Overview

Concrete Pumping Holdings (NASDAQ:BBCP) is a construction services roll-up that specializes in concrete pumping for commercial projects. In the construction processes of large projects, concrete must be moved from the cement trucks to the pour site. BBCP is the owner and operator of a fleet of pump trucks and pumps that move concrete to the pour site. BBCP also operates a complimentary concrete waste management service for unused and washed out concrete. BBCP has extensive Geographic coverage, a de-risked business model, leading market share, growing unit economics and an experienced management team; I rate the stock a buy.

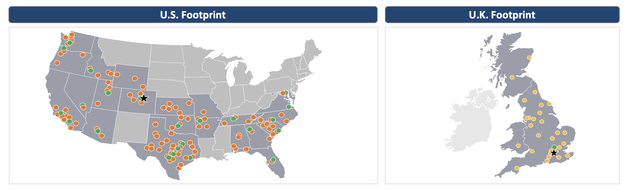

The Thorton, CO-based firm operates heavily in the south-central and East Coast of the US and has operations in the UK. Full year 2022 revenue was roughly $400M, with 14% UK pumping revenue, 74% US pumping revenue and 13% Eco-Pan (mixed geography) revenue.

BBCP typically sends one operator per truck, with the number of trucks varying per job size. The firm emphasizes that contracts do not assume responsibility for the concrete and are negotiated on a time and/or volume basis.

Geography

BBCP Investor Presentation

One of BBCP’s biggest strengths is its geographic diversity. BBCP was founded in Colorado and expanded first across the midwest and Texas. Most recently, BBCP acquired Georgia-based Cherokee Concrete Pumping this year for $6.3m and Coastal concrete pumping last year for $31m, operating in the Carolinas and Florida. Despite already having massive coverage across the US, there still remains untapped markets in Florida (have you seen the Miami skyline recently?), northern California, Washington DC, Philadelphia and Pittsburgh, New York, the Great Lakes region, and Boston and New England. From my research, the hardest pumping markets to penetrate already have large, well-established players: northern California, New York and New England. From a geographic perspective, I suspect the next round of acquisitions will take place in the Great Lakes region, bridging operations between the midwest and east coast. As for the UK, I believe BBCP has a reasonable footprint to command pricing power in the near future. Readers can listen in depth about BBCP’s strategy with long-time CEO and former pump truck operator, Bruce Young, here.

Segments and Fleet Summary

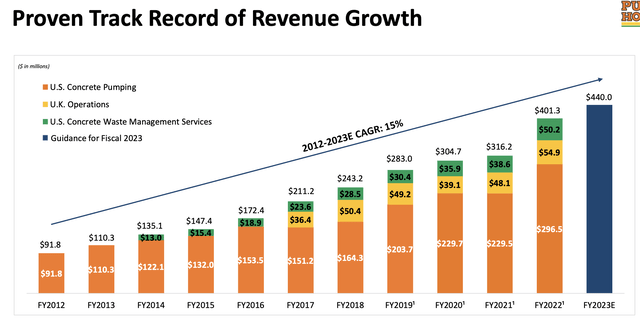

BBCP divides operations into three reportable segments: US pumping, UK pumping, and Eco-Pan. The Eco-Pan division operates in both the US and the UK, and is responsible for concrete washouts. Through the Eco-Pan brand, BBCP supplies worksites with large metal wastepans whereby concrete trucks can pour residual mud. An Eco-Pan operator later collects the pan and dumps it at a nearby waste center. BBCP believes that this waste management brand serves as a nice complement to the pumping business. The graph below illustrates consistent sales growth over nearly a decade, plus the accretive additions of the UK and waste management segments. I strongly recommend investors visit BBCP’s Investor Presentation to gain a clearer understanding of their operations.

Investor Presentation

BBCP has a widening moat in a niche industry. The firm’s M&A activities continue to strengthen its position as a market leader. BBCP and its subsidiaries are the largest operators of concrete pumping equipment by a significant margin, when measured by fleet size. This gives the firm purchasing power over new equipment and parts-most concrete pump trucks are manufactured by two companies, namely Schwing and Putzmiester. Many of BBCP’s competitors operate regionally with a handful of pump trucks. Yet, despite its size, BBCP only occupies 17% of the American market share and operates in just 23 states, suggesting there is more room to grow. In the UK, BBCP’s fleet accounts for 37% of the concrete pumping market.

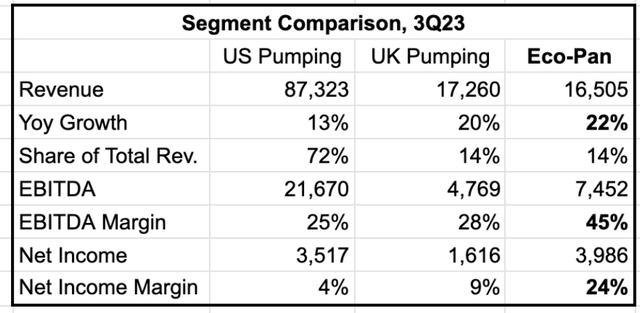

Segment Comparisons, in ‘000s (SEC Filings, Author’s Work)

Of the three business segments, Eco-Pan has posted attractive results. From 2021 to 2022 the segment revenues grew over 30% while EBITDA margins have been at or above 40% since 2019. Revenue growth across all segments is strong, particularly in the UK and waste management. The core pumping businesses are also strong, with much focus on the US segment, accounting for >70% of total revenues.. In the last two years, EBITDA margins in the core pumping segments have ranged between 20% and 25%, with revenue growing in the mid-teens and low twenties.

Moreover, growth in the core businesses allows BBCP to cross-sell waste management offerings nicely, while keeping margins low by sharing resources with other segments (yard space, mechanics, fuel purchases etc.).

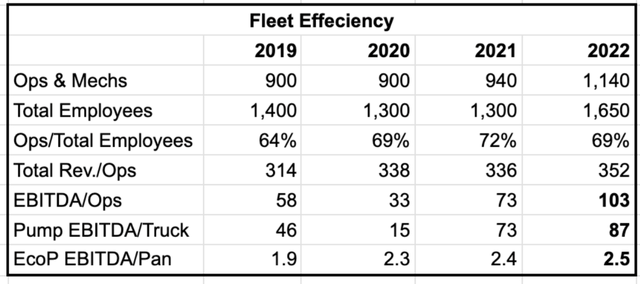

Unit Economics, in ‘000s (SEC Filings, Author’s Work)

BBCP has impressive per-unit profitability and growth. As of 2022, BBCP has 1,650 employees with 69% employed as Operators or Mechanics. More importantly, BBCP has been able to maintain or grow the amount of revenue per operator/mechanic, and the amount of EBITDA generated per Operator/Mechanic has nearly doubled since 2019. This also tracks the growth in EBITDA per pump truck from 46 to 87, considering that operators and trucks are almost perfect complements. On the Econ pan business, BBCP operates roughly 8,000 wastepans, with a ratio of 80 pans-per-truck. Each pan generates $2,500 of EBITDA, up from $1,900 of EBITDA per pan in 2019, when the segment owned only 6,300 pans.

Risks

BBCP, of course, is not without risk. There are 2 secular and 3 broader challenges the firm may face moving forward. First, BBCP has roughly $360M in net debt as of Q3. This debt has an average interest rate of 6%, but the majority is not due until 2026. If rates remain high into 2026, refinancing could become a significant challenge–especially given that the firm has not begun paying down principle on the $360M.

Second, intangibles and goodwill account for roughly 38% percent of the company’s total assets. BBCP has a negative book value per share of -0.98. Although I believe the balance sheet is materially strong (the firm consistently makes gains on the sale of PPE), management must be shrewd about acquisitions in the future. Furthermore, as BBCP expands, they will increasingly control pricing power on used pump truck sales. Since 2019, BBCP has grown their market share of pump trucks and pump-related equipment from 13% to 17% in 2022.

Third, there is foreign exchange risk considering a >14% chunk of sales come from the UK. A strong dollar will weaken some of the revenues from Europe. Furthermore, if the UK falls into a recession before the US, this could spell trouble for the firm. Similarly, a massive global recession would have negative impacts on BBCP; however, BBCP’s target contracts, like large commercial projects like apartments, data centers and HS2 will be resilient to a few quarters of economic contraction. CEO Bruce Young mentioned in the Q2 earnings call that, “the volume of the larger projects have become a significantly greater part of our commercial market than what we’ve seen”. For reference, Young had also noted in the Q1 call that, “there’s as much concrete as two 50-story buildings and still early in an average size chip plant, there’s as much concrete as four 50 story buildings.” That’s a lot of pumpin’!

Finally, there is the risk of high fuel prices cutting into margins. As Jeff LaBounty, BBCP’s national service manager, mentioned in a recent promotional video with CITGO, fuel is BBCP’s largest expense. Thankfully, strategic partnerships have saved the firm, on average, 2 to 2.5% on fuel costs.

Conclusion

I think BBCP is a great stock for investors who like growth at a reasonable price and are looking for an alternative infrastructure play. Although valuation wasn’t the focus of this article, at 8 dollars a share, I estimate a modest FY2023 FCF of roughly .75 per share implying a 10 or 11x Free Cash Flow multiple-pretty cheap by industry standards. Management has been wise about acquisitions up to now, and I’m glad to see they’ve pumped the brakes on acquisitions this year. A recession in 2024 could be a plus for BBCP, as smaller pumping companies will likely be cheap should the firm decide to expand into the north or northeast.

Read the full article here