Arm Holdings

stock may be overvalued, given rising competition, a mature phone market, and China-related risk, Bernstein says.

On Monday, analyst Sara Russo initiated coverage for

Arm

stock (ticker: ARM) with an Underperform rating and a target of $46 for the price, which implies a decline of 24% from Friday’s closing level. It was Arm’s first rating from Wall Street at the equivalent of Sell, according to FactSet.

It is “too soon to declare [Arm as] an AI winner,” she wrote. “Mobile and consumer end markets make up close to 60% of revenues and both continue to be challenging.”

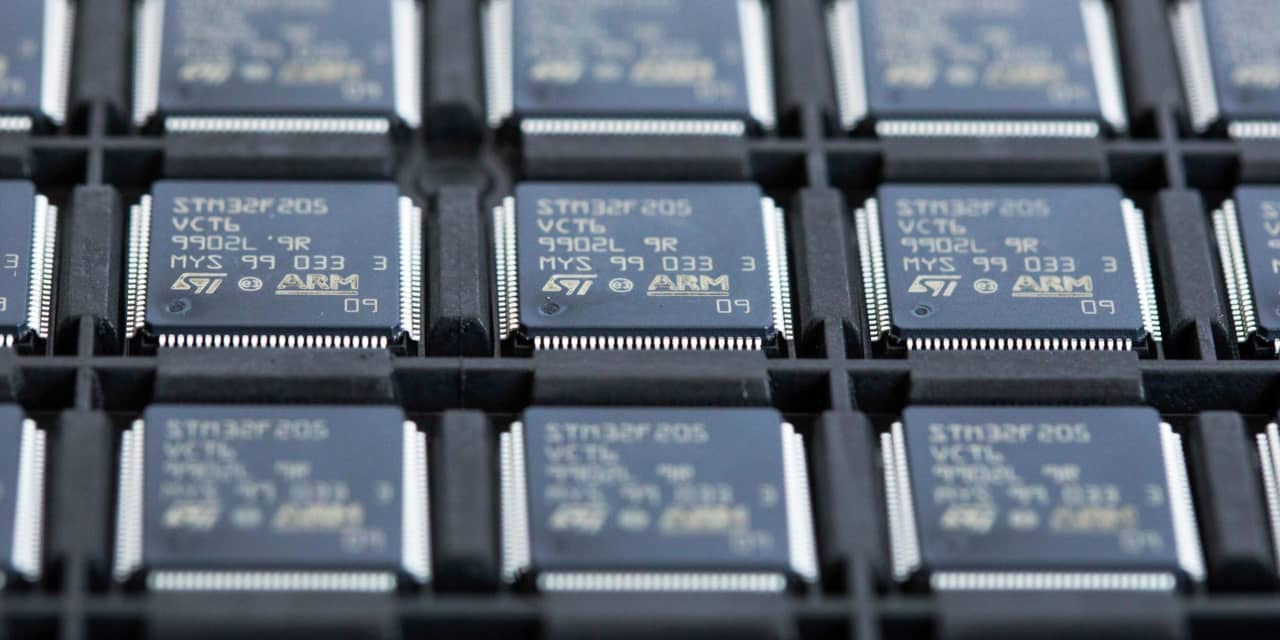

Arm makes money from licensing its chip architecture and other chip designs to semiconductor companies and hardware makers.

On Thursday, Arm listed its stock for trading, pricing its initial public offering at $51 per share, which triggered a surge in the price to a closing level of $63.59. The shares ended the day Friday at $60.75 and were down 6.3% at $56.92 following the Bernstein report early on Monday.

Arm declined to comment on the Bernstein note.

The analyst said the open-source RISC-V chip architecture is increasingly becoming a threat to Arm because manufacturers can use it free, without paying royalty fees. She noted how open-source products have become successful in other parts of the computer industry, citing the Linux operating system.

“We believe that RISC-V is quickly gaining credibility as an alternative to x86 and Arm for some applications,” she wrote, referring to Intel’s x86 chip architecture. “An updated outlook for processor architecture needs to take seriously its viability and presence for the long term.”

Arm’s large exposure to China, at 24% of revenue, plus the rise of RISC-V, could threaten the company’s long-term growth rate, she said. Rising tensions between Washington and Beijing, a lack of control over Arm China, and China’s preference to use non-Western technologies may become headwinds for the company.

Arm has no direct stake in Arm China. In 2022, Arm transferred its 48% ownership to a SoftBank subsidiary and now doesn’t have any management rights. The company has said Arm China operates independently of it.

Write to Tae Kim at [email protected]

Read the full article here