Introduction

As it has been almost two years since I last discussed Schindler Holding (OTCPK:SHLAF) (OTC:SHLRF), I felt an update was warranted. Schindler is one of the largest elevator and escalator companies in the world, and its financial health is closely correlated to the activity level in the construction sector.

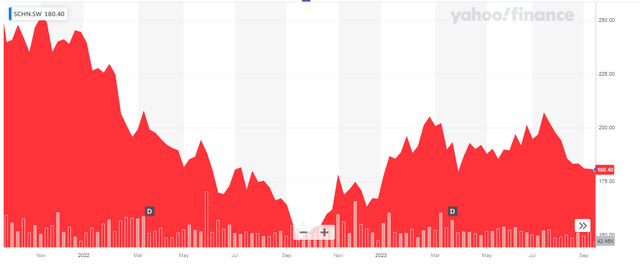

Yahoo Finance

As explained in my previous article, Schindler has two types of shares outstanding: Registered shares and participation certificates. This article is focusing on the participation certificates as SHLAF represents those. The economic rights of the participation certificates are similar to the registered shares, but only owners of registered shares can vote at shareholder meetings. The registered shares are trading in Switzerland with SCHN as the ticker symbol and closed at 180 CHF on Wednesday. The participation certificates are trading with SCHP as ticker symbol closed at 187.85 CHF. Depending on their respective share prices you could be better off buying the registered shares, but the liquidity of the participation certificates is better with an average daily volume of 80,000, compared to just about 20,000 for the registered shares. But if volume isn’t a concern, investors could just pick whichever is the cheapest. In this case, the registered shares are trading at the lowest valuation.

How is the slowdown in the construction market impacting Schindler?

I have been keeping an eye on some companies focusing on end consumers in the construction and building sectors and it really is a little bit of a mixed bag. Kingspan (discussed here) reported a lower revenue but other companies like Legrand (discussed here).

Schindler falls in the latter category. The company reported a revenue increase and a margin increase and although the order intake rate was relatively slow, the manufacturer of elevators did notice an acceleration in the second quarter. Although the total order intake in the first semester decreased by 4.6% compared to a year ago, the order intake in the second quarter was flat (down by 0.5% compared to Q2 of last year, and up 6.7% in local currencies).

The order intake is important, and so is the revenue increase. But the main element to keep an eye on are the margins. Inflation results in price hikes which subsequently results in a higher revenue. But the main question in an inflationary environment is whether or not the company can increase its prices at a faster pace than the cost increases.

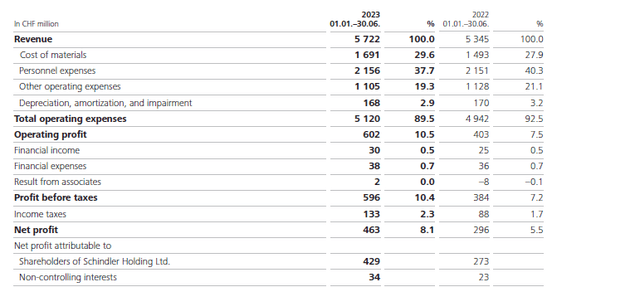

And Schindler passed the test. The company reported a total revenue of 5.7B CHF and although its COGS increased by in excess of 10%, the operating profit increased by almost 50% thanks to keeping most of its other expenses pretty flat. The increase in personnel expenses was negligible, while the other operating expenses decreased. This means that although the revenue increased by approximately 380M CHF, the operating expenses increased by less than half that amount and that’s what caused the EBIT to increase by almost 50%.

Schindler Investor Relations

Schindler also reduced its net finance expense from 11M CHF to just 8M CHF and this ultimately resulted in a pre-tax income of 596M CHF and a net income of 463M CHF which again is almost 60% higher than the net income reported in the first half of last year. Approximately 34M CHF of the net income was attributable to non-controlling interests which means there was about 429M CHF to be divided among its own shareholders. This resulted in an EPS of 3.99 CHF.

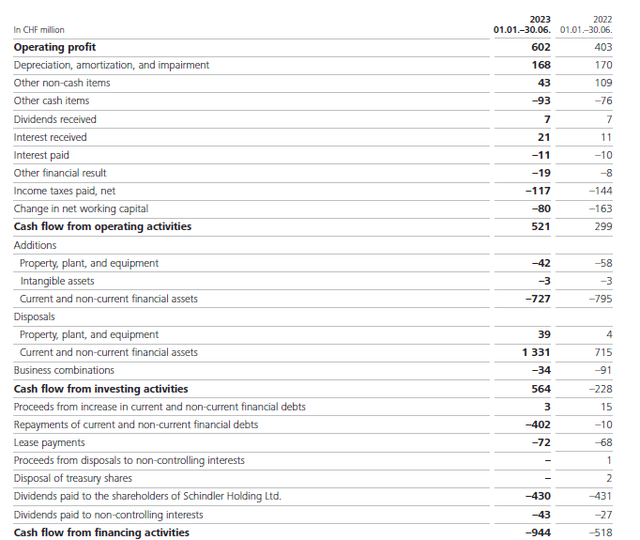

As I am always curious to see if the paper profits can be converted into cash flow, the cash flow statement is my logical next stop. The company reported a total operating cash flow of 521M CHF but this includes an 80M CHF investment in the working capital position. Additionally, it excludes 72M CHF in lease payments and a 43M CHF dividend to non-controlling interests.

Schindler Investor Relations

On an adjusted basis (and I am adjusting the dividend to non-controlling interests as well due to the timing of these payments), the operating cash flow was roughly 495M CHF. The total capex was just 45M CHF (including 3M CHF spent on the acquisition of intangibles) resulting in an underlying free cash flow result of approximately 450M CHF. That is slightly higher than the 429M CHF in attributable net income mainly due to the difference between the depreciation and amortization charges (168M CHF) and the lease and capex payments (72M + 45M = 117M CHF).

Schindler also further improved the quality of its balance sheet. As of the end of June, the company had 2.26B CHF in cash while it had just 59M CHF in short-term debt and 173M CHF in long-term debt. This means Schindler had a net cash position of approximately 2B CHF, and about 2.8B CHF if you include the current financial assets.

Although the situation is still somewhat volatile with limited visibility in China, the company’s outlook for 2023 has improved. It initially expected a low single digit revenue increase in local currency but this goal has now been upgraded to a 5-8% revenue increase (still in local currency). Additionally, the company is now aiming for a net profit of 860-900M CHF. Meeting the lower end of that guidance would result in an EPS of approximately 8 CHF per share. The free cash flow result (excluding changes in the working capital position) should be very similar and may very well be slightly higher.

Investment thesis

This means that based on the current share price, Schindler is trading at approximately 23 its anticipated full year net income. Meanwhile, its free cash flow yield will likely come in around 4.5-4.75%. And if you’re an EV/EBITDA based investor, Schindler is currently trading at a multiple of 12 (this excludes the lease liabilities and obviously also excludes the lease amortization from the anticipated EBITDA result.

And granted, this does not make Schindler cheap. But the company will likely never get really cheap as it is a well-managed company in an oligopoly with Kone and the ThyssenKrupp division which was sold to private equity as its main competitors. I think any material weakness in its share price is a buying opportunity to add a quality company to a portfolio.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here