Ennis, Inc. (NYSE:EBF) manufactures forms and other products for businesses. I believe the company’s risk profile is very low, providing investors with a safe choice in the current economy. Although the company’s growth history isn’t very promising, I believe the current valuation leaves a good safety margin for investors with a good and safe dividend yield. For that reason, I have a buy-rating for the stock.

The Company

Ennis produces and sells multiple products in the print industry. The company’s offering includes forms, financial products, presentation folders, envelopes, as well as tags and labels. Ennis has a long history, as the company was incorporated in 1909 in Texas. The company has kept its operations in the United States.

The company’s offering is quite defensive in its nature – businesses need office supplies and similar products with a stable demand. I believe this is a very good strength in the current economy, as interest rates keep rising and worries for a hard landing are on the rise. As discussed in the financials section, the company’s numbers have demonstrated the stable nature of Ennis’ operations.

Ennis’ stock price has stayed quite stable in the past ten years, as the ten-year CAGR for the stock is only 2.5%:

Ennis’ 10-Year Stock Chart (Seeking Alpha)

Despite the low price appreciation, the company’s investors haven’t been left with an almost non-existent return as Ennis pays a good quarterly dividend; currently the company’s forward dividend yield is estimated at 4.75%.

Financials

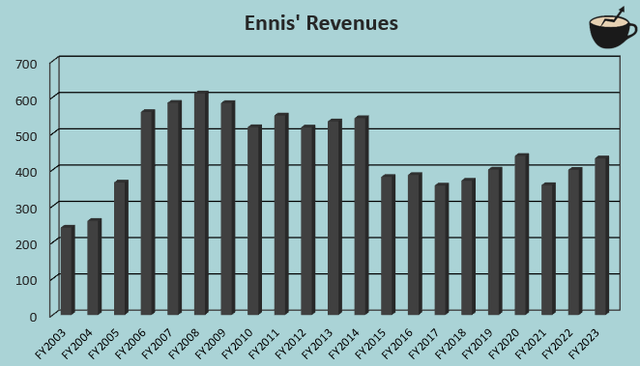

Ennis has had quite turbulent revenues in its long-term history. Although the company’s revenues declined by 30% in fiscal year 2015, the company has achieved a mediocre growth of 3% from fiscal year 2003 to fiscal year 2023:

Author’s Calculation Using TIKR Data

The growth hasn’t been achieved completely organically either, though – the company seems to have quite constant acquisitions, with a most recent acquisition of UMC Print in June. Speaking of an extensive acquisition history, the company has numerous subsidiaries through which the company operates:

Ennis’ Subsidiaries (ennis.com)

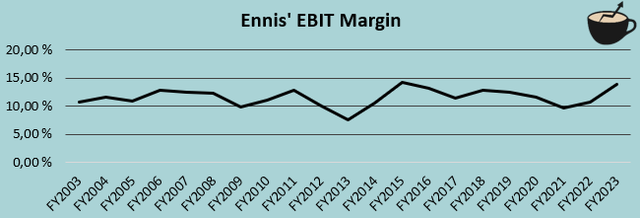

Although the company’s revenue growth history isn’t very good, the company’s history of a stable EBIT margin partly compensates for the prior – the company’s margin has stayed between 10% and 15% for almost all of its history from FY2003 to FY2023, with an average of 11.6% and a trailing figure of 13.1%.

Author’s Calculation Using TIKR Data

The stability is a very valuable aspect as the economy is turbulent – I believe Ennis’ dividend yield is very safe due to the stable earnings level. In fiscal year 2009, for example, the company’s operating income fell by 24%, a very moderate amount compared to most small-cap stocks. The company has also managed the currently stagnant economy well, as in the first half of fiscal 2024 the company’s earnings have only fallen very slightly.

Even though I don’t believe the company needs any more stability, Ennis provides it with a very cash-heavy balance sheet. The company has $100 million in cash and doesn’t have any outstanding interest-bearing debt. The cash balance alone represents around 18% of the company’s market capitalization of around $540 million.

Valuation

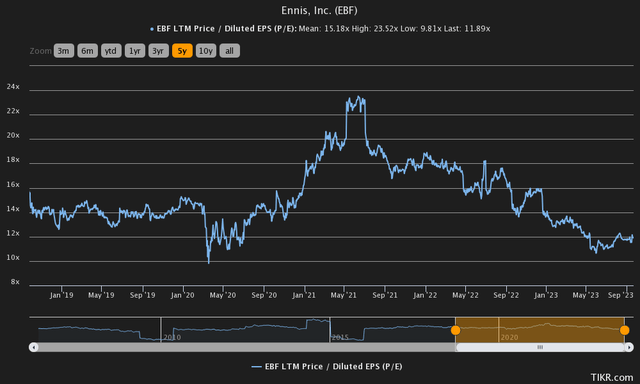

Although not seeming like a screaming buy, at a trailing price-to-earnings ratio of 11.9 Ennis seems quite cheap considering the company’s risk profile. The ratio is also below the five-year average of 15.2:

Historical P/E (TIKR)

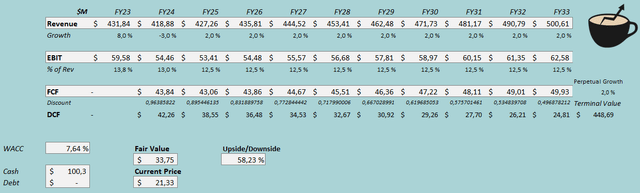

To demonstrate the low risk profile’s effect on a company and to get an estimate of Ennis’ fair value, I constructed a discounted cash flow model. In the model, I estimate decreasing revenues of 3% in the current year as demand is still lower than normal, although not highly affected demonstrated by a small decrease in revenues in Q2/FY2024. Going forward, I estimate a nominal growth of 2% – the company’s organic growth has been quite low historically, and I don’t necessarily estimate a change in the trend.

For Ennis’ EBIT margin, I have an estimate of 13.0% for the current fiscal year, 0.8 percentage points below fiscal year 2023. Further, to be conservative, I estimate a decrease of 0.5 percentage points in fiscal year 2025 into a margin that’s more in line with Ennis’ long-term history. I don’t see any specific catalyst for a decrease, but I believe it’s good to be conservative. The company also has a very strong cash flow conversion, as Ennis has a good amount of amortization in the EBIT due to past acquisitions.

With these estimates and a WACC of 7.64%, the DCF model estimates a fair value of $33.75, around 58% above the current price:

DCF Model (Author’s Calculation)

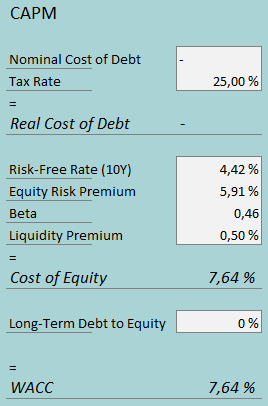

The used weighed average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

Ennis hasn’t leveraged interest-bearing debt in the medium-term – I estimate the trend to continue, as I estimate a long-term debt-to-equity ratio of 0%. For the risk-free rate on the cost of equity side, I use the United States’ 10-year bond yield of 4.42%. For the equity risk premium, I use Professor Aswath Damodaran’s latest estimate of 5.91% for the US. Yahoo Finance estimates Ennis’ beta to be 0.46 – the low beta further demonstrates Ennis’ low risk profile. Finally, I add a liquidity premium of 0.5%, crafting a cost of equity and WACC of 7.63%, used in the DCF model.

Takeaway

Although investors won’t probably see a very high long-term annual return on the stock, I believe Ennis is a worthy dividend pick due to the low risk profile. In my opinion, the current price doesn’t fully reflect on Ennis’ risk profile and large cash balance. With a DCF model pointing towards a very significant upside on the stock, I have a buy-rating on Ennis.

Read the full article here