The iShares Cybersecurity and Tech ETF (NYSEARCA:IHAK) contains a lot of tech exposures that also have meaningful cybersecurity offerings. We think cybersec is one of the most economically interesting parts of tech due to how non-discretionary it is. Also, it’s an area that is still ripe for innovation with AI and platforms and infrastructure that could revolutionise the field. The issue is the higher for longer environment. It has an outsized impact on high multiple stocks which dominate IHAK. We are underweight tech in general.

IHAK Breakdown

Let’s begin with a quick breakdown of what’s in IHAK.

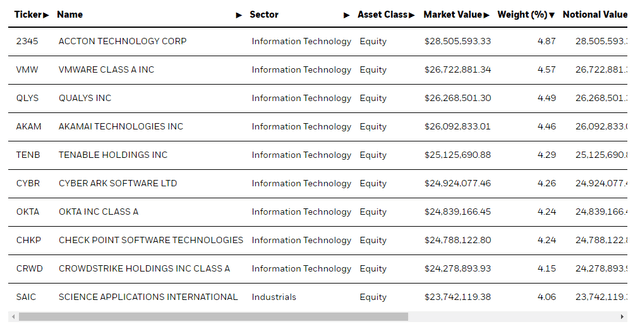

IHAK Top Holdings (iShares.com)

There is no particular skew in the top holdings, and the portfolio doesn’t have an obscene number of stocks in it either just 37.

The portfolio is not value-weighted, it is quite uniformly weighted meaning a lot of emphasis is being given to mid-cap stocks than is usual. This might have played in IHAK’s favour since mid-cap generally is less mined than large cap, but the IHAK PE is actually above that of other more broad iShares tech ETFs, meaning that markets are pricing in the fact that mid-caps are going to have more scope for growth just by being smaller and more idiosyncratic.

The expense ratio is a little higher at 0.47% compared to what you’d expect from a tech ETF, likely because they are not relying on value-weighted rebalancing.

The PE of the ETF is 34x, which is pretty consistent with what you’d expect from a tech ETF.

Bottom Line

Cybersec is relatively under-expensed across corporates considering how important it is to protect cyber-assets. That makes its secular growth excellent. There are also a lot of emerging opportunities in cybersec, including data pooling and inert-corporate cooperation in order to build up AI models that are going to perform better in detecting irregular activity and prevent attacks or other crime. There are platform economics and other network effects to be had in cybersec.

The problem is the valuations in the current environment. While tech has driven US indices into overperformance, it was under the assumption of a soft landing and pricing in a turnaround in rates quite soon. Even smart money bond markets were doing this. But a revision in this expectation deals a particularly sharp blow to all tech issues with high multiples, since the high multiples imply long horizons and therefore compounded discounting effects have an outsized impact on value. While markets have slightly retraced, there is only downside as higher costs of capital become modelled further and further into the horizons of valuation models by market makers and allocators.

The trouble is that real inflationary forces are looking secular. While tit-for-tat price hiking may stop as the economy slows down, which it is, deglobalisation and general economic nationalism is going to put a higher baseline on where rates can be and where inflation will be. Less friendly governments which control important resources such as fertilisers, refineries and oil reserves, have a lot of incentive to keep prices high and pressure their adversaries, which they are doing right now. The yield curve shows higher long-term rate expectations than just a few weeks ago. But even a few weeks ago, tech valuations had been ignoring the fact that long-term rates were anyway well above 4%, closer to 5%. There is no chance that that’s the discount rate being used in tech valuations considering how close tech indices are to 2021 all-time highs.

While the rest of tech may be more exposed to discretionary cuts than the stocks in IHAK, where IHAK is exposed to more non-discretionary business, the valuation is still a problem across tech. With the rather high expense ratios on IHAK too, we don’t want to play the long game with it either since we really do expect more imminent downside. We pass on IHAK.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Read the full article here