Investment Thesis: I take the view that Lindt & Sprungli (OTCPK:LDSVF) could continue to see upside given growth in EBIT margin and a steady net debt to EBIT ratio.

In a previous article back in July, I made the argument that Lindt & Sprungli could continue to see growth due to strong growth in free cash flow and organic sales, despite inflationary pressures.

I had specifically mentioned that I would be keeping an eye on half-year results, looking to see a decrease in net debt and at least a 4% increase in sales volume.

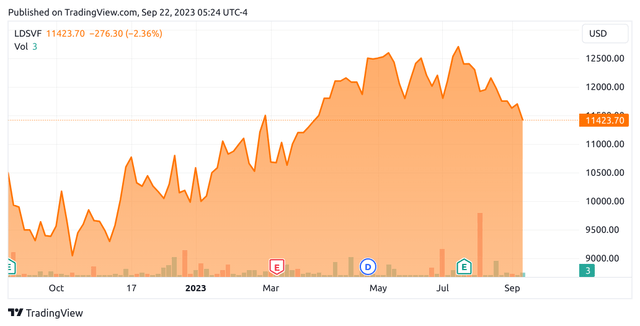

Since then, the stock has descended to a level of 11423.70 at the time of writing:

TradingView.com

The purpose of this article is to assess whether Lindt & Sprungli has the ability to see continued growth from here, taking recent performance into consideration.

Performance

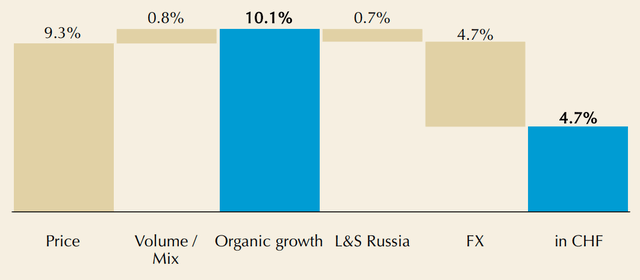

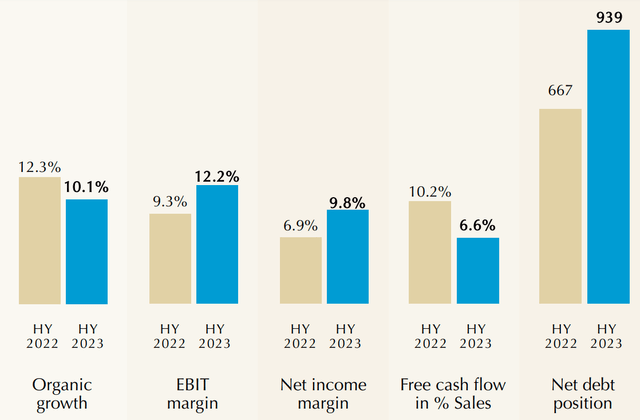

When looking at the most recent earnings results for Lindt & Sprungli, organic sales growth was up by 10.1% to CHF 2.09 billion, with growth in EBIT margin from 9.3% in HY 2022 to 12.2% in HY 2023.

It is notable that price accounted for the vast majority of organic growth – with volume/mix only accounting for 0.8%, which is short of the 4% target that I had stated the company should see in half-year results to ensure that organic growth can continue.

Lindt & Sprungli: Half-Year Results Presentation

One of the reasons I cited low volume growth as a risk is that once price growth starts to plateau – continually low volume may in turn lead to a decrease in organic growth.

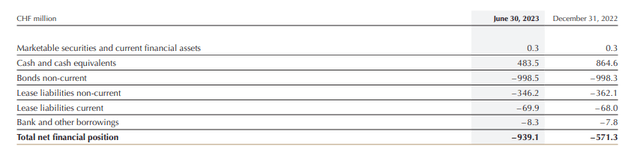

With regards to net debt, we can see that there has been a significant increase from that of HY 2022:

Lindt & Sprungli: Half-Year Results 2023

When looking at the components of the company’s net debt (also known as net financial position), we can see that the rise in debt was largely due to a drop in cash and cash equivalents.

Lindt & Sprungli: Alternative Performance Measures Half-Year 2023

However, this may be as a result of an ongoing share buyback program which is set to last until July 2024 at the latest.

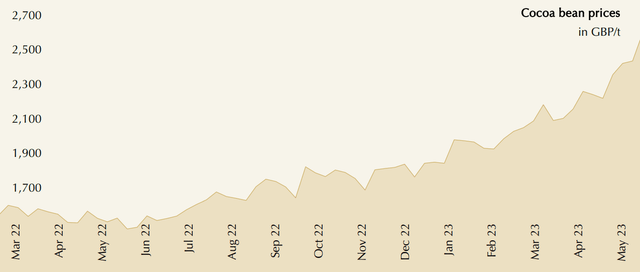

In this regard, organic growth for HY 2023 continued to be largely price rather than volume-driven, while a reduction in cash and cash equivalents drove up net debt. In addition to share buybacks, this may have also been partially influenced by rising costs – namely cocoa prices having increased by over 30% since January of this year:

Lindt & Sprungli: Half-Year Results 2023

My Perspective

As regards my take on the above results and the implications for the growth trajectory of the stock going forward, the fact that revenue growth continues to be largely driven by price increases as opposed to volume growth raises concern that we could eventually see a plateau in revenue growth as inflation eases.

Additionally, while the rise in net debt has been influenced by share buybacks, the fact that we have seen a reduction in free cash flow as a percentage of sales may give investors pause as to whether Lindt & Sprungli can bolster cash levels once again to eventually bring net debt levels down.

However, given that EBIT saw a strong increase from that of the same period last year, the net debt to EBIT ratio is only marginally higher:

| HY 2022 | HY 2023 | |

| Net debt | 667 | 939 |

| EBIT | 185.2 | 255 |

| Net debt to EBIT | 3.60 | 3.68 |

Source: Figures sourced from Lindt & Sprungli Half Year 2023 Financial Publications. Net debt to EBIT ratio calculated by author.

Should we see continued growth in EBIT and ideally a reduction in net debt to EBIT going forward, then I take the view that the higher debt load will not be as much of a concern in the short to medium-term.

Risks

In my view, the main risk to Lindt & Sprungli at this time is that revenue growth may continue to be disproportionately price-driven rather than volume-driven.

This is a risk in that once price growth starts to level out, then a lack of sufficient volume growth will in turn place downward pressure on revenues.

From this standpoint, I will be paying close attention to the company’s revenue growth components for the upcoming full-year results as well as net debt to EBIT – an increase in this ratio would signify that earnings are not increasing in line with debt levels, which would be concerning.

Conclusion

My overall view on Lindt & Sprungli is that in spite of the risk to revenue growth from lack of volume, demand over the longer-term should continue to remain robust. Moreover, the fact that EBIT margin has continued to grow in spite of cost pressures is encouraging. For these reasons, I continue to take a bullish view on Lindt & Sprungli.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here