Shares of Camden Property Trust (NYSE:CPT) are sitting at a 52-week low as higher interest rates continue to take a toll on real estate stocks. On top of this, there have been concerns about slowing rental inflation, given increased apartment supply after the surge in rents post-COVID. Shares do offer a 4.2% dividend yield, but this provides less of a floor for the stock when the 10-year treasury yield also yields over 4% vs when it had been below 2.5% in recent years. Barring a significant further rise in interest rates, I do think CPT shares can stabilize and recover over time.

Seeking Alpha

Overview of Camden Property Trust

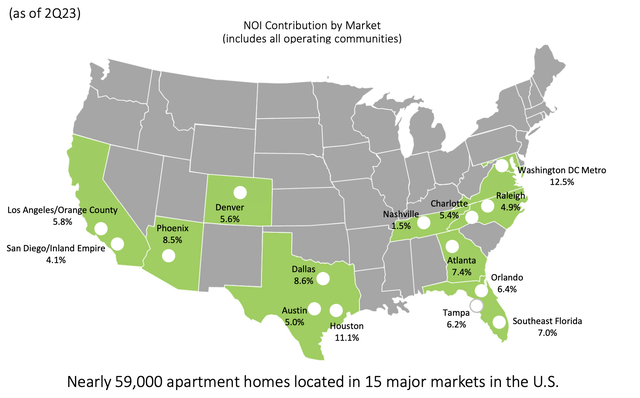

Camden owns nearly 60,000 apartments, alongside a very small single-family house rental business in Texas. As you can see, its footprint is concentrated in faster growing Southern states like Florida, Georgia, and Texas. These regions have seen years of migratory flows, which have supported rising rents. Ultimately, you want to own real estates in place where people are moving to, not moving from, in my view.

Camden Property

While Camden’s portfolio largely does meet this test, it has about 22.5% exposure to Washington, DC and California where population trends are less favorable. This is more of a negative for its California holdings, in my view, after all while companies can move headquarters—the federal government is highly unlikely to! Even as I prefer its Southeast exposure, population in the DC metro area is still likely to be fairly sticky, given the nature of its primary employer. Overall, having over three-quarters of the portfolio in higher-growth markets is a positive for Camden’s investment case.

59% of its properties are suburban with the remainder urban, providing a solid degree of diversification. 62% of its portfolio is Class “B, and 38% is “Class A” or top tier. Camden has $2,265 monthly revenue per occupied unit, which is higher than the national median rent of $2,054. One could view CPT as serving, on average, upscale but not ultra-high-end consumers. Among apartment REITs, this positions them above a firm like Mid-America Apartments (MAA) but below an AvalonBay (AVB), for example.

Now, in the company’s second quarter, CPT generated $1.70 in core funds from operations (FFO), which was up 5.6% from last year. We are seeing the rental market slow, but for now, results are still positive. Management also reiterated guidance of full year FFO of $6.88, pointing to a 5% acceleration from H1’s $3.36, thanks to having a full 6-month contribution from units developed and leased during the first half. In management’s September update, there were also some important trends for how Q3 is shaping up relative to Q2.

On the positive side, we are seeing occupancy rates stabilize. They had reached 97% last year given the surge of demand for housing post-COVID (we will discuss more on the macro environment for renting below), as people left certain cities, and had fallen to 95.3% (still a solid absolute level) in Q2. Thus far in Q3, they are trending back up to 95.7%. In August, new lease rates, were flat. This was down from 2.2% in Q2. Renewal rates are strong but also slowing, down 100bp to 4.9%. Accordingly, blended rental growth was 2.3% last month.

I would expect to see rental growth slow a bit further, in part because Camden has listed DC and San Diego as markets with “above-average” blended rent increase. These markets rebounded more slowly from COVID than did Camden’s southern markets, and are still playing some catch-up, which will likely fade in the coming months in keeping with the slowdown seen elsewhere this year.

The double-digit rental inflation experienced in 2021-2022 has clearly ended. Household formation trends have normalized, and supply has responded to a degree to this demand, but rents are still running higher. It is also important to note that renewal rates are exceeding new lease rates—this is to be expected as rent is typically raised more slowly on existing tenants, as leaving a couple perfect of rent is worth maintaining occupancy and avoiding the cost of securing new tenants. With 50% of tenants renewing, this can help to cushion results relative to trends in the new lease market.

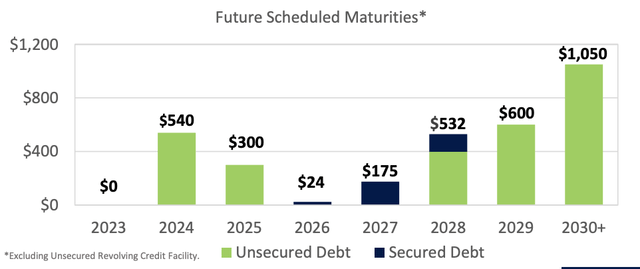

Camden maintains a solid balance sheet with just $3.7 billion in debt, for a debt to capital ratio of just about 40%. With majority equity-funding, Camden has capacity to judiciously consider M&A and development projects. Its debt has a 6+ year average maturity, which I view as a positive, as that provides some immunity to higher rates. This strength is mitigated though by the fact that 23% of the debt is floating rate. At this point, it seems highly likely the vast majority of the Fed funds increases are behind us, so this pain of higher interest expense is already in the numbers. An incremental 100bp rate hike would reduce FFO by $0.08 over twelve months, so I view this as a manageable risk.

Camden Property

All in, CPT is a relatively well positioned apartment REIT with solid geographic exposure, diverse assets, and rental activity that is clearly slowing but also not declining. Over the next 12 months, I would expect FFO to be $6.85-$7.00, given my expectation of low single-digit rent growth. With a solid 1.7x dividend coverage ratio, I would expect ~5-7% dividend growth, in-line with this past year’s increase.

Near-term Headwinds for the Rental Market

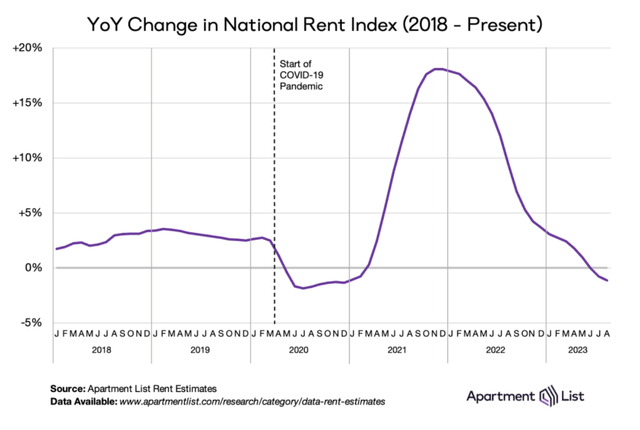

Now, a large risk that investors may be concerned with is not a Camden-specific problem, but that the macro rental market simply continues to worsen and brings down CPT results accordingly. Let me address that. Yes, rents have turned negative based on data from ApartmentList, after their unprecedented surge. I would note though that even with the overall market down, CPT is still posting blended rental rate gains, given its favorable geographic positioning, as noted above.

ApartmentList

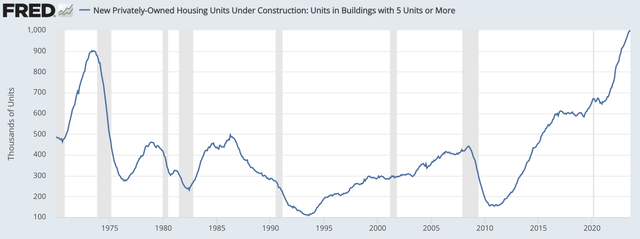

A leading driver of this slowdown in rents is the surge of supply hitting the market. Apartment rental rates surged after COVID, as you can see in the chart above, which made the economics of building new apartments compelling. As you can see below, this caused a surge of construction with a record number of units under construction and hitting the market.

St. Louis Federal Reserve

This has likely caused some localized gluts, and all else equal, more supply reduces prices. Importantly I suspect this chart in 12 -24 months’ time will look similar to the early 70’s, which saw a jump and then a drop—not a permanent increase. This is because the Census Bureau has already reported that new construction starts for apartments are down 40% from their peak. This series is very volatile month to month, but just as accelerating rents encouraged construction, slowing rents discourage construction. Investors want to buy shares, in my view, before we see the headwind of supply clearly diminish.

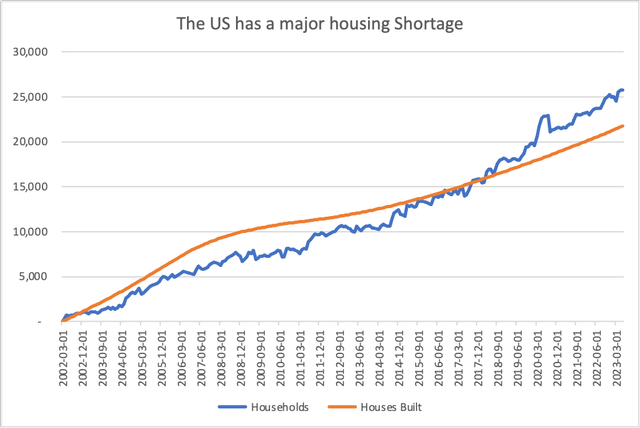

But There Are Secular Tailwinds

It is also essential to emphasize—we have a cyclical supply headwind amidst a secular supply tailwind. As the above chart shows, there was extremely little construction after 2008. As a consequence, America has created 4 million more households than housing structures the past 20 years. This is why when housing demand jumped in 2020-2021, prices of homes and rents reacted so violently. Thinking as a long-term investor beyond just the next few months, this is why I expect landlords to generally have pricing power and for rental inflation to exceed overall inflation, over time as it has the past decade. This is a long-term positive for CPT, and a reason I would be willing to add shares before we see the near-term supply headwind more clearly turn.

Census Bureau, my own calculation

Rather than seeing the rental market as a big risk for shares, I see the bad news as largely priced in, and the long-term dynamics favorable.

Other Risks to Consider

The bigger risk for share price performance will be higher interest rates, which will just raise discount rates investors use to value real-estate and dividend-oriented stocks, reducing the multiples they trade at. If one expects the 10-year treasury to hit 5.5% or 6%, I suspect they will be able to buy shares below $90.

Aside from interest rates, for Camden specifically, I would note that if we were to see a shift in migratory trends away from its markets, that would be a headwind for local rental dynamics. However, population flows from the North and West Coast to the South have been entrenched for years, and there is no evidence they are reversing. With less than 15% exposure to any single market, Camden is also well diversified from very localized downturns.

Its average property age is 15 years, and this creates both risk and opportunity. If tenants prefer new construction, the age of its property could lead Camden to lose customers to the increased new supply, reducing occupancy. On the flip side, Camden has been methodically updating bathrooms, kitchens, etc, to increase the rent these units can earn. Given occupancy trends have stabilized and rent growth is faster than the national average, Camden is managing this risk well.

Valuation Creates Opportunity

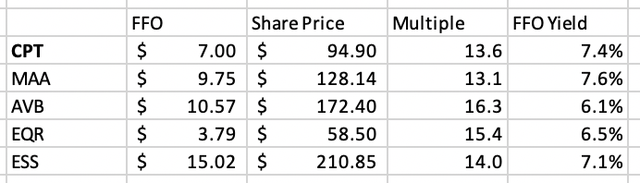

However as you can see below, CPT, using my $7 FFO expectation, has a 7.4% FFO yield, or about a 280bp risk premium to where the 10-year yield is today. Relative to peers, this is towards the cheaper end.

Seeking Alpha, my own calculations

With dividend coverage of 1.7x, CPT has capacity to grow the dividend somewhat faster than FFO growth, which I expect to be ~3% over the next 12-18 months as the supply headwind peaks, before re-accelerating to ~5% based on my view rent inflation will run higher than the overall inflation rate (i.e. 3% vs the Fed’s 2% target), and modest unit growth due to development projects. As such, I see dividend growth rate of over 5% over the medium term with coverage of that dividend remaining strong. Given a starting 4.1+% yield, this creates long-term average return potential of nearly 10%.

Mid-America is my preferred name given its balance sheet, geographic exposure, and rental market price point. However, I actually view CPT as superior position to those with more legacy urban exposure like Avalon Bay and Equity Residential (EQR), even though they get a premium multiple due to their higher-end asset base. I believe CPT merits at least a sector-average multiple, or about 14.5x, for a share price of $100-105. This creates a 10-15% total return potential over the next year. If rates were to fall, I suspect you would see the entire sector have multiple expansion (and conversely contraction if rates rise).

Investors should take sell-off as a change to get exposure to the US multifamily rental market. I view CPT as a solid way to do so and view shares as a buy. There is moderate price appreciation potential, alongside a sizable dividend that should steadily rise.

Read the full article here