Essential Properties Realty Trust (NYSE:EPRT) is an undervalued stock, which provides an attractive yield of 5% with a strong growth component attached to it. The essence here is that the prevailing valuation levels of EPRT are below the sector average despite very resilient cash flow generation that is set to grow meaningfully going forward. In my opinion, the consensus FFO growth estimate is too conservative. Let me explain why.

Company overview

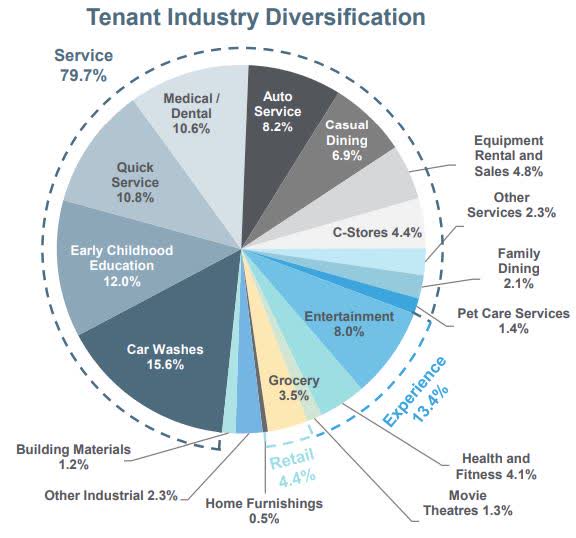

EPRT carries a diversified portfolio consisting of 1742 properties spread across 48 states. It buys and holds real estate based in service-related industries such as restaurants, car washes, medical services, entertainment and health & fitness. In total, EPRT has over 360 tenants with Top 10 accounting for only ~17% of the total leases.

The tenant structure captures the underlying diversity very well.

EPRT Investor Relations

A point of differentiation for EPRT relative to its peers such as Realty Income Corporation (NYSE:O) and NNN REIT (NYSE:NNN) is the heavy focus on experienced and service-based properties. As opposed to conventional retail assets, these types of properties provide a stronger resistance to e-commerce dynamics since the possibility to get the relevant service without visiting stores is very limited.

Moreover, typically the properties, which are of EPRT’s interest are smaller leading to enhanced diversification benefits at a portfolio level. This we can see from the chart and information above that while EPRT has one of the smallest market caps in the sector (~ $3.2 billion), the single industry or tenant concentration risk is greatly mitigated.

Granted, a service or experience driven real estate portfolio introduces a more pronounced risk exposure towards pandemics and economic slowdowns. While the former is structurally relevant for EPRT, the latter risk exposure is somewhat balanced considering the defensiveness of many of EPRT’s industries.

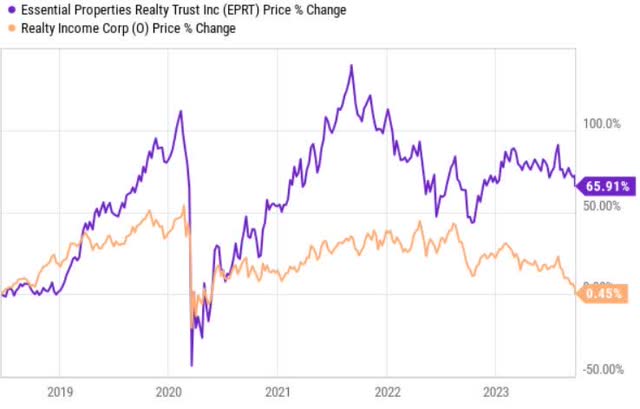

Ycharts

By looking at this chart, we can see how EPRT responded once the COVID-19 broke out. This just speaks of its sensitivity to pandemic risks. Plus, this chart also indicates how EPRT is able to thrive under solid economic conditions. The shift in FED’s monetary policy has indeed inflicted a meaningful damage on EPRT’s share price, but on a rolling three year basis (which includes the period before FED interest rate hikes) the stock is still up.

Investment thesis

In my opinion, EPRT is a solid choice for dividend-seeking investors, who want to combine two elements: (1) to immediately capture an attractive and safe dividend yield and (2) to have the dividend growing over time.

Currently, EPRT offers ~5% dividend yield, which is right in line with the sector average (excluding one one-off).

Let me now substantiate the argumentation on why EPRT’s dividend could be considered safe and having an embedded growth prospect.

First of all, EPRT’s portfolio is not only diversified, but also extremely robust in terms of the occupancy and rent coverage. As of Q2, 2023, 99.9% of the portfolio was occupied at a unit-level coverage of 4.1x. These defensive characteristics are set to last over a notable period ahead as currently the weighted average lease term is just over 14 years.

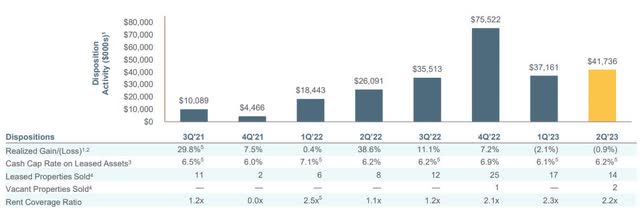

Moreover, in the past couple of quarters, EPRT has assumed a smart portfolio recycling strategy, where more risky properties have been divested.

EPRT Investor Relations

As we can see here, all of the disposed assets have carried subpar rent coverage ratios (i.e., below the current portfolio average). In almost all instances, EPRT has managed to sell at a gain, which sends a nice signal on the underlying value of the remaining core properties.

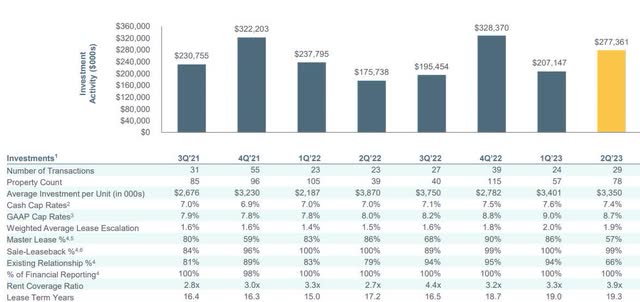

Now, turning to the growth assumptions, EPRT has made tangible steps in M&A space acquiring roughly 30 properties per quarter.

EPRT Investor Relations

Most of the acquisitions have been made at:

- 15+ year existing lease terms.

- Extremely healthy rent coverage ratios.

- Cash cap rates above the WACC and current cost of debt.

- Weighted average lease escalations in line with the current profile.

It is clear that the net positive M&A activity (in terms of the amount of dollars spent vs captured via sales) will stimulate future growth. A strongly positive nuance in this context is that by assuming so growth-oriented strategy, the underlying portfolio quality and durability are not sacrificed, which is not that common when an aggressive growth stance is assumed.

Finally, an element, which renders the investment case safe and truly attractive is the state of EPRT’s balance sheet and liquidity profile.

As of Q2, 2023 had a proforma Net Debt / Annualized Adjusted EBITDAre of 4.2x, which is one of the lowest levels in the sector. Almost all of the borrowing are stipulated on fixed interest rate terms, which considering the prevailing weighted average interest rate of 3.4% offer a juicy spread relative to the property cap rates.

EPRT Investor Relations

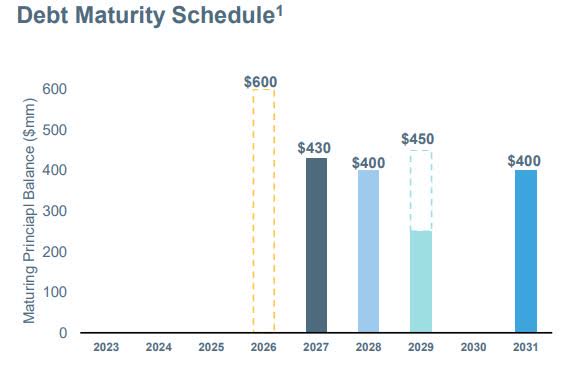

The chart on debt maturity schedule adds a cherry on top. In other words, EPRT has no debt maturities until 2027 (or until 2026 in case EPRT decides to tap into the existing revolver).

This means that next ~ 3 years EPRT can safely focus on accretive M&A transactions and portfolio growth by relying on stable internal cash flows that are not subject to decline due to rising interest rate costs. Given that the TTM FFO payout is at 65%, there is ample room for EPRT to fund notable deals without sourcing in fresh proceeds from external leverage.

The disconnect between valuations and fundamentals

Currently, EPRT trades at a P/FFO of 13x, which implies a relatively minor discount (~6%) to the sector average (i.e., REIT Free Standing segment). However, if we peel back the onion a bit, we should adjust for The Necessity Retail REIT due to its recent merger. Now, we arrive at a bit more pronounced discount – i.e., ~10%.

Looking at the consensus FFO growth estimates beyond 2023, we can notice that the assumptions are very conservative revolving around 4%, while historically and also in 2023 EPRT has managed to grow its FFO closer to a double-digit pace. Plus, there is a rather immaterial difference between the FFO growth estimates of EPRT and those of more indebted REITs such as NNN and O carrying less attractive real estate portfolios (e.g., retail).

It seems the market does not factor in the underlying growth potential of EPRT. As elaborated above, there has nothing changed in the conditions that EPRT had in the most recent years relative to what they have now. In other words, EPRT has locked in fixed rate financing at least until 2026, which protects the Company from higher interest costs. The embedded rent escalators are still there and the portfolio is as robust as it has ever been. In fact, the quality of assets have improved due to the successful portfolio recycling strategy.

In my opinion, the EPRT will manage to deliver close to a double-digit FFO growth at least until 2026 via directing its internal cash generation (the retained part) towards a continued “high cap rate” M&A strategy.

Think of it, the embedded rent escalators of ~1.8%, which are almost guaranteed given the full occupancy and 14 years of remaining lease term explain about 50% of the consensus FFO growth. Considering the funding capacity of EPRT, the odds are quite high of exceeding the conservative growth trajectory, which is currently baked into cake.

If we assume a FFO growth of, say, ~8% (which is double of what is currently priced in) for 2024 and 2025, EPRT’s valuation would converge closer to P/FFO 15x territory. This implies a 20% discount.

My base case is that EPRT throughout Q4, 2023 – 2024 should appreciate by 10 – 20%, while delivering a solid dividend of 5%.

Key risks

Frankly, given the status of EPRT’s portfolio and the duration of the existing leases, there is a very minor risk to the EPRT’s cash flows. The diversity in tenant mix, the rent coverage profile and the sector durability introduce a strong tailwind for the cash flows.

In my humble opinion, there are two major macro-level risks, which could render a negative damage to EPRT’s valuations and underlying business performance.

- An outbreak of pandemic – in such a case, close to 35% of EPRT’s portfolio would become subject to lock downs, restrictions and in general decreased demand. This would obviously send the stock in a free fall.

- Additional interest rate hikes – if the FED decides to increase interest rates further, there is a clear risk that EPRT’s stock price would suffer. Although there is a clear interest rate risk protection at least until 2026, it would make incremental borrowings more expensive (hence, decreasing the spread potential between WACC and cap rates) and impair the purchasing power of EPRT’s tenants.

The bottom line

In this case, EPRT is able to offer 5% yield, which is backed by strong and resilient fundamentals. Historically (last 3 years), EPRT has registered a dividend growth of ~7%, which is by ~4% higher than that of sector median.

Going forward, EPRT there is a strong growth potential driven by embedded rent escalators and an accretive M&A that is funded by internal cash generation, where the cash flows are ample thanks to balanced FFO payout ratio and well-structured debt maturities.

With up to 20% of upside by 2024 with an attractive and growing dividend yield of 5%, EPRT is a clear buy.

Read the full article here