Investment Thesis

I initiate my coverage of First Solar, Inc. (NASDAQ:FSLR) with a Strong Buy rating following my in-depth research of the company and the underlying solar photovoltaic (“PV”) industry.

First Solar presents an opportunity for investors seeking exposure to the thriving solar energy sector. With its innovative technology, strong financial performance, expanding production capacity, and a backlog that stretches into the future, First Solar is poised for remarkable growth and stellar margin expansion. The current valuation may not fully reflect the company’s potential, making it an enticing prospect for those with a long-term investment horizon.

First Solar’s strategic focus on the United States, complemented by manufacturing facilities in stable nations like India, Vietnam, and Malaysia, minimizes geopolitical risks while capitalizing on the growing US solar market. The company’s remarkable expansion efforts, increasing production capacity from 6 GW to a projected 25 GW by 2026, highlight its commitment to meet the surging demand for solar panels and position it favorably for impressive growth

Furthermore, as a pioneer in the solar energy sector, First Solar’s innovative cadmium telluride (CdTe) thin-film solar technology positions it uniquely in the market. This technology, boasting high energy conversion efficiency, lower manufacturing costs, and superior performance in challenging climates, allows the company to serve the utility-scale solar market exceptionally well.

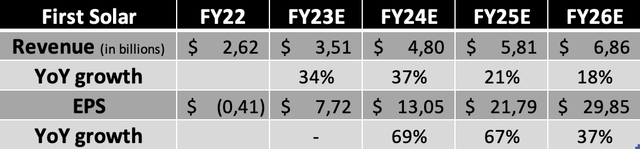

The company’s recent financial performance is equally impressive, with robust earnings and revenue growth backed by a substantial backlog. The implementation of the IRA adds another layer of financial advantage through tax incentives, further boosting profitability significantly. The company has a strong-looking margin outlook with significant expansion through 2026, meaningfully increasing its EPS results.

Also, despite the broader challenges faced by some players in the solar industry, First Solar seems insulated due to its unique market positioning and ability to align production costs with falling module prices. This resilience extends into the near future, with expectations of solid performance in FY23 and FY24.

In this article, I will take you through the company fundamentals, discuss the underlying industry, and show you why First Solar shares are criminally undervalued due to the overall negative view of the market on the solar industry.

First Solar – An Introduction

First Solar, Inc. is an American solar energy company specializing in designing and manufacturing photovoltaic solar panels and providing solar energy solutions. The company is headquartered in Tempe, Arizona, and it is one of the leading manufacturers of thin-film solar modules worldwide with an estimated market share of around 20% and manufacturing facilities across multiple countries, including the United States, Malaysia, and Vietnam.

The company was founded in 1999 and has since played a significant role in the growth of the solar energy industry. First Solar’s products are used in various solar energy applications, from residential and commercial rooftop installations to large utility-scale solar farms.

However, First Solar primarily serves the utility-scale solar market, meaning it often provides solar panels and solutions for large solar power plants and renewable energy projects. This is due to the characteristics of its technologies. First Solar is known for its cadmium telluride (CdTe) thin-film solar technology, which differs from the more commonly used crystalline silicon technology. These panels have several advantages, including high energy conversion efficiency, lower manufacturing costs, and better performance in hot and humid climates compared to traditional crystalline silicon solar panels.

And while these panels are also less efficient, this makes them, in combination with the lower costs and lightweight materials, perfect for project locations with large rooftop areas or open spaces, making them perfect for large solar power plants and renewable energy projects.

First Solar has managed to become the industry leader in this niche market, and this gives them incredible relative resilience and a solid growth outlook. Furthermore, the company continuously works on improving the efficiency and reliability of its technology to maintain its edge over competitors.

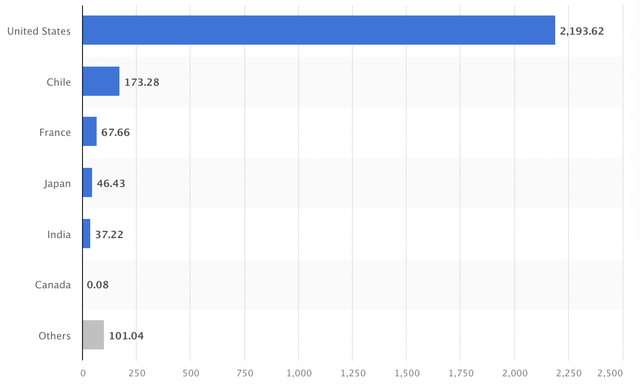

Another aspect that is of fundamental importance here is that the company primarily focuses on the U.S. from which it derives 83.5% of its sales as of 2022, followed by other stable countries like Chile, France, Japan, and India. While this does mean the company is heavily dependent on the health of the U.S. solar market, it also means the company has close to no exposure to more unstable regions and countries, limiting its geopolitical risks. As the U.S. solar market will rapidly grow over the next few decades in one way or another, I am willing to accept the large dependence on this market in exchange for minimal geopolitical risks.

Furthermore, I also view the company’s geographical manufacturing exposure as highly favorable. For one, it will benefit from the IRA through its U.S. production efforts, and second, the company’s overseas facilities, which most likely are cheaper in terms of operational and personnel costs, which favors the margin profile, are located in relatively stable countries like India, Vietnam, and Malaysia. I much prefer these countries over manufacturing in China, as do many of its customers. I believe these choices further lower the company’s risk profile compared to Chinese peers.

First Solar revenue by region (Statista)

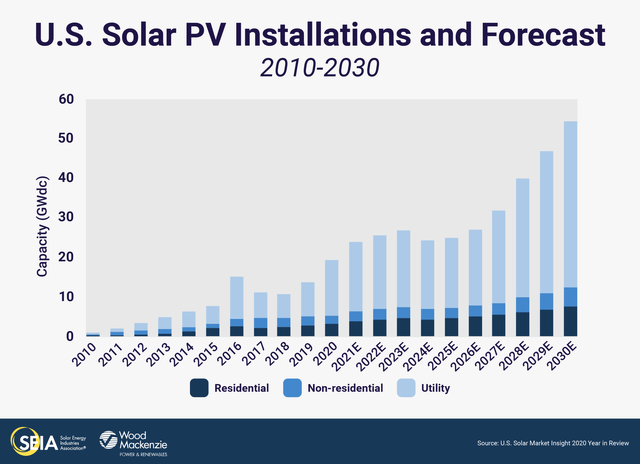

The growing solar industry should support growth for many decades

As the company is a leader in its respective industry, it is perfectly positioned to fully benefit from growth in the underlying industry and this one is looking great, especially in First Solar’s focus region – the US. As pointed out by the SEIA, the number of solar installations in the US will grow significantly over the remainder of the decade, potentially doubling from 2021 to 2030. This does include a slowdown in installations in 2024 and 2025 but a significant acceleration in the following years as the push for green energy persists. This aligns with Grand View Research’s estimates for the U.S. residential Solar PV Market to grow at a CAGR of over 15% through the end of the decade.

SEIA

There is no denying that solar energy will be one of the most important energy sources in future decades. Companies like First Solar, Enphase (ENPH), and SolarEdge (SEDG) will be the large beneficiaries of this push for increased solar penetration – not just in the US but globally. Solar power investments are already set to surpass oil production investments for the first time this year, with an expected $380 billion to be invested.

This industry growth will support growth for First Solar, which is one of the largest solar panel providers in the U.S. and is expanding its business globally. Getting a bit more specific for First Solar, according to VMR research, the global thin film solar cells market is projected to grow at a CAGR of 18% through 2030, of which First Solar should be a primary benefit as one of the most prominent providers of these panels.

Furthermore, while I will not bore you with all the technicalities of its solar panels in this article, it is worth mentioning that First Solar has an excellent and differentiated product, which is superior to many of the products offered by (mainly Chinese) competitors. This technological edge should help it maintain its strong market share and possibly expand it. The company remains committed to further product innovation and looking at its product pipeline and recent announcements, there is plenty to be enthusiastic about and I see no reason to assume market share losses.

Overall, my take from the industry outlook and developments, as well as its product development, is that, no matter what, the company has a really impressive long-term outlook with the potential for incredible growth, driven by a growing solar market and a strong product offering. The solar industry outlook alone already gives plenty of reason for investor enthusiasm. However, to benefit from this growing demand, the company has to increase its production capacity at a rapid and sustainable clip.

First Solar is rapidly expanding production capacity in order to satisfy incredible demand

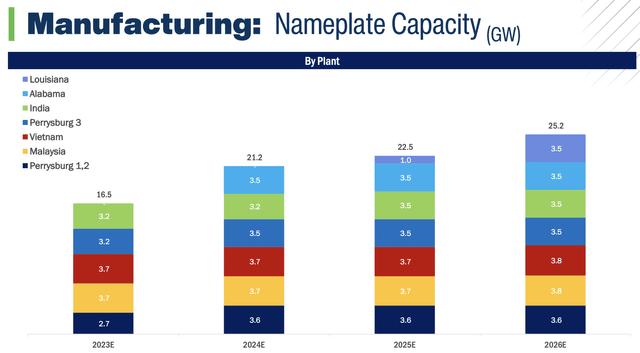

First Solar has rapidly been expanding its operations over recent years, scaling its manufacturing capacity from ~6 GW in 2020 to 13 GW of global operational nameplate capacity today, with further expansion expected to take it to 25 GW by 2026.

First Solar has recently started building its fifth U.S. factory, which will cost up to $1.1 billion in investments but will meaningfully increase its production capacity to satisfy the incredibly high demand for solar panels, especially in North America. The facility is expected to be operational in the first half of 2026 and will increase the company’s manufacturing capacity by 3.5 GW and will boost U.S. manufacturing capacity to 14 GW in total.

The latest capacity expansion investment by the company brings its year total to $2.8 billion after already announcing a new site in Alabama and expansions to existing Ohio facilities. All these investments are part of the company’s expansion strategy, which will add a total of 12 GW to its capacity by 2026 through new facilities in the U.S. and India.

First Solar capacity expansion plans (First Solar)

The company’s choice to boost manufacturing capacity in India is also a highly interesting one and could benefit the company going forward. For one, India has a rapidly growing population and growing demand for green energy offerings, making it a massive market for First Solar to benefit from. This benefit is even more pronounced as First Solar’s products and technologies (as explained earlier) show a better performance in hot and humid climates than traditional crystalline silicon solar panels, making it an excellent suit for many areas in the country.

Furthermore, Western companies tend to prefer to rely on somewhere other than China for their products, which is why Apple (AAPL) is also moving a lot of its production to India. Finally, operational costs are lower compared to U.S. facilities and the Indian government offers incentives to pay back 25% of capex invested in the country over a 6-year period, making it an exciting market for First Solar to boost production capacity.

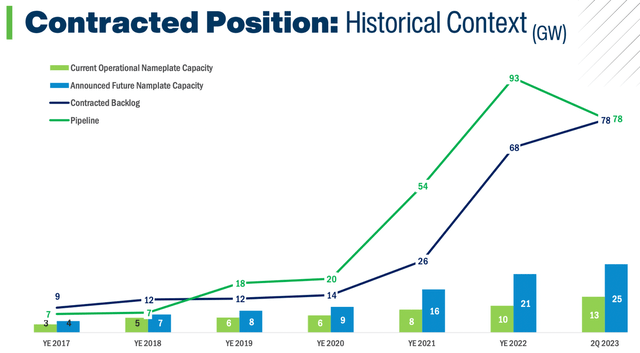

However, despite all these significant capacity investments, the company remains unable to satisfy demand as it has sold out its planned production through 2026 and a part of 2027 and still has a backlog of 77 GW, which could lock up orders until 2030. This is highlighted by a recently announced agreement with Longroad Energy to produce another 2 GW of thin film solar modules. This order is expected to be delivered between 2027 and 2029, showing the high demand for the company’s products and manufacturing, making me quite bullish on the company’s future. As it expands its capacity further over the next few years, it should be able to grow revenue at a similar rate as new capacity will practically be fully booked right away.

First Solar backlog (First Solar)

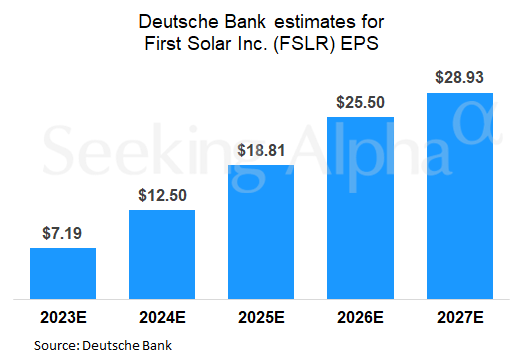

Furthermore, this massive backlog and the fact that the company is fully booked until 2027 also allow it to offset near-term weakness in the U.S. solar market. Deutsche Bank analysts share this opinion as they expect the company to keep growing EPS at a fast and consistent rate driven by its leading position in the niche market of thin film modules and the strong demand for its products, as highlighted by its backlog.

Seeking Alpha

So far, First Solar is insulated from the overall slowdown visible in several solar peers’ financial results and outlook. Companies like Enphase and SolarEdge have seen their share prices tumble over recent months as both (Especially Enphase due to its significant exposure to the U.S. solar market) are dealing with the result of higher interest rates and lower consumer purchasing power, impacting demand for new solar installations. Furthermore, solar panel manufacturers also deal with decreasing module prices due to increased competition and improved manufacturing efficiency.

However, First Solar is not impacted as much by these economic trends or the decreasing module prices as it is able to lower production prices at a similar rate, has a mighty backlog as discussed before, is mainly exposed to large solar projects, and has limited exposure to the current weakening residential solar market. Therefore, the outlook for FY23 and FY24 remains solid.

And I believe that as First Solar continues to build out capacity, it will fully benefit from the growth of the solar industry, driving an impressive growth outlook. Today, I believe First Solar is one of the most resilient and impressive solar companies, based on my analysis of the underlying industry, its product offering, current demand for its products, and capex plans.

On that note, it is time to take a look at the company’s recent financial results and financial health.

The company has a solid and rapidly improving financial profile

First Solar reported its Q2 earnings on July 27 and managed to beat the consensus by an impressive margin of 69% and 13% for EPS and sales, respectively. Q2 revenue was $811 million, up 30.6% YoY. This was driven by higher production and the first sales of the Series 7 modules.

YTD the company recorded total net bookings of 21.1 GW (8.9 GW in Q2), bringing the total backlog to 77.8 GW or a total sales value of over $22 billion. This means the company is fully booked through 2026, excluding the India production facility, which the company will use to satisfy U.S. demand. In Q2, the company manufactured 2.4 GW of Series 6 modules as the Series 7 continued to ramp up from the Ohio plant but was limited to 425 MW in Q2.

The company receives more orders every quarter than it can produce, resulting in a growing backlog. So far this year, the company sold 4.7 GW of volume but received orders for an additional 13.6 GW. Note these are net orders and, therefore, already include any cancellations. This growing backlog is a positive sign that even in a challenging operating environment, demand for the company’s products remains incredibly high and far above what it can produce.

Furthermore and crucially, while panel prices have been dropping, First Solar is actually seeing the average price per watt increase YoY and sequentially by $0.08 to $0.296. This is helped by the company changing certain contracts to include U.S.-manufactured and Series 7 products. The company plans on changing several more contracts in H2, which will boost the backlog in terms of value by potentially $0.7 billion.

Moving to the bottom line, the Q2 gross margin was 38%, compared to 20% in Q1 and a negative margin a year ago. This margin increase was driven by the increase in module ASPs and higher volumes, resulting in a more significant contribution from the IRA. As discussed before, the significant increases from the company on U.S. soil expose it to the IRA bill benefits, which offer it significant tax credits just like its peers. Interestingly, the thin film technology from First Solar gives them an even more significant edge over competitors (apart from performance advantages) as the technology should receive more significant tax credits compared to traditional crystalline silicon panels.

Why? Well, solar panel manufacturing is complicated and requires many different components from different manufacturers. However, CdTe thin-film solar panel manufacturing has a distinct manufacturing process, allowing everything to be completed on the same final unit on one manufacturing line. As a result, First Solar is less dependent on third-party manufacturers and can produce nearly everything in-house.

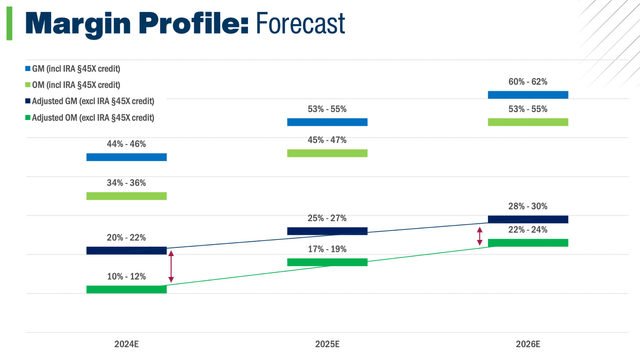

As the IRA rewards U.S.-manufactured products, an all-in-house design receives more significant tax credits. Solar Power World calculations show that a U.S. thin-film panel manufacturer like First Solar receives up to 3x times compared to a U.S. crystalline silicon panel assembler. Therefore, First Solar is a primary beneficiary of the IRA bill, and these incredible tax incentives massively benefit it as it limits the number of financial resources needed to expand capacity, resulting in improved margins. According to estimates made by First Solar, the IRA will have a 24 percentage points positive impact on the gross and operating margin in 2024, highlighting how significant the impact is.

First Solar margin outlook (First Solar)

IRA credits in Q2 rose to a very significant $155 million, up from $70 million in Q1. First Solar expects tax benefits of between $660 million and $710 million for the full year.

Further contributing to the improved margins were decreased freight costs, which drove a 7-percentage point margin increase. Other costs impacting the gross margin were ramp costs for the Ohio facility. These remained aligned with Q1 but should ease off in H2 as the Ohio facility reaches its first production volume targets. However, the impact on the gross margin will increase from four percentage points in Q2 to Q3 as ramp costs will be made for the India facility.

At its current stage, margins will fluctuate a lot for First Solar as it is heavily investing in building out capacity to maximize the opportunity it has from the current high demand for its products. In order to boost sales growth, margins will have to suffer, partially offset by the IRA.

Still, the 38% gross margin reported in Q2 is not far from its FY24 target of 44-46%, especially considering the significant capacity expansion expected by the end of the year, which will significantly boost scale benefits and the contribution from the IRA, driving margin expansion.

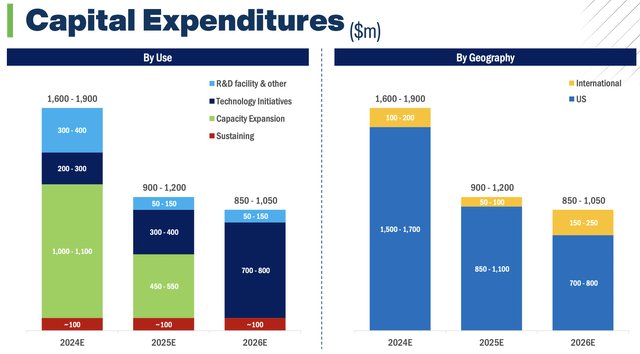

Furthermore, management remains confident in its long-term margin expansion capabilities, as the graph above highlights. Management expects to significantly expand margin through 2026 as the company rapidly grows its output and massively benefits from IRA incentives while it meaningfully lowers its Capex spend, according to the Capex outlook released during its recent investor day.

Management now expects FY24 Capex to be slightly lower than FY23 and to drop more significantly heading into FY25 and FY26 as all facilities have become operational. Whereas $1 billion in Capex is reserved for capacity expansion in FY24, this drops to $0 in FY26. These lower Capex requirements will favor the margin profile, while output from U.S. facilities will result in IRA tax incentives, explaining the strong margin outlook.

Capex outlook (First Solar)

Returning to the Q2 results, Q2 operating income was $169 million, up 16.5% YoY and reflecting an operating margin of 21%. The above-mentioned margin improvements led to an EPS of $1.59, up 205% YoY.

Total cash in Q2 was $1.9 billion, down $400 million sequentially due to significant capex investments in multiple facilities and the acquisition of Evolar. However, the company only holds debt of $437 million, meaning it has a solid net cash position of $1.4 billion, which is sufficient to keep investing in capacity expansion.

Outlook & FSLR stock valuation

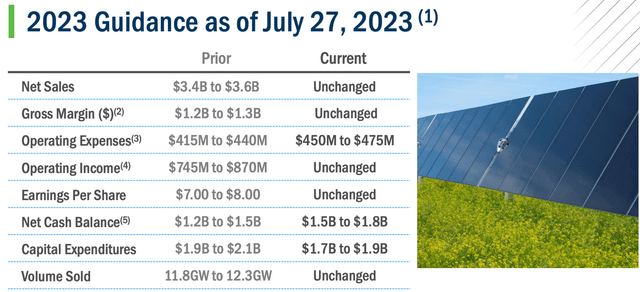

Following the Q2 results, management largely maintained its FY23 outlook, which is shown below.

First Solar

Following my analysis of the U.S. and global solar industry, First Solar fundamentals and developments, and the FY23 guidance from management, I project the following financial results through FY26.

Financial projections (Author)

Based on these forward projections, shares are currently valued at a forward P/E of 21x, which sits around 10% below its 5-year average. Considering the medium-term growth outlook and the long-term potential discussed throughout this article, this might seem like a bargain. However, most of these solar energy companies are valued at somewhat of a discount due to the uncertainties in this particular industry regarding investment and revenue potential, which makes a lot of sense.

Yet, the narrative is shifting somewhat. Whereas most of these companies were struggling to report a profit (and some still are), First Solar, in particular, is now slowly starting to drive serious profits and has started to rapidly improve the margin profile, supported by the IRA. This then might bring up discussions about the viability of these profits once these tax benefits fall away, but we must remember that these companies are still in their high-growth phase, as is the solar industry. Once these growth investments slow down, profitability will improve. Furthermore, the solar industry is slowly getting more mature and is becoming a stable market as investments by the government are growing at a rapid pace. Solar is increasingly looking like the go-to energy source for the future.

As a result, the discount for these solar companies looks increasingly unjustified and I believe these deserve higher valuation multiples. Still, if we go with a relatively conservative 22x earnings multiple on the projected FY24 EPS for First Solar, this results in a target price of $287 per share. Going with a 12% annual return, this results in a fair value share price today of around $242, meaning shares are currently undervalued by 50%, even based on a conservative multiple in my eyes.

Conclusion

First Solar is an impressive company operating in the highly promising and fast-growing solar industry, which sets itself apart from the competition through a differentiated business model and product portfolio. The company has a solid financial profile supported by the IRA and a backlog locking up orders through 2027.

Furthermore, the company has a decreased risk profile compared to many peers thanks to its focus on the U.S. solar market and production facilities mainly located in the U.S. and stable Asian countries. So, while the solar industry is perceived as somewhat high risk due to industry instability and the fact that it is relatively new, First Solar is one of the most de-risked solar opportunities out there.

As a result, the current valuation does not make much sense, especially as First Solar, Inc. now has a clear runway to significant profitability in the medium term and a massive backlog to assure strong sales growth as the company expands.

Of course, there are several risks involved here, but the overall negative view on the solar industry as of recent months is massively discounting these shares, and in the case of First Solar, this is entirely unjustified. I have already pointed this out for Enphase earlier, but this discount is even more pronounced for First Solar, considering the company isn’t even really feeling the impact of the solar slowdown we see reflected in the Enphase financials.

Where do you find a company growing EPS at a 60% rate and sales at a 20% to 30% CAGR in the medium term while being valued at 21x this year’s earnings? While I can point to multiple reasons why shares are being discounted today, none are justified, and none will hold up in the long run.

Based on my financial projections, shares seem 50% undervalued, and I therefore rate First Solar, Inc. shares a strong buy.

Read the full article here