I like Uranium and the nuclear industry as an investment. I believe it’s the only way the world can have its cake and eat it too (Increase the standard of living while sticking to emissions targets). In my first coverage of NexGen Energy (NYSE:NXE), I explained how this can be the case. I also went into detail on how an investor can potentially benefit by making an investment in a development stage pre-revenue company such as NexGen Energy. My thesis rested on potentially one of the three scenarios playing out –

Quick Recap of our thesis

Base Case

The price of the Uranium remains unchanged or even drops to US$30 – $40/lb. for several years. At a low production cost of less than US $20/lb., the company was still going to outperform other companies’ operational mines. This would make the investment long-term as the stock price slowly ticks higher over the years with the company ramping into production and finally realizing a higher valuation.

Moderately optimistic case

Increasing Supply constraints along with a widening demand gap push the price of Uranium. Since the price of Uranium stocks is closely correlated to the price of Uranium, we start seeing NXE tick higher much before production. There is also a possibility that bigger rivals find the valuation attractive enough to make an acquisition offer that would greatly benefit existing shareholders.

Highly Optimistic

An extension of the moderately optimistic case. Driven by supply and demand, the price of the Uranium can get speculative, which may provide a massive boost to underlying Uranium mining stocks. Commodity stocks have undergone speculative frenzies before. Since NexGen has the largest development stage deposit in the world, it may be one of the biggest beneficiaries of a speculative environment.

Presently, we are already seeing the second scenario play out before our eyes and this write-up will serve as an update to our thesis.

The Rally

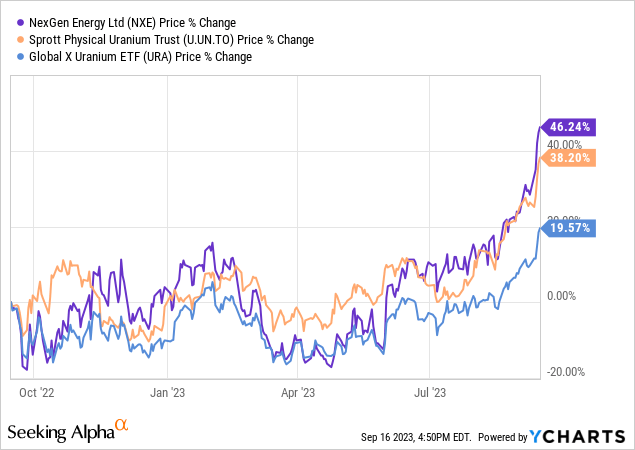

The stock is up 46% since the original thesis was published towards the end of last year. The industry as a whole has been on quite a tear this year. What could be remarkable though is the fact that the stock has outperformed both the ETF (URA) that has Uranium miners as holdings and the financial entity dedicated to the acquisition of physical uranium (OTCPK:SRUUF)

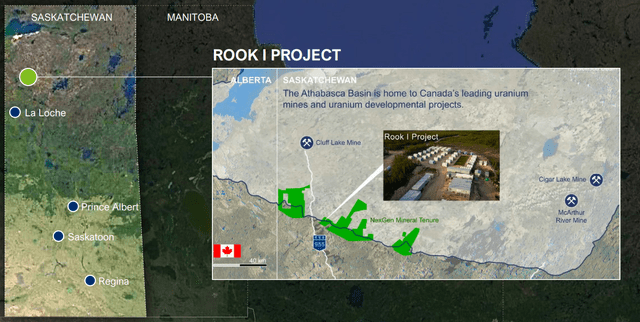

Probably, this would come as no surprise if you understood that NexGen is in possession of the world’s highest-grade Uranium deposits. The region of their deposits (Saskatchewan) is also recognized as Canada’s top-rated mining jurisdiction along with an international ranking as the third most attractive mining investment and policy jurisdictions.

Region of NexGen Energy’s project (Corporate Presentation)

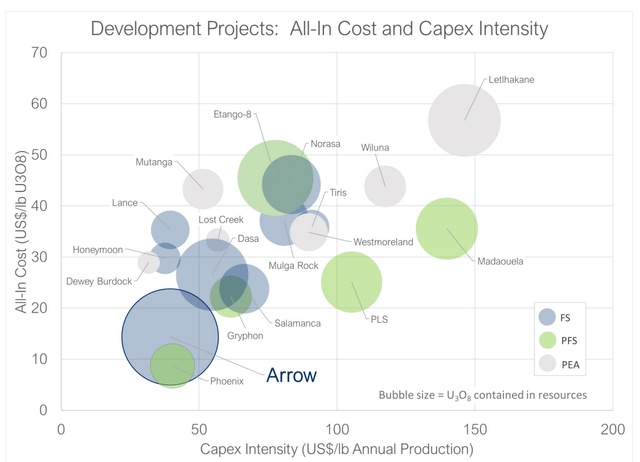

Presently, the company estimates that its Rook I Project is the largest development stage uranium project with the lowest capital intensity compared to peers. The large low-cost and low-capex project mean that the market recognizes how far this company can go when its mines are fully operational and how well the Uranium prices can propel the company.

Corporate Presentation

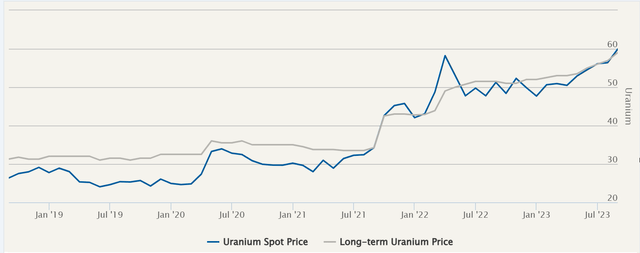

Price movement

It is interesting to see how much prices have moved up since our first coverage. The spot price was approximately $45/lb. and is close to $60/lb. now, an increase of 30 – 35%. This is still significantly less than the time we saw Uranium prices in the last bull cycle. Spot price reached a high of $136 in 2007 and prices have fallen far since then. But the market recognizes that if this rally were to sustain as the company ramps into production, we could be looking at a cash cow by the end of this decade. Earlier still, this company could become an attractive prospect for an acquisition.

Uranium Pricing per lb. (Cameco)

The company estimates at $75/lb. (average contracting price during last contracting cycle) average annual EBITDA during the first five years of annual production would be $2.5B and at the highest point of $150/lb. average annual EBITDA would be at $5.18B. This is when our scenario would move from a Moderately optimistic case to a Highly optimistic one. It could seem that it is too far-fetched to expect this move at this point in time. But the setup looks to have a really good foundation. Below is a short list of “unexpected” news that we have seen recently that makes the case for demand shooting up and supply coming up short.

Demand News

1. Finland has started regular electricity output at Europe’s largest nuclear reactor. Finland’s commitment to nuclear energy, alongside hydro and wind power, is a crucial component of the country’s journey toward carbon neutrality. This strategy has not only supported Finland’s resilience to potential energy supply disruptions but also contributed to its environmental goals.

2. Despite significant anti-nuclear sentiment following the Fukushima disaster, Japan is gradually restarting its nuclear reactors. Currently, one-third of Japan’s operable reactors have resumed operations, and approvals are in progress for an additional 16 reactors, with one set to restart this month.

3. Demand is not only expected to grow through the bulk of new reactors coming mainly from China and India but also by extending the operating lifetimes of existing plants. Canada, France, Russia, etc. are allowing existing plants to operate for up to 60 years, and in the USA, for 80 years. The latest report from WNA has said that demand for uranium in nuclear reactors is expected to climb by 28% by 2030.

4. Utilities are on track to sign contracts for more uranium in 2023 than in any year since 2012

Supply News

1. A coup in Niger, which generates about 4% of the world’s uranium, has added to the upward pressure on Uranium prices.

2. Cameco, the second largest Uranium miner announced lower full-year forecasts for production due to challenges at its Cigar Lake mine and Key Lake mill in Canada. The company has said it might buy uranium from the market if needed to help meet obligations to customers

3. War in Russia has blocked off critical export routes for the supply mined in Kazakhstan which is the world’s largest supplier of Uranium. One of Cameco’s main sources of outside supply is Kazakhstan and delays have hindered the alternative route for exports.

Risks to this thesis and positioning

It has to be stressed that this company is development stage pre-revenue and as such the play is on the movement in Uranium prices. Any correction or drop in the prices of Uranium would accordingly be reflected or even be magnified in the price of the stock.

The fallback or the base case scenario is even if the short-term to medium-term thesis fails on the Uranium prices, the long-term case for the company becoming one of the biggest Uranium commodity players in the world should still hold (But an investor would have to wait until the end of this decade for this to play out fully)

For faster realization of profits, it would be prudent to trim the position as we go further into the Uranium price rally. Most commodities undergo a period of boom and bust and this time would be no different. It seems that we are on the cusp of the boom of another cycle, the catalysts for both supply and demand seem to be supported for now. This may continue to be supported till we see prices high enough to be able to aid the miners’ plans to source additional supply.

For now, I am holding on to my full investment and may even add to my existing position till I reach my maximum threshold for a single position. I will post another update to this thesis when I decide to cut down on my position and take profits.

Read the full article here