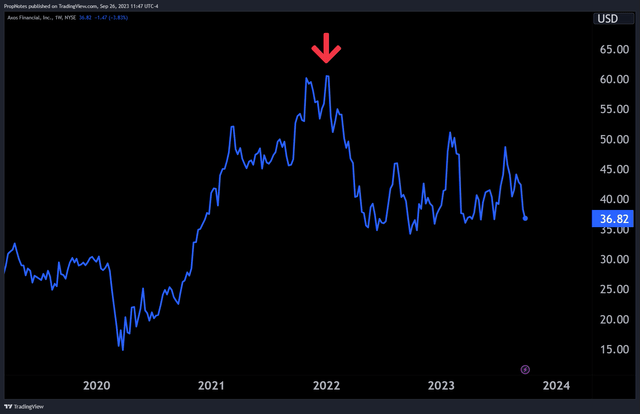

Over the last few years, Axos Financial (NYSE:AX), the parent company of Axos Bank, has fallen quite a way from the where it was trading in early 2022:

TradingView

Down nearly 40% from all-time highs and trading in a range, you’d be forgiven for thinking that the stock was dead and forgotten by the market.

However, the bank is still growing revenues and EPS, which makes us think that the stock is worth another look.

Plus, shares of the company are deeply discounted, and the bank has posted high quality earnings quarter after quarter.

Thus, trading near support, a ‘Buy’ rating seems appropriate in the name.

However, we think there may be a more lucrative way to play the stock – selling put options.

By selling put options, traders can decrease their risk in the name, while simultaneously generating a cash premium that can act as income. Plus, if the stock dips enough, put sellers can buy the stock at a discount to the current market price.

Sound good?

Let’s dive in and explain everything in more detail

Financial Results

As always, let’s start with AX’s financial results.

In their most recent report, AX reported their FY 2023 numbers. Let’s take a look at those.

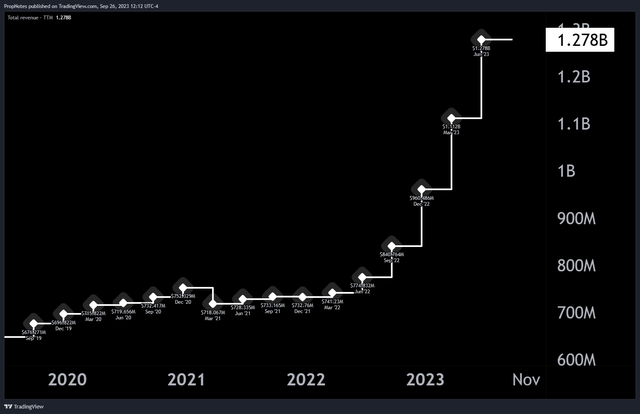

In FY 2023, AX reported Revenue of $1.27 billion, an increase of 64% vs. the year prior:

TradingView

This explosion in revenue is mostly due to an increase in interest rates, as net interest margins have risen, and net interest income has soared.

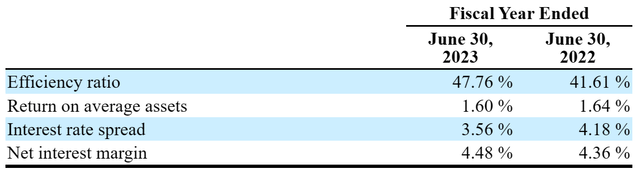

These improvements are complimented by stability in AX’s business bank efficiency ratio, which remained under 50%, despite the drastic revenue scaling over the previous year period:

10Q

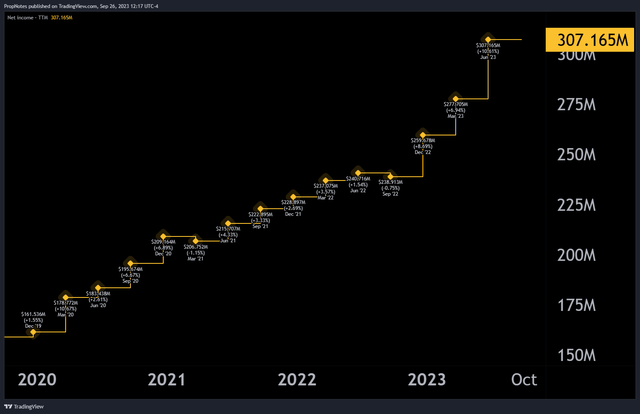

However, it isn’t just revenue that has increased over the last year; Net Income has also continued to grow like clockwork, from TTM $238 million in Q1 2023, to $307 million less than a year later:

TradingView

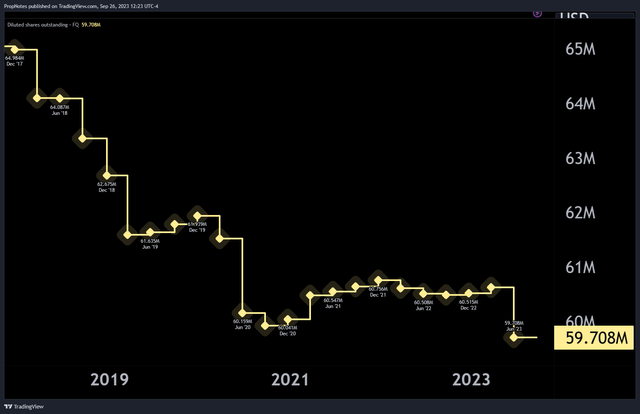

Combined with relatively stable margins overall and a decreasing share count;

TradingView

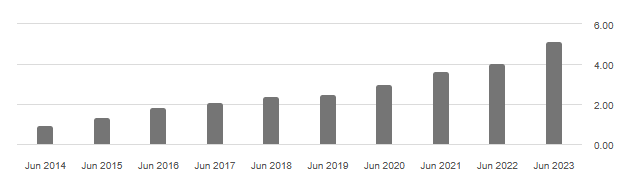

it’s no wonder that EPS has done well over the last few years:

Seeking Alpha

From an operational perspective, the bank has also kept things tight.

There are few non-core activities, which has allowed AX to access operating leverage to increased income rates on its portfolio of loan holdings.

Sure, the bank runs an investment division as well as some other auxiliary businesses, but the primary source of revenue is from the loan portfolio.

Another plus – AX carries almost no U.S. treasury securities, the type that caused SIVB to collapse. Thus, there’s no massive mark-to-market losses hiding anywhere on the balance sheet.

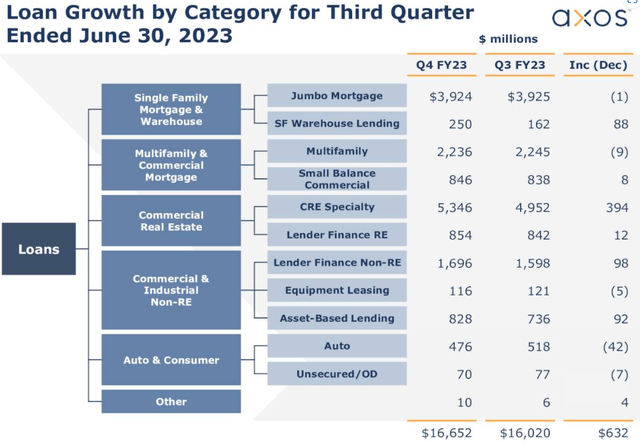

But what about loan quality?

This is where some may sour on AX’s business model. Unlike many other banks that carry a majority of personal debt and mortgage-backed securities on the books, AX’s net loan book is chock full of commercial real estate exposure:

Earnings Presentation

This is tricky to price out from a risk perspective. From one point of view, exposure to this sector is generally viewed as negative, especially given the higher rate environment and the transition of most office work to hybrid arrangements across industries.

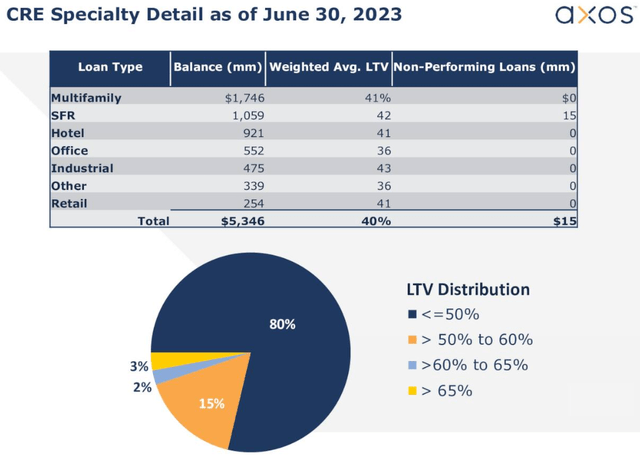

On the other hand, Office space only makes up 550 million of the CRE book, which is less than 10% of CRE exposure, and less than 3% of gross loans:

Earnings Presentation

Fortunately, management takes a very conservative first-lien approach to lending, which means that if things go sour, AX is high up enough in the capital stack to likely see all or most of its money back. 95% of the bank’s loans are arranged this way, which does provide a lot of safety, unless there’s a quick crash and the CRE market goes no-bid.

This doesn’t seem like a likely scenario to us, which is why we’re happy with the higher revenues and EPS that AX has generated off the back of this exposure.

The Valuation

But how expensive is AX?

In short, the valuation is attractive.

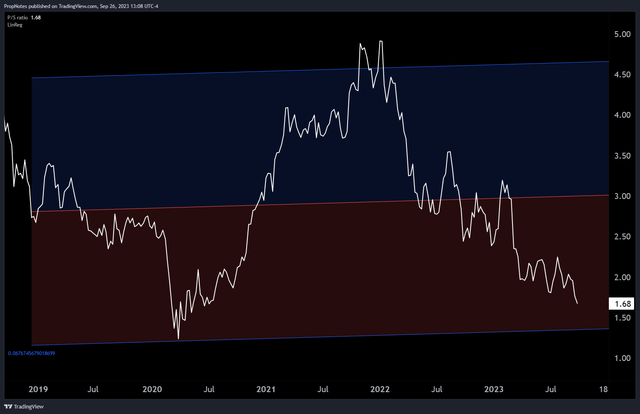

Trading at just 1.68x top line sales, the company is deep into the red “attractive” linear regression zone when looking at how the company has been valued historically:

TradingView

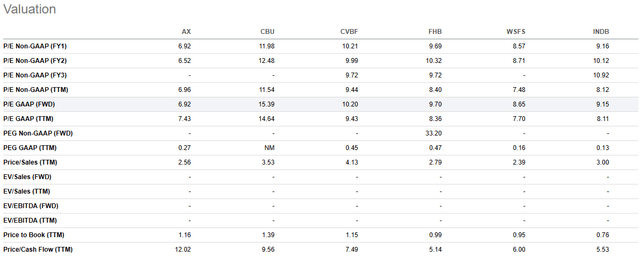

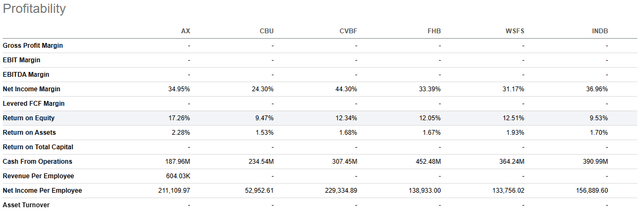

Additionally, TTM GAAP P/E comes in much lower than AX’s peer group:

Seeking Alpha

This makes no real sense, especially in light of the fact that the bank is more performant than any of them from a profitability standpoint:

Seeking Alpha

Thus, net net, we view the company as stable, profitable, and attractive.

The Trade

However, while one could certainly buy shares in this drawdown and call it a day, we think there may be a more optimal strategy for playing the stock: selling put options.

Selling put options on AX shares is a way to generate income and potentially acquire shares of the company at a discounted price.

If you sell a put option, you agree to buy the underlying stock at the strike price on or before the expiration date. If the stock price falls below the strike price, you will be assigned the shares.

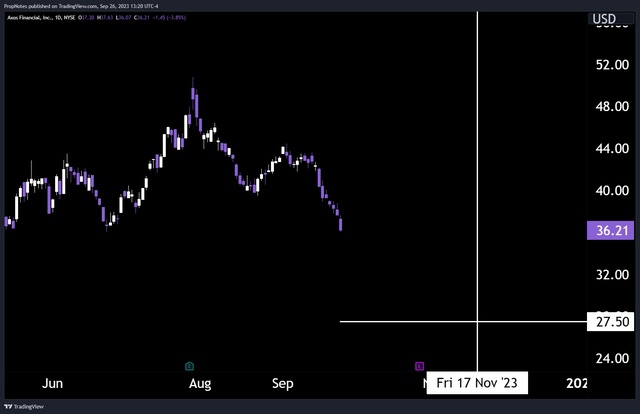

In this case, we like the 11/17/2023 $27.5 strike put options:

Expiry & Strike (TradingView)

If the stock stays above $27.50 by November 17th, then put sellers get to keep the $80 per contract they received free and clear. This calculates to a 3% cash on cash return in that time, which annualizes to just shy of 20%.

If the stock goes below $27.50 by expiry, then put sellers will be forced to buy the stock at the strike price. Right now, the strike price plus the premium represents a potential cost basis in the stock with a -26% breakeven.

Considering that you either profit or buy this great stock at a significantly lower price than where it’s trading today, this trade seems like a win-win.

Risks

The main risk here is that AX reports earnings on October 26th, which is before the option expires. If the market’s reaction to the report is bad (even if the numbers are great!), then put sellers may need to shell out cash to buy the stock above market, depending on where it’s trading and if it declines significantly enough.

This risk profile is no different than just holding the stock into expiry, but it’s important to mention nonetheless.

Summary

Overall, AX is a great bank with a long track record of conservatively growing profits and shareholder value. Currently discounted, we think the best way to play the recent (and potential future!) volatility is by selling put options on the stock.

Either you get to buy the stock at a significantly lower price than where it’s currently trading, or you get to earn a solid 19% annualized cash-on-cash return.

Enjoy this article? Be sure to share it with a friend you think would appreciate it.

Cheers!

Read the full article here