Twilio (NYSE:TWLO) stock has had a rough couple of years.

After rallying more than 500% between February 2020 and February 2021, shares in the company have spent the last 2 years sliding right back to where they came from, a price base between $50 and $100 per share:

TradingView

But is the market correct? Does Twilio deserve to be trading at the same price that it was in 2018?

Today, we’re looking closely at this once-loved market darling to see whether or not this company deserves a chunk of your hard-earned capital.

Let’s dive in.

A Quick Intro

For those who have never heard of Twilio before, here’s a quick summary of the company and its services so you can get caught up in a flash.

Essentially, Twilio is a cloud communications platform that enables developers to build, scale, and operate real-time communication within software applications.

Twilio’s main products are:

Programmable Voice – allows developers to add voice calling and messaging capabilities to their applications, such as the ability to make and receive calls, send and receive SMS messages, and transcribe calls to text. It’s mostly used by sales teams or in call centers.

Programmable Messaging – allows developers to add SMS, MMS, and WhatsApp messaging capabilities to their applications. Programmable Messaging can be used for a variety of purposes, such as sending promotional messages, customer support alerts, and two-factor authentication codes.

Programmable Video – allows developers to add video calling and conferencing capabilities to their applications. Programmable Video can be used for conducting video interviews, hosting webinars, or providing remote customer support.

Twilio Flex – Flex is a cloud-based contact center solution that provides businesses with the tools they need to provide excellent customer service. Twilio Flex includes features such as an omnichannel routing engine, a built-in CRM, and a variety of reporting and analytics tools.

The company has a few other bolt-on products that build off of this technology, but the core of Twilio’s business is basically to empower internal and public facing apps with communication tools.

These products have proven that they have a strong product-market fit.

Financial Results

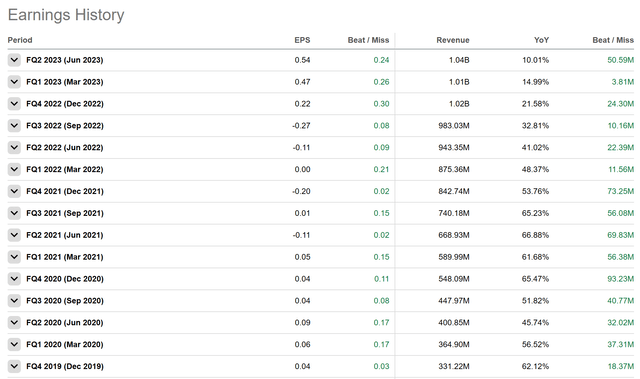

In Q2, Voice, Messaging, and the product suite brought in more than $1 billion in sales, and powered the company’s 18th straight quarterly EPS beat:

Seeking Alpha

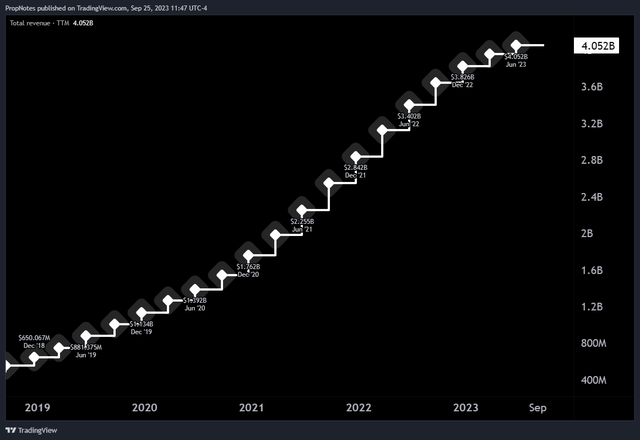

In fact, zooming out, Twilio’s revenue growth has been nothing short of remarkable:

TradingView

Since 2018, TTM revenue has more than 6x’d from $650 million in FY’18 to more than $4 billion over the last 12 months.

This represents a compound annual growth rate of more than 44%(!).

However, revenues have begun to slow, which has alarmed some investors.

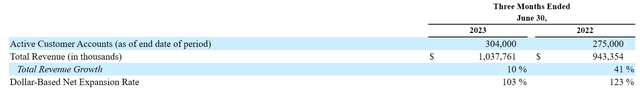

Even more alarming is reduced net expansion, which is a metric that tracks how much product on a percentage basis customers are buying on a recurring basis. As you can see from the company’s recent report, it’s fallen more than 20% YoY:

10Q

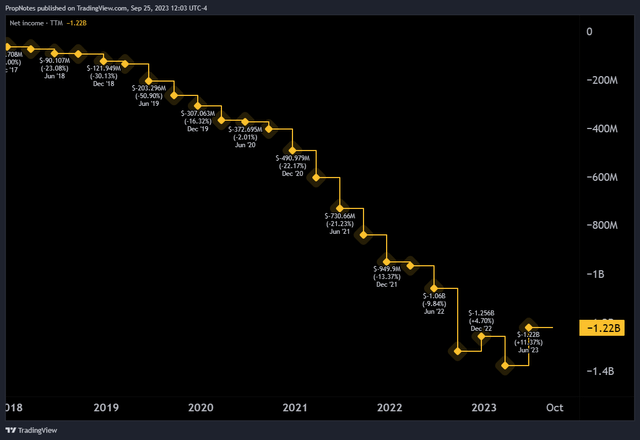

Normally, slowing growth can be acceptable to the market, as nothing scales forever. That said, Twilio doesn’t have the other side of the business figured out yet, as the company hasn’t been earning any real profit throughout this growth.

As revenue has scaled, profits have been grown more and more negative. Free Cash Flow has suffered, and TTM net income has fallen off a cliff:

TradingView

There have been some signs of life in recent quarters, but the majority of these losses are due to Stock based compensation, which the company heavily uses as a non-cash way to retain talent.

Unfortunately, a falling stock price can have the opposite effect on headcount, causing talented team members to leave should their comp drop in the precipitous way that TWLO’s stock has.

Thus, it’s a business problem, but not a direct liquidity problem.

Thankfully, liquidity wise, the company is in good health, sporting more than 3.6 billion in cash, with less than $1 billion in long term debt and relatively paltry current liabilities.

However, it remains to be seen whether or not the company can turn the corner on profitability, especially given the relatively low gross margins relative to the SaaS category (~48%), and the nearly – 40% of revenue – SG&A expense on the income statement.

Org economics like this don’t leave a lot of room for marketing, R&D, and new initiatives.

Valuation

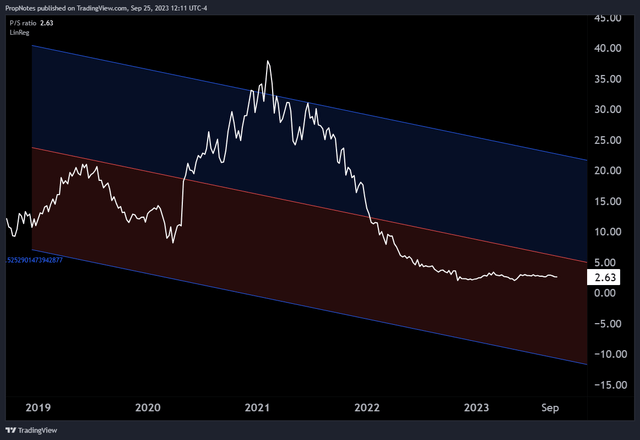

Twilio’s valuation has come in as the company’s growth has slowed.

Trading at more than 35x sales in 2021, the company now sports a more modest 2.6x sales multiple:

TradingView

Given the lack of profitability, there aren’t many other metrics that are useful in trying to gauge the valuation of the company, but it’s clear that the valuation has come in significantly as the market’s confidence in the company’s NPV of future cash flows has been shaken.

Clearly, the market isn’t forecasting historical growth any further into the future.

The Trade

So, what is one to do with Twilio? The product has seen strong demand, and growth has been meteoric.

However, as demand has slowed due to market saturation and a meager economic backdrop, the valuation has come in, SBC has become less valuable, and the company still isn’t earning any money.

We ultimately believe that the company will continue to reduce headcount until profitability can be achieved. Much of TWLO’s core product has been built, which should require less engineering time. Also, more time should allow for management to streamline operations and reduce friction in the business, thus improving per-head efficiency.

That said, it’s not the most confident prediction we’ve ever made.

Being long the product and the market opportunity makes sense, but there’s a fair amount of risk associated with the trade.

Thus, trading Twilio in a conservative manner seems like the best course of action.

How does one trade long stock conservatively? Simple: by selling put options on TWLO stock.

Selling put options on Twilio stock achieves two objectives:

- It gives you a chance to enter the stock lower than you might otherwise have at the current market price.

- It earns you a solid cash premium based on the fact that you could be forced to buy a dip in the stock.

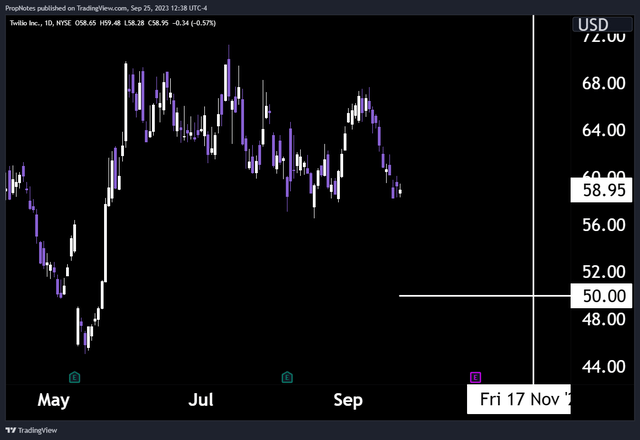

Thus, here, we really like the November 17th, $50 strike put options:

Date & Strike (TradingView)

These are currently trading for $1.37, which represents a 2.82% cash on cash return – which annualizes to 19.3%.

If the stock goes up or sideways, then you keep 100% of the cash collected for selling the option.

If the stock goes down below the strike price, then you keep the cash premium, and also get to buy the stock at a significant discount to where its trading now.

The reason this is ultimately preferential to buying the stock outright is that it reduces the exposure’s volatility in a portfolio significantly, while also producing instant cash.

The option of purchasing the stock on a dip also exists. You miss significant upside, if it should occur, but you also miss out on a lot of downside.

The best way to think about it is like trading with floaties on – less risk of drowning, but less fun/rewarding than swimming. That fits our risk assessment of this scenario perfectly.

Risks

The main risk here is that the company is slated to report earnings in early November, before the option expires.

Selling put options before an earnings report can be a somewhat risky strategy, as the stock price could decline sharply after the earnings report, if the company misses expectations. Even if the company crushes expectations, there’s no telling how the market will react.

If the put option is assigned, the seller will be obligated to buy the stock at the strike price, even if that is above the current market price. This could result in a significant loss.

That said, it’s no worse than what someone long the stock would go experience in the same situation.

Summary

All in all, Twilio seems fairly priced at its current spot. The company and its products are addressing a serious need, and the market opportunity is great. However, profitability and overall business volatility have called into question the wisdom of being purely long, especially into an earnings report.

We think the best way to play Twilio right now is to short put options, thus earning a cash credit while retaining the potential to purchase shares at a lower price if possible.

Good luck out there!

Read the full article here