Icahn Enterprises LP shares fell another 20% on Wednesday, extending their prior-day losses in the continued fallout from a short seller’s report that was critical of the investment arm of activist investor Carl Icahn.

The stock

IEP,

closed down 20% on Tuesday to notch its biggest one-day decline on record after short seller Hindenburg Research accused the company of inflating its value. The market-cap loss was about $4 billion. If today’s slide holds, it will cost another $2.6 billion in market cap.

Icahn Enterprises’ bonds, meanwhile, also fell sharply in far higher-than-average volume, as the following charts from market-data company BondCliQ show.

Icahn Enterprises’ longest-dated bonds, the 4.375% notes that mature on Feb. 1, 2029, were trading at close to 80 cents on the dollar. All five maturities fell 6% to 8%, according to BondCliQ.

Volumes, which had been steady since the beginning of April, spiked to 142 million on Tuesday from just above 10 million on Monday. Today 92 million have traded.

In the report, titled “Icahn Enterprises: The Corporate Raider Throwing Stones From His Own Glass House,” the Nate Anderson–backed Hindenburg said Icahn Enterprises trades at a 218% premium over its last reported net asset value, or NAV, which the report said is far higher than comparable funds.

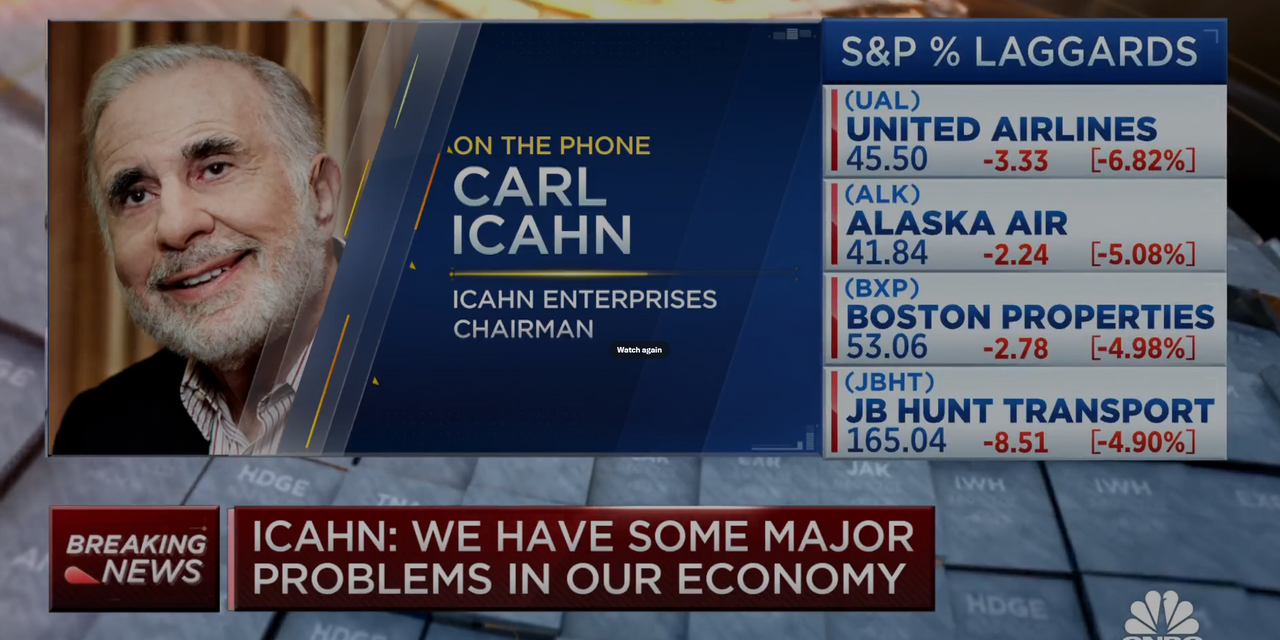

Icahn responded Tuesday afternoon with a statement accusing Hindenburg of being self-serving, with the aim of profiting in the short term from bets that his company’s shares would decline.

“We stand by our public disclosures and we believe that [Icahn Enterprises’] performance will speak for itself over the long term as it always has,” Icahn said in the statement.

Icahn Enterprises, he said, “operates from a position of strength,” with approximately $2 billion in cash and cash equivalents on its balance sheet as of March 31, “to execute on our strategy.”

The company, which is 85% owned by Icahn and his son, Brett, will report first-quarter earnings on Thursday.

Icahn Enterprises offers exposure to Icahn’s personal portfolio of public and private companies, including petroleum refineries, car-parts makers, food-packaging companies and real estate.

Hindenburg is alleging that Icahn Enterprises’ value is overstated according to its own calculations, which are based on regulatory filings. MarketWatch couldn’t independently verify Hindenburg’s claims.

For more, see: Icahn calls Hindenburg short-seller report self-serving, as market value of his company’s stock plunges by $4 billion

Hindenburg Research typically aims to profit from the decline in value of the shares of companies that it writes negative reports about. The short seller notably targeted zero-emission-truck maker Nikola about three years ago.

Carl Icahn is a prominent investor with a net worth of roughly $15 billion, according to Forbes, who is known for taking stakes in companies and agitating for change to drive a company’s stock price higher.

Read the full article here