Investment Thesis

After a sharp decline in share price following the Q3 report, I wanted to take a look at Digi International’s (NASDAQ:DGII) financials to see if the drop presents a good entry point. The company’s reliance on non-GAAP operational performance calls for skepticism on my part, therefore I give it a hold rating for now, until the share price drops more, or GAAP measures improve dramatically.

Briefly on the company

Digi International is an IoT company offering wireless solutions, embedded systems like RF modules, networking, cellular routers, and IoT Software and Services. The company focuses on external network communications, as well as scalable USB products.

Financials

As of Q3 ’23, the company had around $30m in cash against $194m in long-term debt. The amount of debt has increased dramatically in the last year, while the annual interest expense ballooned to around $19m, 9 months ended June 30. So, how worrisome is the debt? I think it’s slightly on the bad side because the weighted average interest rate on the debt is around 10% according to the report. The company’s interest coverage ratio is slightly under 2 as of the latest quarter, which means that EBIT can cover annual interest expenses around twice. Now, many analysts believe that the 2x coverage ratio is healthy, however, I would prefer to see at least 5x coverage because that gives the company much more flexibility in how to deploy its cash, which would be better used to further the company’s growth.

The company is highly exposed to interest rate fluctuations, however, I think it won’t go too much higher from now on, so I would expect interest expense to come down. On a positive note, the company is paying down the debt, which should lessen the burden going forward, unless interests shoot up even more.

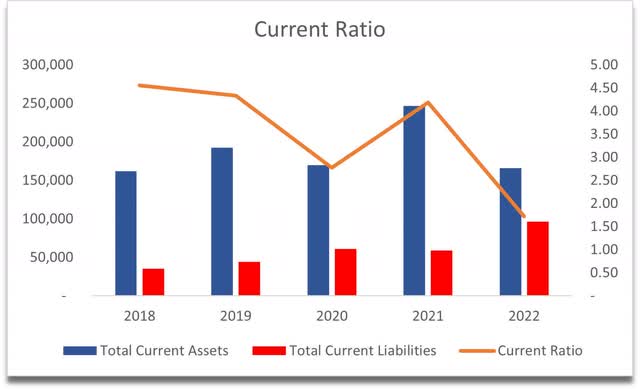

DGII’s historical current ratio has been too elevated in my opinion, which makes it inefficient. In the most recent full year, which is FY22, the company’s current ratio has come down to what I consider to be within the efficient range, which is 1.5-2.0. It stood at around 1.7, meaning it has enough liquidity to pay off its short-term obligations and still has something left over for growth initiatives. This tells me that the company isn’t hoarding cash anymore and is using it for expansion, in this case, the acquisition of Ventus, which was financed by $350m in cash from the credit facility. It’s good to see that the company is using its available resources to expand its operations further.

Current Ratio (Author)

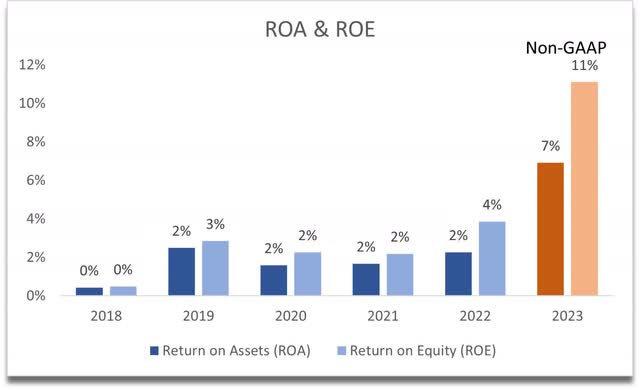

On GAAP metrics, the company’s ROA and ROE are subpar. If we look at the adjusted numbers, which add back amortization, stock-based compensation, and interest expense, these become much healthier. I’m not a fan of this type of calculation because it looks very manipulative, however, I will entertain these numbers, otherwise, the value of the company would be borderline not a good investment.

ROA and ROE (Author)

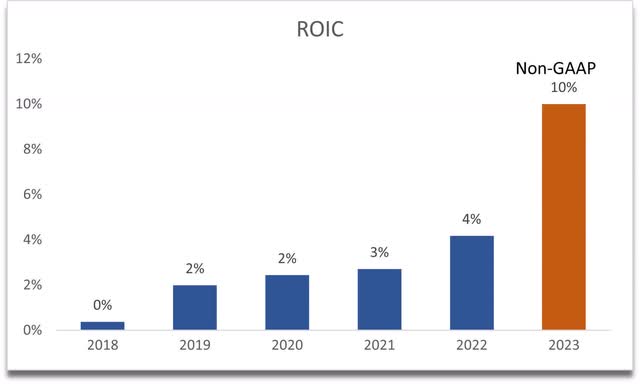

The same story can be said about the company’s return on invested capital. GAAP measures tell me that the company doesn’t have a competitive advantage or a strong moat, but if we adjust these numbers, the company’s ROIC stands at around 10%, which is my minimum. I will have to take a cautious approach when I do my valuations because of these adjusted numbers.

ROIC (Author)

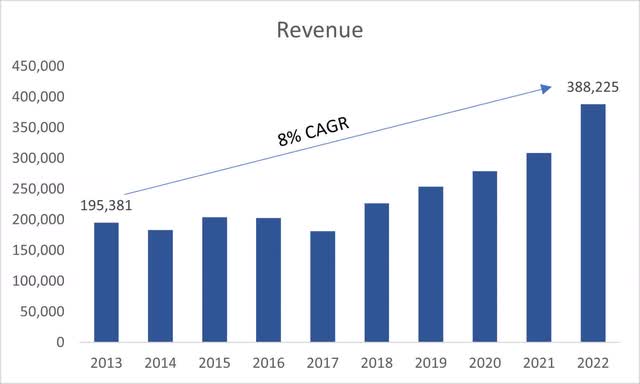

In terms of revenues, the company saw around 8% CAGR over the last decade, which is decent but nothing too outstanding. It is continuing to grow at a similar rate in the most recent results, which gives me a good anchor for my valuation calculations in the next section.

Revenue Growth (Author)

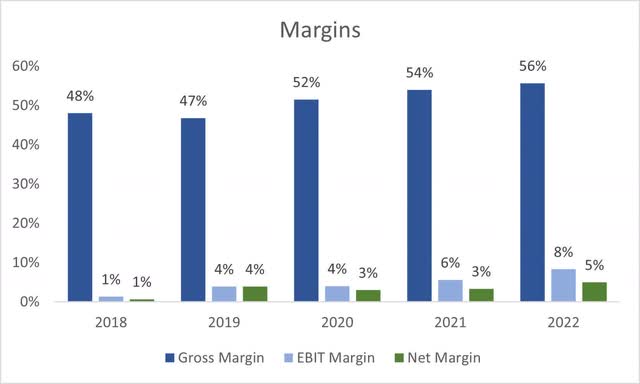

GAAP margins are also nothing to write home about, however, these have improved quite a bit since FY18, which is good to see.

Margins (Author)

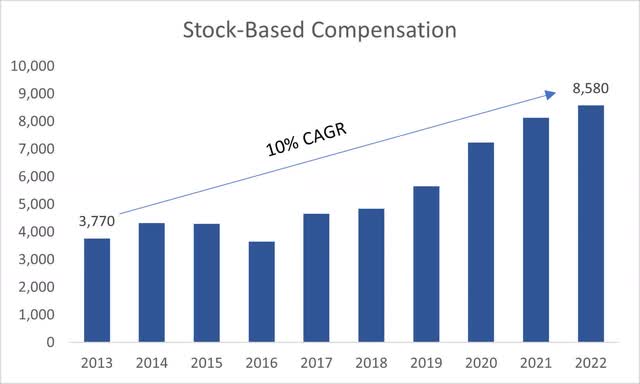

In terms of stock-based compensation, the company has drastically increased it over the last decade, which may or may not dilute the shareholders in the long run.

SBC (Author)

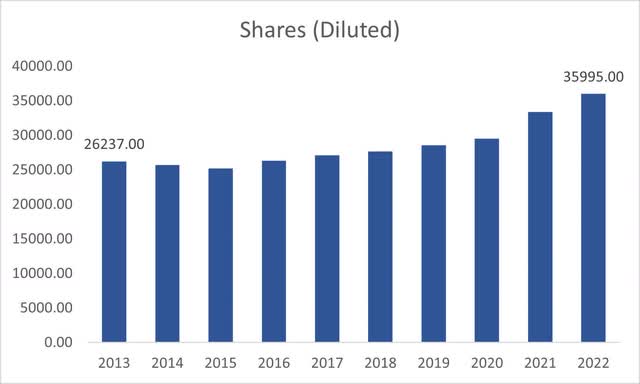

Speaking of share dilution, the company is still increasing its share count every year, which is also not a good sign for existing shareholders.

Shares Outstanding (Author)

Overall, the company is too heavily reliant on non-GAAP metrics to show its “true” value. I will take a cautious approach when valuing the company’s intrinsic value to give myself a better risk/reward profile.

Valuation

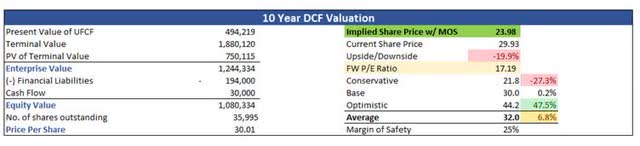

For the revenue growth for the base case, I went with around 8% CAGR for the next decade, which matches what the company has achieved in the past and the most recent quarter. For the optimistic case, I went with around 10% CAGR, while for the conservative case, I went with a 6% CAGR, to give myself a range of possible outcomes.

In terms of margins, I adjusted the numbers to reflect non-GAAP metrics, which added back the largest culprits like amortization and SBC and left them stable over the next decade.

On top of these assumptions, I will also add a 25% margin of safety because the company relies on non-GAAP metrics. As you saw in the previous section, the company on GAAP metrics is not very attractive yet. With that said, DGII’s intrinsic value is around $24 a share, implying that the company is trading at a 20% premium to its fair value.

Intrinsic Value (Author)

Closing Comments

As I mentioned, I’m not a fan of non-GAAP measures, but to entertain the idea of the company, I had to go with the flow, and if we look at the adjusted FW PE ratio, the company seems to be cheap. Now, if we look at GAAP metrics, the company would be trading at a Forward PE ratio of around 37, which with such low revenue growth, seems a bit high in my opinion.

I would consider the company if it dropped more over time, closer to the PT above, which would present a much more enticing risk/reward profile for me. I always look at non-GAAP measures with certain skepticism as they usually conceal a company’s poor GAAP performance, which I think is the case here also. Nevertheless, I added the company to my price alerts list and will see how the numbers develop in the future.

Read the full article here