Kimberly-Clark Corporation (NYSE:KMB) is a leading consumer staple that makes tissues, diapers, and personal care products.

The company has extensive operations in both developed countries and developing countries.

For 2022, $10.663 billion of Kimberly-Clark Corporation’s $20.175 billion total sales were in North America. In the same year, $2.071 billion of the company’s $2.681 billion of total operating profit was from North America.

Due to the macro headwinds such as inflation and the war in Europe that has caused spikes in costs and disruption in supply chain, however, growth has been slower than expected in the past few years and the company’s margins have weakened. Furthermore, the company has experienced commodity inflation, which has further negatively affected margins.

While Kimberly-Clark Corporation had an adjusted EPS of $7.74 in 2020 and $6.89 in largely pre-Covid 19 2019, adjusted EPS was $6.18 in 2021, and $5.63 in 2022.

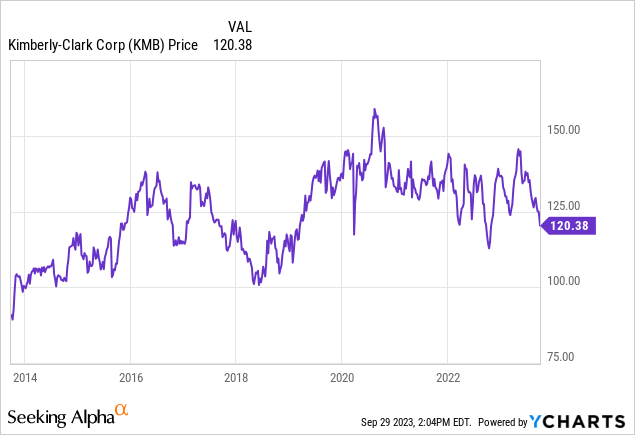

As a result of the headwinds and other factors, Kimberly-Clark Corporation stock is lower than where it has been since the latter half of 2019.

Improving Fundamentals

While Kimberly-Clark Corporation has experienced headwinds, its fundamentals have improved in recent quarters.

In terms of the company’s overall results, Kimberly-Clark Corporation has seen volume improving sequentially.

Whereas Q4 2022 volume declined 7%, Q1 2023 volume fell 5% year over year, volume fell 3% year over year in Q2 2023.

For the future, management expects volumes to improve further.

Management is also seeing abatement in commodity inflation, with costs such as resin coming down in multiple quarters.

Furthermore, management thinks the effects of the macroeconomic headwinds such as supply disruptions due to the Ukraine war are largely behind the company. It isn’t completely behind but largely behind.

As a result of the factors, Kimberly-Clark Corporation gross margin for the second quarter of this year was 34%, or a 400 basis point recovery versus low point of the gross margin in the end of 2021 and management has a line of sight of pre-covid 35% gross margin. Given changes management has made in the business over the past few years such as investing in the brand and investing in innovation, management believes there is potential for further improvement.

North America

For the second quarter of 2023, Kimberly-Clark Corporation said its volume trends were improving, with price gaps having begun normalizing. In the key market of North America which has historically accounted for the majority of the company’s operating profits, the company saw improvement in five of eight categories.

North America’s market share performance hasn’t been great in the past few years with pricing likely the big reason as inflation has negatively affected consumer demand. In North America, management hasn’t been a fan of ‘renting market share’ through pricing promotion.

If inflation decreases in the next few years given the Federal Reserve’s interest rate increases, however, there’s potential for better performance in market share in North America.

Valuation

In the past few years, higher U.S. Treasury yields have also likely been a headwind to Kimberly-Clark Corporation stock as higher Treasury yields which have led to a stronger U.S. dollar.

As a result of the stronger dollar, in Q2 of 2023 quarter, foreign currency was a headwind and management expects currency to impact full year top line growth by around 200 basis points.

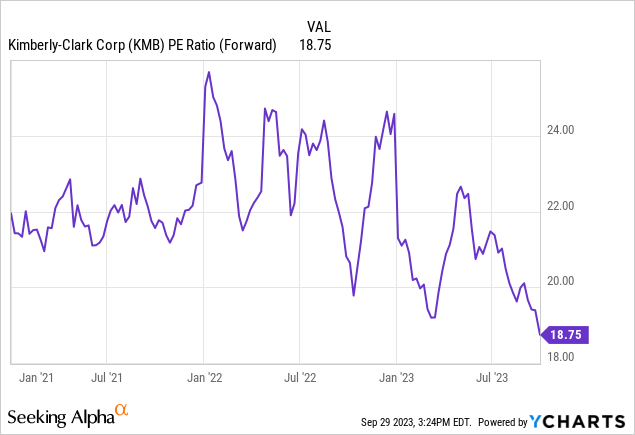

The higher U.S. Treasury yields have likely also led to more modest valuations for dividend stocks such as Kimberly-Clark Corporation.

If the 30-year U.S. Treasury didn’t have a yield of around 4.7% or higher, Kimberly-Clark Corporation’s dividend which currently has a dividend yield of 3.88% would be more attractive to more investors.

With Treasury yields being higher as a key factor, Kimberly-Clark Corporation’s forward P/E valuation is below 19 and around multi year lows.

Depending on inflation, the economy, and what the Federal Reserve does, Treasury yields could go higher or they can decrease to more normalized levels.

If U.S. treasury yields go meaningfully higher, Kimberly-Clark Corporation stock could under perform in the near term as its forward P/E valuation could be even more depressed.

If U.S. Treasury yields don’t go too much higher and management is right on fundamentals improving, there could be opportunity. Kimberly-Clark Corporation’s Q2 2023 results show improvement and management is seeing improving trends with less decreases in volume and stronger gross margins.

For the full year 2023, the company sees organic growth of 3% to 5% and adjusted EPS growth of 10% to 14%.

Analysts are expecting EPS of $6.44 per share for fiscal period ending December 2023, and $7.03 per share in fiscal period ending December 2024 which would be slightly higher than the pre-Covid 19 EPS of $6.89.

If economic conditions normalize and management succeeds in growing EPS, a forward P/E of 22 on the 2024 EPS estimate of $7.03 would suggest a price target of $154 per share in a few years.

I don’t know if Kimberly-Clark Corporation reaches that, but I think it has decent upside given the defensive nature of the stock.

Risks

China’s economy is slowing, and an economic slowdown in the country could affect Kimberly-Clark Corporation’s market share in the country.

China’s economic slowdown could affect the economic growth of other emerging markets such as Indonesia as well. This could make it harder for the company to achieve its top and bottom line growth expectations.

There is a chance that a recession occurs in the United States as interest rates continue to rise. That would negatively affect Kimberly-Clark Corporation’s volume and margins.

Higher Treasury yields could continue to put pressure on valuation.

Inflation could continue to be a headwind.

Long Term

Long term, incomes are rising in the emerging world and many will spend more on baby care products as a result.

With the trend, Kimberly-Clark Corporation has pretty attractive growth opportunities given it has meaningful market share in leading emerging markets such as China, Brazil, and Indonesia.

In China, Kimberly-Clark Corporation has been growing its business in the last four years in high single digits to low teens annually by introducing high quality products. The company has gained 400 basis points of market share in diapers since 2019. The company has also gained 300 basis points of market share in feminine care since 2019.

Kimberly-Clark Corporation intends to do the same playbook in Brazil and Indonesia, which are also big emerging markets.

Indonesia, for example, ranks among the top three countries in terms of births, and the country also has a lot of growth potential.

The long term makes Kimberly-Clark Corporation a worthy buy, although there could be near term downside if Treasury yields go higher or macroeconomic conditions worsen.

Read the full article here