Introduction

I’ve written two articles on SA about satellite imagery solutions company Satellogic (NASDAQ:SATL), the latest of which was in July when I said that demand for its services was nowhere near expectations and that the number of satellites in orbit could decrease by the end of 2023.

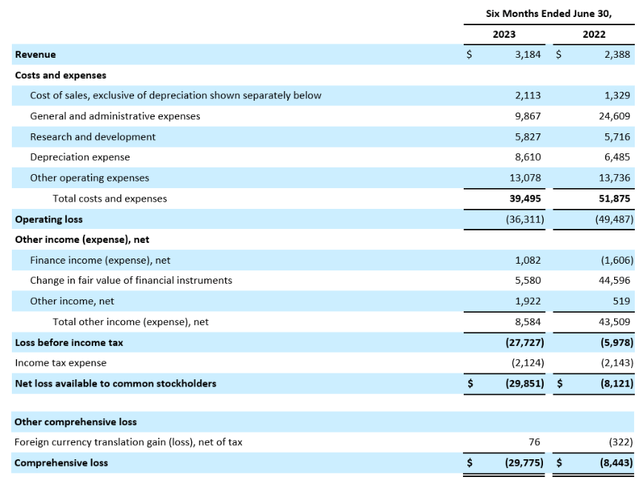

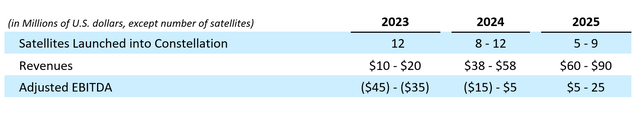

On September 21, Satellogic released its financial results for the first half of 2023, and I think they were underwhelming as revenues came in at just $3.18 million while the operating loss was $36.1 million. The company is scaling down its growth plans significantly, with between 13 and 21 satellites expected to be launched in 2024 and 2025. However, even if the updated revenue and EBITDA estimates are met, I think there is a high risk of significant stock dilution here as cash is running out rapidly. In view of this, I’m keeping my rating on the stock at strong sell despite the market capitalization being a third lower compared to my previous article. Let’s review.

Overview of the H1 2023 financial results

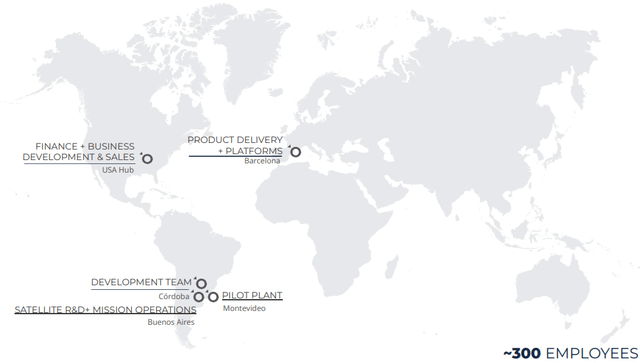

If you aren’t familiar with the company or my earlier coverage, here’s a short description of the business. Satellogic was founded in 2010 and is a vertically integrated geospatial analytics company that got listed on NASDAQ through a merger with a special purpose acquisition company named CF Acquisition Corp. V in early 2022. Satellogic employs about 300 people and it has facilities across Argentina, the USA, Spain, and Uruguay. Its business plan is to become a leading player in the high-resolution satellite imaging sector by deploying a fleet of small satellites that cost less than $1 million each.

Satellogic

The company has a patented camera design can it claims it can capture around 10 times more data than any other small Earth Observation satellite. Its long-term goal is to remap the entire surface of our planet on a daily basis in sub-meter resolution and it would need about 200 satellites in orbit to achieve this.

Satellogic

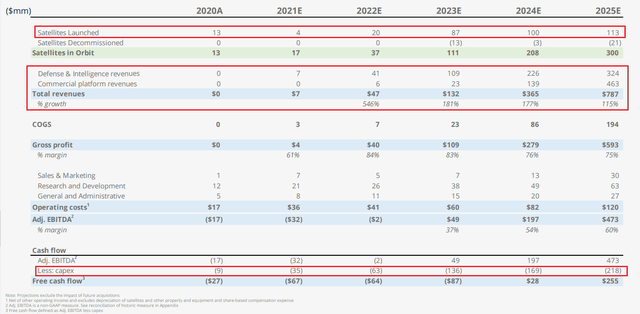

When the SPAC deal was announced, Satellogic forecast that it would have 200 satellites in orbit in 2024 and that its revenues would surpass the $100 million mark by 2023.

Satellogic

Unfortunately for investors, these forecasts were overly optimistic and by December 2022, the company expected to book revenues in the range of just $30 million to $50 million in 2023. Well, the results for the first half of this year showed that even the lowered expectations were far off the mark as Satellogic’s revenue came in at $3.18 million for the period. General and administrative expenses shrank by almost 60% year on year but the H1 2022 figure included higher professional fee expenses due to the SPAC deal. Adjusted EBITDA for the first half of 2023 stood at negative $23.8 million compared to negative $26.7 million a year earlier.

Satellogic

So, what happened? Well, it seems that global demand for high-resolution satellite imaging is much lower than Satellogic forecast, and I also think the low number of satellite launches are also to blame. You see, the company currently has just 36 satellites in orbit (see slide 10 here) which is two less compared to my previous article and far off the 111 that Satellogic expected to have by the end of 2023 at the time of its SPAC deal. The reason that the number of satellites has decreased is they have a design life of 3-4 years and 13 of them are set to be decommissioned in 2023 alone. According to Satellogic’s updated guidance, the number of satellites launched is expected to decrease over the coming years to just 5 to 9 in 2025. In view of this, I expect the number of satellites in orbit to continue shrinking over the next few years and fall below 30 by 2025. Satellogic expects to book revenues of between $10 million and $20 million in 2023 but I think this figure seems overly optimistic as revenues for the first half of the year were barely above $3 million and there are no indications that there could be any major new clients in the coming months. Yet, I expect operating losses to shrink in the second half of the year as Satellogic revealed that it has reduced its headcount by about 110 people so far this year and this translates into annual savings of about $7.5 million starting Q4 2023.

Satellogic

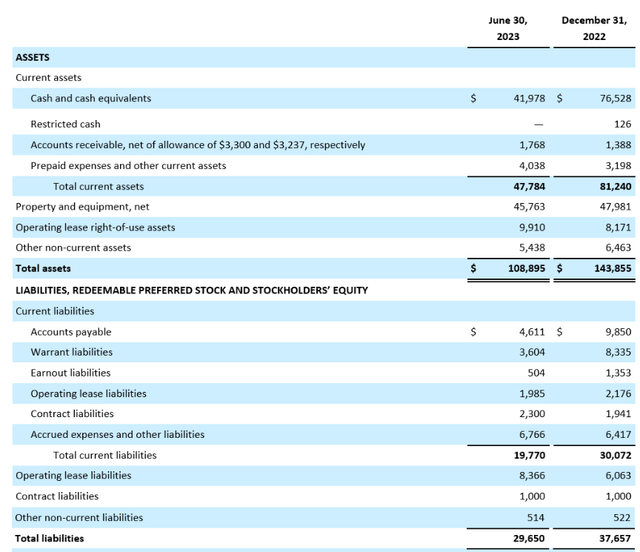

However, even if we assume that Satellogic manages to meet its revenue and adjusted EBITDA guidance for 2023, I think that the balance sheet is in a rough shape and a capital increase in the coming months could be inevitable. As of June 2023, the company had $42 million in cash while cash used in operating and investing activities during the first six months of the year was $36.2 million. At this rate, cash could run out around late April.

Satellogic

Overall, I think that Satellogic booked weak financial results for the first half of 2023 and that revenues for the full year are unlikely to surpass $10 million as the number of satellites in orbit is decreasing. The company’s cash reserves are shrinking fast, and the business looks significantly overvalued. Yet, short selling here seems dangerous as data from Fintel shows that the short borrow fee rate stands at 71.01% as of the time of writing. Also, hedging risks using call options looks ineffective at the moment as the only available strike price is $2.50, almost twice as high as the current share price. In view of this, it could be best for risk-averse investors to just avoid this stock.

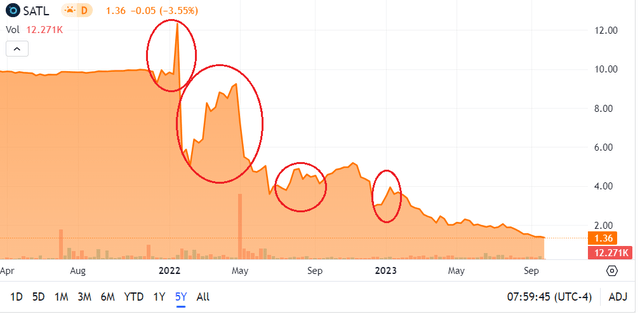

Looking at the upside risks, I think that the major one is that the prices of microcap stocks can increase significantly without clear catalysts, and this can result in major losses for short sellers. This has happened several times here, most notably between February and April 2022.

Seeking Alpha

Investor takeaway

Satellogic continues to underdeliver on its revenue forecasts, and I think that even its updated 2023 guidance looks over-optimistic. In addition, its satellite network is shrinking, and cash is running out at an alarming pace despite headcount reductions. Overall, I think that the business could be close to worthless in its current state. Yet, short selling seems dangerous as the short borrow fee rate is above 70% and the only available strike price for call options is $2.50.

Read the full article here