ConocoPhillips (NYSE:COP) is an attractive energy play for investors with an above-average risk-tolerance after OPEC+ countries Saudi Arabia and Russia recently announced major supply cuts. Petroleum prices moved into a new up-leg and shares of ConocoPhillips have revaluation potential. ConocoPhillips also has considerable potential to buy back shares in the market and support the current valuation. With ConocoPhillips set to benefit from higher average prices in the third-quarter and shares trading at an attractive multiplier factor, I believe the risk profile is favorable and investors may want to consider buying the drop!

OPEC+ supply cuts are supportive of ConocoPhillips’s earnings and free cash flow growth

Every time major petroleum-producing country announce that they are going to curtail production in a bid to prop up market prices, companies that sit at the source, like ConocoPhillips, are set for potentially significant earnings and free cash flow tailwinds. And this is the situation that ConocoPhillips as well as other oil-producing energy companies are currently in.

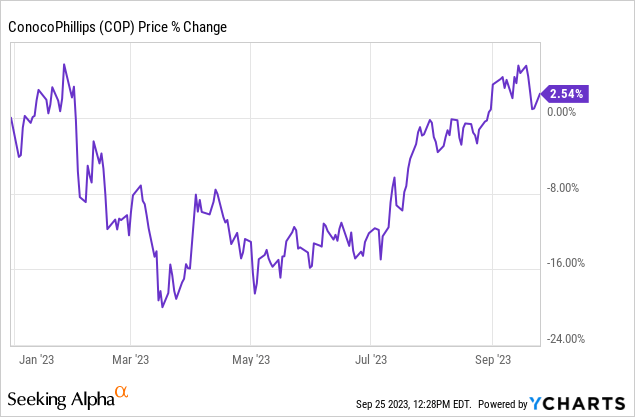

Petroleum prices spiked after Russia invaded Ukraine at the beginning of 2022 and petroleum prices have dropped off considerably, including for ConocoPhillips. However, most recently, OPEC+ country Saudi Arabia announced that it would cut its output by 1M barrels a day until the end of the year. Russia followed suit and said that it would cut its crude exports by 300 thousand barrels per day. As a result, petroleum prices moved into a new up-leg and are currently trading at about $90 a barrel.

As a production-focused energy company, ConocoPhillips benefited in 2022 from higher petroleum prices and the most recent strengthening in pricing bodes well for average prices for ConocoPhillips’ third-quarter earnings report. ConocoPhillips suffered a decline in average petroleum prices in the first half of 2023 as supply fears eased and anxiety about the war in Ukraine dissipated: the average crude oil price across ConocoPhillips’ operations was $57.63 a barrel in the second-quarter (Source) compared to $88.57 a barrel in the second-quarter in the year-earlier period. This marks a decline of a whopping 35%. With supply fears making a comeback most recently, however, ConocoPhillips is set for an earnings and free cash flow upswing in the third-quarter.

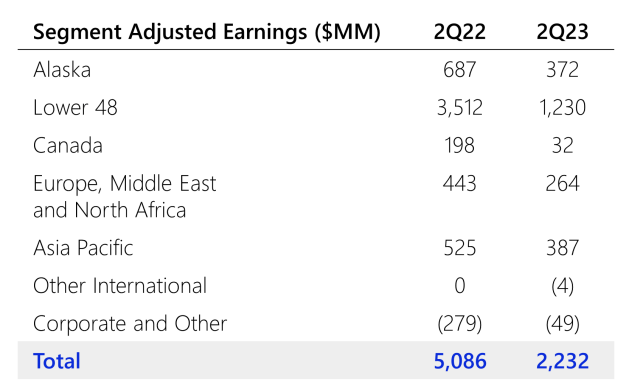

ConocoPhillips’ profits contracted significantly in the second-quarter, although the company remained highly profitable. ConocoPhillips earned $2.2B in Q2’23 across its operational theaters, showing a decline of 56% year over year.

Source: ConocoPhillips

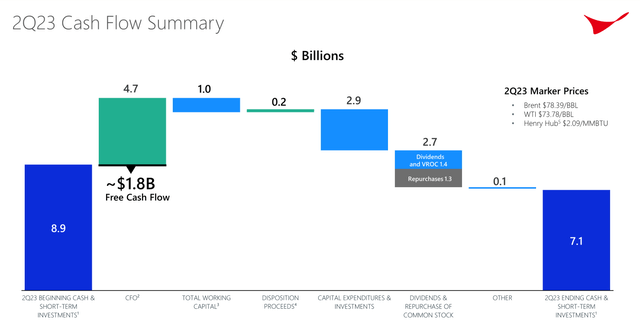

Free cash flow potential, high return potential

ConocoPhillips is considerably smaller in terms of market value, revenues and free cash flow than Exxon Mobil (XOM) or Chevron (CVX). However, ConocoPhillips is focused chiefly on its production business which translates into strong free cash flow upside potential if prices remain high ahead of the winter/heating season. In the second-quarter, ConocoPhillips generated $1.8B in free cash flow and the company returned a total of $2.7B as stock buybacks ($1.3B) and dividends ($1.4B) to shareholders. In the first six months of FY 2023, ConocoPhillips earned $4.8B in free cash flow of which $3.0B were spend on stock buybacks.

Source: ConocoPhillips

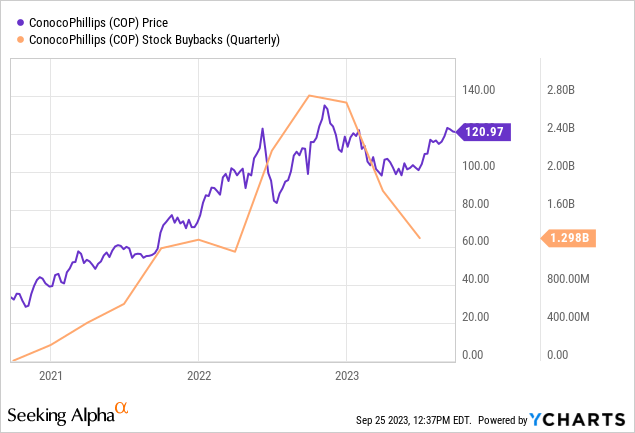

$45B stock buyback plan to provide support

Recurring stock buybacks could, of course, also provide additional support for ConocoPhillips’ share price. ConocoPhillips almost doubled its stock buyback plan to $45B in the fourth-quarter of FY 2022 and has been a steady buyer of its shares in the stock market in the last three years.

ConocoPhillips’ fair value estimate

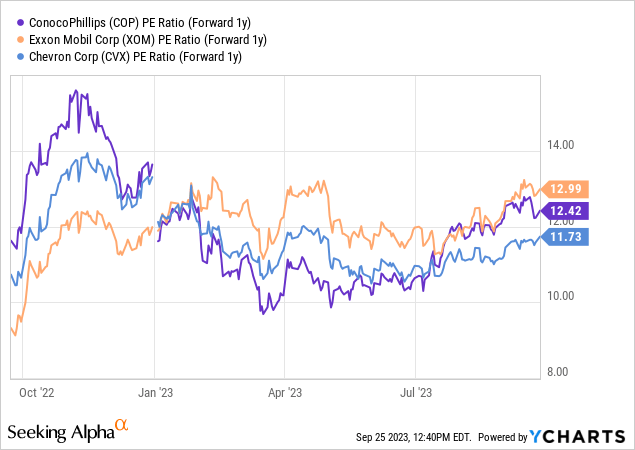

ConocoPhillips is expected to generate earnings per share of $9.74 in FY 2024 which calculates to a forward PE ratio of 12.2X. Considering that the energy producer is more reliant on higher petroleum prices than Exxon Mobil or Chevron (due to the fact that ConocoPhillips does not operate a refinery business), I believe ConocoPhillips could do very well during a new up-leg in petroleum markets.

In my opinion, ConocoPhillips could trade at 14-15X forward earnings. Applying these two multiplier factors to the consensus EPS estimate for FY 2024 ($9.74) result in a more realistic fair value range of $136-146. Shares are currently trading at $121, so I can see 12-21% upside potential to be realized within the next 12 months. Exxon Mobil and Chevron trade at P/E ratios of 12.4X and 11.7X and they offer investors, in my opinion, less upside since their operating portfolio also includes refinery businesses. Production-only businesses, like the one from ConocoPhillips, have higher upside potential in a higher-price world. I recently upgraded Exxon Mobil from sell to hold due to OPEC+’s supply decisions.

Risks with ConocoPhillips

ConocoPhillips is a production-focused energy player meaning the company is a more aggressive bet on petroleum prices than Exxon Mobil or Chevron which run more diversified energy operations (including refinery businesses, for example). As a result, ConocoPhillips has also significantly more earnings and free cash flow risk/volatility than its larger rivals in the energy business.

Final thoughts

ConocoPhillips is a well-run, production-focused energy company with considerable exposure to petroleum prices. The company is focused on petroleum exploration and has considerable earnings and free cash flow upside in the third-quarter, thanks to OPEC+ countries Saudi Arabia and Russia cutting back on supplies. Further supply cuts could have an outsized impact on energy markets and petroleum prices as investors tend to fear supply cuts ahead of the winter/heating season more than at other times during the year. Considering that ConocoPhillips trades at just 12X forward earnings, I believe shares are in a buy-the-drop situation and have an attractive risk profile!

Read the full article here