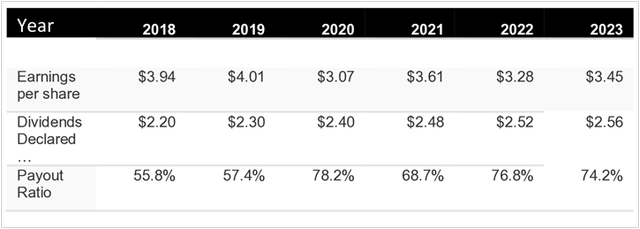

NorthWestern has a target dividend payout ratio of 60%-70%. It began paying dividends, this time around, in March 2008, at the quarterly rate of $0.33 per share. Currently, the dividend is $0.64 per quarter, for a yield of 5.09%. I calculate a compound annual growth rate of 4.51%. Over the last five years, the growth rate has been a bit slower at 3.1%.

The current payout ratio for NWE is 74.2%, based on the consensus 2023 income of $3.45 per share. The pending Montana rate increase could change this, however, as the increase would be retroactive to October 2022. Below is a table of annual payout ratios.

Dividend History and Payout Ratio (Author Calculated)

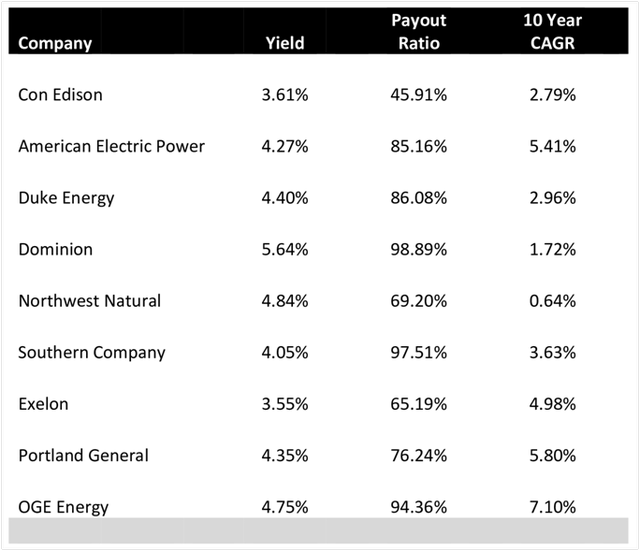

You can compare the current 5.09% yield to other utility stocks such as Consolidated Edison (ED), Duke Energy (DUK), OGE Energy (OGE), or nearby Portland General (POR). NWE’s dividend yield and its CAGR are higher than many of these.

Various Utility Dividends and Compound Growth (Author Calculated)

Share Valuation

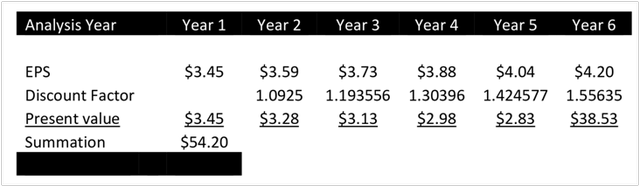

I estimate the current value of NWE shares to be US $54.20. I have used a discounted cash flow cash to value the company’s shares. This involved taking the EPS, beginning in 2023, and then projecting forward. I have used a 5-year period in this analysis, plus a reversion in year 6. For the discount rate, I looked at the average annual return of the S&P 500. The long-term average is about 9.25%, while over the last 10 years, it has been 10.4%. Note that NWE’s return on equity is 9.65%. I used a discount rate of 9.25%, at the lower end, because NWE is a regulated utility, theoretically more stable.

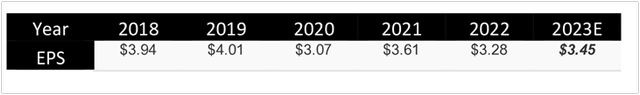

2023 earnings guidance has not been released yet and is expected to be provided following an outcome in the important Montana rate review. The company said its 2023 annualized dividend of $2.56 is expected to be above its targeted 60-70% payout ratio, however. If we assume the payout is 75.0%, that equals EPS of $3.41, near the analyst consensus EPS of $3.45. The company also added that long-term growth targets remain 3-6% EPS; I have used a rate of 4.0% there. Below are NWE’s actual EPS numbers, which fluctuate widely from year to year.

Earnings per Share Over Time (Author Calculated)

The current P/E ratio for NWN is 17.0. The inverse of the P/E ratio is a cap rate, so 1/17.0 = 0.059 or 6.0%. This feels aggressive, so I have used a cap rate of 7.0% for the reversion, to reflect the mature status of the business. The results are presented below:

Earnings per Share Over Time (Author Calculated)

It is important to note that the full requested rate increase would boost earnings per share by $0.68, and even the interim rate already granted could increase net income per share by $0.51, assuming it all flows to the bottom line. I also did the calculations with these numbers and it would raise the value closer to $60 per share.

Risks to Outlook

The primary risk that comes to mind is a Montana Public Service Commission decision that falls significantly short of NorthWestern’s requests. The company has already stated that it goes to the open energy market to bridge gaps in its supply. Another risk to the outlook is variability in weather, with warm days lowering revenues. This may be impacted by climate change. The South Dakota Public Utility Commission’s 30% requested rate increase is also uncertain. Finally, there will be a dividend restriction triggered if equity for Montana operations falls below 40.0%.

Conclusion

NorthWestern Corporation is a successor utility to the prior NorthWestern which reorganized, and to Montana Power Company which it acquired. The company acknowledges that it has insufficient capacity to meet the needs of all its customers in Montana, South Dakota, and Nebraska. It is trying to correct this gap by building new infrastructure. The company is relying on a substantial (as high as 25%) rate increase from Montana regulators, which will increase profitability and improve payout ratios. However, there is a need for greater capital investments and the company often meets this by selling shares. It has done so in four of the last seven years and is likely to continue. So the return achievable will be mostly the dividend yield and its increases, as share prices are frequently diluted.

Read the full article here