Crestwood Equity Partners (NYSE:CEQP) announced in August that it would merge with pipeline giant Energy Transfer (ET) in a $7.1B all-stock deal which pushed units of CEQP into a new up-leg. I believe that the deal is beneficial for investors in large part because it is expected to be accretive to the distribution for CEQP unitholders and because Crestwood Equity Partners’ assets offer Energy Transfer access to new operational theaters, resulting in a more diversified master limited partnership. As a result of the deal announcement and considering the increase in price for CEQP units, I am down-grading Crestwood Equity Partners to hold.

Previous rating

I previously had a strong buy rating on Crestwood Equity Partners — 10.2% Yield, 1.7x DCF Coverage, Low Valuation — when units yielded more than 10%. My strong buy rating was largely supported by the midstream firm’s strong dividend coverage and its ability to generate stable and predictable cash flows from its energy assets. Given the strong increase in valuation since the deal announcement, however, and given the benefits of the transaction for Crestwood Equity Partners’ unitholders, I am adjusting my rating to hold.

Landmark deal with Energy Transfer will create premier master limited partnership with a more diversified energy asset footprint

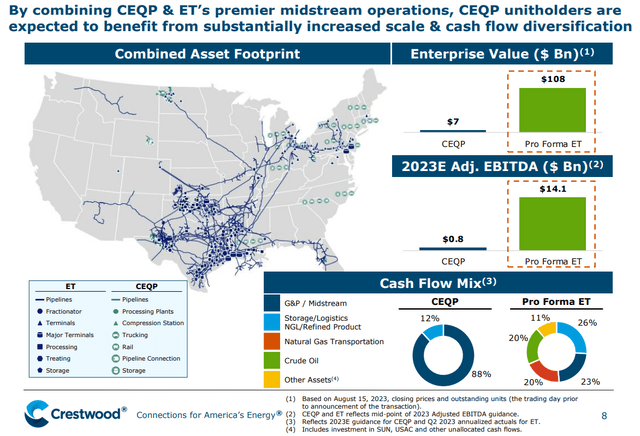

Energy Transfer, one of the largest pipeline companies in the United States with a market cap of $44B — which is fourteen times larger than the market cap of CEQP — announced that it would acquire Crestwood Equity Partners’ energy assets in a $7.1B all-stock transaction. By acquiring CEQP, Energy Transfer gets access to the midstream firm’s natural gas gathering and processing assets in the Anadarko Basin in Oklahoma as well as other assets in the important Williston, Delaware and Power River basins.

The acquisition of Crestwood Equity Partners strengthens Energy Transfer’s natural gas business, as CEQP generated approximately 60% of its revenues from natural gas. Additionally, Crestwood Equity Partners generated 85% of its revenues from take-or-pay or fixed fee arrangements that led to stable and highly predictable cash flows… which serves to enhance Energy Transfer’s cash flow profile as well. These fee arrangements were one reason, besides strong dividend coverage, why I previously recommended Crestwood Equity Partners to dividend investors as a strong buy.

The transaction is expected to close in the fourth-quarter of FY 2023 and will create an MLP giant with $14.1B in estimated annual pro-forma EBITDA.

Source: CEQP

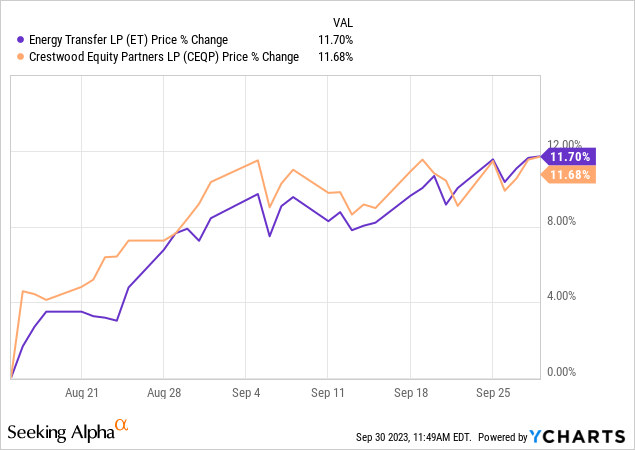

As dividend investors started to price in the prospects for higher, acquisition-driven distributable cash flow growth, units of Energy Transfer also appreciated after the deal was announced, and they currently trade near 1-year highs as well… a sign that investors are hugely in favor of the deal. Since the announcement of the deal, Energy Transfer’s units have actually slightly out-performed units of the acquisition target.

Cost synergies and incremental distribution growth

Owners of Energy Transfer, and holders of Crestwood Equity Partners’ units, are also set to benefit from synergy effects which are estimated to be around $40M annually. Energy Transfer is a major energy player and hinted at the possibility to refinance Crestwood Equity Partners’ debt at a lower capital cost, by leveraging its investment-grade rated balance sheet.

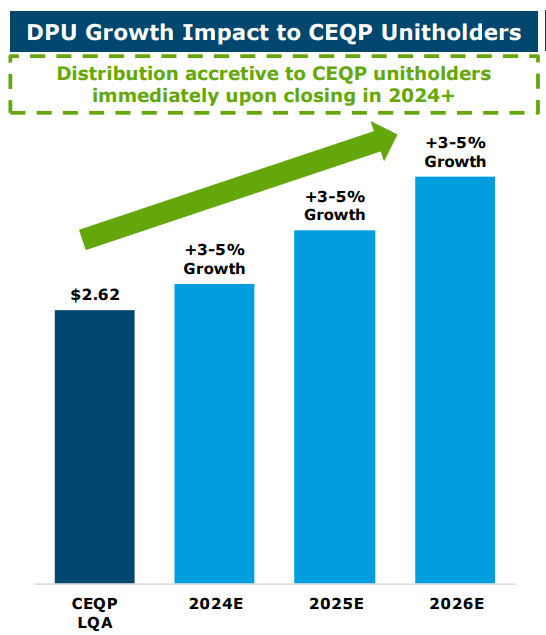

The most important point for CEQO unitholders, however, is that the transaction is expected to be accretive to their distribution… which is expected to make an effect for the first time in FY 2024. Energy Transfer has said that it targets 3-5% long term annual distribution growth, in which CEQP unitholders are set to participate going forward… if the transaction goes through as planned and necessary regulatory approvals are secured.

Source: CEQP

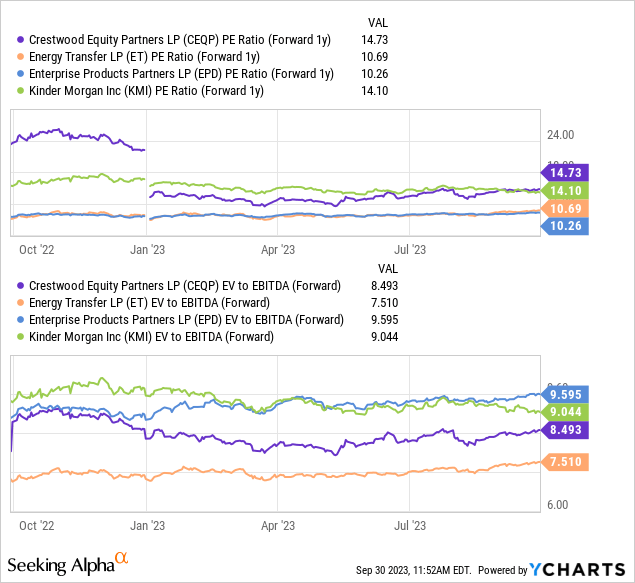

Crestwood Equity Partners, likely fairly valued now

Crestwood Equity Partners’ units went into a new up-leg after the transaction was announced, and units have appreciated approximately 12% since August 16, 2023. Crestwood Equity Partners’ units are currently selling near 1-year highs and are now, based off of P/E, one of the most expensive units that dividend investors can buy in the midstream sector. Based off of earnings, I believe units are fairly valued and have an unattractive risk profile. On an enterprise-value-to-EBITDA basis, units of Crestwood Equity Partners are valued at a more reasonable 8.5X multiplier factor.

Risks with Crestwood Equity Partners

The biggest risk for Crestwood Equity Partners would be if the deal with Energy Transfer fell through, which would likely result in the reversal of recent unit gains. The odds of the deal falling through, however, are small in my opinion since the deal is favorable to both parties. What would change my mind about CEQP is if the units dramatically revalued lower. I would consider changing my rating on the mid-stream firm if the unit price fell back to the $26 price level.

Final thoughts

Following the deal announcement in August, units of Crestwood Equity Partners have soared and are now trading near their 1-year-high, which was marked at $31.46. Given that Energy Transfer has guided for 3-5% annual distribution growth and that the distribution is said to be accretive to CEQP’s unitholders following the close of the transaction, I believe the deal is in the interest of Crestwood Equity Partners’ unitholders. At the current valuation, however, CEQP is a hold, in my opinion!

Read the full article here