While current economic resilience and labor market strength suggest the economy could avoid recession, monthly state-specific deterioration means unemployment could still trend higher from here.

Although the Fed will undoubtedly look for next week’s jobs report to confirm an employment slowdown as they target a soft landing, investors should still expect a modest economic downturn next year as headwinds continue to build.

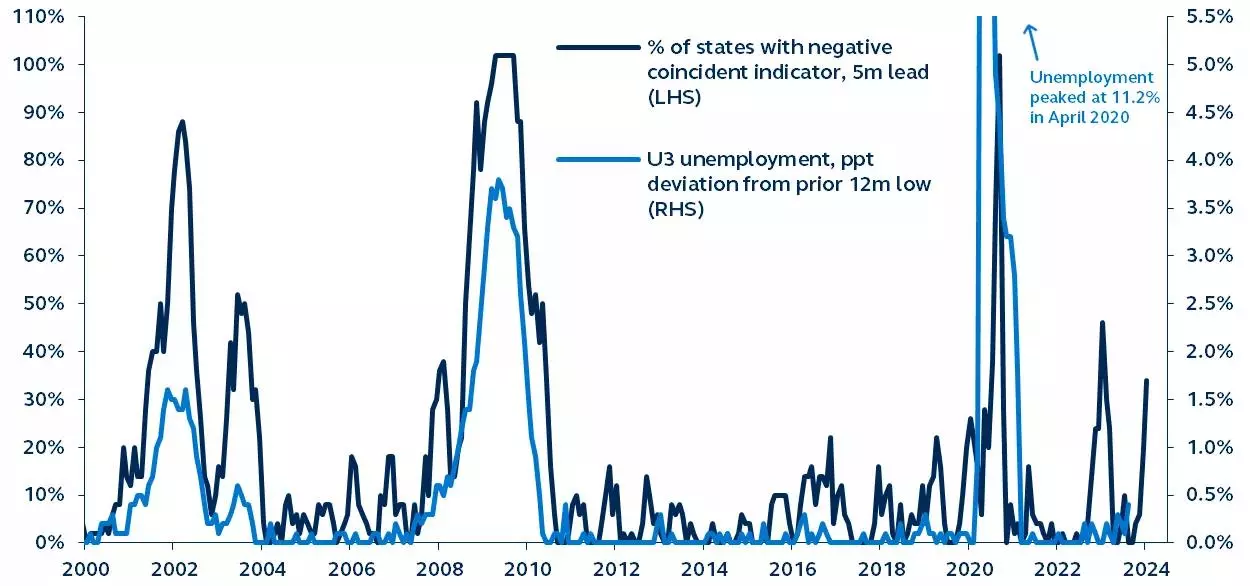

Philadelphia Fed State Coincident Index versus U3 unemployment

2000–present

Note: The coincident index combines four state-level indicators to summarize current economic conditions in a single statistic: Nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index.

Source: Federal Reserve Bank of Philadelphia, Bureau of Labor Statistics, Bloomberg, Principal Asset Management. Data as of August 31, 2023.

Recent economic resilience has led to numerous forecast revisions, with some now expecting the economy to avoid recession altogether. Yet, while jobless claims have remained subdued, payroll gains are also slowing, and next week’s employment report should confirm a continued loss in momentum.

Forward-looking indicators suggest the labor market could weaken over the coming quarters. The Philadelphia Fed’s monthly state-specific indices examine labor market conditions in each state and provide a window into future economy-wide unemployment.

Tech-specific layoffs drove the spike in 2022, and now, with 17 states currently showing monthly deterioration, further economic headwinds could signal an increase in unemployment.

The unemployment rate has already seen an uptick since April’s historic low, but this rise was primarily driven by increased labor force participation rather than by abundant job losses.

Looking ahead, economic headwinds will present themselves as tighter credit conditions and fading household excess savings begin to weigh on consumption, potentially placing pressure on employment levels.

Any resulting increase in unemployment would reflect a much-needed labor market rebalancing, enabling the Federal Reserve to successfully tackle inflation.

Despite being delayed in its arrival, investors should still expect an economic downturn during 2024 as the challenges facing the broader economy continue to mount.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here