It is safe to say that Realty Income Corporation (NYSE:O) investors have had it rough for a while as the stock is down

- 12% in the last month

- 19% in the last 6 months

- 22% YTD

- and 18% in the last 12 months

But anyone reading this article with interest knows that Realty Income is not about capital appreciation but about income potential. After all, the company doesn’t have “income” in its name or advertise itself as “The Monthly Dividend Company®” for nothing. It is all about income. Common sense says if you believe a dividend is fairly safe, you’d rather buy the underlying stock when it is acting weak resulting in a higher yield. And that exactly is the situation with Realty Income right now. I am presenting 5 reasons why I believe Realty Income is enticing here. Let us get into the details.

Realty Chart (Seekingalpha.com)

Stock’s Pedigree – Confidence Backed By Sustainable Execution

Let’s start with the fairly obvious reason. Realty Income, the stock, has an enviable record. History should mean something, if not everything, when picking up a stock on weakness.

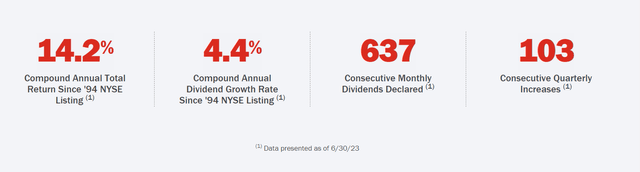

- Realty Income pays a monthly dividend, which shows the company’s confidence in ability to generate continuous cash flow.

- And it has paid that monthly dividend for 637 consecutive months or 53 full years, which shows the company’s execution upon which the confidence is derived from.

- The dividend has increased for 103 straight quarters or 26 full years, which shows the company’s sustainability and scalability.

Realty Highlights (realtyincome.com)

Business Pedigree – When Quality Rents Quality, Cash Follows

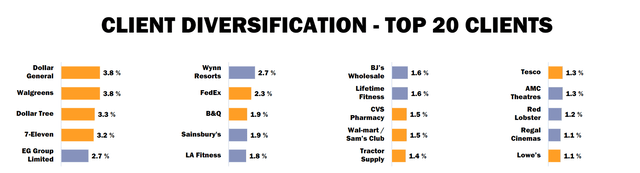

The company’s confidence in paying monthly and its execution over half a century is down to its business strength. Drawing a parallel to Warren Buffett’s management style “find the .400 hitters and then not tell them how to swing“, Realty Income finds the best asset classes and rents them out to qualified tenants and does not have to tell them how to run their business. When you have clients like Walgreens Boots Alliance, Inc. (WBA), Dollar General Corporation (DG), FedEx Corporation (FDX) and 7-Eleven being the cornerstones of your portfolio as a landlord, you sleep well at night.

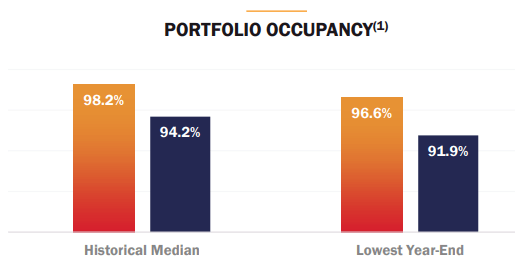

Hence, it is not a surprise that Realty Income’s lowest historical year-end occupancy rate of almost 97% is not only impressive on a stand-alone basis but is also higher than the historical median of other REITs in the S&P 500. Let me state that again for emphasis. Realty Income’s lowest occupancy rate is higher than the median occupancy rate of other REITs in the S&P 500.

Realty Clients (realtyincome.com)

In the chart below, the orange bars represent Realty Income while the blue bars represent the rest of the REITs in S&P 500.

Realty Occupancy (realtyincome.com)

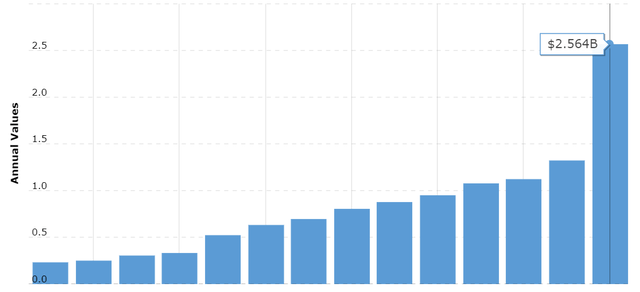

When you have quality assets rented by quality tenants, cash follows. Realty Income’s cash flow from operating activities has gone up more than 11 folds (and sequentially) since 2009. This time period has included latter part of the 2007-2009 recession, the obviously beneficial Quantitative Easing [QE], COVID crash and its aftermath that impacted commercial/retail real estate the most, and the early phase of the current Quantitative Tightening [QT]. I am focusing on operating cash flow because it depicts the cash flow generated by the day-to-day business as opposed to the overall cash flow, which includes investing cash flow, which in turn includes assets and hence depreciation.

Realty Cash Flow from Oper. Activ. (Macrotrends.net)

In short, I believe Realty Income has got an all-weather portfolio on the back of its wise diversification. As impressive as the list of top 20 clients shown above is, even more impressive is the fact that not a single one of them is responsible for more than 4% of the total rent.

But The Stock is Down – Presents 5-Year High Yield, Barring COVID

Despite its enviable portfolio and stock record, Realty Income, at its basic level, is a REIT, which means it is highly perceived as susceptible to interest rates. Year-to-Date, the stock has underperformed by more than 30% compared to the S&P 500. And this has resulted in a nice bargain for investors in my opinion.

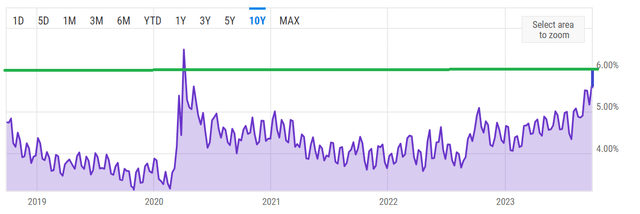

Realty Income’s current yield of 6.19% is the highest in the last 5 years at least, except for the COVID blip as shown below. Each time Realty Income announces its quarterly dividend increase, there are always some commenters who scoff at and ridicule the tiny percentage of dividend increase. But, such comments fail to take into account that this time last year, Realty’s monthly dividend was 24.80 cents and the just announced dividend increase to 25.60 cents means the annual dividend growth rate is 3.22%. Not too shabby when you consider the starting yield for those who bought this time last year was already 5.13%. I know what you are thinking though. What is a 5% or even 6% yield these days? The next section is for you.

Realty Yield (YCharts.com)

Fed Fund Rates Projections

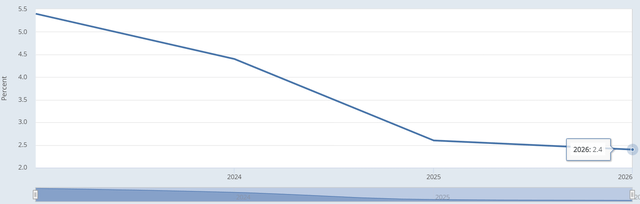

The biggest worry for the Real Estate is undoubtedly, interest rates. The obvious question for investors is “why buy a risky asset like a REIT at 6% yield when safer asset classes are yield close to that, if not higher?”. I have two answers:

- It is a fairly safe to say the rates are nearer to their highs than lows. Even the projections coming out of the Federal Reserve confirm this with the Fed Fund rates expected to fall from its current 5.50% to 2.90% in less than three years. Stocks of strong REITs like Realty Income will be among the first ones to turnaround should the market believe the rates are going to come down.

Fed Fund Rate Projections (fred.stlouisfed.org/series/FEDTARRL)

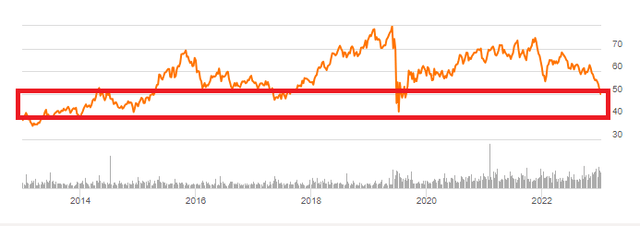

- Stocks (or REITs) offer capital appreciation potential, especially when buying at cyclical lows such as the one REITs appear to be in now. Realty Income has not traded below $50 too many times in the last few years. The COVID low was around $42 and you’d have to go as far back as 2014 to find the stock below $40. Now, this does not mean the past will determine the future but when a company is still going strong, long-term support lines tend to hold well.

Realty Chart (Seekingalpha.com)

SA Quant Ratings

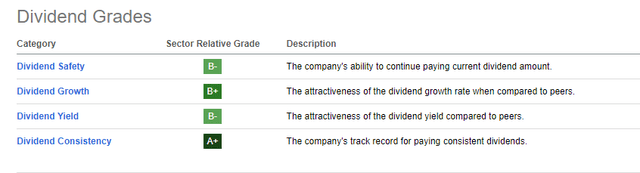

Finally, Realty Income has got one of the best dividend quant ratings I’ve seen on Seeking Alpha. The dividend consistency (53 years) speaks for itself and hence the A+ is justified. I rate the other three categories being B+ as fair to a little harsh. For example, the dividend yield being B+ is likely a reflection of the fact that the sector is filled with risky high yields. I’d rather have a 6% yield that is secure and slowly increasing over time than a risky 10% yield that can topple anytime. For what it’s worth, I’d personally rate everything except dividend growth as A+ with dividend growth getting a B.

Realty Quant Ratings (Seekingalpha.com)

Conclusion

While interest rates may stay higher for a bit longer, it is inconceivable to me and more accomplished professionals that we can go much higher without bringing catastrophe knowingly. In short, in a nod to the upcoming Halloween season, Realty Income and the market are asking investors “Trick or Treat?”. While the overall situation with inflation and rates are indeed scarier than most Halloween costumes, I believe the buying Realty Income here is a long-term treat as long as we are not tricked by the short-term bumps.

Read the full article here