Headwater Exploration (OTCPK:CDDRF) is a company with a great balance sheet that has discovered an unusually profitable heavy oil play called Clearwater. The breakeven point is usually quoted as roughly C$10 per BOE lower than other heavy oil plays. In the current environment, this company is likely to lead the profitability pack. The benefits include the ability to potentially add another rig full time or maybe do more exploration and push a few development projects at a faster pace. The downside is that the discount to WTI increases during a downturn. So, the profit swing is far more volatile than is the case with light oil. That means that peak earnings will likely have a lower price-earnings multiple even though growth of this company will likely be very fast.

What is going to be interesting is that this play is the most profitable I follow of any light or heavy oil play. What characteristics will dominate in a case like this this will prove interesting. Will the market value the extra profitability or the idea that heavy oil tends to make most of the profits near the pricing cycle peak? This one may possibly escape the shut-in that often occurs with heavy oil during cyclical bottoms. Will the market care?

Most investors, when they think of the oil industry, readily identify with light oil patterns because basins like the Eagle Ford and the Permian tend to be in the news the most. In the United States, there are far more light oil companies that investors can identify than is the case for heavy oil producers. Therefore, the differences between heavy oil and light oil need some discussion at certain points in the market because relationships change. In this case we are probably approaching a pricing point where heavy oil becomes more profitable than light oil.

Even so, management also needs to keep an extremely conservative balance sheet. Despite the low breakeven point, there is a reduced risk that heavy oil production will be shut-in when that discount to WTI inevitably expands during a time of weak commodity prices or a recession. Therefore, the debt free balance sheet with a decent cash balance is essential. For the light oil producers, such characteristics are desirable but not as necessary here. Light oil will cash flow during many industry downturns when heavy oil will not.

This company only has heavy oil as a production product. There may be some discoveries down the road where that heavy oil play actually produces some medium grade oil. Now whether the difference is enough for that production to be actually sold as medium grade oil remains to be seen. But until the company has something like that, management is wisely choosing to remain very conservative.

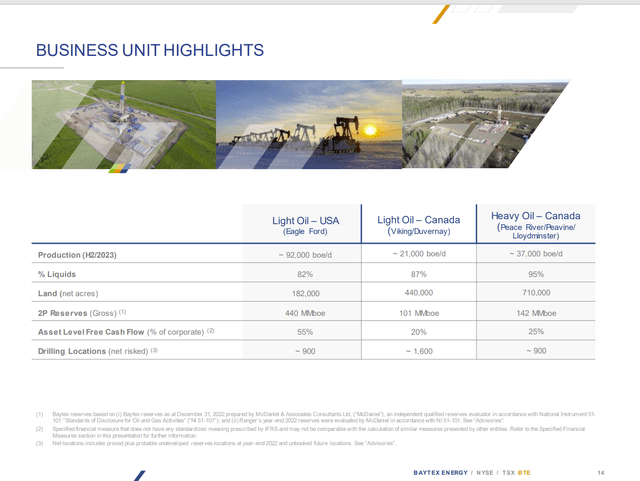

Compare To Baytex Energy

Baytex Energy (BTE) is a company that has pursued a different heavy oil strategy. Baytex has acquired a lot of light oil production so the company can withstand (easily) the volatile profit swings of heavy oil to light oil. That may turn out to be a competitive advantage. It should be also noted that Baytex is a larger company that probably could afford to do that. This company may copy that strategy down the road.

Baytex Energy Overview Of Lines Of Business (Baytex Energy Corporate Presentation September 2023)

I will probably go into greater detail discussing the business of Baytex in a separate article. But the basic idea here is that the light oil business can sustain the company in a downturn even with the current debt load if that needs to happen.

For Baytex, the superior profitability of the heavy oil in the current environment is like a lottery ticket. The actual heavy oil play is too new to see if the lower breakeven point does provide cash flow in a downturn.

Headwater likely does not have the option of debt even with a very profitable play because of the profit volatility. But luckily the basin is so profitable that it generates enough cash for growth and a dividend. Few companies can do one or the other let alone both. That may be reason enough to specialize in Clearwater.

Current Environment

Oil prices are now heading towards the WTI $100 mark. This is generally an area where the heavy oil producers are often more profitable than the light oil producers. This would mean that the company will generate proportionately more cash. Management has in the past mentioned that a pricing environment like the present one has the potential for the better acreage to payback as much as 3 times in the first year of production. That is a figure that few, if any basins can match on a regular basis. It certainly is the shortest payback measurement of all the companies I follow.

But Mr. Market is generally a stickler for business cycle average profitability. In the past other heavy oil basins have had subpar profitability. Baytex management has mentioned in the past that they made no money at all on heavy oil from 2015-2020. So, the company really struggled during that period. Given that history, the peak earnings of Headwater could be valued lower than the peak earnings of Baytex because of the market fears about heavy oil profitability.

The key is there is no Clearwater heavy oil performance in a downturn yet. There are lots of ideas and some really firm opinions. But the market is likely to wait for the proof in the form of actual performance during an industry cyclical downturn.

So far, the company has grown quickly. We will find out about next years’ plans probably in January. Much depends upon the pricing environment projection. Right now, it looks like rapid growth ahead.

Guidance

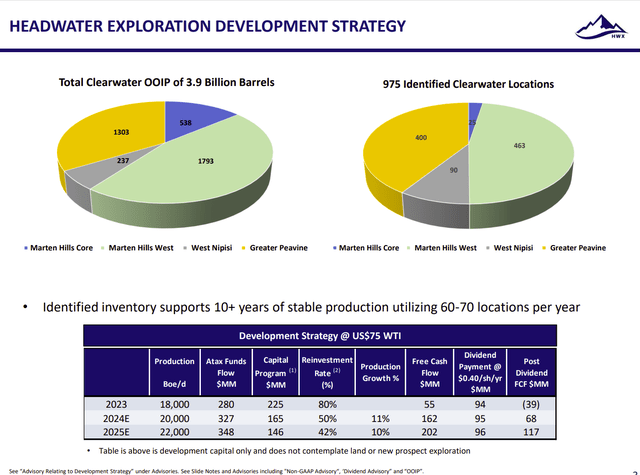

Management will generally give long-term guidance subject to industry conditions for the development side of the business. That is shown below:

Headwater Exploration Development Guidance (Headwater Corporate Presentation September 2023)

This company has had a number of discoveries in the current year that should lead a potential investor to believe that the total capital budget will materially exceed the development guidance shown above.

The current fiscal year is a good example where total growth in production far exceeds the guidance shown above.

Now as the basin becomes more explored and the basin limits are determined, at least some of the new discoveries will not be as profitable as some of the first discoveries. However, the profits from heavy oil just about anywhere significantly exceed the rates of return for light oil in the current environment.

The short payback in the current environment easily allows operators to hedge the current price environment to assure that any development wells do payback if unexpected unfavorable commodity price conditions emerge.

Where The Company Is Now

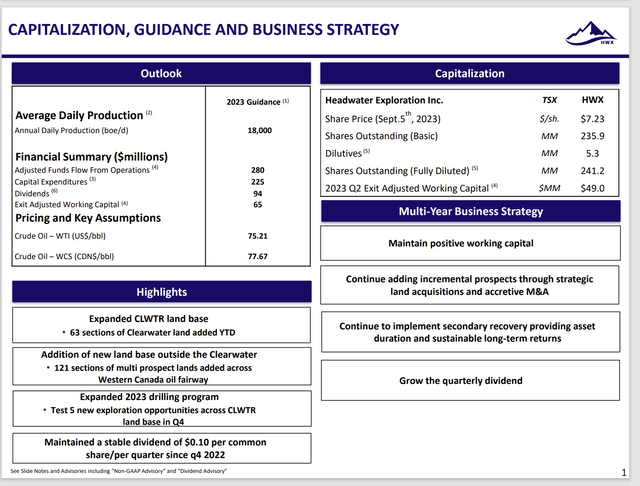

The commodity prices have been considerably weaker in the current fiscal year than is the case last year when commodity prices peaked in the second quarter. The fiscal year actually began with the trend of relatively weaker commodity prices continuing.

Management made the decision to use some of the cash balance to continue the production growth while maintaining an aggressive exploration and lease acquisition agenda.

Headwater Exploration Overall Business Policy Statement (Headwater Exploration Corporate Presentation September 2023)

The average daily production was revised from time to time upward despite some brutal winter conditions follow by wildfire issues. The exit production rate should be considerably above that figure to assure another fiscal year of considerable growth ahead.

Clearwater is a basin where secondary recovery through injection to maintain reservoir pressure begins relatively quickly. The good part about this is that secondary decline rates are often very low. Therefore, the capital needed to maintain production is not as great as a typical unconventional operation.

As production grows, and growth rates moderate, the amount of capital needed to maintain production will likely go below a typical conventional operation as well. The low cost of the secondary recovery would then provide a long-term competitive advantage. Right now, that is not the case as there is currently a large proportion of new wells and exploration (and lease acquisition).

Key Ideas

Heavy oil has a more extreme cycle than does light oil. Because of this a pure play heavy oil player like this one will likely maintain a debt free balance sheet and a decent cash balance.

In the past, heavy oil companies often shut-in production as the discount grew during periods of weak commodity pricing. This company is in a basin where the heavy oil costs are atypically low. Therefore, we will have to see once the basin has significantly established production how this production goes through a cyclical downturn.

There is thought that the low breakeven point may allow these wells to cash flow. That would be in sharp contrast to the usual negative cash flow. But it remains to be seen.

Heavy oil is usually a business where you make your profits all at once and then those profits have to last until the next time you make all your profits at once. As such it is a very risky business.

Many companies treat this as their “lottery ticket division” where is benefits profits tremendously at times and other times gets shut-in.

This company is one of the very few pure heavy oil upstream companies I follow. So far, they are doing fine as an independent. But long term, independent heavy oil companies are relatively rare ever since the big oil price decline back in 2015. Whether this trend continues with the Clearwater Basin independents remains to be seen. The question is: Will the low breakeven allow for long-term basin specialization with smaller independent companies?

But a strong balance sheet will be the key to future success. This management has the experience building and selling companies to handle rapid growth. But anyone considering investing in this company needs to be able to handle the profit extremes.

This speculative investment consideration is a strong buy on the rapid growth of the company so far. The management here has been top notch which lowers the typical investment risks of fast growth and financial risk quite a bit. But this issue as a small company is volatile and the profit extremes will make it more volatile. Many conservative investors will not be interested even with the well protected (and generous) dividend.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here