It’s been a volatile past few months for the Gold Miners Index (GDX), but the sharp pullback we’ve seen in some names like Orla Mining (ORLA), Coeur Mining (CDE), and AngloGold Ashanti (AU) should not be surprising, given that they were priced for near perfection in April/May relative to their peers. Unfortunately, the pullback in these names has contributed to the underperformance in the GDX with a ~45% average decline for these three names, and few names have been able to evade the sector-wide selling pressure, with only a handful of names still sporting positive year-to-date performance.

And while there’s been a lack of overall news outside of financings to help support the share prices of miners over the past couple of months, the Q3 Earnings Season is just around the corner with miners set to report their preliminary Q3 results this week. The first name to report its preliminary Q3 results was Eldorado Gold (NYSE:EGO), which is tracking at ~69% of its annual guidance and will need a strong Q4 to deliver at its guidance mid-point of 495,000 ounces. In this update, we’ll look at the most recent quarter, the stock’s valuation, and see whether the stock is offering an adequate margin of safety following its ~27% correction from its highs.

Eldorado Gold Pour – Company Website

All figures are in United States Dollars unless otherwise noted.

Q3 Production & Sales

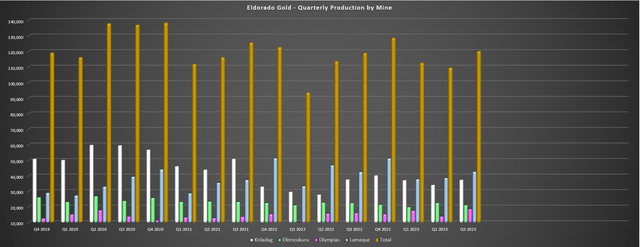

Eldorado Gold released its Q3 results this week, reporting quarterly production of ~120,000 ounces of gold, a marginal improvement from the year-ago period. The 1% increase in production can be attributed to higher output from its smallest polymetallic Olympias Mine in Greece and Lamaque, with production up by ~0.5% at Lamaque and ~16% at Olympias to ~42,700 ounces and ~18,700 ounces, respectively. This was partially offset by lower production at its flagship Kisladag Mine and its smaller Efemcukuru Mine, with production at Kisladag down marginally to ~37,500 ounces and Efemcukuru’s production down over 5% to ~21,200 ounces. The result of the softer quarter than I expected is that Eldorado Gold is heading into Q4 with just ~341,000 ounces produced, or ~69% of its annual guidance midpoint of 495,000 ounces.

Eldorado Gold – Quarterly Production by Mine – Company Filings, Author’s Chart

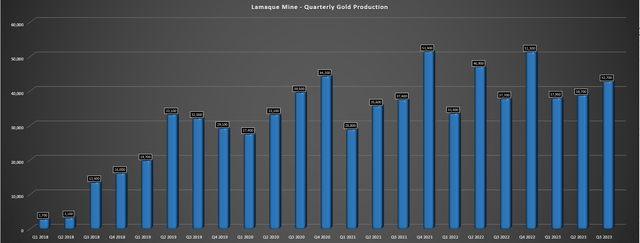

In Eldorado’s defense, it hasn’t been an easy year for the company’s Lamaque Mine in Quebec, with Q2 production affected by wildfires that led to lower throughput, with the company choosing to suspend some shifts to ensure its workers’ safety. While the company still put together a solid Q2 at the mine despite the disruptions, underground development is a little behind because of the lost shifts last quarter. This has left Lamaque sitting at just ~68% of its annual guidance midpoint (175,000 ounces), and the company will now need a record quarter of ~55,700 ounces just to meet its guidance midpoint. And while Q4 will be much stronger with access to high-grade stopes in the C4 Zone (this zone has an average reserve grade of ~7.2 grams per tonne of gold per 2021 TR), the previous record for Lamaque is ~51,400 ounces, suggesting the asset is likely to come in just behind its guidance mid-point even with a strong finish to the year.

Lamaque Mine – Quarterly Production – Company Filings, Author’s Chart

Moving over to Kisladag, it was a satisfactory quarter for the Turkish Mine, with production of ~37,500 ounces, down slightly from the ~37,700 ounces produced in Q3 2022. This has left the mine well behind its guidance as well (~66% of annual guidance midpoint), but like Lamaque, it should enjoy a stronger Q4 as well. And while Q3 came in slightly behind my estimates, Eldorado noted that its agglomeration drum was successfully commissioned and higher tonnes are now being placed with the benefit of increased capacity from its grasshopper conveyors and radial stacker. Still, even if Kisladag has a monster quarter with 55,000 plus ounces (just shy of its best quarter in the past three years in Q4 2020), it will also come in just shy of its FY2023 guidance midpoint of 165,000 ounces.

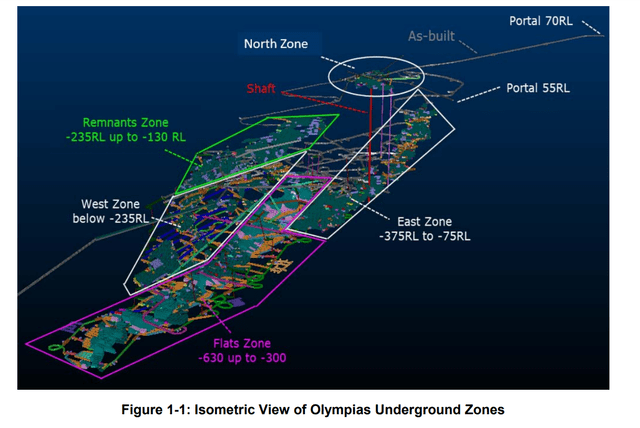

Olympias UG Mine Isometric View – Technical Report

Moving over to the company’s two smallest mines, Efemcukuru is tracking well against annual guidance (~75%), and while Olympias is behind its annual guidance midpoint, we continue to see improvements at this asset which will ultimately take production higher over the coming years. Eldorado noted in its prepared remarks that the asset is now benefiting from improved ventilation, which will allow for increased development headings, and allow for better productivity in lower parts of the mine where higher-grade base metals are present. Meanwhile, the company has transitioned to bulk emulsion blasting which will translate to improved development rates. So, while this asset has been a consistent sub 20,000 ounce producer at higher costs, it’s nice to see things progressing well on the ground, with larger stops in the Flats Zone (lower mine) expected to benefit Q4 production.

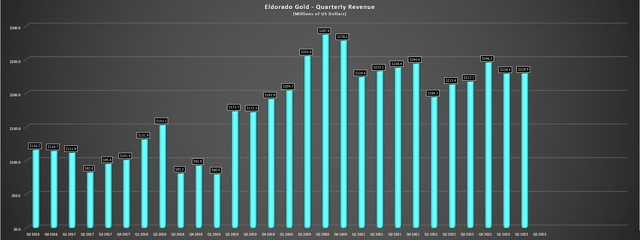

Finally, from a sales standpoint, Eldorado’s gold sales may come in at similar levels to last year (~118,400 ounces), but it will benefit from easy year-over-year comps with an average realized price of just $1,688/oz in Q3 2022. Hence, Eldorado should see a sharp increase in revenue from the $217.7 million reported in the year-ago period, with revenue likely to increase a minimum of 10%, with actual revenue depending on how many ounces are sold in the period and its average realized price. Unfortunately, Olympias won’t benefit as much as its other gold-only assets from a sales standpoint, with lower zinc prices being a minor drag on its results. On a positive note, though, zinc has entered a new uptrend after a violent bear market decline, with base metals firming up for its Q4 results assuming they can hold onto their recent gains, which should help Olympias report lower costs with the benefit of higher by-product credits.

Eldorado Gold – Quarterly Revenue – Company Filings, Author’s Chart

Recent Developments

Moving over to recent developments, Eldorado noted that its Skouries Project remains on budget and schedule, with commercial production at this transformative gold-copper porphyry expected by year-end 2025. As it stands, the project is sitting at 33% completion, detailed engineering is at 55% completion, and procurement is at 68% completion, with the project expected to end the year at nearly 40% complete. For those unfamiliar, this asset may be moving ahead seemingly quickly because it was already partially constructed before construction was halted in 2015 following the approval to complete its construction at Skouries being revoked earlier in the year. Hence, although construction only restarted recently, it’s already over one-third complete due to the headstart from the previous construction period and benefits from significant sunk capital.

When it comes to Skouries, the benefits to Eldorado are enormous, helping to increase its average weighted mine life, helping to significantly improve its margins, and adding ~140,000 ounces of annual gold production to push company-wide production towards the 700,000+ ounce mark. However, while the company’s liquidity and cash flow from its four operating mines can easily support funding construction of Skouries without the need for any further share dilution, this large project will result in significant free cash outflows in the near term, and we’re still two years away from commercial production. So, while building this asset is certainly the right move as it makes Eldorado’s margins much more competitive among its peer group, the stock could underperform in a market where little value is being given to future growth. This isn’t an issue for patient investors, but with energy prices increasing, the gold price softening, and inflationary pressures remaining sticky, we could see up to $300 million in free cash outflows next year if commodity prices don’t improve.

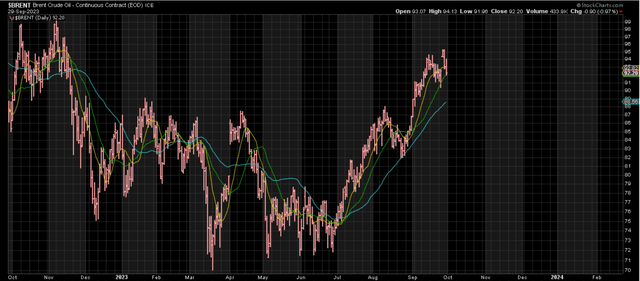

Brent Crude Oil Daily Chart – StockCharts.com

Meanwhile, at its current operations, it looks like it will be tight in regards to meeting all-in sustaining cost guidance, with the higher oil price set to impact Eldorado’s costs and sustaining capital already being quite back-end weighted with ~40% of planned sustaining capital spent in H1. So, with all-in sustaining costs already sitting 4% above its guidance mid-point in H1 ($1,296/oz vs. $1,240/oz), it will be tough for Eldorado to deliver at or below its guidance mid-point. Obviously, this is not a big deal when it comes to the bigger picture with an asset with sub $100/oz AISC set to enjoy a full year of production in 2026. Still, short term, Eldorado could see more margin pressure like its peers with weaker gold prices, a rising oil price, and several companies reporting sticky inflationary pressures. Let’s take a look at the stock’s valuation below.

Valuation

Based on ~208 million fully diluted shares and a share price of US$8.90, Eldorado trades at a market cap of ~$1.85 billion and an enterprise value of ~$1.95 billion. This leaves Eldorado Gold as one of the lowest capitalization names among its 500,000 ounce producer peers, and one of the steeper discounts among companies that have the potential to grow production to 700,000+ ounces within four years. That said, the company is not generating free cash flow currently in an environment where the market is giving little value to future growth and instead focusing on current cash flow for valuations. So, while Eldorado Gold may have a bright future and the potential to generate $320+ million in annual free cash flow in 2026, investors can expect a free cash outflow of $300+ million next year if gold prices don’t rebound, given the significant growth capital for Skouries set to be spent between now and year-end 2025.

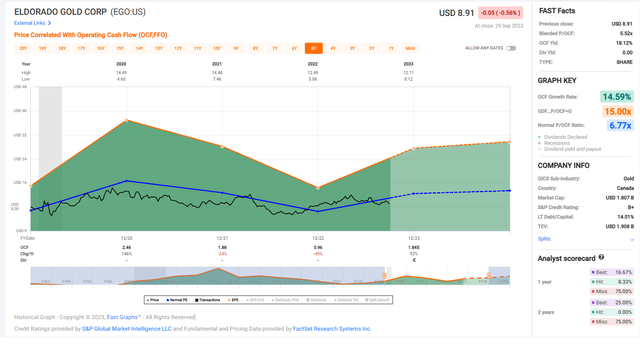

EGO – Historical Cash Flow Multiple – FASTGraphs.com

Looking at the above chart, we can see that Eldorado has historically traded at ~6.8x cash flow, and traded at ~6.6x FY2023 cash flow per share estimates in May, hence why I noted this was not the time to be chasing the stock above US$12.00. Since then, EGO has underperformed its peer group with a 26% drawdown (24% drawdown in the GDX). As for the stock’s fair value, I think a more conservative multiple for EGO is 6.5x cash flow given the multiple compression we’ve seen sector-wide, with some senior producers trading below 6.0x FY2024 cash flow per share estimates, let alone mid-tiers like Eldorado. If we apply this more conservative multiple to FY2024 cash flow per share estimates of $2.05, Eldorado’s fair value comes in at US$13.30, pointing to a 48% upside from current levels.

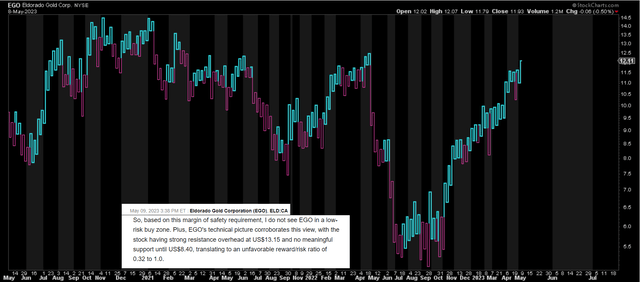

EGO Daily Chart & May Update – Seeking Alpha Premium, StockCharts.com

Although this is a decent upside case for an 18-month price target and Eldorado is trading at just ~4.9x P/CF on this year’s estimates, I am looking for a minimum 40% discount to ensure a margin of safety. If we apply this discount, Eldorado’s ideal buy zone comes in at US$8.00 or lower, suggesting that although the stock may be down sharply from its highs, it still hasn’t entered what I would consider being a low-risk buy zone. Although the company’s future is bright, investors will have to wait at least two years at current gold prices to see an inflection point in free cash flow. So, while EGO would be in a low-risk buy zone already if not for its recent financing that resulted in share dilution, I don’t see enough of a margin of safety just yet with it trading at ~6x FY2026 free cash flow estimates vs. names like B2Gold (BTG) at barely 5x FY2025 free cash flow estimates with a larger production profile and a ~5.6% dividend yield that pays investors to wait.

Summary

Eldorado Gold has pulled back sharply from its highs and has outperformed its peer group year-to-date, enjoying a 6% year-to-date return vs. the GDX’s negative return for the third consecutive year if its recent performance continues. This outperformance can be attributed to the transformation that Skouries will provide to its portfolio, and that this project was green-lighted for the resumption of construction earlier this year, with its first gold pour expected in 2025. That said, while this asset will be a free cash flow machine, we will see significant free cash outflows in the interim, given that this is a massive project, and while on budget, there is risk to capex misses for major growth projects (like we saw from the Super Pit Expansion and Hemi recently in Australia) with inflation remaining stickier than expected. So, while EGO is certainly a name worth owning given its combination of growing production at improving margins, I continue to see more attractive bets elsewhere from a relative value standpoint.

Read the full article here