Introduction

As most of my followers will likely know, I have more than 20% aerospace & defense exposure in my dividend growth portfolio. This industry is part of the industrial sector, which accounts for roughly 50% of my portfolio value (also close to 50% of my net worth, as I invest every penny I have into my highest-conviction picks!).

The reason I decided to go overweight in aerospace & defense (mainly the defense part) is the terrific qualities the nation’s largest defense giants bring to the table. I’m not talking about benefiting from the horrors of war but their innovative power and the fact that innovation is currently the biggest driver of peace among the world’s superpowers.

Not only are these companies focused on innovation, but they also benefit from anti-cyclical demand and moats so wide they can be seen from space.

One of these companies is Lockheed Martin (NYSE:LMT), the star of this article.

Lockheed Martin was my largest holding before Union Pacific (UNP) took over. This is mainly caused by Lockheed’s sluggish performance.

In July, I wrote an article titled Dividend Growth: Lockheed Martin Is My Largest Investment For A Reason. Since then, the stock is down 7.2%, excluding dividends.

Like most of its peers, the company is, once again, struggling with supply issues and budget uncertainties, keeping investors uninterested in buying the most anti-cyclical industrial companies on the market.

Google News

While I don’t enjoy these challenges, I remain as confident as ever. Despite issues, Lockheed remains in a fantastic place to maintain strong dividend growth. It now yields close to 3% and benefits from long-term demand that could accelerate earnings over the next few years.

In this article, we’ll discuss all of this and more as I reiterate why LMT is among my favorite dividend investments, especially in light of new, favorable developments that deserve some attention.

So, let’s get to it!

The LMT Dividend & Outperformance

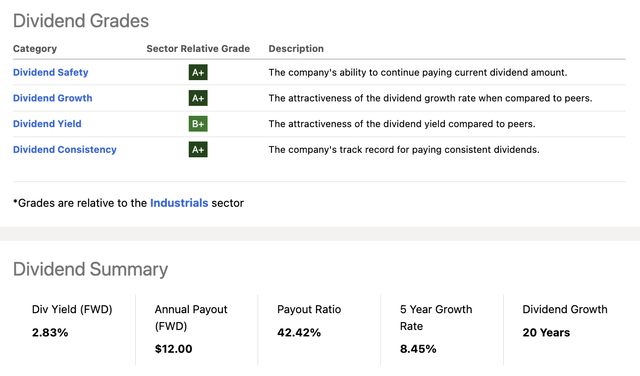

Taking a look at Seeking Alpha’s dividend scorecard for LMT, we see a sea of green, as LMT has A+ scores for dividend safety, dividend growth, and dividend consistency. Please note that these scores are relative to the industrial sector, which includes defense companies.

Seeking Alpha

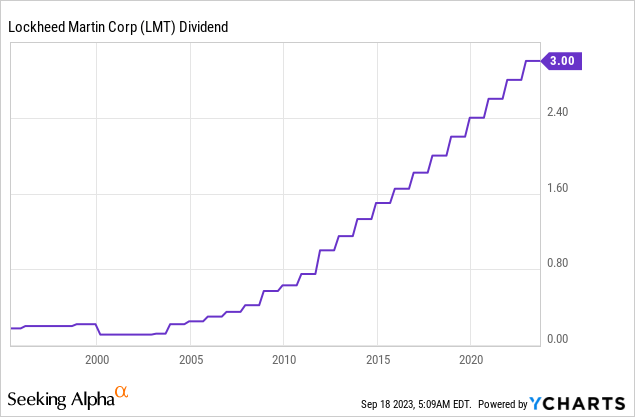

The company currently pays $3.00 per share per quarter, which translates to a 2.8% yield.

On September 30, 2022, the company hiked its dividend by 7.1%. Over the past five years, the average annual dividend growth rate was 8.5%. I expect the company to increase its dividend again at the end of this month.

If history is any indicator, we’re once again looking at a potential high-single-digit dividend hike.

Furthermore, the company, which has hiked its dividend for 20 consecutive years, has a well-protected dividend. The net income payout ratio is 42%, supported by a lot of free cash flow.

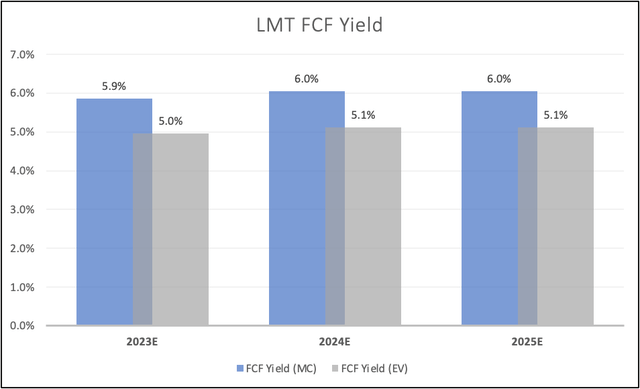

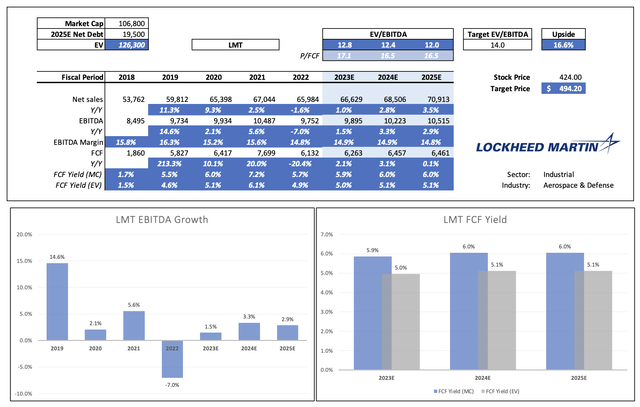

The company is expected to consistently generate close to $6.5 billion in free cash flow in the next few years, which translates to a 6% free cash flow yield, resulting in a very healthy 47% cash payout ratio.

Leo Nelissen (Based on analyst estimates)

It also helps that the company has a stellar balance sheet, which means it does not need to prioritize debtholders over shareholders.

The company has a 1.4x (EBITDA) leverage ratio, which is expected to fall to 1.3x by 2025. It has an A- credit rating, making it one of the most financially stable industrial companies on the market (not just in the defense industry).

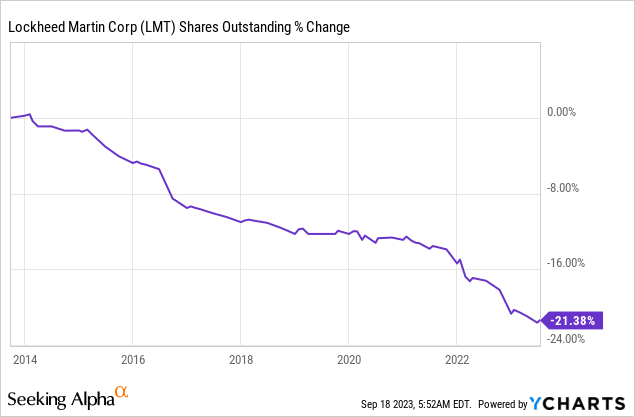

Hence, any excess cash is spent on buybacks. Over the past ten years, LMT has bought back more than a fifth of its shares.

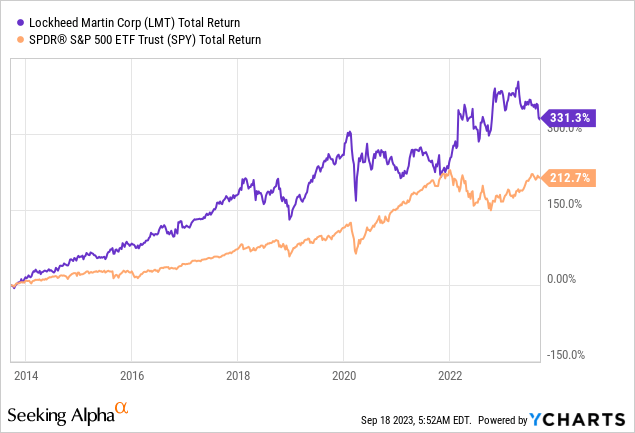

This has allowed Lockheed to outperform the market’s already stellar performance by more than 100 points over the past ten years.

In both 2023 and 2024, the company aims to distribute all of its free cash flow to shareholders!

Having said that, we need to dive deeper to assess the risk/reward of LMT shares.

Opportunities Outweigh Headwinds

A few days ago, the company presented at the Morgan Stanley Annual Laguna Conference. The timing could not have been better, as investors have become a bit nervous again.

After all, supply chain and budget fears have put some shade on the industry – again.

The good news is that despite fiscal year budget caps set at 3% for 2024 and 1% for 2025, the company is confident in achieving its growth plan.

The company emphasized its ability to adapt and thrive within these budget constraints by capturing a larger share of the market.

Lockheed also acknowledged that while budget fluctuations may occur due to supplementals or other opportunities, its goal remains to outperform and align with its growth plans based on a strategic approach to navigate evolving fiscal landscapes.

Essentially, this means that companies want to focus on top-tier projects that get accelerated funding for strategic purposes. By focusing on these niches, defense companies are able to outperform despite sluggish funding growth.

One of these projects is the Next Generation Air Dominance Program (“NGAD”). The pictures below are early pictures of what the next-generation fighter jet might look like – it probably won’t look like this, but it’s still cool to see the first guesses/renderings.

The Drive (Via Lockheed Martin)

During the aforementioned conference, the company emphasized the importance of long-term investments in key technologies such as advanced stealth, autonomy, and sensor fusion, which could be relevant to the NGAD program.

What’s also important is that the company will not be entering a full-blown bidding war to get the deal for the next-gen fighter. Like most contractors, the company is increasingly focused on margins, which will likely put more pressure on the Department of Defense to boost its spending.

So we think we have a lot of experience in the key technologies. And so we do think we’ll be competitive. And we’ll see what comes about and we’re just going to keep investing in those technologies in those technologies. And we’ll see what the Air Force comes out with, but we’ll at least be ready to participate in the assessment if we’re asked to. – Lockheed Martin

For now, the company cannot comment on these developments until the Department of Defense reveals more data. Until then, it will mainly remain a restricted project.

One issue the company can comment on is its role in the Ukraine war, especially when it comes to delivering systems that are needed to modernize Ukraine’s defense capabilities.

It estimates that orders for its products could total $7 billion.

The opportunity covers various programs such as Javelin, HIMARS, GMLRS, and PAC-3, aligning with the heightened demand for missile systems.

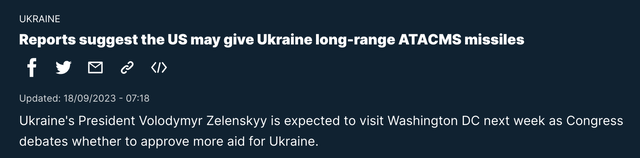

Future deals may soon include ATACMS missiles, which are long-range missiles needed to compete with Russia’s long-range arsenal.

Euronews

Lockheed plans to capitalize on this opportunity through a substantial increase in production and deliveries.

In this case, it isn’t just a business decision but something Western governments have asked for, as inventories of missiles and related were already in poor shape before the war.

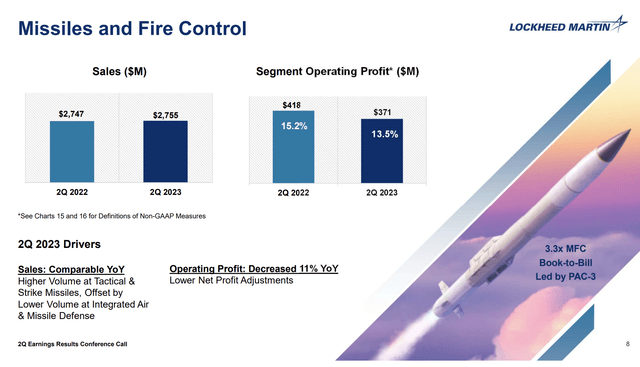

In the second quarter, the company reported a 3.3x book-to-bill ratio in its Missiles and Fire Control segment, which means that for every $1.00 in finished products, it is getting $3.30 in new orders, which is the highest book-to-bill ratio I’ve seen so far in the industry.

Lockheed Martin

In light of surging orders and (global) defense replenishing trends, Lockheed is increasingly careful when it comes to accepting orders. I already briefly highlighted this with regard to the next-gen fighter jet.

According to the company, different contracts come with varying risk levels and contractual structures, ranging from fixed price development to cost-plus.

The key challenge lies in striking the right balance between risk and return.

During the aforementioned conference, the company highlighted the need to assess whether certain elements of the contract warrant assuming the risk or if a cost-plus structure is more appropriate.

Lockheed Martin’s focus is on accurately factoring in risk while pricing and making informed decisions accordingly.

After all, if inflation remains sticky, the company does not want to be put in an unfavorable position again. This isn’t just bad news for its bottom line but also for the health of the defense supply chain, which relies on thousands of suppliers. LMT is just the top of the pyramid – along with its major peers.

Inflation pressures have been a reality for Lockheed Martin for about 1.5 years. The company has been successful in mitigating these pressures through incremental cost reductions, but the challenge remains for the coming years, particularly 2024 and beyond.

The most acute effects of inflation are expected in the Missiles and Fire Control sector, exacerbated by a double headwind caused by a classified program (likely the next-gen fighter).

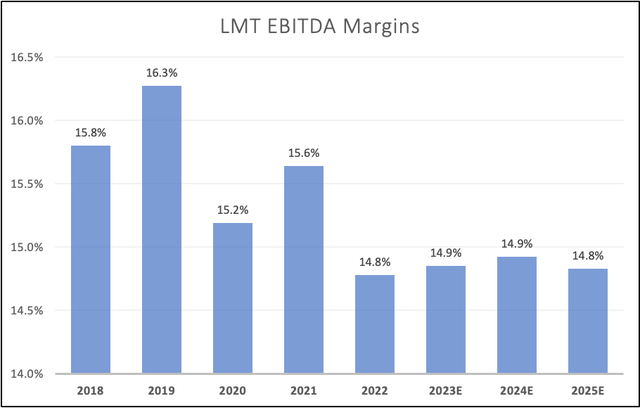

Based on this context, Lockheed Martin anticipates some margin gravity in the near future, especially in the upcoming year, followed by a gradual improvement beginning in 2025.

I’ve heard similar comments from other companies. 2025 seems to be the year we could see a steep surge in free cash flow among major defense contractors.

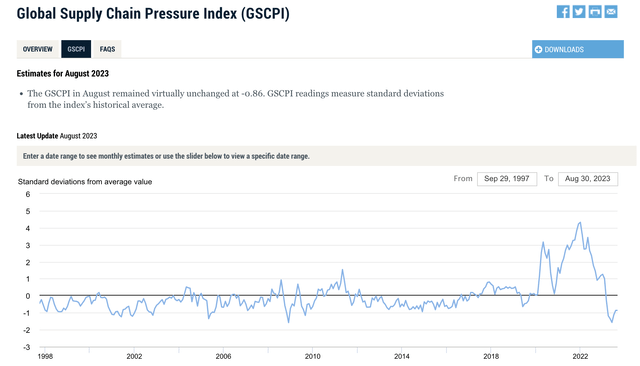

It also helps that the New York Fed Global Supply Chain Pressure index has normalized again, indicating that it will get much easier to compete for high-tech components in the next few quarters.

Federal Reserve Bank of New York

Unfortunately, other challenges exist as well, which is why LMT’s stock has been in decline since my prior article.

Lockheed is currently working on Tech Refresh 3 upgrades for its F-35 jets. As most defense programs are multi-decade programs, regular updates are important to implement the latest technologies – to put it bluntly.

TR3 is now running into some issues caused by delays in hardware deliveries impacting the software integration and testing phases. This requires more test flights and adjustments.

Despite these challenges, the company is confident in achieving its stated delivery targets after TR3 incorporation. However, they noted the possibility of some deliveries carrying over to 2025 due to constraints in flight testing capacity, which would somewhat hurt income prior to 2025 but not derail the bull case.

With regard to deliveries, Lockheed Martin has worked on a PBL program for some time.

PBL stands for performance-based logistics contracting. Contractors are paid based on performance outcomes instead of discrete parts and services.

During the Morgan Stanley Conference, Lockheed made clear that the PBL approach was viewed as a mutually beneficial proposition, aiming to optimize aircraft readiness levels and concurrently enhance Lockheed Martin’s profitability (higher margins!).

The company’s current assessment suggests that the PBL contract may temporarily lower the overall margin for Lockheed Martin’s Aeronautics sector, but it could improve profitability in the long run through efficiencies.

Leo Nelissen (Based on analyst estimates)

In other words, like most of its other measures, we’re looking at a longer-term recovery in margins, which is fine with me, just not great for investors looking to make a quick buck.

So, what about the valuation?

Valuation

Lockheed Martin is expected to maintain low-to-mid-single-digit EBITDA growth in the next three years (including the full year 2023). Margins are expected to remain steady.

I expect that we’ll likely see accelerating EBITDA growth and margins after 2025, which is supported by the company’s comments, its margin-enhancing measures, and the current order flow on top of the favorable development in global defense needs.

Leo Nelissen (Based on analyst estimates)

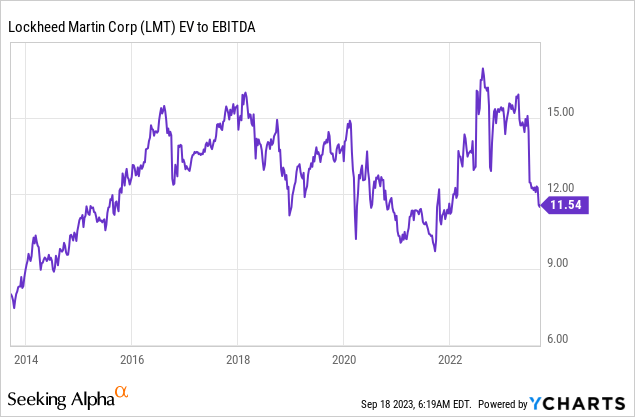

Over the past ten years, the company’s valuation has hovered close to 12x EBITA with outliers to 15x EBITDA and 10x EBITDA. The free cash flow multiple (not pictured) used to be close to 18x.

If the company were unable or unlikely to boost its margins over the next few years, a 12x valuation would be as good as it gets. However, given favorable demand developments and company measures, I believe that a 14x EBITDA multiple is warranted.

This would indicate roughly a 17% upside to a fair stock price of $494. The current consensus price target is $503.

On a long-term basis, I expect Lockheed to continue outperforming the market.

Despite the headwinds we discussed in this article, I believe that LMT is one of the best dividend stocks money can buy.

- The company has a ~3% yield.

- It has consistent dividend growth, backed by healthy payout ratios and a stellar, anti-cyclical business.

- The company has a top-tier balance sheet.

- Ongoing challenges are expected to end, resulting in accelerating earnings and free cash flow growth after 2025.

- The company is attractively valued.

- All excess cash is spent on buybacks.

- I expect Lockheed to continue outperforming the market on a long-term basis.

So, needless to say, I’m adding on any major weakness, which is what has suited me very well over the past few years.

Takeaway

Despite recent challenges and market fluctuations, Lockheed maintains a stellar dividend track record and is positioned for consistent growth.

The company showcases robust financials, high dividend safety, and a history of dividend hikes.

With a strategic approach to navigating evolving fiscal landscapes, Lockheed aims to outperform and align with its growth plans, emphasizing long-term investments in key technologies.

Despite short-term hurdles, Lockheed anticipates a steady recovery in margins, making it a compelling long-term investment.

With its balanced approach to dividends, buybacks, and business growth, Lockheed Martin remains a cornerstone in my dividend growth portfolio and one of my favorite ways to build long-term wealth.

Read the full article here