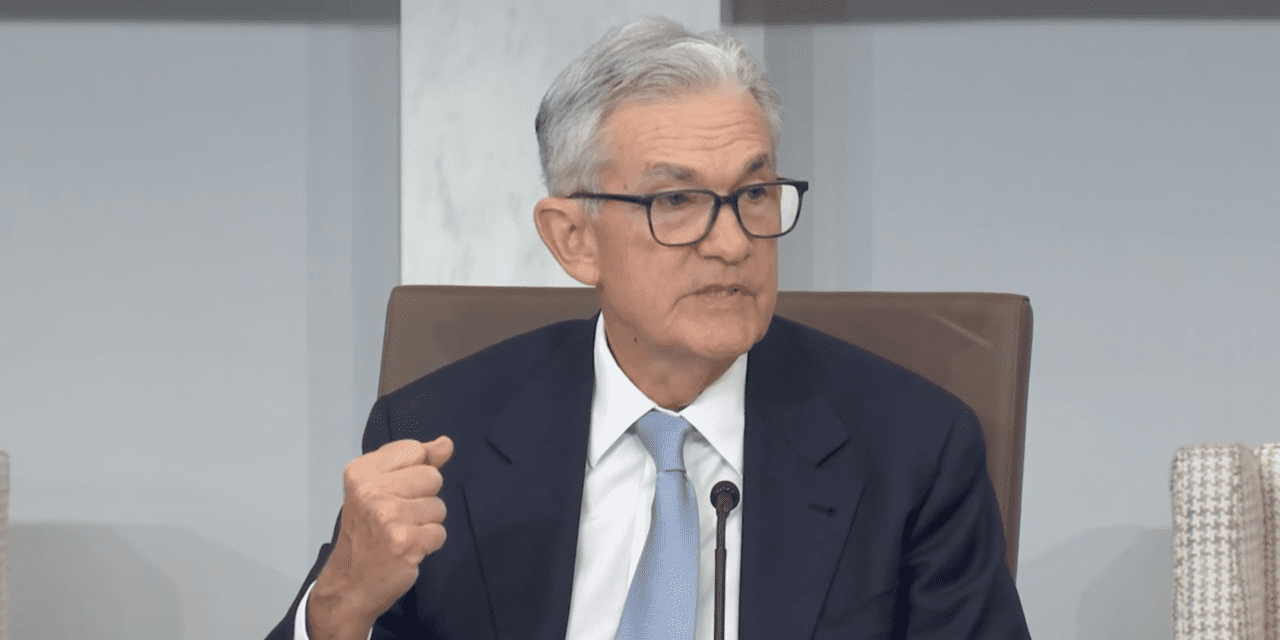

Federal Reserve Chair Jerome Powell took time away from the demands of steering U.S. monetary policy to talk with a group of teachers about the importance of economics in today’s fast-paced society.

The Sept. 28 town hall, held at the Fed’s William McChesney Martin Jr. building in Washington, D.C., provided no new insights into the central bank’s next interest-rate move, or policy makers’ thoughts about a looming government shutdown that could imperil the gathering of economic data on which the Fed relies. Instead, attendees got a lot of life and career advice from Powell, 70, to take back to their students.

“Every student should try economics—and take introductory macro and micro because I think you will find it’s more interesting than the first two pages of the textbook might make it appear,” Powell said.

He noted that getting through the basic economic fundamentals will stand today’s students in good stead. “Frankly all I took as an undergrad was macro and micro—I didn’t major in economics,” he said.

Powell earned an AB in politics from Princeton University in 1975.

The Fed chair came up blank when asked about his favorite macroeconomic topic during his student days. “That’s a hard question because, for me, that was literally 52 years ago,” Powell said. “If you give me a list of five, I’ll pick one. Can we do this multiple choice?”

Microeconomics was of far greater interest to Powell, and he doesn’t think he’s an exception. “For many students, micro makes more sense than macro,” he said, noting that his own daughter decided not to major in economics, despite his urging, after taking macroeconomics.

For anyone who has tuned into Powell’s press briefings, it was no surprise to learn that the Fed chair finds labor economics particularly interesting. “I think it’s a fascinating thing to watch the way the labor market evolves, and sometimes in very unexpected ways,” Powell said.

America’s central banker is on the job even when he’s not. “What I like to do in my free time these days is work,” Powell said. “There’s quiet time at home on the weekends, where I can really read more of the background stuff — so, for example, read about AI and things like that. That, for me, is very enjoyable.”

When asked if there was a common misconception he would like to clear up about the Federal Reserve or his position, Powell said there were many. “The main thing I would want people to know is that we’re a nonpolitical, nonpartisan agency that serves all Americans,” he said.

That includes members of Congress. As Powell explained to the teachers, “I testify under statute four times a year, twice in the House, twice in the Senate…That’s supposed to be a monetary-policy oversight hearing. In fact, it’s about whatever our elected representatives want to ask. And our job is to answer.”

Although Powell cracked a few jokes and revealed a bit about his personal life—he’s a guitar player who jams with friends in his free time—the purpose of the town hall was serious: helping today’s teachers and students.

Powell pointed to the lingering effects of the Covid-19 pandemic on education and students as a meaningful concern. “There are likely to be consequences, for the economy and for society, in a generation of young people who may lack some of what they need to be well-informed and engaged participants in our economy and in our democracy,” Powell said. “Addressing this legacy of the pandemic is a major public policy challenge.”

As for monetary policy, the Federal Open Market Committee next meets on Oct. 31-Nov. 1. The Fed chair is expected to hold a press conference after the proceedings conclude.

Write to Megan Leonhardt at [email protected]

Read the full article here