“We are having discussions with Europe to supply Europe for the fall of ’23,”

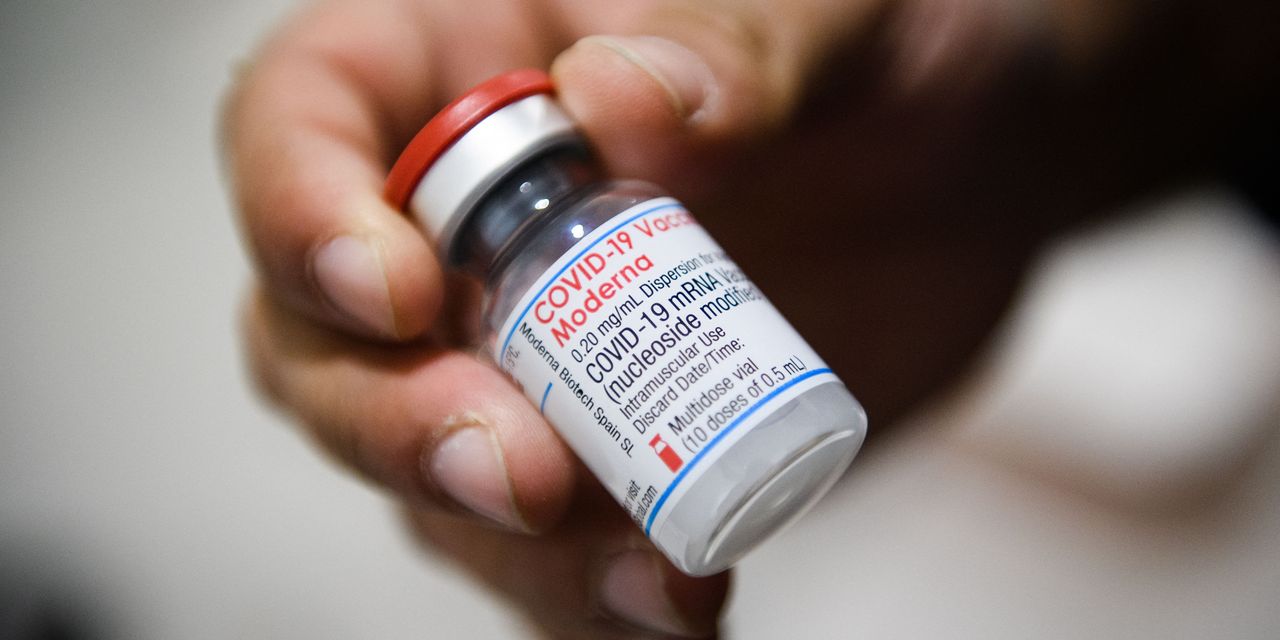

Moderna

CEO Stéphane Bancel told Barron’s early Thursday.

A report on Sunday from the Financial Times sent jitters across Wall Street, not only because it suggested that Moderna and other manufacturers would be effectively locked out of the European Covid-19 vaccine market. It also said that the E.U. would buy only 70 million doses per year from

Pfizer

and

BioNTech,

far fewer than analysts had expected.

“I don’t think that the E.U. will want to be single source for a product, for any product, that’s a medicine,” Bancel told Barron’s early Thursday, while saying he wouldn’t comment on the details of confidential discussions. “Any factory any day of the week can have an issue, and out of caution those products will have to be put on hold.”

Moderna (ticker: MRNA), which vaulted to prominence with its vaccine for Covid-19 and depends on it for revenue, is rushing to bring additional products to market as demand for Covid shots quickly dries up. On Thursday, the company reported first-quarter earnings that significantly beat Wall Street expectations, suggesting that there might be more life in the Covid-19 vaccine franchise than investors had anticipated..

The company recorded revenues of $1.9 billion for the quarter, better than the $1.2 billion

FactSet

consensus estimate, with diluted earnings of 19 cents per share. Analysts had expected Moderna to lose $1.75 a share, according to FactSet.

Moderna shares, which had been down 28% as of the close of trading on Wednesday, were up 1.6% in the premarket hours.

Bancel played down the earnings outperformance, saying that the mismatch with expectations was due to the timing of the company’s R&D spending across the year. Moderna has said it expects to spend $4.5 billion on R&D this year, and spent $1.1 billion in the first quarter.

“R&D needs to ramp up,” Bancel said. “Those numbers are not linear, because they’re based on studies.”

As for the revenue beat, Bancel said that it was a sign that the company is on its way to delivering the sales of at least $5 billion it announced earlier this year, and that there is substantial room to grow beyond that number. Sales to the U.S.., Japan, and other markets aren’t included in the $5 billion minimum forecast.

“I’m happy we delivered close to $2 billion of sales,” Bancel said. “We are well on our way to $5 billion.” Analysts are expecting $7.1 billion in Covid-19 vaccine sales for the company this year, according to FactSet.

Bancel said that the company is now in discussions with U.S. pharmacy chains, hospital chains, and government agencies to provide doses of its Covid-19 vaccine for the fall. Covid-19 vaccine doses had previously been purchased by the federal government in the U.S.

“Customers are very engaged,” Bancel said. “They want to have products…They all know that COVID is not going away, and that people that are at high risk—50 plus, comorbidity, people that because of jobs are going to be exposed to any respiratory virus—we know those people need a new vaccine.”

The company is working towards the launch of a respiratory syncytial virus vaccine, which could come next year and would compete with vaccines from

Pfizer

and

GSK

(

GSK

), as well as aiming to offer an influenza vaccine. Moderna said Thursday that it has begun manufacturing its RSV vaccine in advance of a 2024 launch.

Beyond the Covid-19 vaccine, investors have focused on the company’s personalized cancer vaccine, mRNA-4157, on which Moderna is partnered with

Merck

(MRK). While the drug is one of the most intriguing under development, the path to approval remains a long one.

Some debate among investors has centered around whether Merck and Moderna might seek accelerated approval from the Food and Drug Administration, or whether they would wait for the completion of a Phase 3 study, scheduled to start this year.

Bancel said Thursday that he believes accelerated approval might be achievable. “I believe that with the maturation of the data, and us on away with Phase 3, it will be a discussion that we, for the sake of patients, should have [with the FDA],” Bancel said. “Of course the regulator will decide. But I think it’s possible.”

Moderna had cash, cash equivalents, and investments of $16.4 billion as of March 31, down from $18.2 billion as of the end of December.

-Jack Denton contributed to this article.

Read the full article here