Viatris Inc. (NASDAQ:VTRS) could make waves in the weight loss and diabetes market, were it to launch generic versions of Novo Nordisk’s (NVO) Ozempic and Wegovy (both contain semaglutide). This article takes a look at where a generic semaglutide fits into the weight loss/type 2 diabetes market, when it might enter that market, and what it might mean for VTRS shareholders.

Where would generic semaglutide fit in?

VTRS’s Q2 2023 earnings presentation notes a generic Ozempic and generic Wegovy are two of many drugs that the company has under regulatory review. To think about where a generic semaglutide might fit in for VTRS, it is worth considering the current competition, and the future competition, but also how quickly that competition can take away market share.

Tirzepatide offers potential benefits over semaglutide

The first thing to consider is that although Ozempic (22.1B DKK in Q2’23, ~$3.1B USD) and Wegovy (7.52B DKK in Q2’23) are generating huge sales, there are new entrants to the incretin market. LLY’s Mounjaro (tirzepatide) is already off to a strong start, bringing in $979.7M in global revenues in Q2’23 ($915.7M of that from US revenues) for Eli Lilly (LLY), despite only launching in June 2022 in the US for the treatment of type 2 diabetes. An approval of tirzepatide for weight loss could come in the US in 2023. That doesn’t mean it isn’t already being used off-label in that setting, but approval in weight loss specifically will aid sales growth as it will allow marketing for that indication.

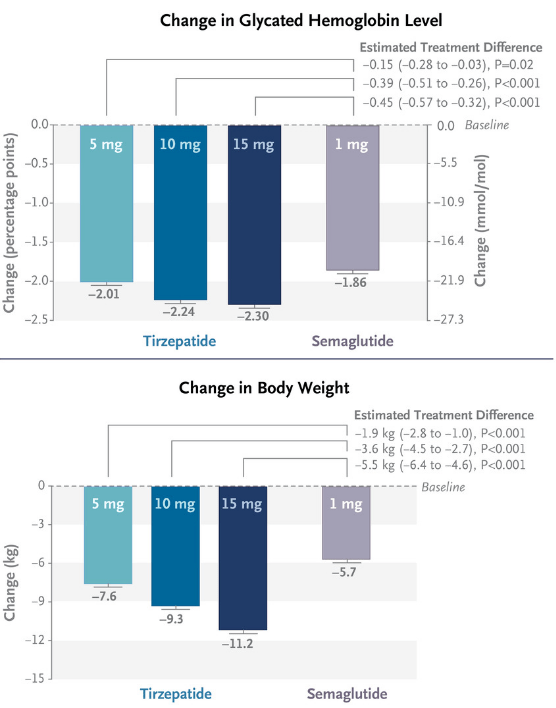

Figure 1: Results from the SURPASS-2 study. SURPASS-2 was an open-label study in 1879 patients with type 2 diabetes, randomized equally to four arms, three doses of tirzepatide and one of semaglutide. The endpoint was at 40 weeks. (N Engl J Med 2021; 385:503-515.)

Tirzepatide does offer potential benefits over semaglutide in terms of weight loss, and glycated hemoglobin (a measure of blood sugar over time), although some comparisons flatter Mounjaro by showing semaglutide at only the 1 mg dose. Indeed Wegovy includes doses of semaglutide up to 2.4 mg. Nonetheless, results from a suite of phase 3 studies do suggest tirzepatide is the most impressive weight loss drug currently on the market.

Older drugs continue to sell in an era of new drugs

Despite the launch of Mounjaro, sales of Ozempic and Wegovy haven’t stopped, there can be a physician preference for using something tried and true. Certainly the continued sales of Eli Lilly’s (LLY) Trulicity (dulaglutide), an older GLP-1 receptor agonist than semaglutide are evidence of that. Q2’23 worldwide revenues of Trulicity were $1.81B, just a 5% decrease from Q2’22. Notably, U.S. revenues were down 4% in Q2’23, from the same quarter in 2022, to $1.37B, despite the fact that Mounjaro has been available in that market for many quarters. Dulaglutide still offers good control of glycated hemoglobin, even if it doesn’t have the weight loss prowess of semaglutide or indeed tirzepatide. Still, a new diabetes patient can probably get a better response with semaglutide and indeed tirzepatide. It looks like LLY is able to adjust the price and rebates to keep the drug selling in a era of slightly better drugs. Further, existing patients may tend to continue on the drug they are already using (or a generic if it is available).

As such, VTRS launching a generic semaglutide doesn’t have to worry that everyone will be on tirzepatide now. Trulicity still sells, Ozempic and Wegovy still sell. Patients who would normally be candidates for Ozempic or Wegovy could take VTRS’s generic semaglutide from the start. Secondly, existing Ozempic and Wegovy patients could save money, but stay on the same drug, by going to VTRS’s generic semaglutide. Semaglutide, especially at higher doses used in weight loss, may just be “good enough” for many years to come, so that the extra cost of newer branded drugs, like Mounjaro, isn’t worth it for many patients. Certainly a patient with diabetes or looking to lose weight, or both, might be able to try generic semaglutide first to save money, before having to pay more for a branded drug.

Is Retatrutide an even fiercer competitor?

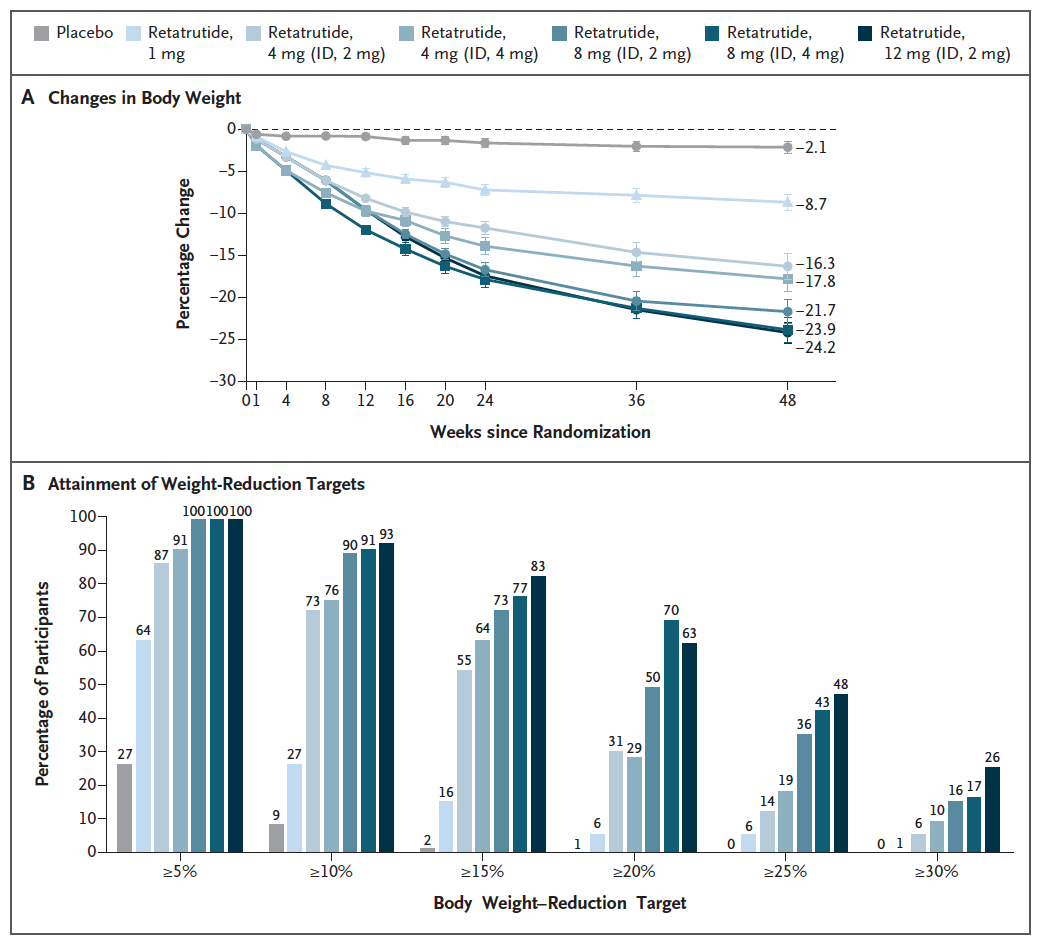

The potential competition for semaglutide, including generic semaglutide, might be even fiercer when you look at what other companies have in the pipeline. For example, in June 2023, LLY’s retatrutide (an agonist of GLP-1 receptors, GIP receptors and glucagon receptors, or triple G) stole the show with the announcement of remarkable weight loss numbers. A phase 2, double-blind, randomized study compared six dosing regimes of retatrutide (from 1 mg to 12 mg) to placebo in 338 overweight or obese patients. Patients in the placebo group lost just 2.1% of their body weight at 48 weeks, compared to a body weight reduction of 24.2% in the 12 mg retatrutide group.

Figure 2: Results from a phase 2 study of retatrutide vs placebo in Obesity. (N Engl J Med 2023; 389:514-526.)

Among those discussing the impressive retatrutide data, there were some concerns about potential side effects. The publication of the data does note that there were increases in heart rate seen, although these peaked at 24 weeks and declined afterward. Still over 10% of patients saw arrhythmias in the 8 mg and 12 mg retatrutide groups. Phase 3 then represents another chance for LLY to show retatrutide’s side effects are manageable, but if dose reductions are required, or the higher doses aren’t used, then some of the benefit over tirzepatide is lost. At this point, then, I don’t even know if a generic semaglutide will ever compete with retatrutide, as success and a launch still isn’t guaranteed.

When would generic semaglutide enter the market?

The fact that generic semaglutide is under regulatory review doesn’t necessarily mean it is close to entering the market. There is a patent lawsuit underway where NVO claims VTRS infringes on their patents covering Wegovy. As such, even if VTRS’s generic semaglutide is approved by a regulatory agency, like the US Food and Drug Administration, VTRS could hold off on a launch.

In that scenario, uncertain about the outcome of the patent infringement lawsuit, VTRS might decide not to conduct an “at risk” launch and later have to pay NVO. That doesn’t seem to be a common scenario however, a 2021 working paper published by the National Bureau of Economic Research noted the decision to launch at risk following FDA approval is the norm.

We examine generic drug applications that have received FDA approval with “first-filer” status (which precludes later filing generics from entering before the first filer). In our data, the generic and brand usually settled prior to the conclusion of litigation. For the remainder, drugs that received FDA approval prior to a favorable district court decision were always launched at risk.

Excerpt from No Free Launch: At-Risk Entry By Generic Drug Firms.

In another scenario, which is probably the most likely scenario, NVO will reach a settlement with VTRS. That settlement between VTRS and NVO, could include an agreement not to launch before a certain date and or limitations on the volume of product VTRS could sell.

In yet another scenario, VTRS could lose the infringement lawsuit and be enjoined from launching its generic semaglutide, perhaps for quite some time.

The reason we have to speculate about these possibilities is pretty simple, at the current time, VTRS hasn’t provided too much disclosure as to what the timeline is for a regulatory review. Often a patent infringement suit will result in a stay of approval of 30 months from the US FDA on the ANDA, which allows time for the lawsuit to play out.

In any case this discussion only applies to the potential US launch of a semaglutide generic. In other territories, NVO won’t just let VTRS take market share, and so it isn’t going to be that simple for VTRS to launch a generic semaglutide worldwide. Notably, there was a previous settlement between NVO, Mylan and Pfizer (PFE) regarding liraglutide (Victoza), another GLP-1R agonist marketed by NVO. Note VTRS was formed through a merger of PFE’s Upjohn division and Mylan in 2020. Despite the initial regulatory filing for the generic being in December 2019, a settlement wasn’t announced until March 2021, and NVO subsequently said it didn’t expect PFE or Mylan to launch a generic version of Victoza until June 2024. I think we could be in a similar situation with generic forms of Ozempic and Wegovy, with an entry to market potentially years away.

Financial Overview

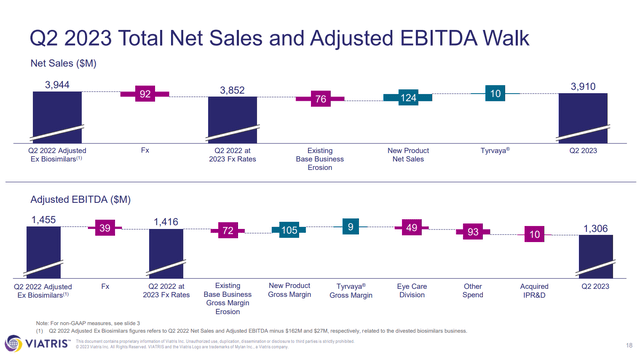

In Q2’23 VTRS reported total net sales of $3.91B and total revenues of $3.92B, both representing a 5% decrease from Q2’22 ($4.11B and $4.12B). To be fair, VTRS divested its biosimilars business in November 2022, and so the Q2’22 numbers should really be adjusted to cut out the contribution of the since divested biosimilars business. VTRS has a slide in its Q2’23 earnings presentation showing just that.

Figure 3: VTRS Q2’23 total net sales and adjusted EBITDA walk. (VTRS Earnings Presentation, Q2’23.)

That slide reveals however that $76M worth of the difference between the adjusted Q2’22 net sales, and the Q2’23 net sales, is due to existing base business erosion. It should be noted that VTRS was able to offset that erosion of the base business with new product net sales and Tyrvaya (varenicline, used for dry eyes) net sales. Still, this highlights a big issue with VTRS, given that it markets generics, it sees constant erosion due to competition with other generics entering the market. Further, the contribution of new product net sales and Tyrvaya ended up being offset by exchange rates, hence the drop quarter-over-quarter.

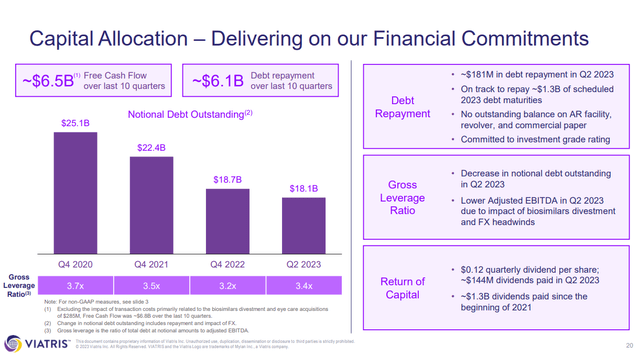

Concerns over top line growth lead to concern over VTRS ability to keep paying down its debt ($727M paid down in 2023-YTD, $18.1B in notional debt still outstanding), pay the dividend and continue to fund the pipeline (trials, regulatory activities, marketing activities).

Figure 4: VTRS slide covering ratios of debt to EBITDA over time. (VTRS Earnings Presentation, Q2’23.)

VTRS isn’t going to go broke, it is profitable, but it does need to keep on the road it is on; paying down the debt towards its target or below and providing top line growth.

Conclusions

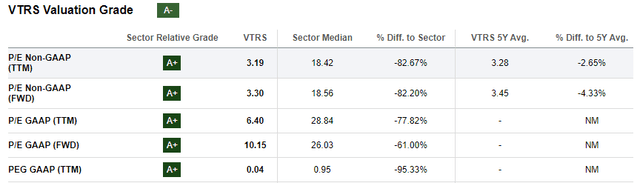

VTRS offers a dividend (4.91%) that barely beats inflation, modest topline growth, a constantly eroding generic business, and I’m not confident semaglutide will be adding to that topline too soon. Still, the company is nonetheless getting the job done, launching new drugs and generics to offset the decline in sales of other products and paying down its debt. Further, if VTRS can launch generic semaglutide products, they could prove very popular despite the presence of newer agents. Lastly, the name does trade very cheaply by several metrics.

Figure 5: Excerpt from Seeking Alpha’s valuation tab for VTRS. The company does perform a little weaker on metrics like EV/sales, where it scores a B. (SA’s Valuation tab for VTRS.)

I think another few quarters of top line growth and debt reduction could see sentiment turn. I have no problem rating VTRS a buy right now, especially when it trades closer to $10, than $12, where it has previously traded this year.

The risks of any long are several fold. Firstly, Q3 ’23 earnings in a month or so could be a disappointment, especially if revenue growth doesn’t continue. Secondly, delays in launching new products or starting or completing clinical trials can impact analyst estimates of future revenues, leading to downgrades. Lastly, Viatris Inc. could engage in business development, either acquiring or divesting, like it has done previously, but those developments might not be well received.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here