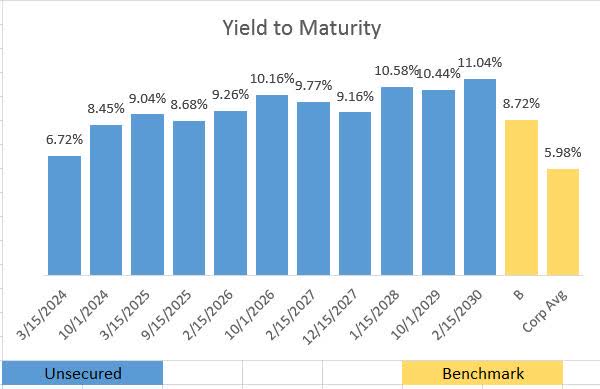

Service Properties Trust (NASDAQ:SVC) is a real estate investment trust (REIT) that owns hotels and commercial properties on net lease agreements. The company has had an eventful 2023 with its largest net lease tenant being sold and some hotels being divested. Despite the progress, Service Properties Trust debt continues to trade between 9 and 11% yield to maturity. I see the short-term debt maturities as a good alternative for income investors over the company’s high yield dividend.

FINRA

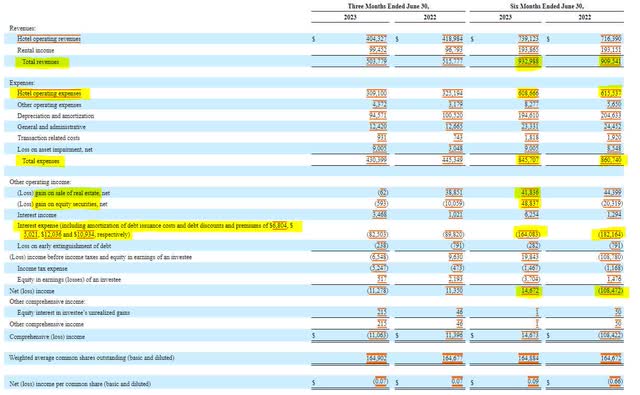

Despite the divestiture of a few hotels in 2023, Service Properties Trust has seen an increase of $23 million in revenues compared to the same period a year ago. Additionally, the company improved its hotel operating expenses, leading to operating revenues less operating expenses being approximately $38 million higher than a year ago. Had it not been for gains on real estate sales and the sale of equity owned in its largest tenant, interest expenses would have pushed Service Properties into a net loss.

SEC 10-Q

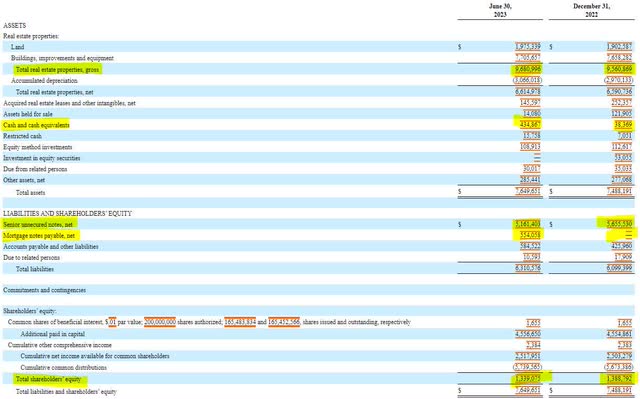

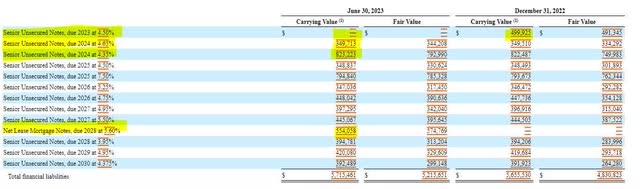

From a balance sheet standpoint, not much has changed with the company in 2023 other than a robust increase in cash on hand. Service Properties swapped some of its unsecured notes out for mortgage notes payable, and shareholder equity decreased by $50 million.

SEC 10-Q

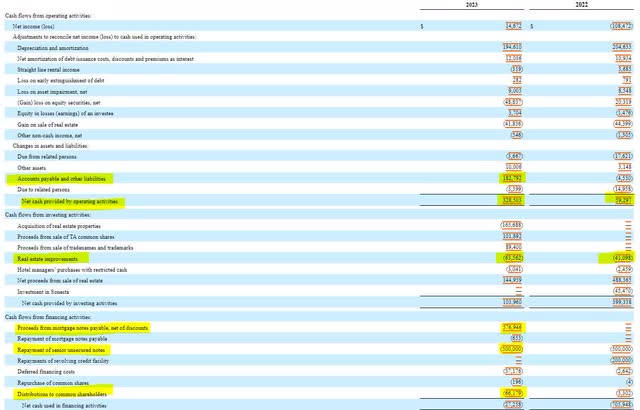

Investors examining Service Properties Trust cash flow statement are prone to see some huge variances, but a deeper dive can give us a better picture of the company’s cash flow generation and dividend sustainability. While operating cash flow surged to $328 million in the first half of 2023, it was led by a $182 million increase in accounts payable, an amount that will likely be due in the third quarter. After the trade payables are removed, the $146 million remaining is still enough to cover capital expenditures and dividends, but not by much.

SEC 10-Q

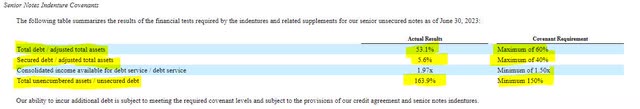

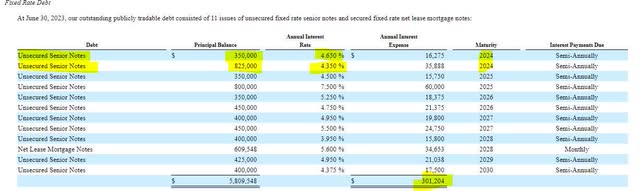

Where I become concerned about Service Properties Trust’s dividend is when examining debt. The company has more than $1.1 billion of debt coming due in 2024. Fortunately, the company was able to mitigate rising interest rates by swapping 4.5% notes due this year with a 5.6% mortgage note payable, a move that appears it will continue into 2024. When examining the company’s debt covenants, there is not much room for error in its unencumbered assets to unsecured debt ratio, but there is sufficient room under secured debt to adjusted total assets.

SEC 10-Q

SEC 10-Q

Despite the possibility of securing mortgages at 100 to 200 basis points higher than the maturing debts in 2024, the higher mortgage rates will increase interest expenses by $10 to $20 million, further stressing cash flows and dividend sustainability. The strain on cash flow could be further amplified if these new mortgages require principal payments.

SEC 10-Q

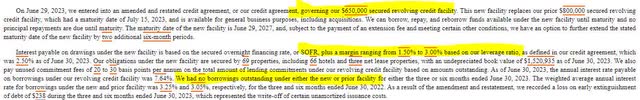

Investing in Service Properties Trust near term debt would avoid the risk of income loss and volatility of their shares while generating comparable returns. Service Properties has a B credit rating, but I doubt they will find themselves locked out of the credit markets. Even if they have issues here, the company has an untapped $650 million credit facility, which gives them over $1 billion in liquidity when combined with cash on hand.

SEC 10-Q

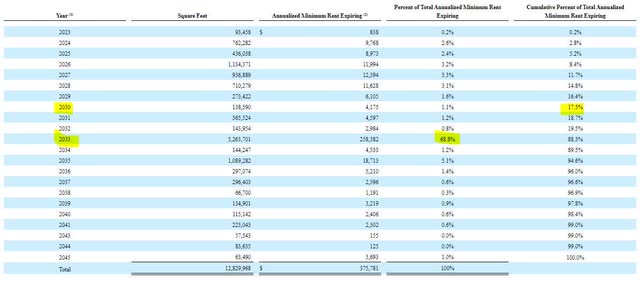

While I am not invested in Service Properties Trust longer term debt, investors should take note that 83% of the company’s leases are in place until after the company’s 2030 bond maturity, with a 68% lease maturity wall looming in 2033. Barring significant problems in the hospitality or travel industries, these leases should support the organization financially and cover their debt maturities.

SEC 10-Q

While Service Properties Trust’s dividend is currently supported by its cash flow generation, the margins are narrow. Higher interest rates against the backdrop of over $1 billion in upcoming debt maturities threaten to rip cash away from shareholders in the form of higher interest payments. Fortunately, the company’s debt offers comparable returns in the short-term where investors can park their money, earn income, then re-assess the company’s equity upon maturity.

Read the full article here