The value of the U.S. dollar continues to rise.

On Tuesday afternoon, September 26, one Euro cost only $1.0560, and one British pound cost only $1.2150.

These are the lowest these prices have been for some time.

What’s going on here?

My belief is that the markets have finally come to the realization that the Federal Reserve is going to continue to fight inflation till it achieves its target goals, and, to do so, it will even raise its policy rate of interest one…or, possibly two…more times.

Even Jamie Dimon, CEO of JPMorgan Chase & Co. (JPM), is now saying that interest rates could hit 7.0 percent.

“Are you prepared?” Mr. Dimon asks.

Can We Trust the Federal Reserve?

It seems as if market participants have doubted Fed Chairman Jay Powell ever since the Federal Reserve began to raise its policy rate of interest in the middle of March 2022.

The underlying belief was that Mr. Powell and the Fed would “back off,” not wanting to overdue a tight monetary policy and cause financial distress.

So, the value of the U.S. dollar remained softer than many expected and the U.S. stock market stayed stronger than many expected.

But, seemingly, that time has changed.

When did market attitudes change?

Let’s say toward the end of July 2023.

That is, market participants only became “believers” after 16 months of the Federal Reserve raising its policy rate of interest and maintaining its effort at quantitative tightening.

Why have I determined that market attitudes changed around the end of March?

Market Moves in July

Well, let’s look at these market changes that took place toward the end of July 2023.

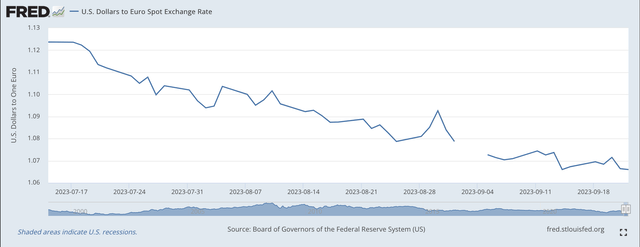

First, let’s look at what happened to the price of the U.S. dollar.

U.S. Dollar/Euro Exchange Rate (Federal Reserve)

On July 14, 20232, one Euro cost $1.1230. The price of one Euro has declined almost steadily since that time.

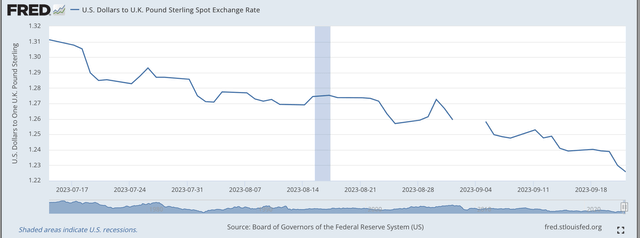

The dollar price of the British pound took a similar path.

U.S. Dollar/British pound exchange rate (Federal Reserve)

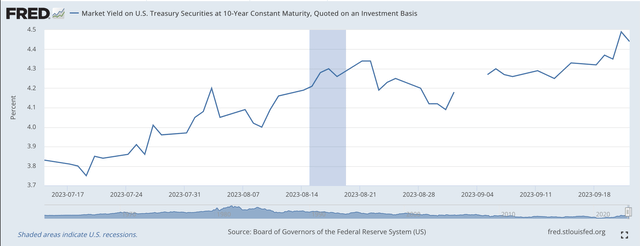

Now, let’s look at what happened to the yield on the 10-year U.S. Treasury security.

Yield on 10-Year U.S. Treasury Note (Federal Reserve)

The yield on the 10-year U.S. Treasury note on July 14, 2023, was 3.820 percent. Currently, the yield is 4.620 percent.

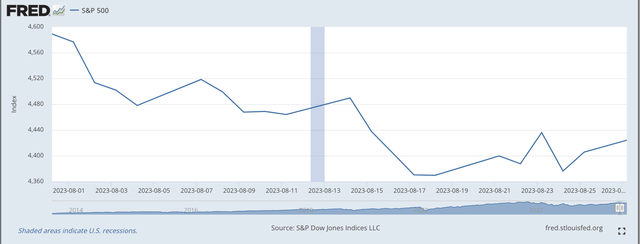

And, the stock market, the S&P 500 stock index (SP500)?

S&P 500 Stock Index (Federal Reserve)

On July 31, the S&P 500 stock index closed at 4,589. The price has been downhill for most of the following period.

The story that the markets seem to be telling us is that sometime in the middle of July 2023, market participants started taking the Federal Reserve at its word.

Since then, the value of the U.S. dollar became stronger and stronger, as investors bought into the dollar.

Bond prices fell and stock prices declined as investors sold these items.

All of this is consistent with the fact that investors really started to believe that Mr. Powell and the Federal Reserve were going to do what it said it had set out to do.

The Fed, market participants believed, going to continue to fight inflation and were going to bring the rate of price increases down to the level the Fed wanted…2.0 percent.

In this past week, the Federal Reserve published its latest round of forecasts for the future. This release was followed by a new set of forecasts by the U.S. Commerce Department. (Both forecasts are discussed in my recent post.)

Both forecasts estimated that inflation and unemployment would approach the Fed’s goals within the next year or so. The feeling expressed in both forecasts was that the Fed is succeeding in its efforts to get the economy back to a “more normal” rate of operation.

Mr. Powell and other Federal Reserve leaders continued to caution the investment community to “be patient.” But, the underlying message seemed to be, we are approaching what we set out to achieve.

Bottom line, Mr. Powell and others were saying…be patient…after 18 months of quantitative tightening…we are getting there.

It seems as if the markets have been right on the side of the Federal Reserve at this time.

What the Fed has done supports a strong dollar relative to other currencies throughout the world.

The U.S. dollar deserves to be strong.

But, there is still a way to go.

The Fed may be getting the car in the garage, but the car is not fully in the garage yet…and the garage door has not been shut.

Let’s hope the job can be completed.

Unfortunately, there may be some fiscal discomfort taking place before the final chapters are written. The potential government shutdown is not good news.

But, that story is for next week.

Read the full article here