Research Summary

Before the analysis, just a few words about why this stock was chosen this week.

A few days ago, as a Seeking Alpha analyst I got to attend a very large tech conference called Infobip Shift 2023, as I mentioned on LinkedIN, in an ancient coastal city in Croatia in southern Europe. Though it was somewhat more geared for developers, which I am not, a running theme of the summit was artificial intelligence “AI” with many talks and roundtable discussions about this space.

So, this week I wanted to review a company in the tech space that does something with (AI), and believe it or not Logitech (NASDAQ:LOGI) produces an AI-powered meeting room camera, using (AI) to detect & accurately frame meeting participants.

However, is this company in the tech sector & tech hardware subsector a potential buy, sell, or hold for investors?

That is the question I hope to answer today.

Already in its FY2024, it reported its Q1 earnings results on July 24th, and some of that data along with other sources will be used in today’s article.

For readers less familiar with this company, besides making an AI-driven camera here are some more relevant company facts, according to its website: A Swiss-based company in business 40+ years but its stock also trades on the NASDAQ, produces an array of products across the categories of computing / video / streaming /gaming/ music.

My own experience with this brand goes back years ago, using the Logitech web camera and computer mouse.

Two key peers of this company, according to Seeking Alpha data, are Lenovo (OTCPK:LNVGY) and Seagate Technology (STX).

Rating Methodology

Using a streamlined, structured process, I break down my overall holistic rating of this stock into 5 categories I rank individually and of equal weight: dividends, valuation, share price, earnings growth, company financial health.

If I recommend this stock on at least 3 of 5 categories, it gets a hold rating. 4 of 5 gets a buy, and less than 3 gets a sell rating. Then I compare my rating to the consensus from analysts, Wall Street, and the SA quant system.

Then, I explain any upside or downside risks to my outlook.

Dividends

In this category, I will analyze the dividends of this stock and whether I think they present an opportunity for dividend-income investors. The data comes from official Seeking Alpha dividend info.

As of the writing of this analysis, the forward dividend yield is 1.74%, with a payout of $1.23 per share. Unlike the majority of the stocks I covered lately here, this one does not pay on a quarterly basis, but once annually. However, for new investors, the next ex-date is practically here already, on Sept. 25th.

Considering that many stocks in the tech sector, according to my research, do not pay out a dividend at all, the ones that do certainly gain my attention. However, let’s see how this yield compares to the sector average.

Logitech – div yield (Seeking Alpha)

When comparing to its sector average, this dividend yield is actually in line with the average.

I believe this is a positive point to consider for dividend investors who are comparing multiple stocks in which to invest. In my opinion, my target range for this stock is a yield ranging between 1.5% – 2.5%, to stay within a few points of the sector average. In this case, the yield seems in line with average, so it is not exorbitantly high or low.

For example, if it was 6% and the industry is closer to 1.75%, that would be a red flag for me indicating the share price perhaps fell off a cliff recently.

I welcome a discussion the comments section as to what dividend yield range you would find reasonable for this stock?

Logitech – div yield vs sector avg (Seeking Alpha)

In looking at the 5-year dividend growth for this stock, it has shown a positive growth trend. This is, in my opinion, a positive point for dividend investors and a sign of this firm’s capacity to return capital back to shareholders, one of the things I look for in terms of financial fundamentals.

Logitech – dividend 5 yr growth (Seeking Alpha)

Additionally, I am looking for stability with dividend payouts, and this stock has shown regular dividend payment history over several years without interruption, and with increasing payouts each year.

Again, it is not ideal for someone seeking quarterly income, as they pay out annually. Keep that in mind for your planning.

Logitech – dividend history (Seeking Alpha)

Based on the holistic picture above, I would therefore recommend this company on the category of dividends, and I will include it in my dividend “quick picks” for this month.

Valuation

In this category, I will analyze the valuation of this stock. The data comes from official valuation info on Seeking Alpha, specifically the forward P/E ratio and forward P/B ratio, the key metrics I look at.

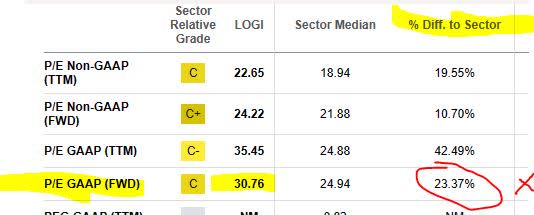

This stock has a forward P/E ratio of 30.76, which is 23% above its sector average.

Since some of my recent articles covering the financial sector often see valuations closer to 10x earnings, Logitech’s valuation may at first appear high, however comparing the two industries is like apples and oranges.

I think that a reasonable price to earnings for this stock, in the context of the sector it is in, would be between 20x earnings and 28x earnings, to stay within a reasonable few point range of the average. In this case, on this metric the stock appears overvalued vs its overall sector, which is already an overheated sector in my opinion as I continuously see big tech being hyped up in large financial media.

Logitech – PE Ratio (Seeking Alpha)

Now, let’s look at the price to earnings. This stock has a forward P/B ratio of 5.01, which is 35% above its sector average.

I think that a reasonable fwd price-to-book value for this stock would be between 3x book value and 4x book value. In this situation, this stock appears overvalued vs its overall sector. My preference is for modestly undervalued rather than overvalued, as I am looking for value-buying opportunities.

Logitech – PB ratio (Seeking Alpha)

Based on the examples I gave, I would not recommend this stock on the basis of valuation, and consider it too overheated.

Share Price

Next, I determine if the current share price is a potential buying opportunity based on my portfolio goal of buying at current price, holding the shares for 1 year until Aug. 2024, and achieving an unrealized gain of +10%.

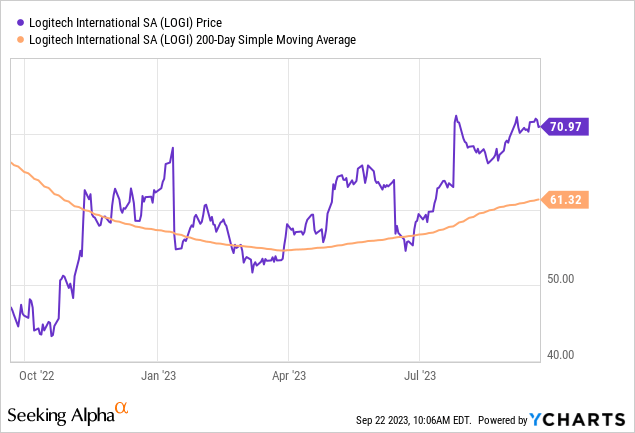

The price chart (as of the writing of this article) shows a share price of $70.97, compared to its 200-day simple moving average “SMA” of $61.32, over the last 1-year period. I like using the 200-day SMA as it is a long-term trend indicator that smooths out the trend nicely.

Just glancing at the price vs the moving average, it appears overbought. But let’s see how it works out with my investment idea.

I plug in the current SMA and share price into the following simulator I created, which simulates unrealized gains & losses if the share price as of Aug. 2024 reaches +10% above the current SMA but also if it drops -10% below the current SMA:

Logitech – investing idea simulation (author analysis)

In the above simulation, my goal is to meet or exceed a +10% unrealized gain in 1 year, and I have a maximum loss tolerance of -10% unrealized loss.

Based on the simulation results testing the current buy price, I miss my goal for unrealized capital gains and also exceed my loss limit for unrealized losses. The above trading scenario projects a loss in both situations!

Here is another illustration to better understand my approach. As you can see in the price chart below, the current share price is more than +10% above the current 200-day average. I personally don’t consider it a great spot to buy at right now but would consider it in the under $66 dollar range perhaps.

Logitech – trading range (author analysis)

In this case, I would not recommend the current buying price.

Since every investor has different profit goals and risk profiles, consider this simulator just a general framework to help think about this stock in a longer-term sense.

Earnings Growth

In this category, I examine the earnings trends over the last year, looking at both top-line and bottom-line results but also any relevant company commentary from the last earnings results.

From a top-line overview, it appears the revenue has dropped on a YoY basis, but also has been on a larger downward trend since June 2022, as the table shows. I find this to be a modest negative point.

Logitech – total revenues (Seeking Alpha)

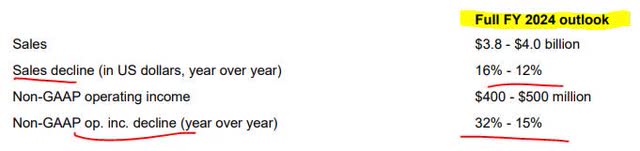

Relevant to mention is that the company already has planned for up to a 16% sales decline for its current fiscal year, as well as a significant decline in operating income, according to its FY2024Q1 earnings release:

Logitech – FY24 outlook (company quarterly release)

Further, in looking at results segmented by region, the declines in net sales were not in one global region but all of them:

Logitech – net sales by region (company quarterly presentation)

The bottom-line did not instill confidence in me as an analyst, either, with a considerable YoY decline.

Logitech – net income YoY (Seeking Alpha)

To help me understand what could be driving these headwinds to earnings, I turned to a late-July article in Reuters which called out the drop in product demand and therefore sales:

Logitech has been suffering a downturn after riding a boom during the pandemic when people stocked equipment to work from home. (Chief Financial Officer) Boynton said he did not know if the U.S.-Swiss company had now hit the bottom of its current sales slide. ‘We are cautiously optimistic. We don’t know if we are at bottom yet, we are still in transition.’

Based on this evidence as whole, I would not recommend Logitech in this category and expect continued headwinds for the next quarter too.

Financial Health

In this category, I will discuss whether the overall company shows strong financial fundamentals beyond just things like dividends, valuation, earnings and share price, with a focus on the capital strength.

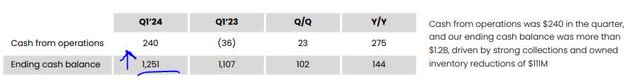

First, it appears this category is more positive than the prior few, with over $1.2B in cash, and having grown YoY and QoQ, a good sign.

Logitech – cash (company quarterly presentation)

In looking at their balance sheet, the company has $3.4B in total assets with just $1.2B in total liabilities, leaving a positive equity of $2.2B.

In terms of cash flow, their cash flow statement shows positive free cash flow per share of $1.41.

One thing to call out is that this company appears to have $0 debt. (not $0 in long-term liabilities, but $0 in debt itself!).

This was also recognized by SA analyst Alex Galanis back in his 2021 article when he highlighted that “Logitech has virtually no debt” during his buy rating.

Logitech – debt (company quarterly presentation)

Based on the evidence, I recommend in this category, and consider it a firm with solid fundamentals.

Rating Score

Today, this stock was recommended in just 2 of my 5 rating categories, earning a sell rating from me today.

This is more bearish than the consensus rating from both analysts and the quant system:

Logitech – rating consensus (Seeking Alpha)

My Rating vs Upside Risk

My bearish rating can face an upside risk as follows:

Since this is essentially a products business, it is driven by consumer & business demand for their products, otherwise sales drop. We already mentioned that their business saw a boom during the so-called pandemic-driven “remote work era” when demand for their products soared, and this type of demand returning is the upside risk my rating faces as it could make my rating overly cautious.

Consider that remote work is not gone yet, and according to a Fortune article this August many prominent firms including Atlassian (TEAM), Airbnb (ABNB), and Twilio (TWLO) has no mandatory return-to-office rule yet. These companies and others consist of literally thousands of persons still working remote, and therefore demanding technology for their home office, and home.

However, my counterargument is that they are not selling toilet paper or apple juice that you have to replace weekly but tech hardware that should last at least a few years or more. Perhaps they get a holiday sales boost during gift-buying season, but at the same time in my opinion with interest rates where they are it is much more expensive now to buy on credit than a few years ago.

I am not convinced, especially since the company already forecasted a sales decline this fiscal year, that product demand for this company specifically will return to pandemic buying-spree levels anytime soon, so my sell rating on this stock stands.

Analysis Wrapup

To wrap up today’s discussion, here are the key points we went over:

This stock got a sell rating today.

Its positive points are: dividend growth, company financial health.

The headwinds it faces are: valuation too high, current share price too high, steady earnings declines.

The upside risks to my rating have been addressed.

In closing, I would add this stock to my “dividend quick pick” this week in the tech sector, for having a stable and growing dividend each year. And although the share price could keep going up, based on the holistic review today if I was an investor I would capture the sell opportunity at the current price if I can get a capital gain of at least 10% or better.

Besides AI-powered meeting room cameras, I think we should continue to keep an eye on what innovations this company develops in the AI space going forward.

Read the full article here