Having survived a challenging environment last year amid COVID-driven supply constraints and outsized raw material inflation pressures, things are finally heading in the right direction for Japanese auto manufacturer Nissan Motor (OTCPK:NSANY). In its most recent quarter, Nissan posted sharply higher operating profits and earnings growth YoY, helped by easing constraints and continued yen depreciation. Expect more of the same through this fiscal year as the supply/demand dynamic continues to revert, helped by resilient US auto demand and a continued production recovery.

Also helping the risk/reward are the ongoing United Auto Workers (UAW) strikes in the US, which threatens to skew competitiveness in its favor (along with other Asian manufacturers like Hyundai Motor (OTCPK:HYMTF)) over the long run. Meanwhile, the relative lack of China earnings contribution (vs. other manufacturers via their equity-method JVs) implies limited contagion risk should the economy deteriorate.

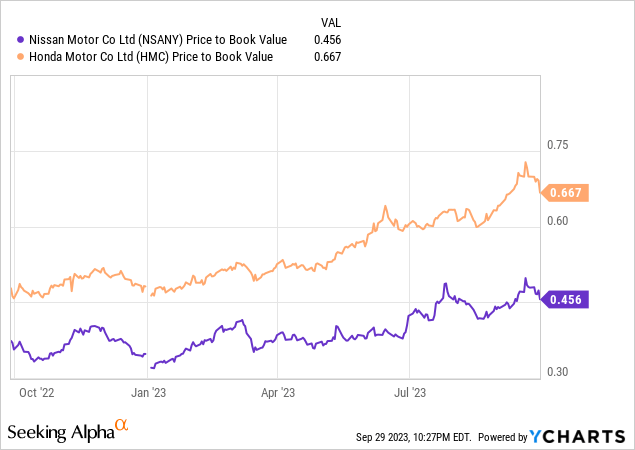

To be clear, some of the positives are already in the price – Nissan stock is having one of its best years on record at +60% year-to-date, well ahead of the TOPIX index. Yet, Nissan still trades at a steep ~50% book value discount (vs. key peer Honda’s ~30% discount to book) despite retaining strong cash generation capacity. The mid-term plan later this year presents a potential upside catalyst, along with upsized capital returns (dividend or buybacks) amid reform pressures from the Tokyo Stock Exchange.

UAW Strikes Boost Near-Term Earnings Prospects

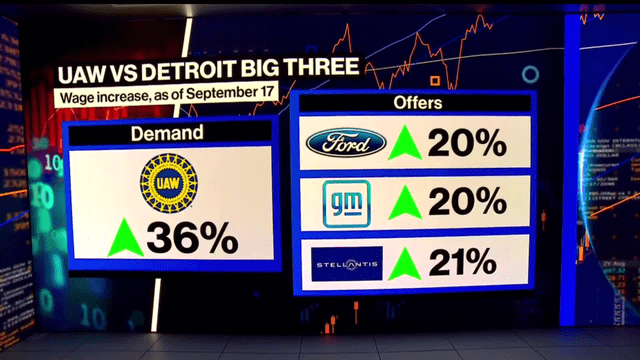

Coming off a solid start to the fiscal year, Nissan looks set for a further earnings boost from the escalating UAW union dispute, covering employees of the Detroit-3 US automakers (Ford (F), General Motors (GM), and Stellantis (STLA)). Since the strike action commenced earlier this month, the union has rejected a 21% pay hike from STLA (deemed a ‘no-go’ by President Shawn Fain) and looks set to rebuff a similar 20% offer from Ford. Given how far apart both sides are right now, expect a drawn-out strike, perhaps even longer than the last 40-day strike at GM in 2019.

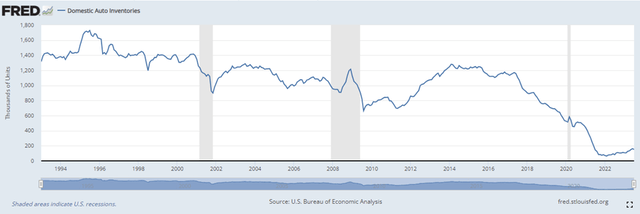

While the initial UAW strike won’t hit vehicle output particularly hard, further escalation will mean as much as 55-65k of lost production per automaker. So, depending on the length and severity of these strikes, supply could well tighten by >500k vehicles in a worst-case scenario (not including post-strike disruptions). Given domestic auto inventories are already on the decline and dealer inventories (~2m in September) are also set to slow, this bodes well for firmer US auto pricing going forward.

St Louis Fed

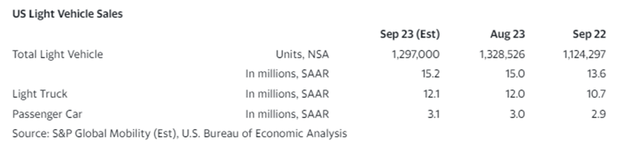

As for the demand side, the surge of new light vehicle sales in the US (+17% YoY to 1.3m units; another ~1.3m projected for September) indicates a strong economy despite the Fed’s extended monetary tightening. While improved new vehicle supply post-COVID has helped to absorb some ‘pent-up’ demand, the UAW strikes should again tighten the supply-demand balance through year-end. For the likes of Nissan, longer UAW strikes present an opportunity to grab share and boost its export earnings this fiscal year. Even if a slowing economic backdrop materializes (due to the lagged impact of higher interest rates), demand for lower-priced cars will gain likely momentum at the expense of higher-end offerings, benefiting Nissan’s focus on value.

S&P

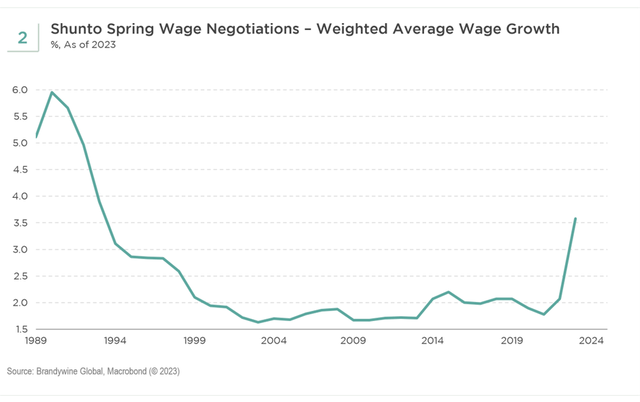

Meanwhile, domestic auto sales are also shaping up nicely – overall Japan auto sales rose +17% YoY in August and should continue to gain momentum as record Spring wage hikes boost consumer demand. Either way, the setup for Nissan looks great heading into its next quarterly earnings reports.

Macrobond

Building on Production Advantages for the Mid to Long-Term

The biggest upside to Nissan, in my view, is over the mid to long term. Managing labor pressures is key, and going by how significant wage pressures have been at the US-based Detroit-3 (note the UAW is currently demanding ~36% vs. the >5% hike for Japanese autos), their inability to do so will affect their relative competitiveness going forward. Even assuming we see the UAW settle somewhere in the middle (likely in the ~30% range over the next four years), a lot of that will still come out of margins, so it’s hard to see the US pricing environment not becoming more disciplined going forward. Nissan’s limited US production footprint is also a big advantage here – its presence in lower-cost regions like Mexico, where it already has the scale, means it has a head start on the US automakers’ ‘near-shoring’ push in the coming years.

Bloomberg

Poised to Capitalize on UAW Disruptions

Nissan’s stock has successfully climbed last year’s wall of worry to emerge as one of the best-performing auto names this year. On the one hand, the shortages that weighed on earnings last year have begun to reverse. Alongside the competitive boost from further yen devaluation, Nissan has seen higher automotive earnings and the market has rightly rewarded the stock. That said, Nissan still trades in a steep ~50% book value discount (far below its Japanese peers), so it is by no means overvalued.

From here, the US market will be key – amid a resilient demand backdrop, UAW-driven production disruptions have given foreign manufacturers like Nissan a window of opportunity to gain incremental market share near-term. And in the mid to long term, a wider labor cost differential vs. the Detroit-3, helped by Nissan’s lower-cost production base in Mexico and Japan, bodes well for its earnings power. The lack of China exposure also means less downside potential as the region continues to see demand weakness and persistent pricing pressure, particularly on EVs. In the meantime, investors get paid a decent ~3% dividend yield (with ample room for a hike) to wait.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here