At the beginning of the year, I penned a cautious article on the Utilities Select Sector SPDR ETF (NYSEARCA:XLU), noting that valuations for utilities were absurdly high on both an absolute and relative basis. After massively outperforming in 2022, I believed that utilities would underperform in 2023.

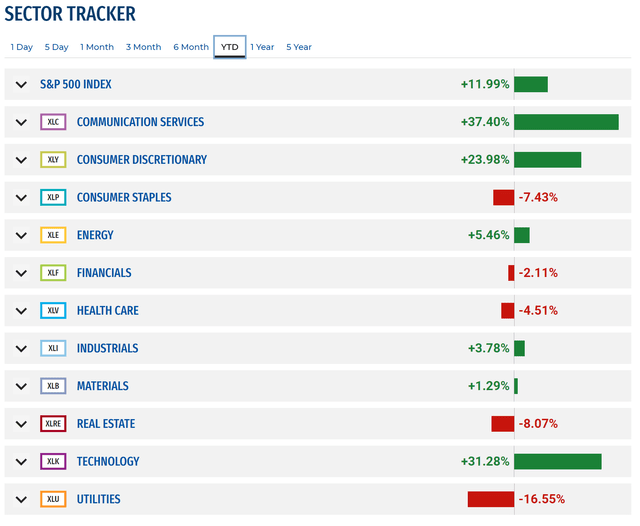

So far this year, the utilities sector, as represented by the XLU ETF, has been the worst performing sector in the markets, declining by over 16% YTD, justifying my caution (Figure 1).

Figure 1 – XLU has been worst performing sector in 2023 (sectorspdrs.com)

As we head into the last quarter of the year, is my outlook still negative for utilities? Or will utility stocks mean revert higher, closing the YTD performance gap against the other sectors?

Brief Fund Overview

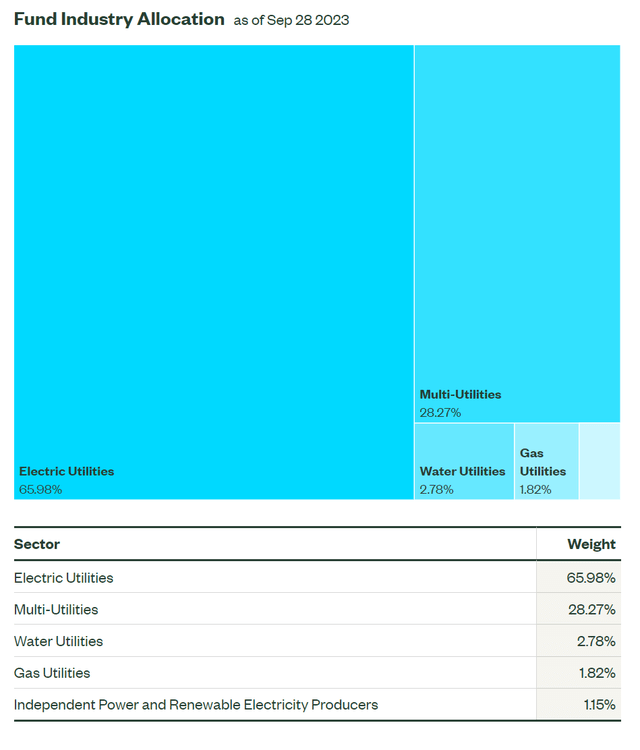

Before delving into the outlook for utility stocks, let us take a step back and review the XLU ETF. The Utilities Select Sector SPDR ETF is a utilities sector-focused ETF offered by State Street Global Advisors (“SSGA”). The XLU ETF tracks the Utilities Select Sector Index (“Index”), an index that provides exposure to electric utilities, water utilities, multi-utilities, independent power producers, and gas utilities (Figure 2).

Figure 2 – XLU sector allocation (ssga.com)

The SPDR suite of ETFs have been around since the late 1990s and are a low-cost and convenient way for investors to gain exposure to specific sectors within the S&P 500.

The XLU ETF currently has $13.1 billion in assets and charges a low 0.1% gross expense ratio.

Valuations Were At Extremes

When I last covered the XLU ETF, utility sector valuations were at extreme levels as investors had crowded into defensive utility stocks as a safe haven from the equity drawdown in 2022.

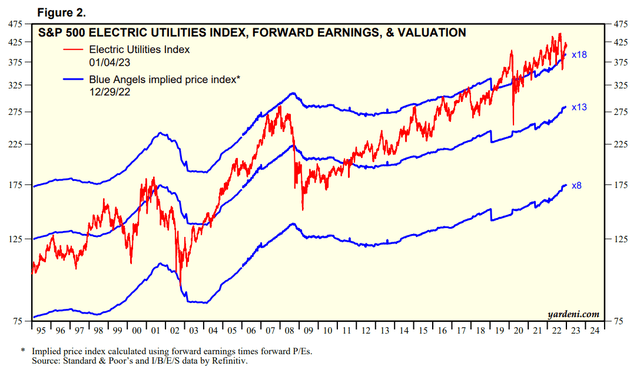

Figure 3 is reproduced from my prior article and shows that the utility sector was trading at ~20x Fwd P/E multiples, the highest ever. As all investors should know, even the safest assets, in this case defensive utility companies, when bought at bad prices, can lead to poor forward returns.

Figure 3 – Utility sector valuations were at absurd levels (yardeni.com)

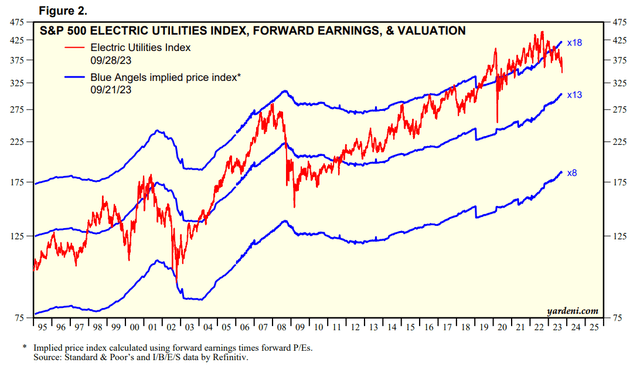

Fast forward 9 months, and after a 16% correction plus rolling onto 2024 estimates, utility sector valuations have normalized from the January extremes. Currently, the utility sector is trading at ~16x Fwd P/E (Figure 2).

Figure 4 – After stock declines, utility valuations are at more normalized levels (yardeni.com)

While still not ‘cheap’ on an absolute sense, utilities are no longer flashing a ‘warning sign’ as they were back in January.

Nextera Was Poster Child For Extreme Valuations

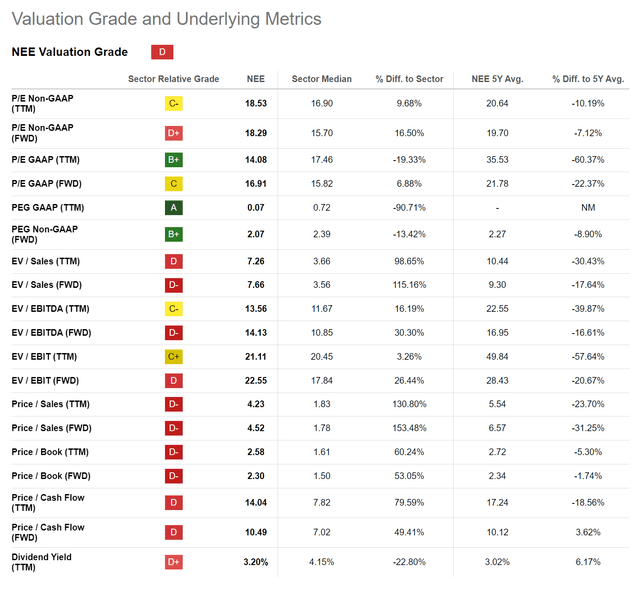

As I noted in my prior article, NextEra Energy, Inc. (NEE) was the poster child of the utility sector’s elevated valuations as it was a 16.2% weight in the XLU ETF and was trading at 36x Fwd P/E. However, after a 30% plunge in NEE’s stock price due to downgraded growth prospects (Figure 4), NEE is now trading at a much more reasonable 16.9x Fwd P/E, inline with the sector median (Figure 5).

Figure 4 – NEE’s stock price has come back to earth (Seeking Alpha)

Figure 5 – NEE is now inline with sector median valuations (Seeking Alpha)

Utilities’ Relative Valuation Screens Attractive

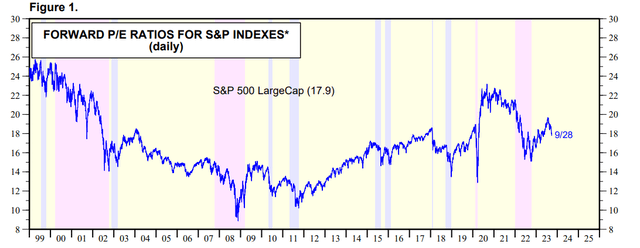

Furthermore, while the utility sector’s multiple has contracted from 20x to 16x, the market’s multiple has expanded from 17x in January to 18x currently (Figure 6).

Figure 6 – S&P 500’s multiple has expanded from 17x to 18x (yardeni.com)

So on a relative basis, the utility sector had gone from a 3x premium to the market to a 2x discount to the market.

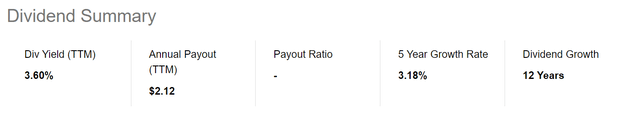

XLU Pays Double The Market’s Distribution

Furthermore, the XLU ETF is currently paying a trailing 3.6% distribution yield, more than double the S&P 500’s 1.6% dividend yield (Figure 7).

Figure 7 – XLU is paying a 3.6% distribution yield (Seeking Alpha)

Conclusion

As expected, utilities as represented by the XLU ETF underperformed the markets in 2023, as sector valuations were at historic highs driven by investors’ desire for safe haven assets. As the fears of a recession dissipated, assets held in defensive utility stocks rotated back into other areas of the market.

However, after a 16% decline in the XLU ETF, utility sector valuations have normalized and is now screening 2 multiple turns cheap relative to the market. I am raising my outlook for the XLU ETF to a buy and expect utilities to perform as well or better than the market on a forward basis.

Read the full article here