Investment Thesis

The recent pullback in Pagaya Technologies’ (NASDAQ:PGY) share price provides an exciting opportunity for investors to buy into the vast potential of AI-driven lending at a deep relative discount. While macroeconomic uncertainty has impacted sentiment, Pagaya’s growth narrative and expanding competitive moat remain intact.

Pagaya operates a two-sided network connecting lending institutions and institutional capital through superior data science and artificial intelligence. This facilitates expanded access to credit for borrowers while enabling attractive risk-adjusted returns for investors.

While still well below its SPAC IPO price, Pagaya shares rallied over 140% during the course of this year as the market warmed back up to tech stocks amid the strengthening narrative around AI, before pulling back approximately 35% from those highs. Today the company sits at a market cap of $1.24bln, or around 1.25x 2024 Sales, allowing investors to participate in the powerful network effects and competitive advantages propelling Pagaya’s growth story at a reasonable valuation.

Resilient Growth Model

Pagaya has showcased resilient business performance, even against the challenging backdrop of volatile markets and rising rates. Q2 results beat estimates across all key metrics – network volume, revenue, and EBITDA.

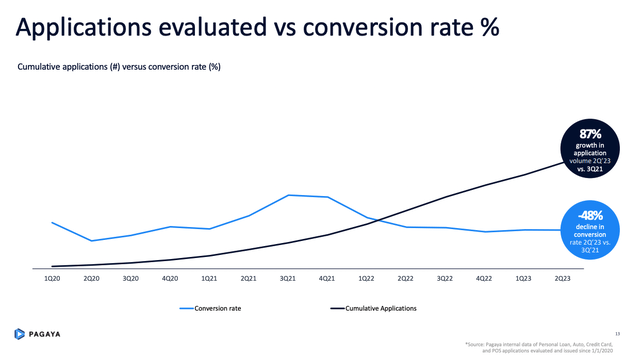

Network volume reached a record ~$2 billion, up 8% year-over-year. Total revenue grew by the same amount to $196 million. This growth is especially impressive considering Pagaya has intentionally kept approval rates low to optimize for performance.

With prudent underwriting, Pagaya’s portfolio has outperformed benchmarks. As liquidity returns, approval rates can be dialed back up, creating a lever for accelerated growth.

Pagaya metrics (Pagaya)

The business model also provides multiple integrated revenue streams. So as capital markets soften, Pagaya can capture more economics on the partner side through AI integration fees.

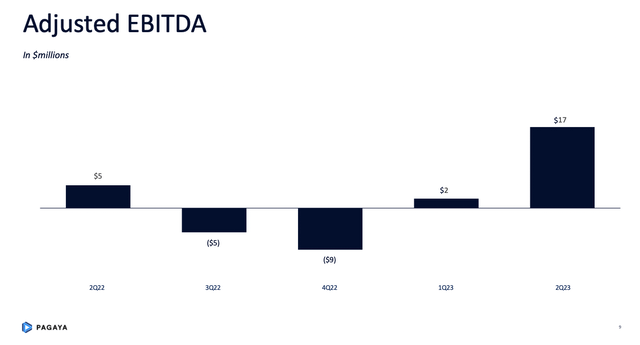

With consistently growing positive EBITDA prints, it’s evident that profitability can ramp up even further with operating leverage.

Profitability (Pagaya Presentation)

Vast Addressable Market Being Ignored by Market

However, quarterly performance isn’t the full story here. Pagaya is tapping into a massive $4 trillion total addressable market in annual U.S. consumer loan originations. Today Pagaya commands only a tiny single-digit market share, exemplifying the enormous runway ahead.

Network effects also fuel growth, as accumulating data bolsters AI models and attracts more partners and investors. The network has already evaluated over $1.1 trillion in application volume, providing unique consumer behavior insights. More data and analysis enhance the accuracy of predictions and underwriting.

Partners have realized substantial value, with origination volumes continuously expanding. As CEO Gal Krubiner stated in the Q4’22 earnings call, “Partners are seeing immediate value creation when they join our network. On average, partners have seen 3x growth in origination enabled by our network between the third and 12th months of onboarding.”

Deep Discount to AI Peers

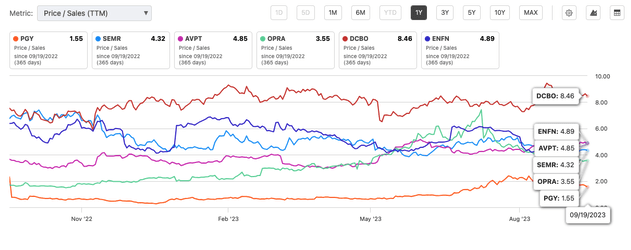

Pagaya trades at a substantial discount compared to other public and private AI lending companies.

Recently, lending platform Upstart traded around 3.5x revenue before plunging due to loan retention issues. In contrast, Pagaya trades at just ~1.5x trailing twelve-month revenue without facing similar balance sheet risks. Moreover, recent venture capital-backed private rounds have awarded infinitely high revenue multiples, making Pagaya look like an attractive value play in early-stage fintech.

Once Pagaya demonstrates consistent profit growth in upcoming quarters, its valuation gap compared to AI lending peers should converge and drive upside.

Relative valuation (Seeking Alpha)

Macro Backdrop Improving

There are early signs the macroeconomic backdrop could become more favorable for high-growth companies like Pagaya. The Fed’s aggressive interest rate hikes to tame inflation appear to be working, with the CPI steadily slowing down. Hikes have paused, and a 180 policy towards easing in the face of liquidity events cannot be overruled.

Markets are now pricing in rate cuts starting in late 2023 as inflation falls back towards the 2% target. Lower rates would ease financing conditions, providing a tailwind for lending volumes and Pagaya’s network growth.

As the economy recovers from the shock of rapid tightening, investors may also return to premium valuations for disruptive tech companies like Pagaya riding secular adoption curves.

PGY Valuation Estimate:

| 2028 (E) | |

| Revenue CAGR | 20% |

| Revenue Estimate | $1,800m |

| P/S ratio | 3 |

| Target Price | $5,400m |

| Target Price | $7.62/share |

| Annualized return | ~37% |

Downside Risks

While Pagaya’s vast addressable market, network effects, and reasonable valuation provide an attractive risk/reward profile, prudent investors should monitor a few key risks. If credit markets remain frozen longer than expected, Pagaya’s growth reacceleration may be delayed.

Competitive threats could also emerge over time as AI lending gains traction. And if global macro weakness persists, investors could stay skeptical of premium growth multiples. However, these concerns appear appropriately discounted at current prices for long-term believers in the AI lending revolution, in which Pagaya is poised to be a key leader and disruptor.

Compelling Risk-Reward

Balancing the huge TAM and competitive strengths against execution risks provides a favorable risk-reward profile at current valuations.

Trading at only 1.5x TTM revenue, shares price in minimal growth. Considering top-line growth could re-accelerate into the 20-30% range in more normalized markets, the asymmetry in outcomes is pronounced.

While some caution is warranted given Pagaya’s early growth stage and reliance on capital markets, the underlying secular tailwinds from AI adoption leave room for exponential expansion.

The network effects should also help Pagaya continue outpacing legacy lenders, justifying premium multiples once consistent profitability is demonstrated.

In summary, the recent pullback offers longer-term investors a chance to buy into the enormous potential of AI lending at a reasonable price. For those with patience and appropriate risk tolerance, Pagaya provides differentiated exposure to this transforming trend in financial services.

Read the full article here