Key Takeaways

- FOMC Meeting Wednesday

- Interest Rates Pushing To Levels Not Seen In Over A Decade

- Oil Continues Moving Higher

Heading into last Friday, market volatility wasn’t really suggesting anything to worry about and perhaps we’d even have a slow triple witching (expiration of listed options, futures and options on futures). Then again, markets have a way of catching you just when everything seems quiet. The S&P 500 dropped 1.2% and the Nasdaq Composite fell 1.5%. However, despite those losses, markets were relatively unchanged for the week and volatility continues to hover at its recent low levels. The big story this week will be the Fed meeting at the conclusion of which, it’s highly expected interest rates will remain unchanged.

Although markets finished the week flat, September has seen stocks give back some of this year’s gains. The S&P 500 is down about 1.3%, while the Nasdaq Composite is off 2.3%. Shares of Apple

AAPL

The jump in interest rates comes as oil continues moving higher, something I’ve been talking about for a while now. Crude oil futures are over $91 in premarket trading and pushing up against their highs for the year. As I’ve said, if there is one thing that can quickly jumpstart inflation, it’s the price of oil. This is something I’ll continue monitoring.

On a related note, as I mentioned above, it’s Fed week. The Federal Reserve Open Market Committee (FOMC) will announce a decision on interest rates, Wednesday. Currently, according to CME projections, there is a 99% certainty rates will remain unchanged this month and 69% they will stay unchanged when the Fed meets again in November. In addition to our own Fed meeting this week, the Bank of England meets on Thursday and Bank of Japan will meet Friday. While I’m not concerned about a surprise rate hike, I will be interested in the comments from Jerome Powell following the meeting for any hint as to what the Fed thinks moving forward.

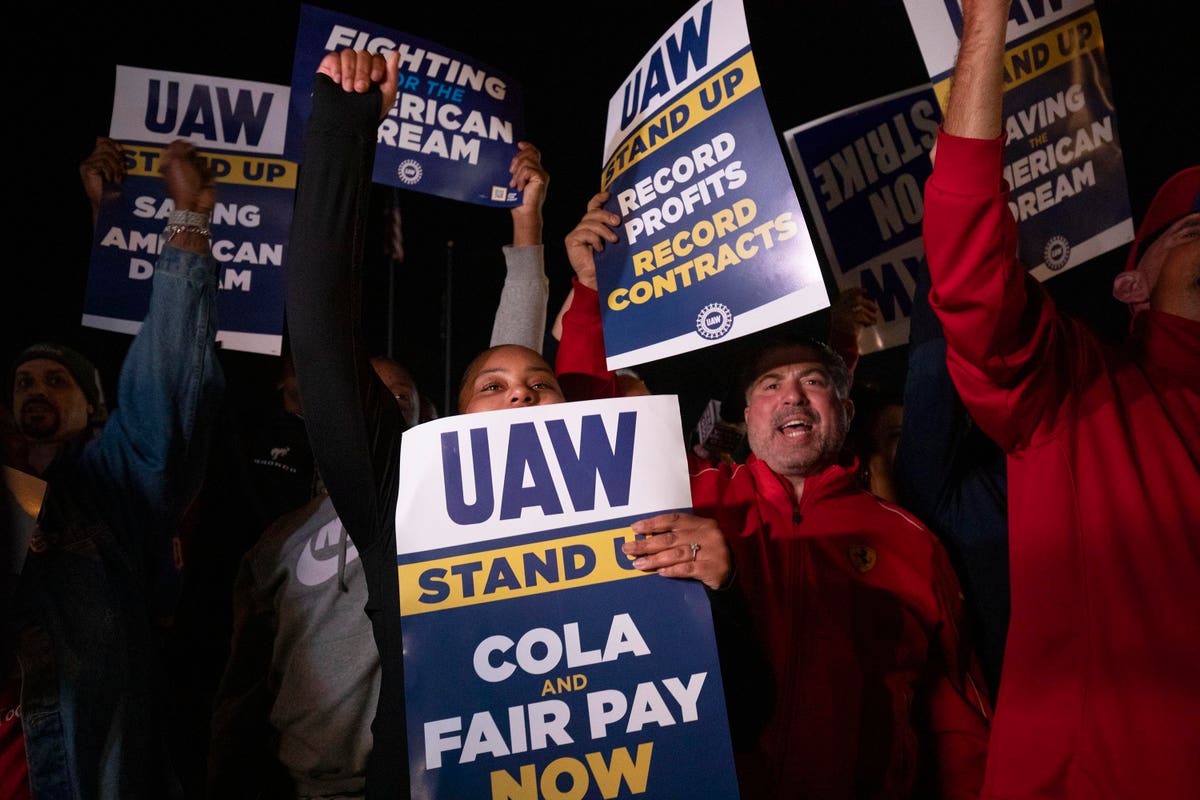

Elsewhere, United Auto Workers (UAW) are in their fourth day of targeted strikes at the three major automakers. As of this morning, all parties involved appear to still be far apart on any deal. On Sunday, UAW President Shawn Frain rejected an offer from Stellantis for a 21% pay increase and is seeking a 40% increase. Negotiations are scheduled to continue this week.

Today after the close, Instacart is expected to price their IPO as the grocery delivery company seeks a $9B valuation. Shares are anticipated to begin trading tomorrow. Then on Wednesday after the close, we’ll get the latest earnings report from FedEx

FDX

tastytrade, Inc. commentary for educational purposes only. This content is not, nor is intended to be, trading or investment advice or a recommendation that any investment product or strategy is suitable for any person.

Read the full article here