Background

In some ways, financial responsibility has fallen out of fashion in our foolish culture. Regrettably, it also appears that good faith, integrity, and basic competence are reduced within the leadership of some publicly traded companies. It might be easy for fools to forget, but our money and investments often represent decades of work, discipline, sweat, and even blood. I have scars from stringing barbwire fences by the mile when I was an engineering student to prove it. I am certain I earned the right to demand that the companies I invest in keep their promises including those paying distributions.

Dividend Kings are rightly valued by investors for their long-term record of honoring their commitment to shareholders by paying increasing dividends for over 50 years. I recently completed a review of midstream energy companies that appear to have the qualities of dividend royalty. Readers should consider that review, Let’s Talk About The Dividend Kings’ Midstream Cousins, essential background for this analysis of Delek Logistics Partners, LP (NYSE:DKL).

Does Delek Logistics Partners, LP Look Like Future Dividend Royalty?

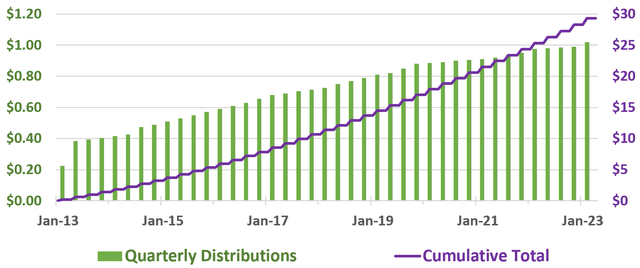

As an MLP, DKL makes regular distribution payments to unit holders with unique tax benefits and considerations. DKL paid its first quarterly distribution of $0.22 in February of 2013 and its subsequent distribution history is detailed in the plot below.

DKL Distribution History: 2013 Forward

Author, SA Data

DKL’s most recent distribution in February of this year was $1.02 or 355% greater than its first distribution 10 years earlier. Over the same ten years, the cumulative total of DKL quarterly distributions is over $29 vs DKL’s share price of $23 in early 2013.

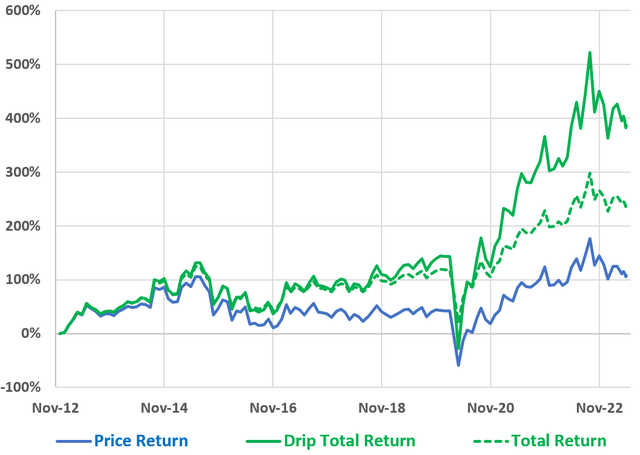

DKL Returns: 2013 Forward

Author, SA Data

Since January 1st of 2013, DKL has rewarded shareholders who reinvested dividends with a drip total return (green line) of well over 300% vs SP500 total return of about 240%. Total return with dividends set aside was well over 200% while price return was about 100%. Obviously those returns are fantastic, but as investors we are required to look ahead.

Distribution Safety and Growth Potential

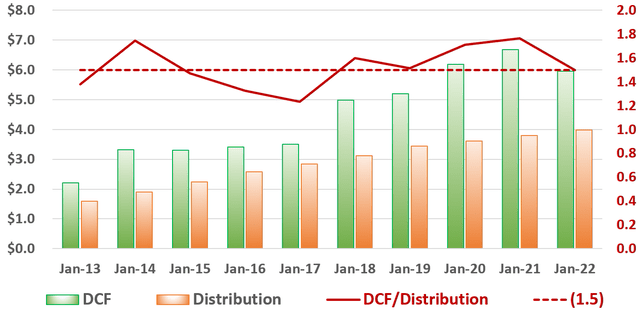

In order for DKL’s distribution to be safe over time with potential for growth, it must be well supported by distributable cash flow (DCF).

Distribution Coverage Ratio: 2013 Forward

Author, SA and DKL Data

DCF (green columns) and distributions (orange columns) are plotted against the left axis while distribution coverage ratio (red line) is plotted against the right axis. Generally, a distribution coverage ratio of at least 1.5 (dashed red line) is considered sustainable. Over most of the last ten years, DKL’s distribution coverage ratio has been above the 1.5 threshold. FY 22 distribution coverage ratio was exactly at the 1.5 minimum. However in order for distributions to grow sustainably, I would like to see the distribution coverage ratio remain above the minimum.

Looking Beyond Distributions and Coverage Ratio

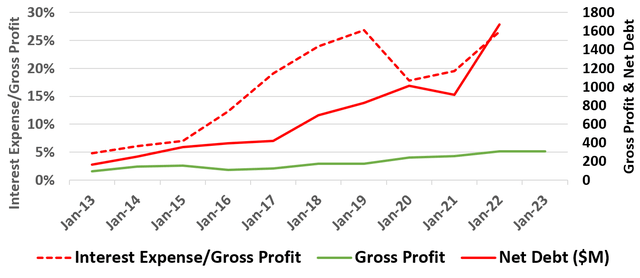

Since 2013, DKL has grown aggressively with a series of acquisitions and has increased its net debt substantially.

Gross Profit, Net Debt, and Interest Expense – 2013 Forward

Author, SA Data

Since 2013, gross profits (green line) have increased over 220% while net debt has increased over 900%. As a result, interest expense/gross profit has grown from 5% to over 25%. Note, DKL’s most recent investor presentation provides a detailed overview of its current assets and growth history. Not only is growing debt a drag on earnings, but DKL book value is currently negative.

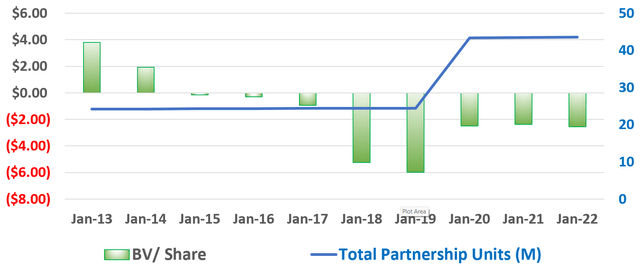

Book Value and Total Units Outstanding

Author, SA Data

In addition to accumulating debt, DKL has also sold additional units to fund its growing operations. From 2019 to 2022, total partnership units increased 78% from 24.4 million to 43.5 million. To the credit of DKL management, distributable cash flow increased 104% over the same interval such that distribution coverage ratio (on growing distributions) remained above the 1.5 threshold.

Is DKL Fairly Valued?

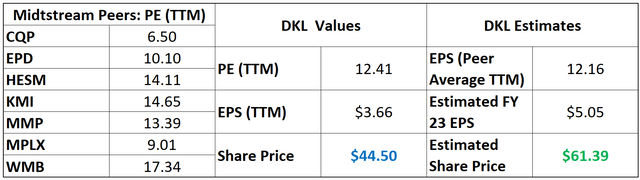

In my previous analysis, Let’s Talk About The Dividend Kings’ Midstream Cousins, I identified DKL and seven peers with a superior record of high and increasing distributions over at least 5 years. Those seven peers were selected for an estimated valuation based on average PE ratio.

DKL Share Price Estimate

Author, SA Data

Based on peers’ average PE and DKL estimated FY 23 earnings, share value was estimated at $61.39, suggesting almost 38% upside vs its current share price. In order to approach $61.29, DKL will likely have to not only meet earnings expectations but also benefit from some positive sentiment in the broader energy sector.

Risks

Demand destruction and recession are both risks across the entire oil and gas sector. Oil and gas markets are volatile and subject to fear and speculation. Recession, or even continued fear of recession, could drive energy markets down.

I remain apprehensive with regard to DKL’s substantial debt and would like to see it reduced. Moreover, DKL FY 23 earnings estimate appears awfully steep and equates to average quarterly EPS of $1.26. For reference, FQ4 22 EPS was $0.98 while FQ1 23 EPS is expected to be $1.01. I should also note that earnings estimates seemed to be based on only one analyst.

Conclusions

Delek Logistics Partners has demonstrated qualities similar to dividend royalty by returning over 300% with distributions reinvested over the last ten years. DKL’s distribution appears sustainable with future growth possible based on a current coverage ratio at the generally accepted 1.5 threshold. However, growing debt and dilution may become limiting factors.

I will stop short of rating DKL a buy mostly on debt and dilution. Perhaps even more importantly, current momentum in the energy sector and poor outlook more broadly seem unfavorable. However, DKL will be reporting earnings on the 8th of this month and I will be watching closely. I recommend those investors who are considering DKL wait patiently while looking for a bottom around gloomy market sentiment or falling energy prices.

If you argue against all your sensations, you will then have no criterion to declare any of them false. – Epicurus, Principal Doctrines

Read the full article here