Compass (OTCPK:CMPGF) has recovered well from the sizeable challenges foodservice companies like it faced over the past several years.

I last covered the company in June, in my “sell” note, Compass Group: Costly For What It Is. Since then, the shares have lost 10% of their value. Although I rate the quality of the company, I consider it to be overpriced for what it is and so maintain my rating.

Business is Performing Strongly

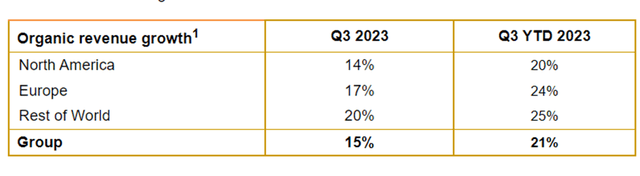

As I outlined in my previous piece, we have already seen the company raise its guidance for the year thanks to strong trading. A third quarter trading update subsequent to that piece provided some more colour on this.

Company announcement

Clearly, things are going well, with organic revenue growth of at least 20% in all three regions. The third quarter shows some slowing of that high growth rate in all three regions, though.

The nine-month organic revenue growth was delivered thus: client retention at 96.7%, net new business growth (5%), pricing (7%) and like-for-like volume growth (9%).

Long-Term Outlook

As well as affirming its guidance for the year, Compass said that in the longer term, it expects mid-to-high single-digit organic growth and “a path back to our historical margin”. It expects profit growth rates to outstrip revenue growth.

In fact I do not see the company as being very far off its historical margin in any case (using net post-tax profit margin on a statutory basis). In 2018 and 2019 it was 4.6% and 4.9% respectively. Last year it came in at 4.6%. Perhaps the reference digs further back, for example to the 5.1% and 5.2% achieved in 2016 and 2017 respectively. Still, if the margin lifts from 4.6% to, say, 5.1%, that would equate to over a 10% lift in earnings on flat revenue.

However, based on the above long-term company outlook, revenue is set to keep growing at 5-9% even before considering the impact of acquisitions, which have historically helped fuel Compass’ growth.

Add into the mix a smaller share count due to a buyback programme of £750m planned for the current year following the same amount in the prior year. In the current year that ought to reduce share count by 4-5% (presuming current share price) before considering any share issue.

Add all of that together and I think that over the coming three or so years we could be looking at EPS growth from last year’s 63p to around 90p.

Whether that happens depends on whether the company is able to deliver on its forecast. There are risks along the way. Cost and wage inflation is one, labour availability is another and any structural shift in away from home dining (e.g. less working at the office) is another. For now, though, I do not see a clear and present risk I expect to derail the plan on the current trajectory. Net debt was £3.2 bn at the interim results point. That is within the company’s target range.

Valuation Looks Optimistic

Reader Booya21 left an insightful comment below my most recent piece on Compass when it came to valuation.

Seeking Alpha

Currently, the P/E ratio here is a lofty 33. Even if Compass does get to the 90p EPS in coming years I mooted above, that would still mean it is trading on a prospective P/E ratio of 23 some years out, with the execution risk involved.

I agree with the broad point that Compass’ scale is mostly unmatched though, specifically, I would say competitors like Sodexo (OTCPK:SDXOF) are nipping at its heels, albeit with a market cap around the third of Compass’s.

Over five years, the shares are 27% higher. I agree with Booya21’s implied point that Compass’ scale gives it a competitive advantage and that could grow over time as it continues to roll up smaller competitors. So, indeed, there is considerable runway ahead using the current strategy.

However, this is a labour-intensive industry with fairly low margins and pretty low barriers to entry at the local level, albeit that changes once addressing a national or international market, as Compass does.

I continue find the valuation too rich, and accordingly maintain my “sell” rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here