Investment Thesis

Since my last article on Adobe Inc. (NASDAQ:ADBE), the stock is up 8.45%. In this article, I will take a look at the company’s recent Q3 earnings report and my view on the stock going forward. Adobe’s large and diversified product set across its digital media and digital experiences offerings continues to position the company as a multi-year compounder in the software landscape with a premium business model and leading brand awareness, providing Adobe with a strong competitive moat across creative professionals, content creators, developers, advertisers, and publishers. I remain bullish on the stock and reiterate my buy rating on the stock.

Q3 Results and Outlook

Adobe had a strong third fiscal quarter with increased sales and improved margins despite higher costs associated with the use of generative AI. The company has introduced new AI features that were well-received during testing and will now start charging for them. While the initial revenue boost from these AI tools may be modest, Adobe anticipates significant potential in the future as these features enhance the products. The Digital Experience sector, which focuses on online marketing solutions, experienced a slowdown in sales due to cautious marketing spending, but Adobe Experience Platform and native applications still gained traction. There was no new information provided about Adobe’s pending acquisition of Figma, which, once approved, could expand its presence in the creative software market.

Adobe’s Creative Cloud business, accounting for 81% of Digital Media segment revenues, grew by 11% year-over-year to $2.9 billion. New Creative Cloud’s annualized recurring revenue reached $332 million during the quarter, totaling $12 billion. This growth was driven by strong demand for photography and video editing applications, reflecting the increased creation and consumption of digital media. Adobe integrated its generative AI offering, Firefly, into flagship products like Photoshop and Illustrator, with over 3 million beta release downloads.

Six months ago, the company introduced a set of generative AI tools called ‘Firefly,’ which Adobe later integrated into key products like Photoshop, Illustrator, Adobe Express, and Adobe Genstudio for enterprise customers. This integration of generative AI tools into their products is expected to enhance customer retention and attract new users. Recently, Adobe announced a 10% price hike for its core Creative Cloud subscription service, as well as new pricing for individual apps, effective November 1, 2023. This price adjustment aims to offset the increased computational costs associated with the growing use of generative AI. The risk of losing customers due to these price changes is low because there is significant interest in AI tools, and competition in this area is limited. Furthermore, Adobe is prioritizing safety and protecting customers from copyright violations in its AI models. To prevent legal issues related to generative AI tools, Adobe will train its ‘Firefly’ AI model using Adobe Stock images and other openly licensed content with expired copyrights, ensuring that users do not inadvertently violate copyright laws. Additionally, the company plans to provide a one-time bonus to certain Adobe Stock creators for using their images and illustrations in ‘Firefly’ training.

Adobe Creative Cloud Could Get a Boost From Gen AI

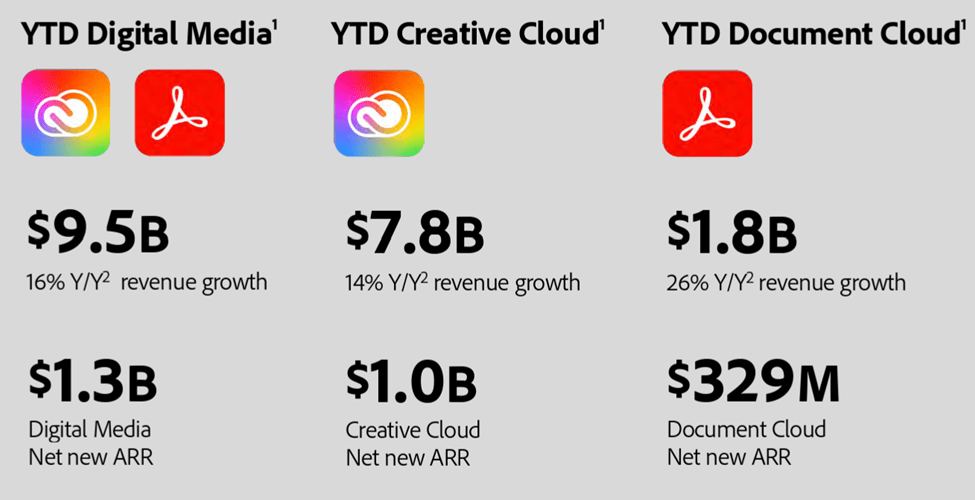

Investing in artificial intelligence is a compelling long-term strategy due to its widespread integration into our daily lives and its continuous growth in various applications. Adobe seems well-positioned to experience significant revenue growth in its Creative Cloud unit through product enhancements driven by generative AI. Compared to other enterprise software companies, Adobe has a unique advantage in capitalizing on generative AI, especially within its Creative Cloud segment, which generated $7.8 billion in FY22. Adobe has already introduced a tool called “Firefly,” which can create images based on text prompts. This innovation significantly boosts the productivity of graphic designers by reducing the time needed to create or modify images.

Moreover, while Firefly’s generative-fill feature is currently primarily used for image creation, I believe this technology offers substantial productivity improvements for clients using Adobe’s Document Cloud as well. One potential application could involve generating summaries for large PDF documents, particularly in fields such as legal, medical, and engineering. It’s worth noting that Document Cloud, with revenue of $1.8 billion, may not contribute as much to Adobe’s overall revenue as AI enhancements within the Creative Cloud segment. However, it still represents a valuable opportunity for Adobe to enhance its offerings and provide additional value to its clients in the document management space.

Company Presentation

Emerging Markets to Be Long-Term Drivers

During the pandemic, India, China, and other emerging markets quickly adopted digital document solutions, and I anticipate that these regions will play a significant role in driving sustained growth. Currently, Adobe generates approximately 60% of its sales in the Americas, but this distribution is expected to change in the future. In the public sector, there is a notable lag compared to commercial counterparts when it comes to embracing digital documents. Areas such as tax processing, licensing, and property registrations have the potential to transition predominantly to digital formats, creating new sales opportunities for Adobe. Adobe’s management has been actively investing in expanding its efforts to attract new users through Adobe.com, the recent launch of product’s like new Adobe Express and Firefly, will help in expanding the company’s user base.

Valuation & Financials

Adobe’s Document Cloud unit is experiencing continued growth driven by factors such as document digitization, evolving global regulations supporting e-signatures, and the dominance of PDFs in electronic text. Despite a slight slowdown in revenue growth to 15% year to date in constant currency, compared to over 20% in recent years, Adobe’s platform-oriented approach seems superior to competitors like DocuSign. DocuSign’s growth has declined to 11% year to date from an average of 44% from fiscal 2020-22.

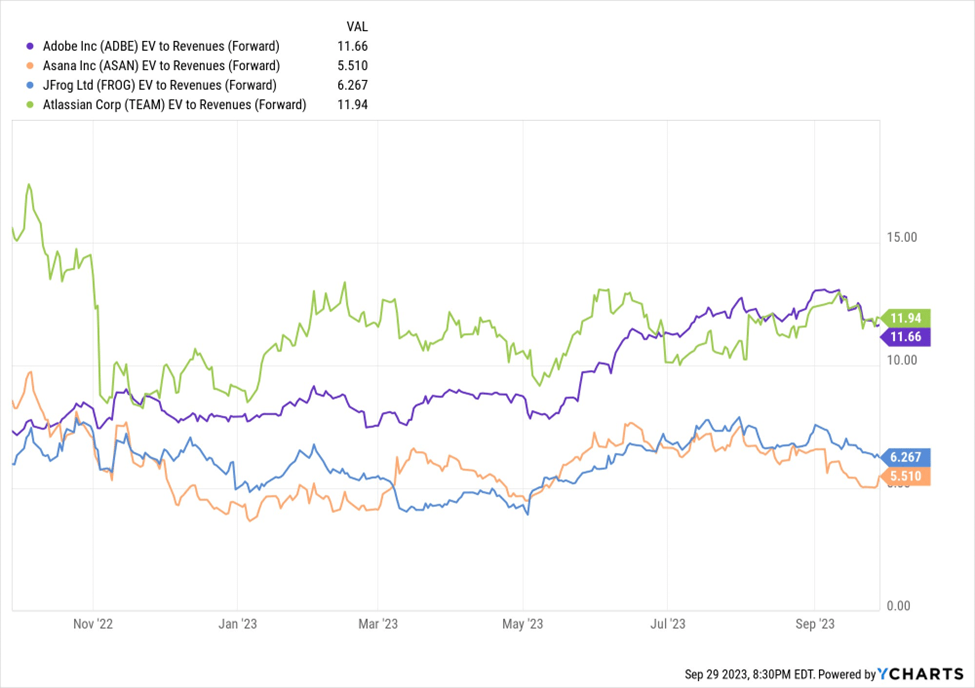

I have selected a Productivity SaaS comp group for valuation which I believe as the most relevant group for the company. Adobe is trading at a higher end of the spectrum, but I believe the premium multiple is warranted given the company’s recent performance and boost from AI. Adobe is well positioned to gain from the rise in content consumption, the paper-to digital movement, and increasing demand for better customer experiences. Furthermore, I believe ADBE should see a significant boost from increasingly monetizing its large installed base and driving more holistic sales over time. Hence, I remain bullish on the stock and reiterate my buy rating on the stock.

Ycharts

Risks to Rating

The maturation of the Creator Economy poses both opportunities and challenges for Adobe. While the company continues to invest heavily in new product ventures, any difficulties in effectively entering these adjacent markets could result in slower overall revenue growth, especially as some of its existing offerings may become saturated. Moreover, investors would keep a keen eye on Adobe’s ability to achieve double-digit year-over-year revenue growth within its substantial $205 billion TAM. Failure to execute on this growth trajectory and demonstrate sustainable progress in new product areas could lead to a downward adjustment in Adobe’s stock valuation, requiring investors to recalibrate their expectations for the company’s long-term growth potential. Additionally, Adobe faces the risk of reduced growth in its Digital Media business, comprising the Creative Cloud and Document Cloud segments, due to challenges in converting free users to paid subscription plans, particularly in mobile and web-based solutions. Furthermore, growing competition from established players like Google, Salesforce, SAP, and Microsoft in creative software, as well as emerging competitors like Canva offering competitive pricing, may lead to enterprise-level spending consolidation and threaten Adobe’s position in the small and medium-sized business market if customers opt for more specialized solutions rather than a comprehensive platform.

Conclusion

Despite a slowdown in enterprise IT spending, Adobe continues to perform strongly. The company has been swift in introducing generative AI tools, which have been well-received by its customer base and have the potential to attract new users. While the direct sales impact of these stand-alone AI tools may not be significant in the near term, Adobe’s management is incorporating these features into its core offerings and plans to increase subscription prices later this year. This strategic move is expected to help maintain profit margins even as computing costs rise. I remain bullish on the stock and reiterate my buy rating on the stock.

Read the full article here