Crawford United Corporation (OTCPK:CRAWA) communicated two appealing acquisitions. In addition, management recently noted operating profit margin growth thanks to efficiency initiatives in the commercial air handling equipment segment. In my view, successful pricing strategies to fight inflation and more inorganic growth could lead to FCF generation. Yes, there are risks from concentration of clients and competition, however I think that CRAWA could trade at higher price marks.

Crawford United

Crawford United Corporation is a company oriented toward creating value for shareholders. It has a series of subsidiaries through which it designs factories and markets specialized products for various industries such as transportation, aerospace, education, and chemicals among others.

Source: Company’s Website

Due to the type of business model that the company has, much of its development occurs in parallel with the acquisitions that it makes year after year. The company operates through its two operating segments.

The operating segments include the product segment for the management and handling of aerial activities and the product segment for the transportation industry. It is important to note that in both the cases, the segments have active operations at a national and international level, and the products are marketed through the company’s own sales channels.

The first of these segments was formed through the acquisition of Commercial Air Handling Equipment in 2017, and mainly offers non-corrosive aluminum products, which are sustainable in the long term, and are estimated to have a useful life of 50 years for use. End markets for these products include healthcare, educational, and pharmaceutical industry customers.

On the other hand, the acquisition of Federal Hose Manufacturing was the origin of the transportation and industrial segment in 2017. The main product of this segment is hydraulic hoses, aluminum hoses, and silicone hoses for different applications within the industrial field. Thanks to the development of this segment, a long series of acquisitions began that remains active at present for the purchase of a company that manufactures this type of products nationally in the United States. Although not all activities within this segment are intended for the manufacture of hoses, they are related products in this sense that serve as parts for the equipment of industrial systems such as oil refining.

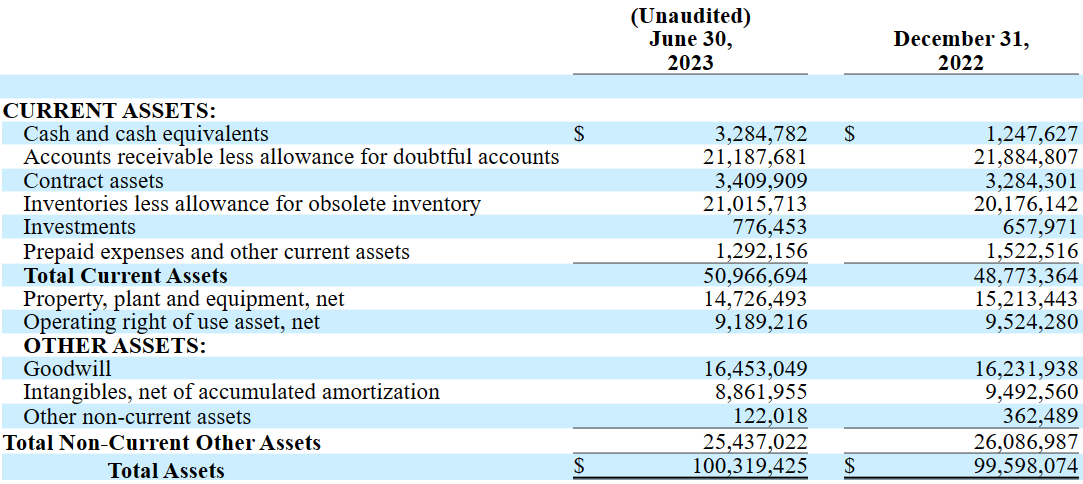

Solid Balance Sheet

As of June 30, 2023, the company reported cash and cash equivalents worth $3 million, with accounts receivable less allowance for doubtful accounts of $21 million, inventories less allowance for obsolete inventory of close to $21 million, and total current assets worth $50 million. With a current ratio of more than 1x, liquidity does not seem to be a problem.

Also, with property, plant, and equipment of close to $14 million and goodwill close to $16 million, total non-current other assets stand at $25 million, and total assets are equal to $100 million. The asset/liability ratio is larger than 2x, so I believe that the financial position is solid.

Source: 10-Q

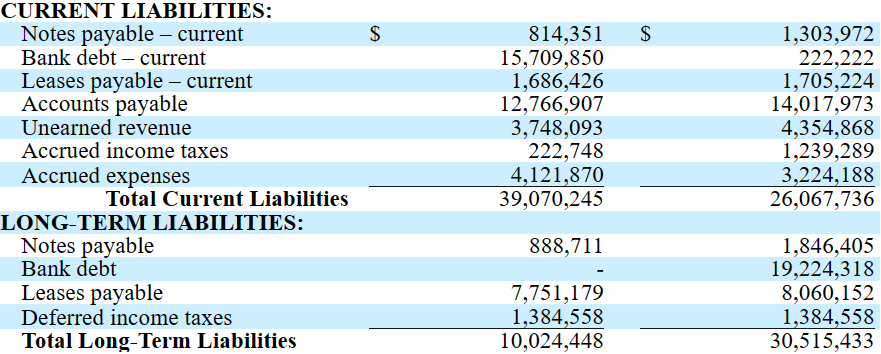

I am really not worried about the list of liabilities and the total amount of debt. Crawford United reported bank debt close to $15 million, with accounts payable of $12 million, and total current liabilities worth $39 million.

Source: 10-Q

In the last quarterly report, Crawford United reported changes in its credit agreements, and I took a look at the notes payable. I really do not think that the current debt being paid would make investors afraid. I used some of the information about the banking debt and the noted payable to design my CAPM model.

The Company entered into a sixth amendment to the Credit Agreement on June 12, 2023. The most significant change in the amended Credit Agreement was the discontinued use of LIBOR as a reference rate. Source: 10-Q

The Company refinanced the outstanding First Francis promissory notes in the aggregate amount of $2,077,384, including accrued interest payable through the refinance date and combined this amount with an existing First Francis promissory note carried by Komtek Forge in the amount of $1,702,400 into one note for a combined $3,779,784 loan due to First Francis Company, payable in quarterly installments beginning April 15, 2021. The interest rate on the refinanced loan remained at 6.25% per annum. Source: 10-Q

Recent Acquisitions And New Acquisitions Would Most Likely Accelerate FCF Growth

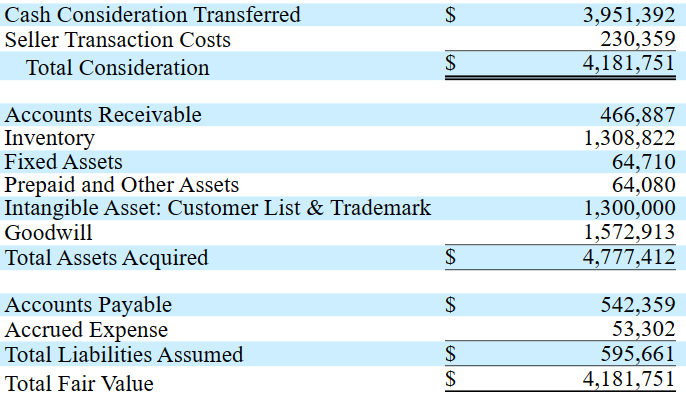

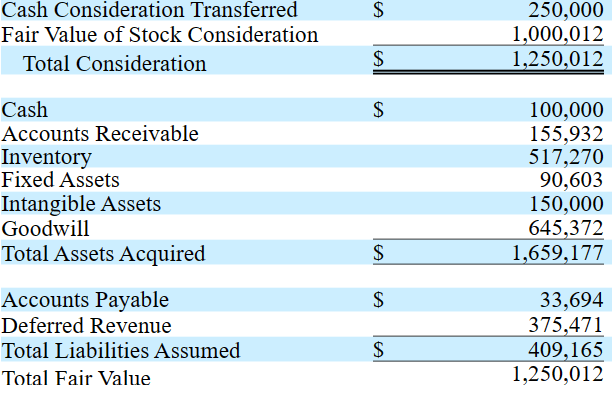

Effective January 10, 2022, Crawford REV Acquisition Company LLC, a Delaware limited liability company, and indirect wholly-owned subsidiary of Crawford United Corporation, completed the acquisition of substantially all the assets of Reverso Pumps, Inc. Total assets acquired were equal to $4.7 million, with goodwill worth $1.5 million and intangible assets worth $1.3 million. According to Zoominfo, Reverso Pumps, Inc. reported annual net sales close to $5.4 million, which means that Crawford bought the company for close to 0.7x net sales. Crawford trades at more than 0.7x sales, so I believe that the acquisition may benefit its corporate valuation.

Source: 10-Q

Crawford United also bought KMC Corp. dba Knitting Machinery Corp for close to $1.2 million. The new acquisition is expected to bring a bit less revenue of $2 million. We would be talking about an acquisition of close to 0.6x revenue, which may also benefit the valuation of Crawford United.

Effective May 1, 2022, Knitting Machinery Company of America, LLC, a Delaware limited liability company and indirect wholly-owned subsidiary of Crawford United Corporation, completed the acquisition of all of the operating assets of KMC Corp. dba Knitting Machinery Corp., a Delaware corporation and specialist in the manufacture of hose reinforcement machinery for the plastic, rubber and silicone industries pursuant to an Asset Purchase Agreement entered into as of May 1, 2022. Source: 10-Q

Source: 10-Q

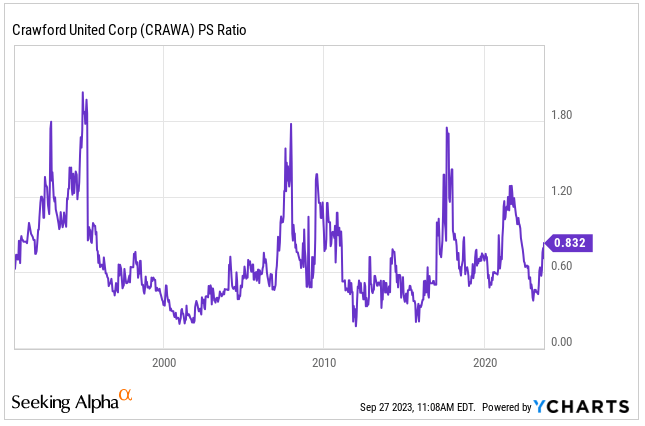

Considering the previous expertise in the M&A markets and recent acquisitions, I think that we may soon see further inorganic growth. In my view, if the company continues to acquire targets at 0.6x-0.7x net sales, total net sales of Crawford would increase, which may lead to further demand from investors.

Source: Ycharts

Further Pricing Strategies Will Most Likely Bring FCF Growth And FCF Expansion

Crawford Corporation’s main strategy is aimed at generating long-term value for its shareholders through a diversified business sustained by acquisitions, allowing the expansion of productive capacities as well as geographical extension and participation in the markets. So far in 2023, sales have grown by 15.8% mainly through the company’s organic growth guided by the pricing strategies that the company has carried out in relation to the situation of growing inflation. I assumed that further pricing strategies will most likely play a role for enhancing net sales growth and FCF margin expansion.

Efficiency And Continuous Improvement Initiatives May Bring More Operating Profit Enhancement Mainly In the Commercial Air Handling Equipment Segment

I believe that expecting further profit margin enhancements could make sense. Let’s keep in mind that the Commercial Air Handling Equipment segment reported double digit operating profit growth thanks to improvement initiatives. If management continues to make further efforts, and net income growth continues, we may see further demand for the stock and stock price enhancements.

Segment operating profit in the Commercial Air Handling Equipment segment for the current quarter was $4.0 million, or 26.8%, compared to $1.4 million, or 11.7% in the same quarter of the prior year, an increase of $2.6 million or 1,520 basis points. The improved segment operating profit and segment operating margin were primarily a function of the increased revenue base, combined with lessened input costs and a factory that has implemented several efficiency and continuous improvement initiatives. Source: 10-Q

With The Previous Assumptions, I Designed A Discounted Cash Flow Model

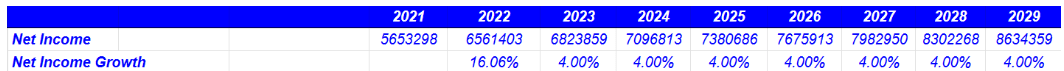

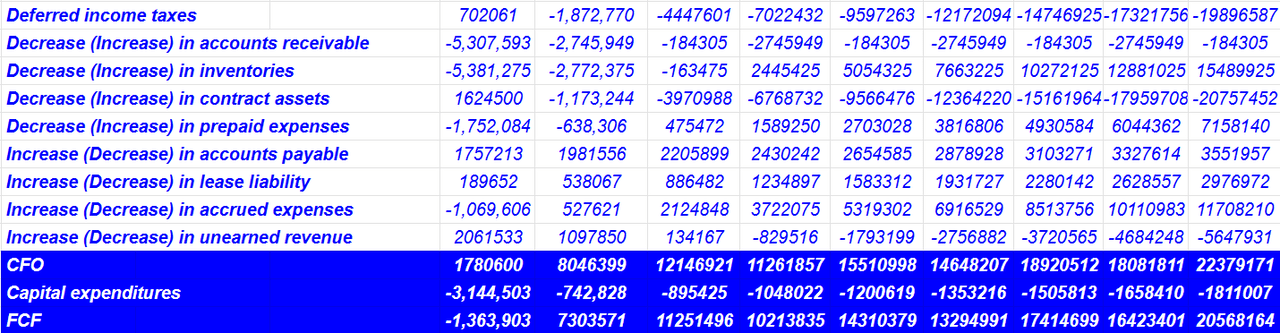

Under my conservative model, I assumed that Crawford United would report 2029 net income of $8 million, with net income growth close to 4%. I used net income growth of about 4%, which is quite a conservative figure. Net income growth in the past was significantly higher than 4%.

Source: Cash Flow Expectations

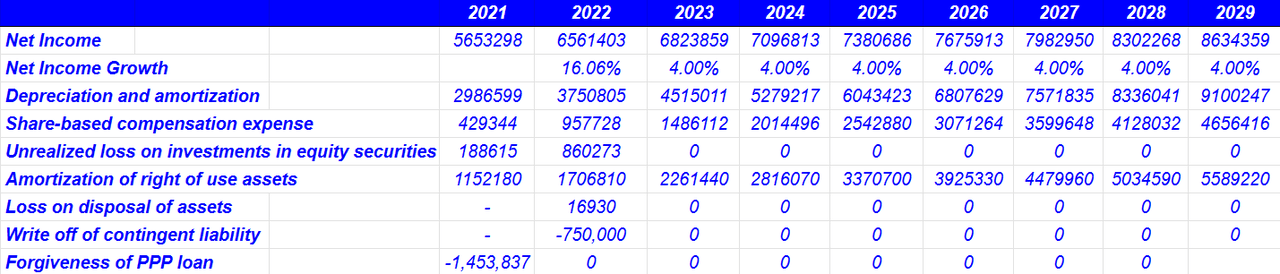

My financial model also included 2029 depreciation and amortization of $9 million, with share-based compensation expense close to $4 million, but no unrealized loss on investments in equity securities, losses on disposal of assets, or write off of contingent liabilities.

Source: Cash Flow Expectations

I also believe that future changes in the cash flow statement would include changes in accounts receivable close to -$1 million, changes in inventories worth $15 million, and changes in contract assets of about -$21 million.

Finally, taking into account 2029 prepaid expenses of about $7 million and changes in accounts payable of $3 million, my DCF model results in 2029 CFO of $22 million and 2029 FCF of $20 million.

Source: Cash Flow Expectations

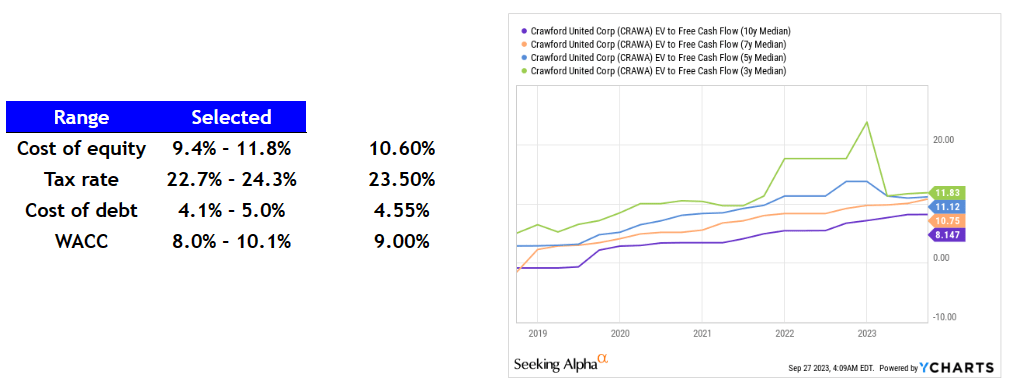

My CAPM is not very different from the model SA offers or other investment sites out there. It includes a cost of equity close to 10%, with a tax rate of about 23.5%, cost of debt of 4.5%, and an implied WACC of 9%. Besides, I used an EV/FCF of 8.1x, which is close to the EV/FCF reported in the past.

Source: Ycharts

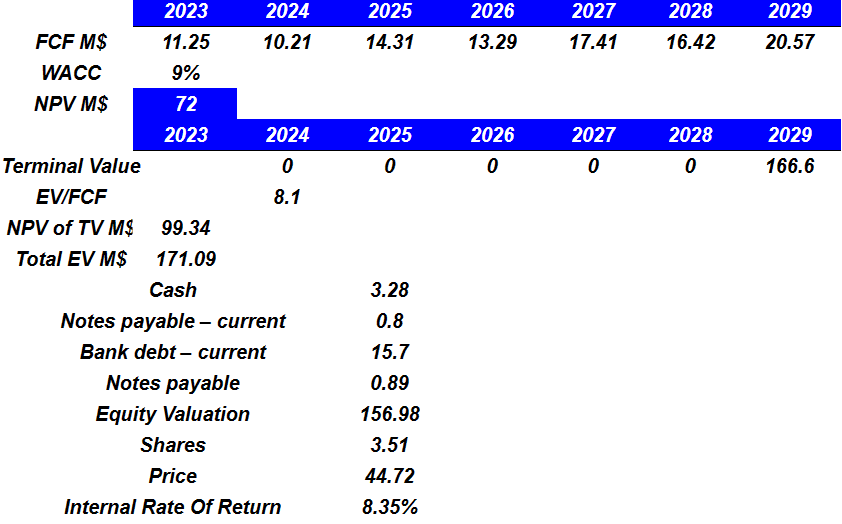

The implied net present value of future FCF from 2023 to 2029 stands at $72 million. Besides, with a terminal value of close to $99 million, the implied enterprise value would stand at about $167 million. Adding cash in hand and the banking debt, the equity valuation would be close to $156 million. Finally, the implied price would be $44 per share, with an IRR of 8.3%.

Source: My DCF Model

Competitors And Risks

For both segments, the competition that the company receives is high. The competition comes from both international and national firms. In any case, Crawford points out that it has competitive advantages due to the useful life of its products in the air management solutions segment, as well as the relationship and experience it has maintained with its clients for several years. Furthermore, the company knows the importance of having its own patents and licenses for its products, and for this reason, it has managed to obtain ISO licenses for several of them, achieving standardization and recognition of its products at an international level.

The concentration of clients is high, with the top ten accounting for 29% and 38% of sales in recent years. Any disruption in its activity as well as the markets in which it offers its products in general would generate significant reductions in operating profit margins for the company.

Furthermore, due to the type of company structure, Crawford reports some debt to finance its operations. Besides, insufficient access to liquidity that may occur for various reasons would generate delays in payment of obligations and subsequent problems for new access to lines of credit.

Conclusion

Crawford United Corporation recently acquired several companies at close to 0.5x-0.7x net sales, which would most likely have a beneficial impact on the valuation of Crawford United. I would also expect further acquisitions as the balance sheet is solid, and the total amount of debt looks limited. In addition, in the last quarterly report, Crawford United noted operating performance improvements as a result of efficiency and continuous improvement initiatives. Besides, I would expect pricing strategies to bring further organic growth as we saw in 2023. Yes, there are some risks out there from concentration of clients, competition, or inflation, however I believe that the company could trade at higher price marks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here