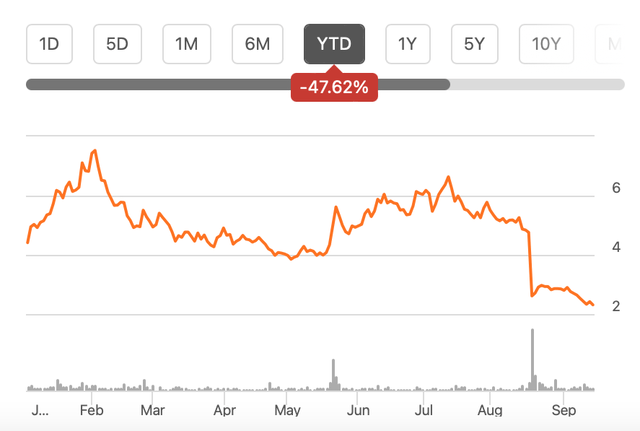

Since the last time I wrote about the online luxury seller Farfetch (NYSE:FTCH) in July, its price has dropped by an eye-popping 62.4%. Even at the time, I had given it a Hold rating, with the title itself saying that it was too volatile to buy. The only reason holding me off from a Sell rating was the company and indeed analysts’ optimistic outlook, which made a case for waiting and watching until its next set of results.

Source: Seeking Alpha

However, the results were so disappointing for investors that the stock was decimated. Within a day of their release, the price almost halved. It has fallen so much now, that the stock looks far more interesting than it has in the past year. Not only is its trailing twelve months [TTM] price-to-sales (P/S) ratio at 0.39x now lower than the 0.86x for the consumer discretionary sector, it’s way lower than the 1x it was at the last time I checked.

Despite this, however, I can no longer make a Hold case for Farfetch. Here’s why.

Continued weakness from China

With the release of its first quarter results (Q1 2023), I was already uncomfortable with its lack of growth from its second biggest market, China. That this trend has sustained in Q2 2023 for its big revenue generator, the digital platform, is an even bigger challenge.

Sure, China’s growth isn’t quite as buoyant as was hoped post-lockdowns, but that’s a relative statement. In actual fact, China’s retail sales grew by 4.6% year-on-year (YoY) in August, which is higher than expectations of a 3% rise.

Additionally, its US market is also in decline. This isn’t surprising though, since the market has been lackluster for a number of luxury brands. But most luxury companies have seen a sharp pickup in demand from China, which is a contrast with Farfetch.

Downgraded outlook

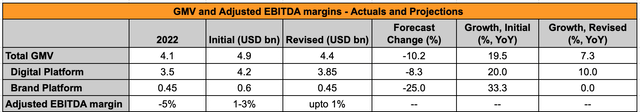

This brings me to its outlook, which has been downgraded. After seeing sub-1% gross merchandise value [GMV] growth in the first half of 2023 (H1 2023), it has downgraded expectations by 10% to $4.4 billion now.

This is due to an 8% reduction in forecasts for the digital platform, with a 91.4% share in total GMV. But the additional drag comes from the much bigger 25% cut in forecasts for the brand platform (see table below). It has also lowered adjusted EBITDA margin expectations from 1-3% to up to 1% for the year.

Source: Farfetch, Author’s Estimates

In themselves, the projections still aren’t bad. At 7.3%, the expected GMV growth might be way smaller than the 19.5% rise expected earlier, but it’s still better than a 4% decline seen in 2022 and a 2% rise in constant currency terms during the year. Also, it made an adjusted EBITDA loss last year.

Falling behind projections

But here’s the real rub. This isn’t the first time that the company has downgraded expectations. Let’s rewind to a year ago. In Q2 2022, it projected growth of 0-5% for its digital and 0-10% for the brand platform. Instead, it wound up with a 5% decline in digital and a 2.6% fall in the brand platform for the full year 2022.

Further, it also targeted a break-even adjusted EBITDA at the time, after a small adjusted EBITDA profit in 2021. Instead, it ended up with a $98.7 million adjusted EBITDA loss.

Brace for further downgrades

To be fair, by Q3 2022, Farfetch did reduce its expectations significantly, with expectations of a 5-7% decline in digital platform revenues, zero growth in the brand platform and a negative EBITDA margin of 3-5%. It delivered on these, rather dismal expectations. But it does show, that until the first three quarters of the year were done, it didn’t quite see clearly how the year was going to wind up.

It can of course be argued that the past doesn’t always inform the future. Except that in this case, all signs are pointing in that direction. Growth in its key markets is weak, even though it shouldn’t ideally be so in China at least and it has downgraded its initial projections already.

Recent weakness raises questions

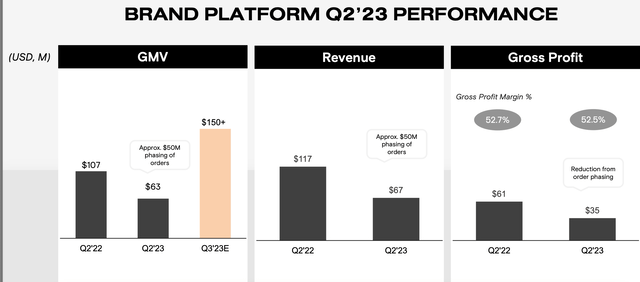

Still, there would have been a case to believe its projections this year, if the numbers so far were in line with projections. That isn’t the case either. Its revenue growth is at 3.1% for the first half of 2023 (H1 2023), so to meet its 8.7% revenue growth projections, it will have to do way better in H2 2023.

Further, it says that it expects the adjusted EBITDA margin to come in at up to 1% for the full year. But so far, the company has reported a negative margin of 7.3% in Q1 2023 and 6.4% in Q2 2023.

It does mention a $50 million hit in the latest quarter on account of “phasing of orders”. If we add this number back in, the H1 2023 revenue growth rises to 7.7%, which brings it closer to the targets. But still lower.

Source: Farfetch

The positives

It’s not like there are no redeeming qualities to Farfetch, though. It has seen robust growth in the past, with the five-year compounded annual growth rate [CAGR] in revenues at over 30%. And it’s not just during the pandemic that sales soared for it. It saw double-digit growth even in the pre-pandemic years.

Its balance sheet doesn’t look bad to me either. It has a current ratio of 1.47x, which isn’t the best but it’s alright. At 33% it’s debt-to-assets ratio also looks fine.

What next?

The positives, however, aren’t enough to significantly alter perspectives on the stock. The key challenge with Farfetch, as I see it, is a loss of credibility in its financial projections. They have been downgraded this year, in a repeat of what we saw in 2022. In fact, it was only by Q3 2022 that we saw full-year projections that were in line with the actuals.

It’s hard to rule out the same for this year, with muted GMV growth so far, a surprising lack of demand from its big China market, an expected softening in the US market and adjusted EBITDA losses.

If it is able to do better in Q3 2023, I have no doubt that its news sensitive share price will rally again. Especially now that its P/S looks attractive. That said, I have my doubts if it will be able to pull off the growth rates required to meet its projections.

This is unfortunate given Farfetch’s potential as a leading online marketplace in its domain and in general, the future of online sales. But there’s always something getting in the way of its growth recently. It’s getting to be a test of patience. I’m downgrading it to Sell.

Read the full article here