TotalEnergies SE (NYSE:TTE) hosted a Capital Market Day in New York today. Since our last update, Buy More, as expected, oil prices continued a positive trend, with European crude Brent and WTI above $90 per barrel. Last time, we increased Total valuation from €60 to €65 per share, confirming our overweight target. In addition, we positively view the latest company’s indication to pay out “at least 40%” of the CFFO. After having participated in the CMD event, we are even more optimistic. CMD items could now grab investor attention, and we expect a positive stock price reaction with potential Wall Street analysts re-rating. Here at the Lab, we were not expecting significant strategic pivot changes, and Total confirmed its three crucial pillars: 1) oil, 2) gas, and 3) electricity. The management team well confirmed this in the just-released presentation.

Below are our main highlights:

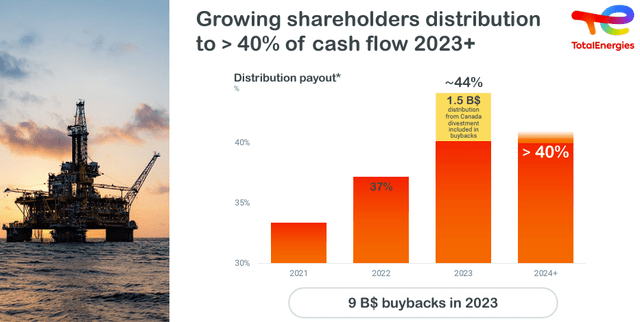

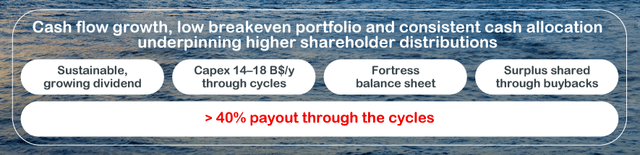

- Starting with the numbers, in 2023, Total will allocate Canadian assets’ disposal to share repurchase. This number will reach $9 billion, and now the company anticipates returning almost 45% of its CFFO to current investors (Fig 1). In addition, higher shareholders’ remuneration is expected in the next five years to distribute more than 40% (vs. previous estimates set between 35% and 40% of CFFO). Here at the Lab, we believe that this supportive outlook will be confirmed if the oil price likely remains robust (with at least $60 oil per barrel);

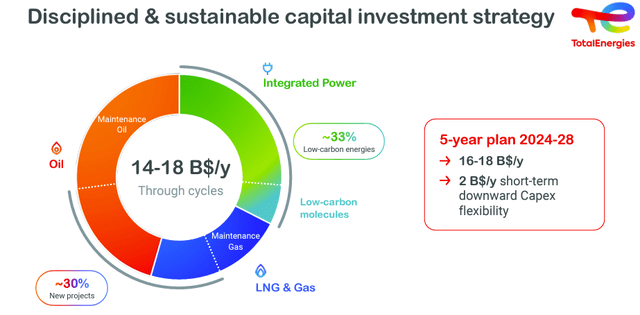

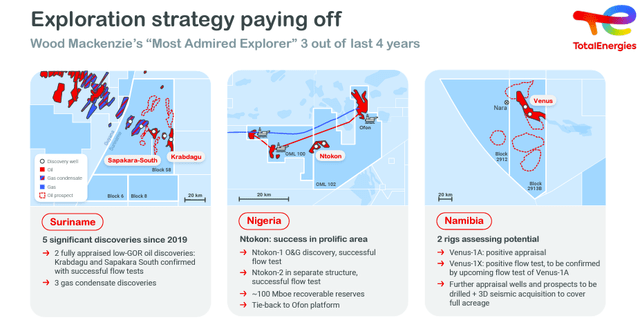

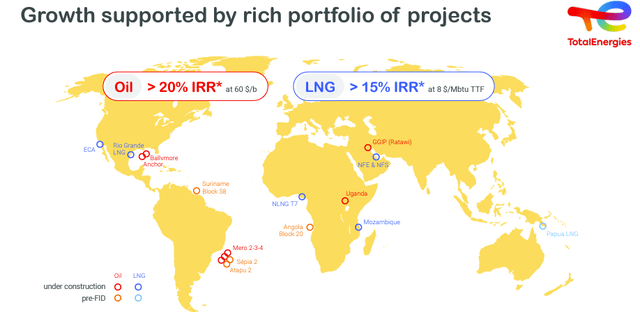

- During the period, the company confirmed its net investments CAPEX in the range of $16-18 billion per year until 2028 (Fig 2). In detail, the company anticipates increasing oil production growth to approximately 2% per year by 2030. We positively reported exploration success in Namibia and Suriname (Fig 3), and we won’t be surprised to expect Total to discuss oil growth opportunities more openly. The company has an asset portfolio with a low breakeven cost that will support renewable energy investments. This is well supported by our Eni analysis, which confirmed years of CAPEX under-investment and an oil demand still growing through the next decade. Total LNG discoveries are also outpacing BP and Shell. Still related to LNG CAPEX, Total is deploying more investment in Qatar expansion, US, Papua, and Mozambique;

- To support point 2), Total displayed its IRR trajectory both double digit in Oil and LNG (Gas) considering a 60 $/b and an 8 $/MbtuTTF, respectively (Fig 4);

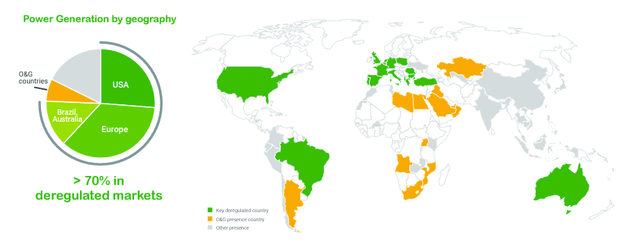

- As reported by the company, “TotalEnergies stays the course of its balanced multi-energy strategy.” Total has never hidden its ambitions to grow in the renewables segment. The company aims to build a sizeable integrated electricity business focusing on returns rather than growth. We positively view this development as Total shareholders; we demand profitability. Total aims for a target ROACE of approximately 12% and a cash flow-positive contribution by 2028. These are solid numbers considering its ambitions “to grow its power generation to more than 100 TWh by 2030.” This plan requires a yearly CAPEX of almost $4 billion per year. Total’s consistency and execution are not left to chance, and we are sure the company will build a world-class cost portfolio. In addition, we report that renewable energy projects will be allocated mainly in the EU and US (Fig 5). This is a positive note to remark, given Enel’s investment thesis based on lower FX volatility at the P&L level and disinvestment in emerging markets.

TotalEnergies higher shareholders remuneration

Source: TotalEnergies Investor Presentation – Fig 1

TotalEnergies CAPEX

Fig 2

TotalEnergies new exploration

Fig 3

TotalEnergies IRR on Oil & Gas

Fig 4

TotalEnergies Ren. Inv. Target CAPEX

Fig 5

Conclusion and Valuation

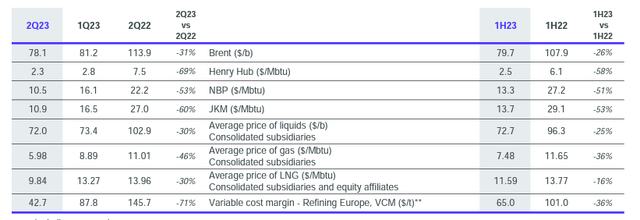

Post-Q2 results, we are estimating a 2023 adjusted net profit projection of $23 billion. Given the European gas demand and the fact that ‘Winter is Coming,‘ Oil and Gas prices will likely remain elevated. Although our estimates are incorrect and oil prices will significantly decline, we see supportiveness from OPEC+’s latest words and Saudi Arabia’s projection cut possible announcements. For this reason, our 2024 net profit projection is at $20.5 billion. In addition, we expect the company’s gearing ratio to move from 11% to 7.5% by year-end (excluding IFRS 16 leases). Given lower debt, we are lowering finance costs to $1.3 billion in 2024. This is also based on Canadian asset disposal.

Commodities Price Evolution

Source: TotalEnergies Q2 press release

Given the solid results and the new guidance, here at the Lab, we are raising our quarterly share buyback to $2 billion from $1.5 billion in Q1 2024. Total already increased its interim dividend by a plus 7.25%; however, it is vital to report that the company has a lower capital intensity vs. its EU peers measured by CAPEX/CFFO, which stands at an average of 48% vs. competitors at > 50%. Therefore, Total might aim to remunerate its shareholders base higher. Considering that, even in a scenario of declining oil prices, Total would be a more defensive player to hold. For this reason, valuing TotalEnergies in line with US peers (and not EU), we decided to raise (once again) our target price from $65 to $69 per share, supported by a 7x P/E. We reaffirmed our buy rating target as it offers an underpinned distribution yield (buyback with dividend), solid growth visibility (in gas and oil), and an upside on the ongoing energy transition.

TotalEnergies Upside

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here